Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. Bitcoin (BTC) can be an option for beginners to consider. Prices might surge because of the upcoming halving event. InQubeta (QUBE) is also being explored because of its earning potential. On the other hand, Cardano (ADA) is firm, but momentum is fizzling out. InQubeta could rally InQubeta has raised over $8.1 million in the ongoing presale. The platform aims to democratize access to artificial intelligence (AI) investment opportunities. With AI…

Day: January 13, 2024

Grayscale Moves Nearly $1 Billion Worth Of Bitcoin In Past Month

According to the latest report, asset management firm Grayscale has been transferring large amounts of Bitcoin to various wallet addresses over the past month. This data revelation comes days after the asset manager’s application to convert its Bitcoin trust to a spot exchange-traded fund (ETF) was approved by the United States Securities and Exchange Commission (SEC). It is believed that the Grayscale Bitcoin Trust is one of the largest Bitcoin entities in the world. In September 2023, crypto analytics platform Arkham Intelligence discovered the asset manager’s multi-billion dollar BTC holdings…

Ethereum Eclipses Bitcoin In A Crypto Coup

The winds of change are swirling through the once-Bitcoin-dominated cryptocurrency landscape, as Ethereum (ETH) stages a stunning rally, leaving the reigning king, Bitcoin (BTC), in its wake. Just days after the highly anticipated approval of Bitcoin’s spot ETF, a paradoxical scene unfolds: ETH soars 13.5%, scaling a 9-month high above $2,650, while BTC stumbles with a 10% dip. This unexpected turn of events has sent shockwaves through the crypto community, igniting a fierce debate – is Ethereum finally usurping Bitcoin’s throne? While the Bitcoin ETF approval was initially heralded as…

ETF Dream Fades, Price Tumbles Under $42,000

In a dramatic turn of events, Bitcoin prices plummeted Friday, erasing almost 10% of its value and dashing hopes of a sustained rally fueled by the highly anticipated launch of spot Bitcoin ETFs. The cryptocurrency, which had surged to a two-year high of $49,000 just a day prior, retreated below $42,000 as investors digested the implications of the new financial instruments. Bitcoin’s Downturn: ETF Impact, Trust Sell-off, FTX Bankruptcy Analysts point to a confluence of factors behind the sudden downturn. Profit-taking by early adopters who cashed in on the ETF-induced…

South Korea stands firm on crypto ETF ban, unswayed by US approval

South Korea’s stance on cryptocurrency ETFs remains unchanged despite the U.S. giving the green light to a Bitcoin spot ETF. The South Korean government continues to disallow the launch of cryptocurrency ETFs, adhering to its long-standing policy of not recognizing digital currencies as financial assets. Since 2017, financial institutions in the country have been barred from investing in cryptocurrencies. Local sources have reported that the Financial Services Commission (FSC) of South Korea reaffirms the government’s commitment to financial market stability and investor protection. The FSC official highlighted that there has…

Analyst Draws Crucial Support Levels For Ethereum (ETH) Post-ETF Surge

According to data from CoinMarketCap, Ethereum (ETH) had dipped over 2% in the last 24 hours. This negative price movement comes after an initial price boost by the token which it gained by over 19% following news of the Bitcoin spot ETF approval in the US on Wednesday. Interestingly, popular crypto analyst Ali Martinez has offered more insight into ETH’s developing downtrend, highlighting the next possible support zones for crypto’s largest altcoin. Ethereum May Be Headed For $2,450 – Analyst In an X post on January 11, Martinez shared that…

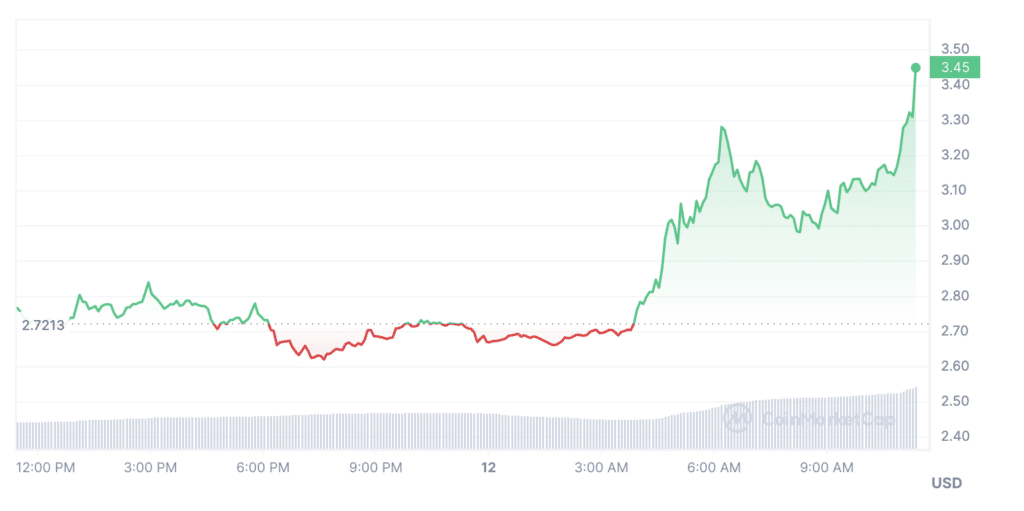

FTT jumps 24% on former FTX customer complaints

The native token of the FTX cryptocurrency exchange, FTT, is up more than 24% over the past 24 hours. According to CoinMarketCap, in just 24 hours the FTT token has risen by 24.5%, reaching $3.45 at the time of writing. The coin’s market capitalization also increased to $1.13 billion, with trading volumes over the past 24 hours increasing by 133% to $96 million. Source: CoinMarketCap Notably, the sharp rise came amid news that dozens of FTX clients have asked a U.S. bankruptcy judge to stop the collapsed cryptocurrency exchange from…

Crypto mixer Tornado Cash laundered over $550m in 2023 despite sanctions

Notorious crypto mixing service Tornado Cash laundered more than half a billion worth of crypto in 2023. Although the U.S. imposed sanctions against Tornado Cash in late 2022, the mixing service is still helping criminals launder hundreds of millions worth of cryptocurrencies. According to data compiled by SlowMist, in 2023 alone, Tornado Cash saw around 314,740 ETH in withdrawals, valuing at around 818.3 million at current prices (or $567.2 million based on 2023 rates). In 2023 alone, we saw 342,042 ETH deposited and ~314,740 ETH withdraw from Tornadocash, followed by…

Coinbase Expands to Africa, This Partnership Will Make It Happen

On January 11, crypto exchange Coinbase unveiled its partnership with Yellow Card, the largest and first licensed Stablecoin on/off ramp on the African continent, to expand the access of their products to emerging economies across the African continent. Expansion To Emerging Economies Coinbase will expand access to its products through this new partnership with Yellow Card, starting with 20 African countries. They will provide millions of African users access to USD Coin (USDC) on the Coinbase Wallet and the Yellow Card app. Both partners expect to “increase economic freedom” in…

BlackRock’s Larry Fink points to value in Ethereum ETFs, crypto asset class

Larry Fink, CEO of BlackRock, likened Bitcoin to gold a day after spot BTC ETFs went live but forecasted slim chances for cryptos as currency. Speaking with CNBC on digital assets, ETFs, and tokenization, BlackRock’s CEO noted that the world’s largest asset manager sees value in spot Ethereum (ETH) ETFs as another crypto-related investment product following the successful launch of identical funds underpinned by Bitcoin (BTC), crypto’s biggest token. Fink clarified that BlackRock views cryptocurrencies as a prospective asset class, with Bitcoin utility revolving around storing and protecting wealth akin…