A number of spot bitcoin ETFs began trading on Jan. 11, with bitcoin surging to $49,000 in the minutes after their launch. The rise was fleeting though, and the price has been heading south since, finally falling through $40,000 moments ago. Bitcoin is now at its weakest price since the beginning of December, but still more than a double from year-ago levels. Original

Day: January 22, 2024

Bitcoin Price (BTC) Down to $40,600 Despite Bullish FTX News

So while the new spot ETFs have gathered more than 94,000 bitcoin and $3.9 billion in assets under management (AUM) since opening for trade (data through Jan. 19), the bears are pointing out that 53,000 of those tokens may just be GBTC holders moving their money into the lower cost vehicles. (GBTC charges a 1.5% management fee, at least 1 percentage point more than nearly all of the new funds.) Source

Analyst Predicts When Bitcoin Price Will Reach New ATH

Bitcoin has been experiencing a downward trend recently, dropping from its 2023 all-time high of about $49,000 to below $41,000 at the time of writing. Despite this significant price correction, popular crypto analyst Kevin Svenson has predicted a new all-time high for BTC in the months after the 2024 Bitcoin halving. Bitcoin Anticipated To Hit New All-Time High Svenson released a YouTube video last week, predicting that BTC’S new all-time high is set for June 2024. Despite the hype surrounding the approval and launch of Spot Bitcoin ETFs, the crypto…

Bailing DeSantis May Leave Deafening Crypto Silence in 2024 U.S. Presidential Race

So, it’s possible that this legacy digital-assets issue could survive the departures of DeSantis and Ramaswamy from the field, but besides his brisk personal business in non-fungible tokens (NFTs), Trump has shown no special interest in the field and once called Bitcoin a “scam.” And the specter of a U.S. CBDC has so far been a one-sided debate in which Republicans paint President Joe Biden and his administration as pushing a government token to spy on the citizenry when there hasn’t been any evidence that the Fed or Department of…

FTX’s Alameda Research withdraws Grayscale lawsuit

FTX’s sister company, Alameda Research, willingly dismissed litigation action against Digital Currency Group’s Grayscale Investments shortly after spot BTC ETF approval. Court filings from Jan. 22 showed that Alameda opted out of suing Grayscale, its CEO Michael Sonnenshein, its parent company Digital Currency Group’s (DCG), and founder Barry Silbert over a ban on Grayscale’s Bitcoin Trust (GBTC) redemptions. The lawsuit submitted in March last year alleged that Grayscale implemented a self-dealing and unfair regulation ban that withheld over $9 billion in value from FTX’s bankrupt estate. CEO John J. Ray…

Bitcoin ETFs aren’t giving crypto a big boost just yet. Here’s where the new funds stand

The newly launched bitcoin ETFs are showing early signs of success, but they have so far fallen short of being the massive boost for crypto some bulls predicted. The funds began trading on Jan. 11 after receiving approval from the Securities and Exchange Commission, and ETFs from iShares ( IBIT ) and Fidelity Wise Origin ( FBTC ) have already raked in more than $1 billion of cash from investors in fewer than 10 trading days. Despite those quick milestones, reviews of the launches have been somewhat tepid. Citi analyst…

FTX Affiliate Alameda Research Drops Grayscale Lawsuit

The lawsuit, filed last March, alleges more than $9 billion in investor funds became trapped in Grayscale’s Bitcoin Trust (GBTC), following the collapse of FTX. The complaint formed part of wider efforts to retrieve and “maximize” recoveries for FTX customers whose funds were funds lost by, or locked on, the failed cryptocurrency exchange and its affiliates’ platforms. The suit also alleged Grayscale had excessively high fees. Source CryptoX Portal

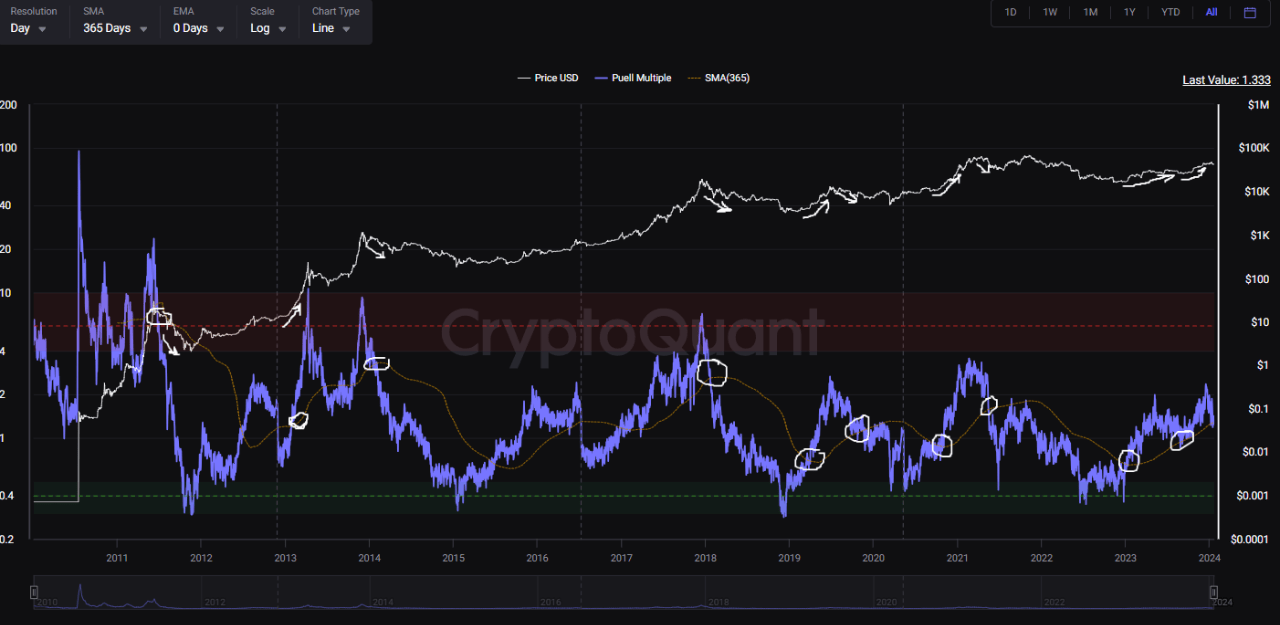

Bitcoin Puell Multiple At Crucial Juncture: Will Retest Save Rally?

On-chain data shows the Bitcoin Puell Multiple indicator is currently retesting a crucial level that may end up deciding the fate of the latest rally. Bitcoin Puell Multiple Is Now Retesting Its 365-Day Moving Average As explained by an analyst in a CryptoQuant Quicktake post, the interaction of the Puell Multiple with its 365-day moving average (MA) can indicate trends in the market. The “Puell Multiple” refers to an indicator that keeps track of the ratio between the daily revenue of the Bitcoin miners (in USD) and the 365-day MA…

3 reasons to watch Bitcoin this week

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. Bitcoin is at a crucial point as numerous factors align for a big potential move. However, it remains to be seen which direction the move will swing. Let’s take a look at how the Bitcoin price could swing this week. Bitcoin price at mid-term tipping point Investors are closely watching Bitcoin this week to gauge the impact of the recent approval of Bitcoin ETFs. BlackRock’s ETF has seen significant…

Zuzalu, Vitalik Buterin-Led Retreat in Montenegro, Inspires Grants for 'Zu-Villages'

The aim of the program is to continue the “growth of the pop-up city movement” and “support technology-driven projects,” according to a post on Gitcoin. Source