However, this underperformance might provide a window for investors looking for an opportunity to buy into mining stocks. “Just like bitcoin, the next two months offer a dip buying opportunity in bitcoin miners,” as the stocks will offer “higher beta trade” to the next bitcoin price inflection, analysts Gautam Chhugani and Mahika Sapra wrote. There may be a further temporary weakness in bitcoin, with a potential short-term bottom in the $38,000-$42,000 range for the world’s largest cryptocurrency, the report said. Still, investors should be “structurally long” ahead of the next…

Day: January 17, 2024

VanEck to liquidate Bitcoin futures ETF

In a significant move impacting cryptocurrency investment vehicles, VanEck announced on Wednesday its decision to liquidate the VanEck Bitcoin Strategy ETF. The decision announced in a Jan. 16 press release, was influenced by a comprehensive analysis of the fund’s performance, liquidity, assets under management, and investor interest, marks a notable shift in the ETF landscape. According to VanEck, shareholders holding positions in the VanEck Bitcoin Strategy ETF (XBTF) have until the market close on Jan. 30 to sell shares. The ETF, which has recently experienced a 1.4% decline, will be…

How Tokenized Assets Can Replace Money

The greater the number of tokenized assets, the easier it gets to use them directly for payments without first cashing them out into bank deposits, CBDCs, or stablecoins, reducing transaction costs. If any asset can be tokenized, fractioned, and then seamlessly transferred on blockchains, you could always use your tokens for payment, no matter what your tokens represent — from securities or Bored Apes to houses or airline tickets. Source

A Pivotal Year for Bitcoin with SEC’s ETF Approval and Halving Event Reshaping Digital Asset Dynamics

On the demand side, the SEC’s potential approval of a spot bitcoin ETF should open the door for a significant number of new investors seeking exposure to the price of bitcoin directly in their traditional investment accounts. They can now forego the complexity of dealing with crypto exchanges, and access a familiar investment vehicle — an ETF. This will spark both higher liquidity and greater price stability in bitcoin. Equally importantly, the SEC’s approval represents a significant milestone for bitcoin’s growing legitimacy with established financial institutions. Original

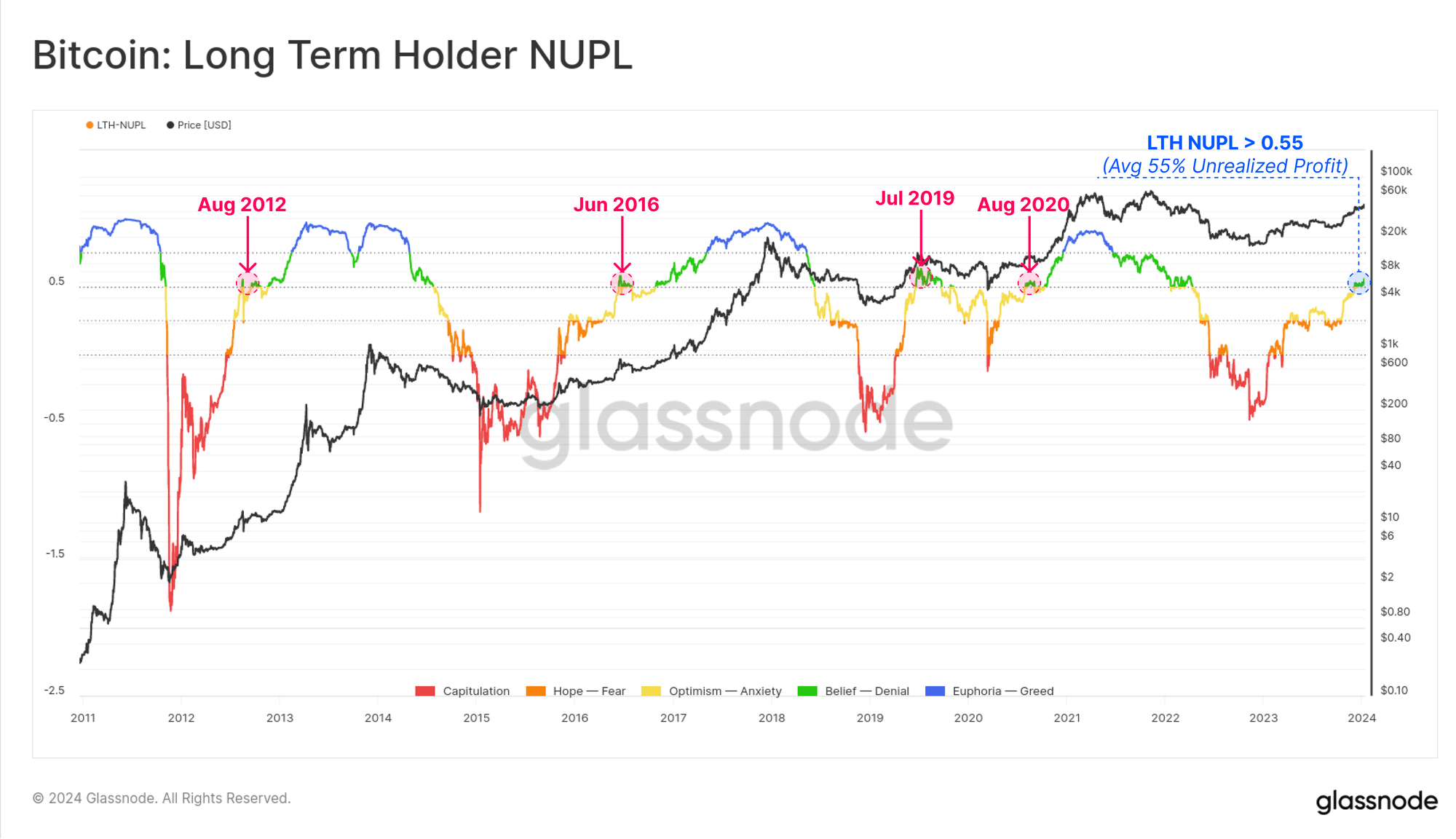

Average Bitcoin Long-Term Holder Now Carries 55% Profit

On-chain data shows the Bitcoin long-term holders (the so-called HODLers) are now carrying an unrealized profit of 55% on average. Bitcoin Long-Term Holder NUPL Has Hit A Value Of 0.55 According to the latest weekly report from Glassnode, the profit that the BTC long-term holders are holding has gone up recently. The indicator of interest here is the “Net Unrealized Profit/Loss” (NUPL), which keeps track of the difference between the unrealized profit and loss that Bitcoin investors are carrying currently. By “unrealized,” what’s meant here is that the profit or…

MetaMask’s Secret ‘Intents’ Project Could Radically Change How Users Interact With Blockchains

In the past, a MetaMask user looking to sell tokens would have needed to submit a transaction specifying exactly how, where, and for what price they wanted their tokens to be sold. With Smart Swaps, which is an “opt-in” feature based around intents, a user can simply request that MetaMask sell their tokens for the best price it can find. Source

Bitcoin grew by 155% in 2023 due to ETF optimism

CoinGecko shares industry highlights from its Annual Crypto Industry Report, including Bitcoin’s major growth attributed to the ETF approved in early 2024. Included in the report’s highlights, CoinGecko reveals that the total crypto market increased 108% in 2023, with an increase of $869 billion. However, at the same time, the daily trading volume saw a 31.6% decrease from 2022, settling at $58.9 billion. CoinGecko 2023 Annual Crypto Industry Report is now LIVE 📊 The crypto market witnessed substantial growth in 2023, doubling its total market cap by $832B, driven by…

SUI Overtakes Bitcoin, Aptos To Become 13th-Largest DeFi Network

The SUI blockchain has been ramping up since the year 2024 began, and a natural consequence of this rapid growth is that it has now surpassed some major players in the decentralized finance (DeFi) space. This has put it ahead of heavy hitters such as Bitcoin and Aptos as SUI begins to leave its mark on the market. SUI Network TVL Crosses $360 Million The total value locked (TVL) on the SUI network has completely exploded in the last year. The total value locked on the blockchain was sitting at…

Bitcoin (BTC) Bashed by JPMorgan CEO Jamie Dimon

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is an award-winning media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. In November 2023, CoinDesk was acquired by Bullish group, owner of Bullish, a regulated, institutional digital assets exchange. Bullish group is majority owned by Block.one; both groups have interests in a variety of…

Test and Deploy: A New Era for CBDCs

Test and Deploy: A New Era for CBDCs Source