The Bitcoin price has been experiencing a phase of stagnation over the past days, leaving investors and analysts searching for the underlying causes. Three key factors can be seen as central to explaining Bitcoin’s current sideways trading trend: #1 ETF Inflows Are Offset By GBTC Selling, But For How Much Longer? The spot Bitcoin ETFs continue to be the dominant theme on the market, and Grayscale in particular, with its GBTC, remains the focus of analysts. While the ETF inflows continue to be record-breaking, the Bitcoin price remains flat. One…

Day: January 18, 2024

Ethereum Staking Platform Kiln Raises $17M for Global Expansion

The round was led by 1kx, with participation from IOSG, Crypto.com, Wintermute Ventures, KXVC and LBank. It also included additional contributions from existing investors, the Paris-based firm said. The new round was an extension of Kiln’s $17.6 million Series A announced in November 2022. Source

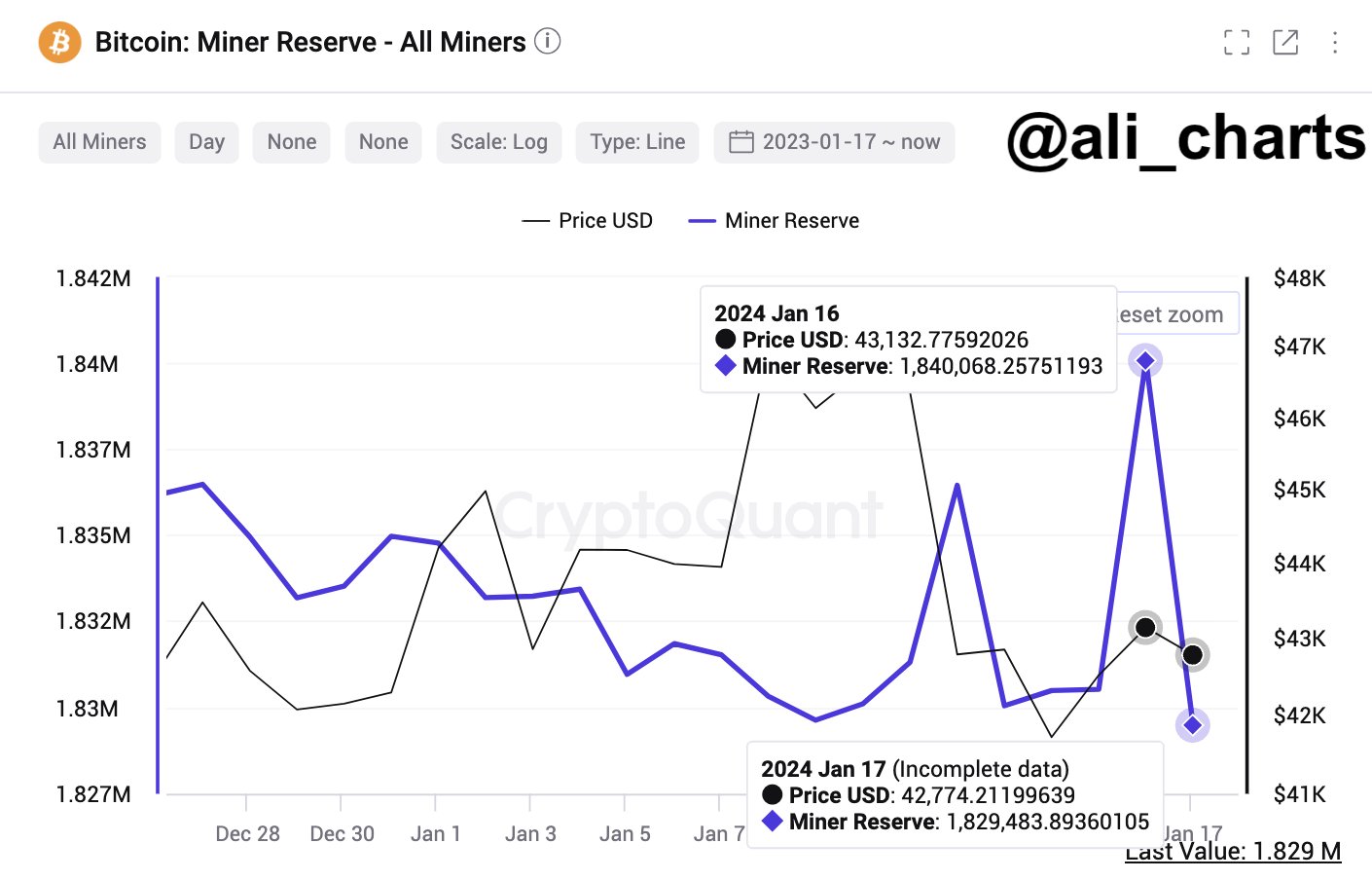

Bitcoin Sees Massive Sell-Off From Miners, As Price Holds Steady

Amid the excitement encompassing the approval of Bitcoin Spot Exchange-Traded Funds (ETFs), BTC miners have been spotted carrying out an aggressive selling spree leaving the community to ponder on the impact of the sell-off. Bitcoin Miners Engage In Selling Spree Well-known cryptocurrency analyst Ali Martinez shared this information with the community on the social media network X (formerly Twitter), noting a “substantial increase in selling activity” from Bitcoin miners lately. According to data shared by Ali, miners have sold about 10,600 Bitcoin in less than 24 hours. This was valued…

TrueUSD Wobbles Towards $1 Peg Amid Reported Redemption Issues

TUSD went as low as 96 cents as Binance data shows traders apparently sold over $300 million worth in the past 24 hours. Source

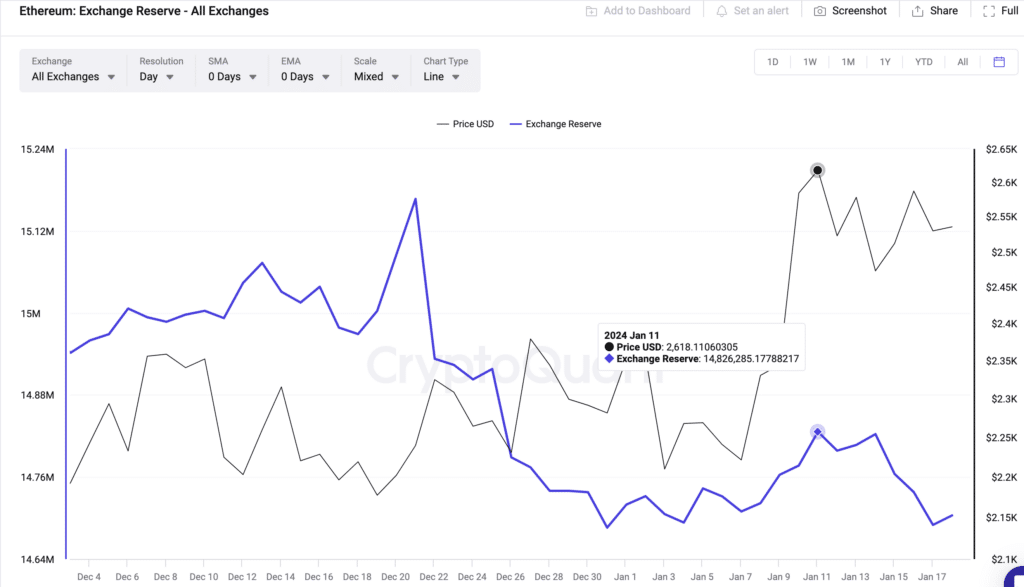

Can Ethereum (ETH) Price Reach $2,700 as a $1B Trading Strategy Unfolds

ETH price has outperformed BTC since the Spot ETF approval on Jan. 11, but on-chain data suggest the gap could further widen in the days ahead. Ethereum price continues to consolidate its lead over Bitcoin this week closing above the $2,500 mark in each of the last 4 trading days from Jan. 15. 2 vital trading indicators highlight how the ETH bulls could further assert dominance in the days ahead. Investors have shifted ETH Worth $1 billion from exchange-hosted wallets into long-term storage As Ethereum price raced up the charts…

Sui Teams Up With Oracle Stork to Provide Builders With Fast Pricing Data

“With Stork’s real-time pricing data, trading venues can manage their perpetual swaps and options books with greater accuracy, reducing the risk of loss related to liquidations when a customer’s positions are undercollateralized,” said the press release. Source

Robinhood Goes Shiba Crazy, Buys 230 Billion SHIB In 24 Hours

On the widely-used trading platform Robinhood, Shiba Inu, frequently hailed as the “Dogecoin slayer,” has sparked a surge of enthusiasm within the cryptocurrency realm. In a remarkable turn of events, Robinhood amassed a staggering 231 billion tokens within a mere 24 hours, boldly proclaiming its presence in the crypto arena. This surge in popularity, according to crypto enthusiast Lola in her latest analysis, has catapulted SHIB to the coveted third position on Robinhood’s crypto podium, leaving established players like Litecoin and XRP trailing in its wake. Robinhood Stuffs More SHIB…

Singapore’s MAS cautions investors against buying spot Bitcoin ETFs

The Monetary Authority of Singapore has warned retail investors against buying spot Bitcoin ETFs following U.S. approval. The Monetary Authority of Singapore (MAS) has cautioned retail investors in the country against purchasing spot Bitcoin exchange-traded funds (ETFs) following the recent approval of such funds in the U.S. MAS, in response to inquiries from CNA, issued a cautionary statement for individuals considering engaging in the trading of these products in international markets, emphasizing that spot Bitcoin ETFs have not been approved as eligible assets for collective investment schemes (CIS). “Given this,…

Investment Firm With $1B in Assets Looks to Invest in BTC Mining With Fabiano Consulting

“Fabiano Consulting will provide valuable expertise in evaluating new potential investments in the fast expanding bitcoin mining industry while exploring opportunities to develop trading, treasury and financing solutions within Deus X’s existing portfolio businesses, such as Alpha Lab 40,” according to the statement. Source

Crypto Market Sentiment Positive Despite BTC’s Price Weakness, CoinDesk 20 Perpetual Futures Show

CoinDesk Indices, a subsidiary of CoinDesk, introduced the CoinDesk20 index on Wednesday. The CoinDesk 20 is a broad crypto market benchmark, representing over 90% of the total value. While bitcoin and ether (ETH) account for just over 50% of the index, other tokens like filecoin (FIL), stellar’s XLM, aptos’ APT, XRP, dogecoin (DOGE), and others make for the rest, making it an S&P 500-like gauge. Source