Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. A wave of confusion has swept the crypto market after a cyber security blunder on the U.S. SEC’s X account. Currently, Bitcoin is trading at $45.9K, with the decision on the ETFs still uncertain. Let’s take a look at how the Bitcoin price could react next. Apprehension grows amid ETF false start On Jan. 9, the official U.S. SEC X account “falsely” announced that they had approved all the…

Day: January 10, 2024

Arthur Hayes Joins Decentralized AI platform Ritual

“AI is made for decentralization – in fact, the future of this technology hinges on its ability to assert independence from the handful of powerful tech giants who control each input and output. I’m excited to join the Ritual team as an adviser to ensure the burgeoning AI economy has access to a more censorship-resistant, collaboration-powering technology than we currently have,” Arthur Hayes said. Source

Bitcoin ETF Drama Reveals Post-Approval Price Trend: Experts

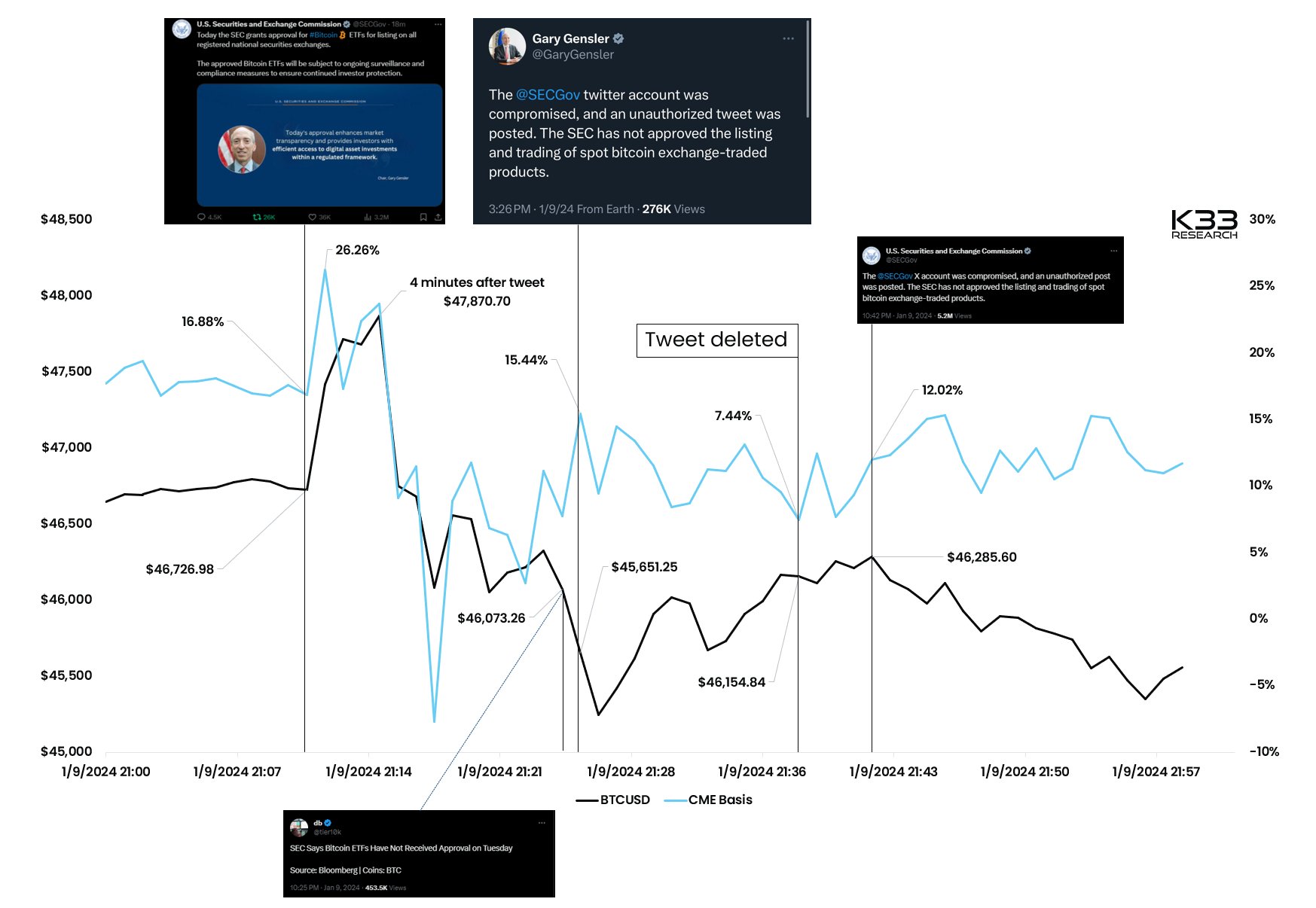

The Bitcoin market was swept into a frenzy following an alleged hack of the US Securities and Exchange Commission’s (SEC) X account, falsely claiming the approval of 11 spot ETFs. This misinformation led to a rollercoaster in Bitcoin’s price, which initially soared from $46,800 to $48,000, only to crash to $45,000 within a span of 20 minutes. This incident has become a pivotal moment for market analysts, providing insights into how the market might react to today’s potential Bitcoin spot ETF approvals in the short term. So here’s what experts…

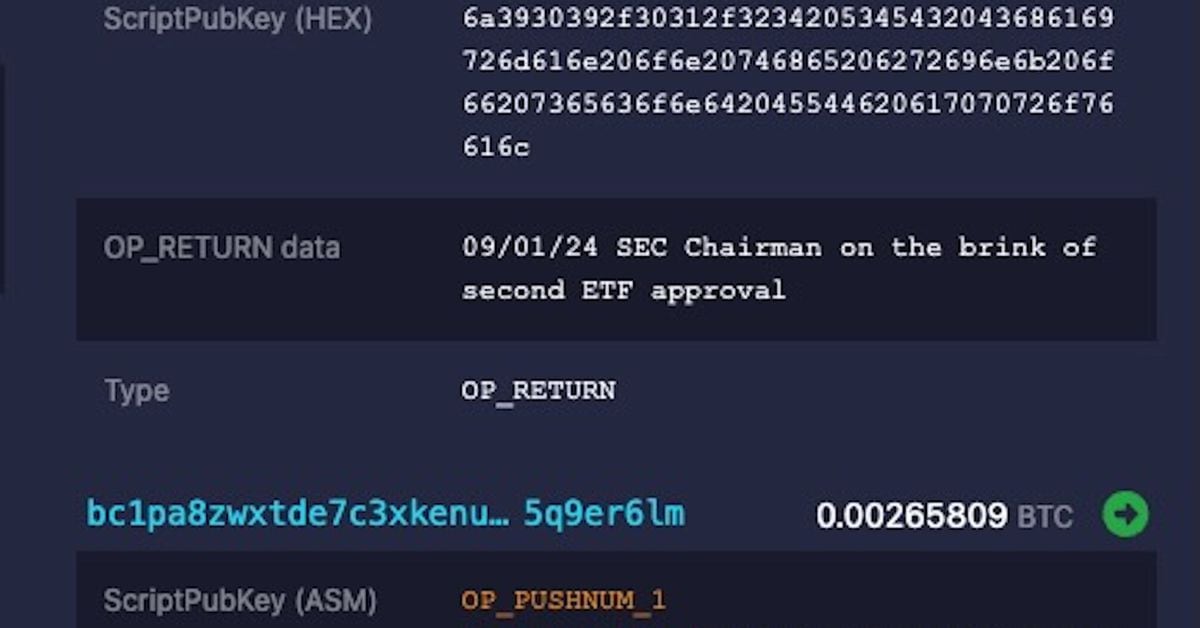

‘SEC Chairman on the Brink of Second ETF Approval’ Gets Embedded Into Bitcoin Network Forever

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is an award-winning media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. In November 2023, CoinDesk was acquired by Bullish group, owner of Bullish, a regulated, institutional digital assets exchange. Bullish group is majority owned by Block.one; both groups have interests in a variety of…

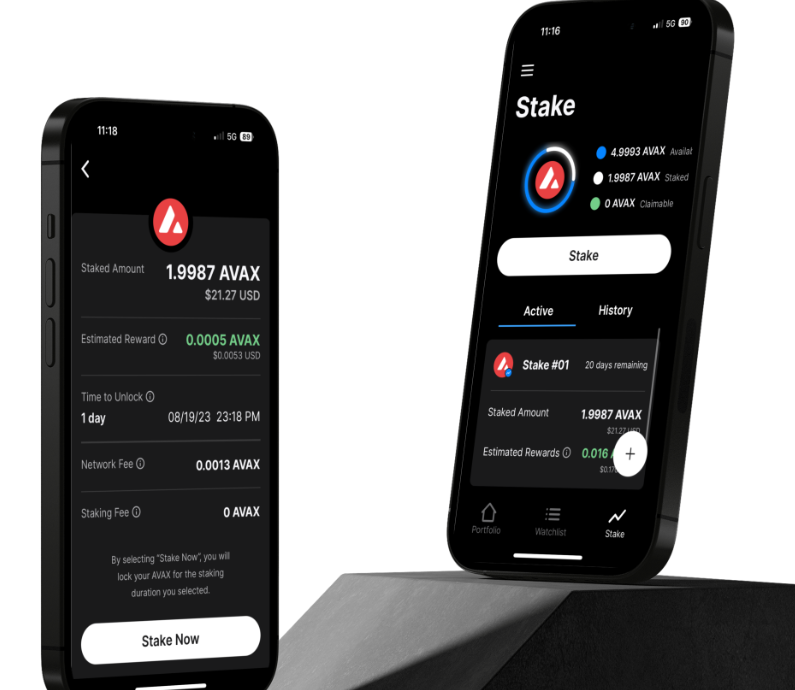

Core Mobile now supports Avalanche staking

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. Users can now use Core Mobile to stake AVAX and participate in network consensus on Avalanche, earning rewards. In a press release shared exclusively with crypto.news, Core Mobile is the smartphone version of the popular Core wallet application. Available on the Google Play and iOS App Store, Core Mobile allows users to explore blockchains, including Bitcoin, Ethereum, and Avalanche. The wallet also supports decentralized finance (defi) and staking native assets. This setup is convenient…

Shiba Inu Whale Accumulates Massive Holdings, Amid Price Recovery

Ethereum-based memecoin Shiba Inu (SHIB) has once again garnered the attention of the crypto community as the altcoin has witnessed a massive whale accumulation leaving the community to ponder on the reason behind the whale accumulation. Shiba Inu Whale Amassed 1.44 Trillion SHIB Recent data from crypto analytics firm Lookonchain has revealed that new buyers are stacking Shiba Inu on Binance and Gate.io. The analytics platform shared the data on the social media platform X (formerly Twitter). As of the time of the report, over 1.44 trillion SHIB, valued at…

BlackRock races to the bottom with new Bitcoin ETF fee

BlackRock cuts its fee for the potential Bitcoin ETF, looking to crush the competition before the products even reach the market. BlackRock, a global investment management behemoth, has announced a significant fee reduction for its spot Bitcoin (BTC) exchange-traded fund (ETF), setting a new competitive standard in the cryptocurrency investment space. This is a significant play by the world’s top asset management firm amid fierce competition in the still unexisting United States Bitcoin spot ETF space. The race to the bottom Similarly, Ark Invest also decreased its fee to 0.25%.…

Ether, Lido DAO, Arbitrum Gain on Possibility of ETH ETF

Ether (ETH) and native tokens of applications built on Ethereum surged in the past 24 hours as traders bet on the possibility of an ether exchange-traded fund (ETF) following the expected approval of a bitcoin ETF in the U.S. Ether exchanged hands over $2,400 in early European hours Wednesday, up 5% in 24 hours. LDO, the governance token of the decentralized autonomous organization (DAO) behind liquid-staking system Lido, gained over 20% while the ARB token of Ethereum scaling solution Arbitrum rose almost 17%. Bitcoin fell 2.2%. BlackRock has filed an…

SEC Mishap Triggers $220 Million In Crypto Liquidations

On Tuesday, the crypto market was taken by storm when a tweet emerged from the official X (formerly Twitter) account of the United States Securities and Exchange Commission (SEC) saying all Spot Bitcoin ETF applications had been approved. This had been initially followed by a surge in price but this was short-lived as the price would crash shortly after. The reason for this was because Gary Gensler, chairman of the Commission, revealed that the tweet was fake and the regulator’s social media account had been compromised. SEC Hack Triggers $220…

Dogecoin Price Risks 25% Correction Ahead of Bitcoin ETF Verdict

Dogecoin (DOGE) price dipped below $0.08 mark in the early hours of Jan. 10, while market data trends suggest a positive Bitcoin Spot ETF verdict could trigger further downside. Market analysts and speculators are leaning heavily towards an imminent ETF approval verdict from the US Securities and Exchange Commission (SEC). Recent market data trends show that price correlation between Dogecoin (DOGE) and Bitcoin (BTC) have flipped negative over the past month. This alignment signals a potential DOGE price downswing if BTC reacts positively to an ETF approval verdict. DOGE price…