BlackRock ushered in a bullish optimism within the digital assets market in January when it got approval to offer the Bitcoin Bitcoin Fund (IBIT) to investors, which in less than two months of trading, became one of the top five ETFs overall in the market. The fund has attracted $15 billion in assets, significantly more than any of the other nine funds. Source CryptoX Portal

Day: March 22, 2024

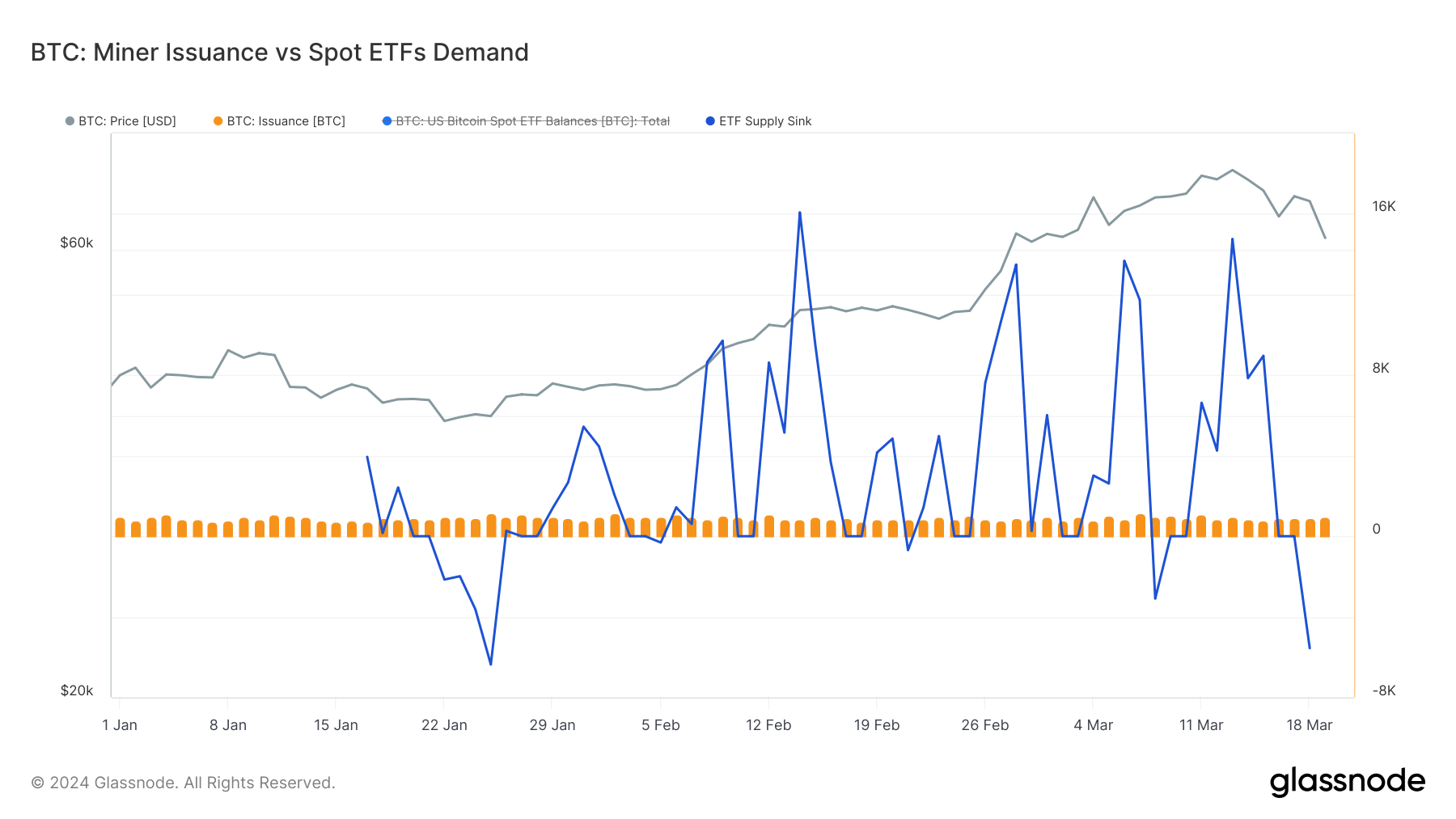

This Bitcoin Halving May Not Result In Supply Squeeze: Glassnode

Glassnode has suggested that the upcoming Bitcoin halving might not result in a supply squeeze that the market may have anticipated. Bitcoin Halving May Not Carry Same Impact Due To Spot ETFs In a new report, the on-chain analytics firm Glassnode has discussed the impact the next Bitcoin halving may have on the economics of the cryptocurrency. The “halving” is a periodic event for BTC where its block rewards (the rewards the miners receive for adding blocks on the network) are permanently cut in half. This event is built into…

Bitcoin, Ethereum options worth $2.6b expire; investors show caution

Bitcoin and Ethereum options worth early $2.6 billion in notional value expired today amid a broader market pullback. According to Greeks.live, 25,000 BTC options expired, showcasing a Put Call Ratio of 0.56. The ratio indicates a higher interest in call options than puts, suggesting optimism among a segment of investors. The Max Pain point stood at $67,000 with a notional value of $1.7 billion. Similarly, 250,000 ETH options expired, with a Put Call Ratio of 0.51 and a Maxpain point of $3,500, amounting to a notional value of $890 million.…

There Can (Probably) Be Only One Bitcoin

But the market for cryptocurrencies and blockchains that deliver consumer and business benefits is likely to be bigger than the one for “digital gold,” says Paul Brody, head of blockchain at EY. Original

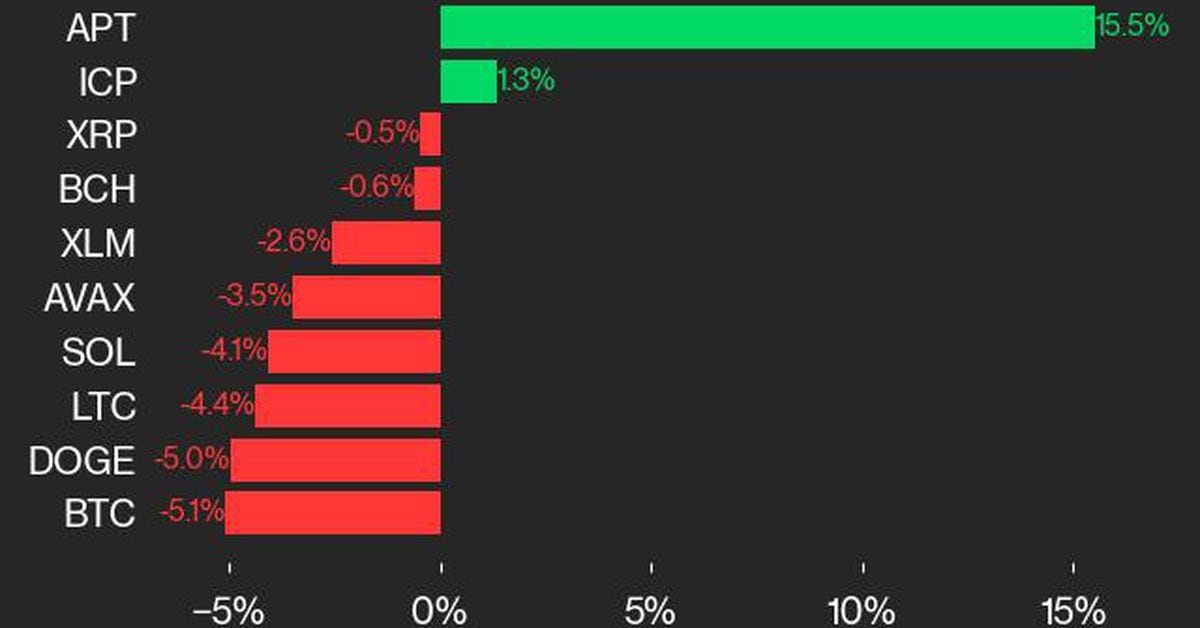

Bitcoin ETFs shed $94m on fourth day of net outflows

Bitcoin declined over 5% on March 22 as spot ETFs recorded negative numbers for the fourth consecutive day, mainly due to Grayscale GBTC exits. According to SoSo Value, 10 spot Bitcoin (BTC) ETFs marked $93.8 million in cumulative single-day outflow during trading on March 21. Grayscale’s GBTC accounted for most of the BTC ETF share liquidation, amounting to $358 million. Bloomberg’s James Seyffart verified that Grayscale’s BTC ETF has lost nearly half of its shares to sell orders following the approval of spot BTC ETFs on Jan. 11. Seyffart concurred with…

Fantom (FTM) Jumps 180% In 4 Weeks: Just The Beginning?

Over the past 24 hours, Fantom (FTM) has emerged as the standout performer among the top 100 cryptocurrencies by market capitalization, registering a remarkable 13.5% gain. This surge is part of a broader rally that has seen the FTM price soar by 180% over the last four weeks, propelling it from $0.42 to $1.20. This upward trajectory has significantly boosted Fantom’s market capitalization to $3.3 billion, positioning it as the 41st largest digital asset worldwide. Here’s why this might be just the beginning: #1 Sonic Upgrade: The Catalyst for Fantom’s…

Bitcoin Price (BTC) Drops 5.1% as CoinDesk 20 Falls 5.4%

The CoinDesk 20 tracks top digital assets and is investible on multiple platforms. The broader CoinDesk Market Index comprises approximately 180 tokens and seven crypto sectors: currency, smart contract platforms, DeFi, culture & entertainment, computing, and digitization. Original

Do Kwon’s Extradition to South Korea Postponed by Montenegrin Supreme Court

The decision effectively puts a time-out on the ongoing tug-of-war over Kwon between South Korea and the United States. Both countries want to try Kwon for criminal charges, including fraud, relating to the $40 billion collapse of the Terra ecosystem in May 2022. Source

U.S. SEC Asking for More Millions, Dozens of Lawyers to Beef Up Crypto Oversight

Executive branch budget proposals are gathered into a single push from the White House for its spending priorities, with more detail about how exactly the agencies want to spend the funds they’re requesting. Then Congress gets its turn, sometimes embracing some of the president’s wishes, and sometimes ignoring them. But even when lawmakers put together a plan for final consideration, the process can get derailed by politics, as the U.S. has seen in the current federal budget effort, which has flirted repeatedly with failure and government shutdowns. Congress is currently…

El Salvador Doubles Down on Bitcoin

The decision to make the transfer to a cold wallet came after El Salvador’s bitcoin treasury swelled unexpectedly, nearly doubling its previously known stash. The country had been acquiring bitcoin through various means, including daily purchases, sales of passports, currency conversions for businesses, mining and government services. This approach has dramatically increased El Salvador’s bitcoin holdings, which were believed to be less than 3,000 BTC before this revelation. Original