Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. The upcoming Bitcoin halving may trigger a bull run, depending on the approval of a spot Bitcoin ETF. Solana may benefit from this decision. However, analysts expect Pushd (PUSHD) to outperform them, especially if a Bitcoin ETF is approved. Bitcoin rises as ETF speculations reach fever pitch When writing, Bitcoin is up 6% to around $47,000, fueled by speculation that regulators could soon approve a spot Bitcoin ETF. Former…

Day: January 10, 2024

15% Rally Bucks The Trend

In a market dominated by red arrows, one Solana-based meme coin is swimming against the tide. BONK, the self-proclaimed “first Solana dog coin,” has soared a staggering 15% in the past 24 hours, emerging as a beacon of green amidst a sea of plummeting peers. While Dogecoin and Shiba Inu wallow in double-digit losses, BONK has bucked the downtrend, leaving investors wondering if this canine crusader has the bite to back its bark. But BONK’s bullish gallop isn’t an isolated thing. This week has seen the meme coin rise 10%,…

Bitcoin ETF Fees Cut at BlackRock, ARK 21Shares

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is an award-winning media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. In November 2023, CoinDesk was acquired by Bullish group, owner of Bullish, a regulated, institutional digital assets exchange. Bullish group is majority owned by Block.one; both groups have interests in a variety of…

Spot Bitcoin ETF ‘mostly priced in’ as false approval got muted reaction, analysts say

QCP Capital suggests this muted reaction to false spot Bitcoin ETF approval signals a potential that the event is already priced-in, highlighting Ethereum as a ‘laggard play.’ In a Telegram post on Jan. 10, analysts at Singapore-based QCP Capital addressed the recent false approval of a spot Bitcoin ETF published on the U.S. Securities and Exchange Commission’s X account, saying that failure to break through the resistance area after the news broke might be considered as a signal that a potential ETF approval “mostly priced in.” Analysts at QCP Capital…

Fidelity cuts proposed spot Bitcoin ETF fee to 0.25% amid industry fee competition

Fidelity discloses in a recent S-1 filing that is aims to lower the charge for its upcoming Bitcoin ETF to 0.25%. The development marks a significant decrease from the previously set fee of 0.39% announced on Dec. 29. Additionally, Fidelity intends to waive this fee for market participants until the end of July, as stated in the latest filing. U.S. companies vying to launch the initial spot Bitcoin ETFs are engaging in a competitive market by slashing fees ahead of anticipated approval from the Securities and Exchange Commission (SEC). Earlier…

Turkey to Wrap Technical Studies Ahead of Introducing Crypto Legislation, Finance Minister Says

The planned legislation includes a broad definition of crypto assets as “intangible assets that can be created and stored electronically using distributed ledger technology or a similar technology, distributed over digital networks, and capable of expressing value or rights,” according to Şimşek. Source

Nearly 10 hedge funds are set to launch spot crypto ETFs in Hong Kong, HashKey says

With Hong Kong on the verge of approving spot crypto ETFs, almost a dozen hedge funds are queuing up to submit applications for the new financial product. In an interview with Chinese news outlet Caixin, HashKey Group COO Livio Weng revealed that approximately a dozen hedge funds are preparing to submit applications for the launch of spot crypto exchange-traded funds (ETFs) in Hong Kong as the city is poised to become the first market in Asia allowing the listing of these financial products. While the timeline for Hong Kong regulators…

Brevan Howard, Hamilton Lane Back New Tokenization Platform Libre

Libra is looking to go live in the first quarter with a hedge fund type of asset of the sort Brevan Howard focuses on and, on the Hamilton Lane side, a private credit fixed-income type product, Sehra said. Thereafter, the roadmap for later this year includes collateralized lending and separately managed accounts, allowing users to balance portfolios on-chain. Source

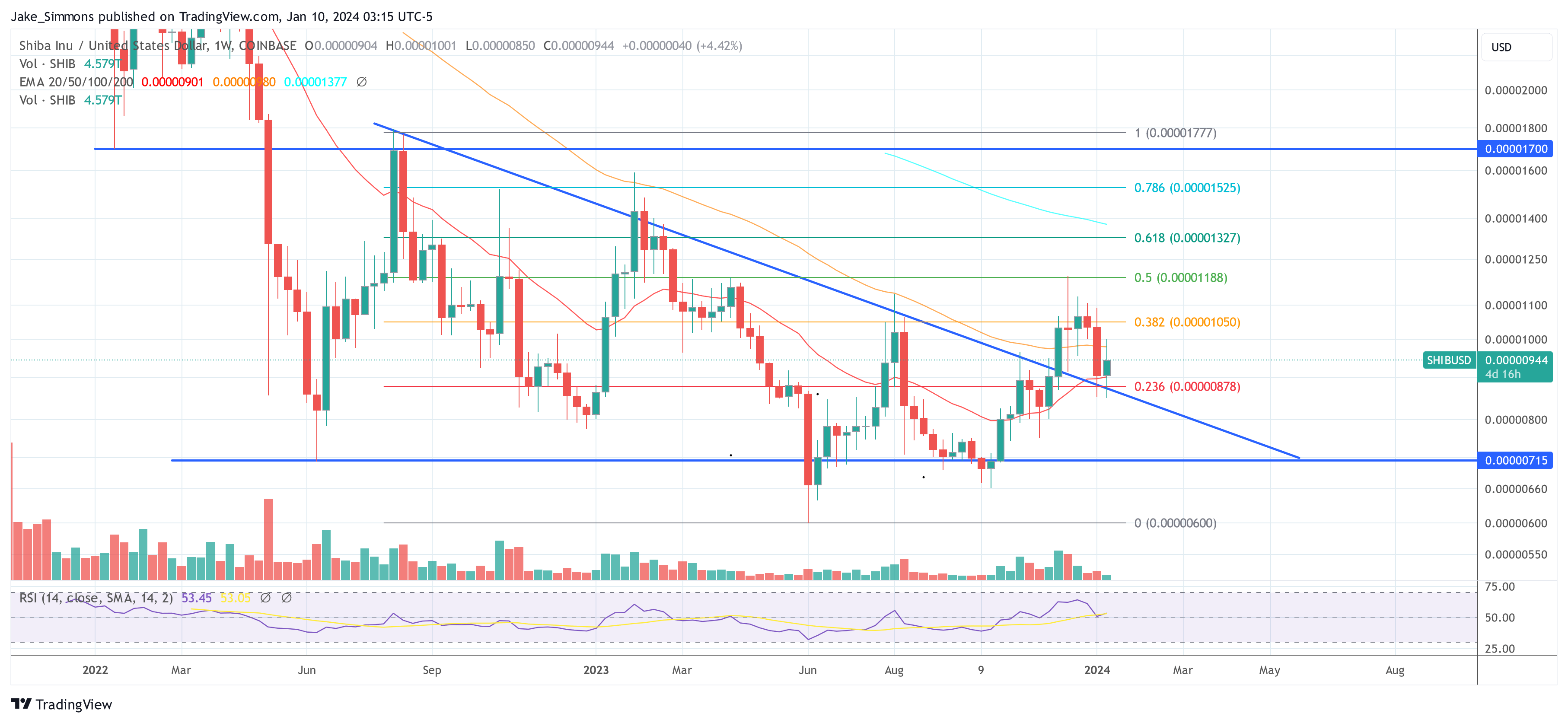

Shiba Inu Dev Hints At Major Progress, SHIB Holds Key Support

Shiba Inu lead developer Shytoshi Kusama has hinted at significant progress in the project’s ambitions. Kusama’s statements, shared on X (formerly Twitter), provide insights into the strategic direction of Shiba Inu and its integration with broader internet infrastructure. Alluding to the fake spot Bitcoin ETF approval news, Kusama stated, “Hey, SHIBARMY! While everyone is focused on approved or not, hacked or not, we remained focused on creating what we said we would: A Network State. Since I’m hearing a lot of Web 3 but not enough WEB, let’s talk about…

Are you clear on clarifying information requests?

Sophie Turner is the Senior Upstream Regulation Officer – FOI and Transparency Public organisations hold a huge amount of information across a wide range of areas. That’s why it’s vital that practitioners understand exactly what people are asking for when dealing with requests under the Freedom of Information (FOI) Act or the Environmental Information Regulations (EIR). Unclear requests make it difficult to respond effectively and within the mandatory timeframes. Without clarity, organisations not only risk providing the wrong information, which could damage people’s confidence in the organisation, it could…