ETHEREUM’S DIVERSITY PROBLEM. In the blockchain tech context, “client diversity” refers to the goal of having multiple software programs – known as “clients” – available for node operators and validators to access networks; as the thinking goes, if one of these clients goes down, due to a bug or some other mishap, there are plenty of other clients that would remain largely unaffected, preserving the blockchain’s uptime. Ethereum’s problem, based on a debate that erupted on the social-media platform X over the past few days, is that it’s heavily reliant…

Day: January 24, 2024

Mt Gox Starts Verifying Addresses For 200,000 BTC In Payouts

Defunct Japanese-based cryptocurrency exchange, Mt. Gox has taken the next steps toward its Bitcoin distribution process to customers who were previously affected by its 2014 hack attack. The crypto exchange has delivered mass emails to account holders as they confirm wallet addresses for individuals eligible for its repayment process. Mt. Gox Prepares For Bitcoin Repayments Recently, Account holders at Mt. Gox reported in a Reddit post that they have been receiving new emails from the crypto exchange regarding an identity verification and confirmation procedure initiated by the exchange. Mt. Gox…

Alameda gap is still haunting Bitcoin despite ETF approval

Despite spot Bitcoin ETFs generating over $20 billion in trading volume, the crypto market faces ongoing challenges with liquidity. The market’s liquidity, as measured by Bitcoin’s market depth, indicates that the ease and speed of executing transactions in the digital currency remain suboptimal. The current Bitcoin (BTC) depth chart indicates that there is a considerable amount of orders placed both for buying (bids) and selling (asks) Bitcoin, yet the liquidity—referring to the ability to execute large orders without impacting the price significantly—is limited around the current price level. So, the…

Why Tornado Cash Remains the Most Pivotal Legal Case in Crypto

Indeed, it is not. We should have the right to transact freely online, whether it’s to communicate with words or to exchange value in the form of crypto. The operation against Tornado supposes that all money sent through a mixer is necessarily dodgy, when, in all likelihood, only a portion of the $1 billion was laundered and sent to North Korea. Vitalik Buterin, for instance, used Tornado to send funds in support of Ukraine (presumably because he didn’t want to make that donation public). In effect, as my colleague Dan…

BlackRock and Fidelity lead billion-dollar spot Bitcoin ETF race

The SEC approved a handful of spot Bitcoin ETFs, but funds from two particular issuers are heads and shoulders above the lot while Grayscale’s GBTC bleeds outflows. Inflows of $1.9 billion and $1.6 billion confirmed spot Bitcoin (BTC) ETFs from BlackRock and Fidelity, respectively. They are the dominant issuers from a basket of 10 asset managers approved to list products by the U.S. Securities and Exchange Commission (SEC). Crypto native firm Bitwise and Cathie Wood-backed ARK 21Shares followed leagues behind the two frontrunners; both recorded inflows of over $500 million. …

Shiba Inu Team Teases ‘Next Big Thing’ As ‘Big Money’ Eyes SHIB

Shiba Inu marketing lead Lucie has ignited the community’s excitement with a teaser about the project’s future. On X, the platform that has taken the place of Twitter, Lucie dropped a tantalizing hint about what’s to come for the Shiba Inu ecosystem. Her message, shrouded in mystery, suggests a bullish future while details remain undisclosed. Lucie teased, “I can’t disclose specifics, but if you possess basic blockchain skills and understand the Shibarium process, you can anticipate what’s ahead.” Lucie continued by highlighting the interest from significant investors: “Big investors are…

Ripple's David Schwartz Talks 'Bottom-Up Growth' on XRP Ledger, Rebuts Critics: Q&A

Schwartz spoke to The Protocol about the aftermath of Ripple’s SEC win, his method for dealing with XRP’s rabid fanbase, the XRP Ledger’s controversial approach to centralization, and more. Source

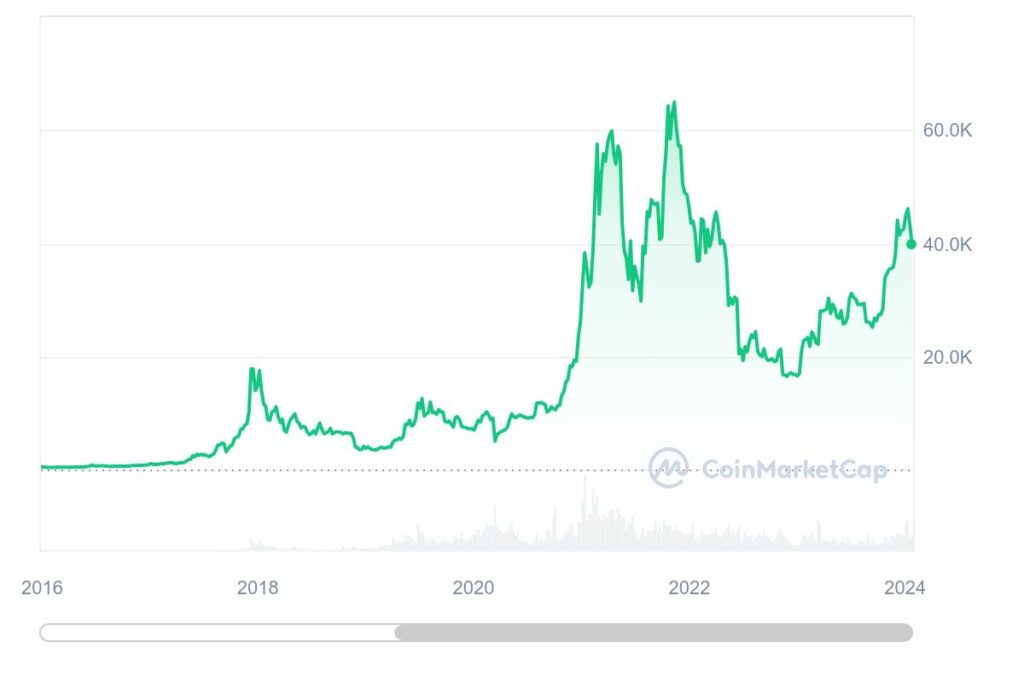

What could drive crypto bull run expected in 2024-2025

Explore the anticipated next crypto bull market in 2024-2025, its key driving factors, and determine which strategy is optimal for you. The crypto market has experienced several bull and bear cycles since Bitcoin’s (BTC) inception in 2009 giving cues for the next crypto bull run 2024-2025. One of the earliest significant bull runs occurred in 2017, when Bitcoin saw a near 20x price increase, peaking close to $20,000 levels. This was followed by a steep decline in what was later termed the “crypto winter” and saw BTC lose over 80%…

Crypto Needs Cohesive Regulation – A Look at Europe’s MiCA

Utility token refers to crypto-assets that are only intended to provide access to a good or a service supplied by its issuer. NOTE! Outside the scope of MiCA are: DeFI protocols, pure NFTs, CBDCs, security tokens or other crypto-assets that qualify as financial instruments according to MiFID II. Licensing. MiCA introduces licensing requirements for crypto-asset service providers, issuers of asset-referenced tokens and issuers of electronic money tokens. In general, CASP will trigger the licensing requirements, unless they are already a licensed credit institution under MiFID. As mentioned before, even with…

Do Bitcoin ETFs Kill the Bull Case for Crypto Equities?

The days of rising crypto prices lifting all boats, including mining stocks, may be gone. But it still looks like being a good year for digital assets, says Alex Tapscott. Original