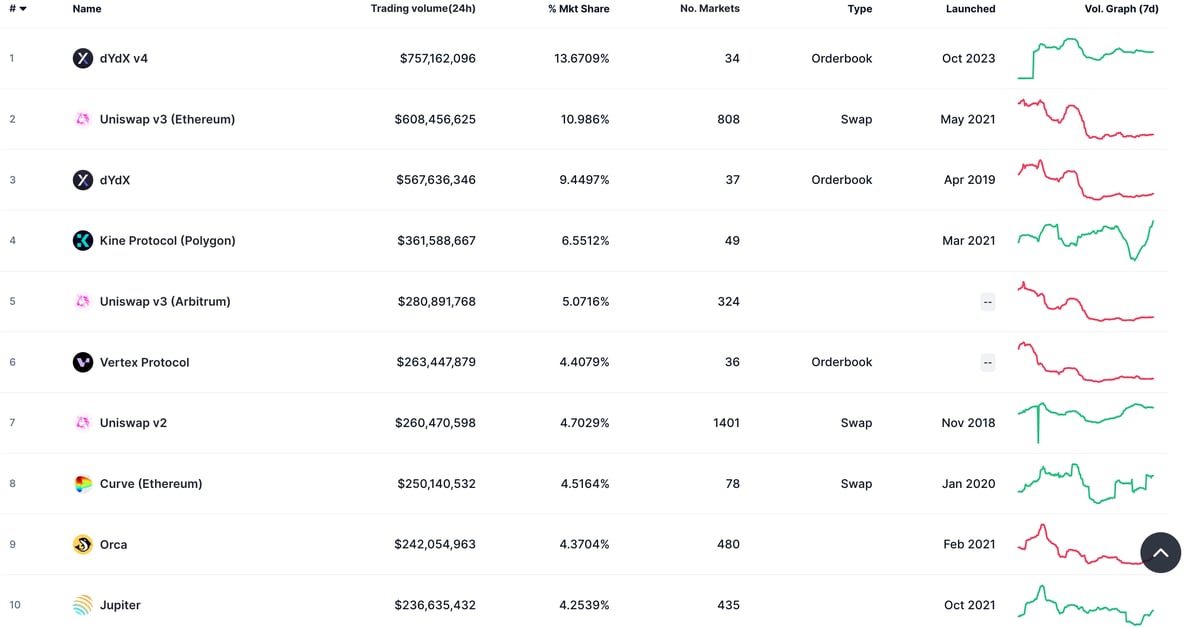

The decentralized exchange, which last year moved over to the Cosmos blockchain, just saw $757 million of volume over a 24-hour period. Source

Day: January 17, 2024

Peter Schiff Warns Impending SEC Regulations Could Tank Prices

Prominent economist and vocal crypto skeptic Peter Schiff has once again stirred the pot with his latest prognosis on Bitcoin (BTC). Schiff, known for his critical stance on digital currencies, has raised eyebrows with his latest post, where he warns of impending regulatory changes that could trouble Bitcoin’s transaction costs and future price trajectory. Regulatory Changes On The Horizon Schiff’s warnings are anchored in his belief that the US Securities and Exchange Commission (SEC), under the leadership of Gary Gensler, is poised to introduce new, more stringent regulations for cryptocurrencies.…

ARK Investment shifts $16m from ProShares to own Bitcoin ETF

ARK Investment Management, led by Cathie Wood, divested from the ProShares Bitcoin ETF, reallocating approximately $16 million towards its own Bitcoin ETF. This move involved the sale of ProShares Bitcoin ETF (BITO) shares, a pioneering ETF in the Bitcoin futures market in the U.S., and the acquisition of 365,427 shares of ARK 21 Shares Bitcoin ETF (ARKB). This adjustment resulted in ARKB accounting for 1% of the ARK Next Generation Internet ETF (ARKW). The value of ARKB shares declined to $43.51 on Tuesday, a significant drop from the initial listing…

$89,500,000,000 Asset Manager To Shut Down Bitcoin Futures Exchange-Traded Fund Days After Approval of Spot ETFs

A financial services giant with nearly $90 billion in assets under its management is shutting down its futures Bitcoin (BTC) exchange-traded fund (ETF) just days after the U.S. Securities and Exchange Commission approved a slew of spot market BTC ETFs. According to a new press release, New York-based investment management firm VanEck says that it plans to close and liquidate the VanEck Bitcoin Strategy ETF, an exchange-traded product listed on the Chicago Board Options Exchange (CBOE). “As the sponsor of VanEck ETFs, VanEck continuously monitors and evaluates its ETF offerings…

Bitcoin gearing up for a massive pullback

According to YouTube analyst Crypto Banter, Bitcoin technical charts show an incoming fall in the market. Despite the approval of spot Bitcoin ETFs on Jan. 10, which many recognized as a win for the industry after the first application was submitted 10 years ago, the prices of Bitcoin (BTC) only dropped further, pulling most of the market into the red. The analyst relates that success should be more money going into BTC than flowing out. In looking at the numbers, while there was $1.2 billion in net inflows in the previous…

Parabolic Bitcoin Indicator Points To Continued Bull Run Despite 15% Crash

Recently, Bitcoin experienced a significant drop, crashing 15% from its 2024 highs around $49,000. This decline followed closely on the heels of the approval of 11 spot Bitcoin Exchange-Traded Funds (ETFs), a move that was initially met with optimism in the crypto community. The sudden downturn has left investors and traders analyzing the charts for clues about Bitcoin’s next move. Is The Bullish Bitcoin Trend Over? In the wake of this decline, technical analysis offers a beacon of insight. Notably, the correction was marked by a bearish engulfing candle on…

Here Are The Most Bullish Predictions For ETH Price As Ethereum Dominance Rises Against Bitcoin

The sentiments around Ethereum look to be very bullish at the moment as the second-largest crypto token by market cap has seen its dominance surge against Bitcoin. Ethereum’s rise against the flagship crypto token is also significant, as crypto analyst Jaydee recently suggested that it could usher in the altcoin season. Bullish Predictions For Ethereum’s Price Crypto analyst Ali Martinez recently highlighted the fact that Ethereum broke out from an ascending triangle on the weekly chart. According to him, the crypto token has its eyes on the $3,400 price level…

Bitcoin and Ethereum’s Rise Signals a Promising Year Ahead for Digital Assets

Because it’s a more familiar, regulated way to allocate capital into the crypto market. Check out Coinbase and MicroStrategy stocks in 2023 – they outperformed Bitcoin, and that’s no coincidence. These ETFs will open the floodgates for Registered Investment Advisors (RIAs), pension funds, and hedge funds to get in on the action. Plus, investment banks will start concocting new products based on these ETFs and the CBOE is awaiting approval to begin listing options on these new ETFs. Original

QCP Capital Forecasts ETH’s Dominance Over Bitcoin To Persist, Ethereum ETFs In Focus

Over the past 30 days, Ethereum (ETH), the second-largest cryptocurrency, has experienced a notable surge of 17%, outperforming Bitcoin (BTC), which has recorded a surge of 2.5% over the same period. This comes as the initial excitement surrounding the approval of the exchange-traded funds (ETFs) by the US Securities and Exchange Commission (SEC) appears to have waned, with BTC witnessing a 5% drop in the past seven days. Interestingly, according to crypto trading firm QCP Capital, following the approval of Bitcoin ETFs, the focus has shifted to the potential launch…

Grayscale moved $1.3b Bitcoin to Coinbase since ETF approval

Following the approval of spot Bitcoin ETFs, Grayscale has transferred some 31,638 BTC within its dedicated Coinbase accounts. According to Arkham Intelligence, the GBTC issuer moved a total of $1.3 billion in Bitcoin (BTC) since the U.S. Securities and Exchange Commission (SEC) approved 11 spot BTC exchange-traded funds (ETFs) on Jan. 10. The data available revealed transactions over three days, including Jan. 12, Jan. 16, and Jan 17. These deposits into Coinbase Prime wallets from Coinbase custody accounts all happened during the opening trading hours of the U.S. stock market.…