In a technical analysis, renowned crypto analyst Gert van Lagen presented an extremely bearish outlook for Solana (SOL), suggesting that its price is poised for a substantial downside move. Van Lagen’s analysis is underpinned by the widely acclaimed Elliott Wave Theory, a methodology that seeks to identify recurring patterns and cycles in market price movements. Why The Solana Price Could Crash At the core of Van Lagen’s analysis lies a dissection of Solana’s price action over the past few years. According to his assessment, the year 2021 marked the culmination…

Day: June 4, 2024

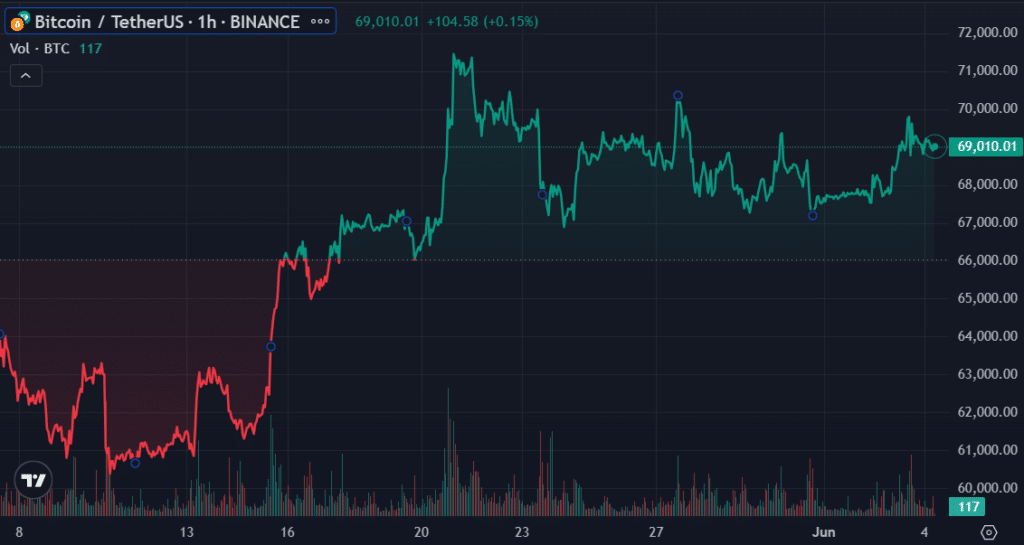

Bitcoin (BTC) Drops From $70K as Bullish Signal Strengthens

Bitcoin’s price fell below $69,000 during the European morning having briefly topped $70,000 late on Monday. BTC is currently priced at about $68,900, down just over 0.2% compared to 24 hours ago. Other major crypto tokens also dropped, and the broader digital asset market, as measured by CoinDesk 20 Index (CD20), lost 0.70%. Crypto exchange Bitfinex said on Monday that bitcoin’s slump since March was driven by long-term holders selling. This trend has now stalled, however, with the number of net accumulating BTC addresses growing over the past month, a…

Notcoin (NOT) Maintains Bullish Momentum, What Next?

After a retracement from its previous, Notcoin (NOT) has been exhibiting strong bullish momentum that has drawn the interest of both traders and investors. This ongoing upward trend indicates a robust level of market confidence and increasing optimism over its prospects. Market analysts are keeping a careful eye on important indicators and trends as the cryptocurrency rises in order to predict how long this bullish period may remain and what possible heights it may reach. Using a few technical indicators, we will examine Notcoin’s price possibilities in this article focusing…

$3,000,000,000 in Ethereum Has Left Crypto Exchanges Since SEC Approved Listing of ETH ETFs, Says Analyst

An on-chain analyst and trader says crypto exchanges have been witnessing massive Ethereum outflows since the listing approval of spot ETH exchange-traded funds. Ali Martinez tells his 63,500 followers on the social media platform X that market participants have taken out 777,000 ETH worth $3 billion from crypto exchanges since the U.S. Securities and Exchange Commission (SEC) green-lighted spot ETH ETFs last month. Source: Ali Martinez/X At time of writing, Ethereum is trading at $3,776, a fractional decrease in the past day. Turning to fellow layer-1 protocol Toncoin (TON), the…

Thailand approves first spot BTC ETF for ultra high net-worth individuals

The Thailand Securities and Exchange Commission (SEC) approved the first spot Bitcoin (BTC) exchange-traded fund (ETF) in the country, making it available only to ultra high net-worth individuals. According to the Thailand-based daily newspaper Bangkok Post, the country’s SEC gave the green light to the local asset management company, One Asset Management (ONEAM), to launch its spot BTC ETF. The investment product is called the “ONE Bitcoin ETF Fund of Funds Unhedged and not for Retail Investors (ONE-BTCETFOF-UI).” However, the report says that the ETF will not be available for…

English Soccer Club Watford FC to Offer 10% Digital Equity Through Investment Platform Seedrs

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as…

ROAR Explodes Over 300% After Kitty’s GME Move

The echoes of 2021’s meme stock saga reverberated through financial markets this morning, as the obscure ROAR meme coin and video game retailer GameStop experienced a meteoric rise fueled by social media nostalgia. The catalyst? The return of a familiar face – Keith Gill, better known by his online moniker “Roaring Kitty.” Related Reading Kitty Claws Back In Retail investors were sent scrambling after Gill, a superstar among the online investment community on Reddit’s WallStreetBets forum, posted a cryptic message hinting at a significant stake in GameStop. The post, featuring…

Australian Regulator ASIC Scolded Over ‘Misleading’ Release, Must Pay Costs as Block Earner Avoids Penalty

ASIC subsequently published a press release entitled “Court finds Block Earner crypto product needs financial services licence.” While the release acknowledged that ASIC had been unsuccessful in arguing that Access needed a license, Jackman upheld Block Earner’s allegation that it was “unfair and misleading.” Source

Spot BTC ETFs start 4th consecutive week with positive inflows

Spot Bitcoin (BTC) exchange-traded funds (ETFs) in the U.S. have started their fourth consecutive week with positive gains while BTC consolidates. According to data provided by Farside Investors, spot BTC ETF products in the U.S. recorded $105.1 million in inflows on June 3 — making a positive entrance into the fourth straight week. The majority of the inflows came from Fidelity Wise Origin Bitcoin Fund (FBTC), worth $77 million. Bitwise Bitcoin ETF (BITB) and ARK 21Shares Bitcoin ETF(ARKB) registered $14.3 million and $10.7 million inflows, respectively. Moreover, VanEck Bitcoin Trust…

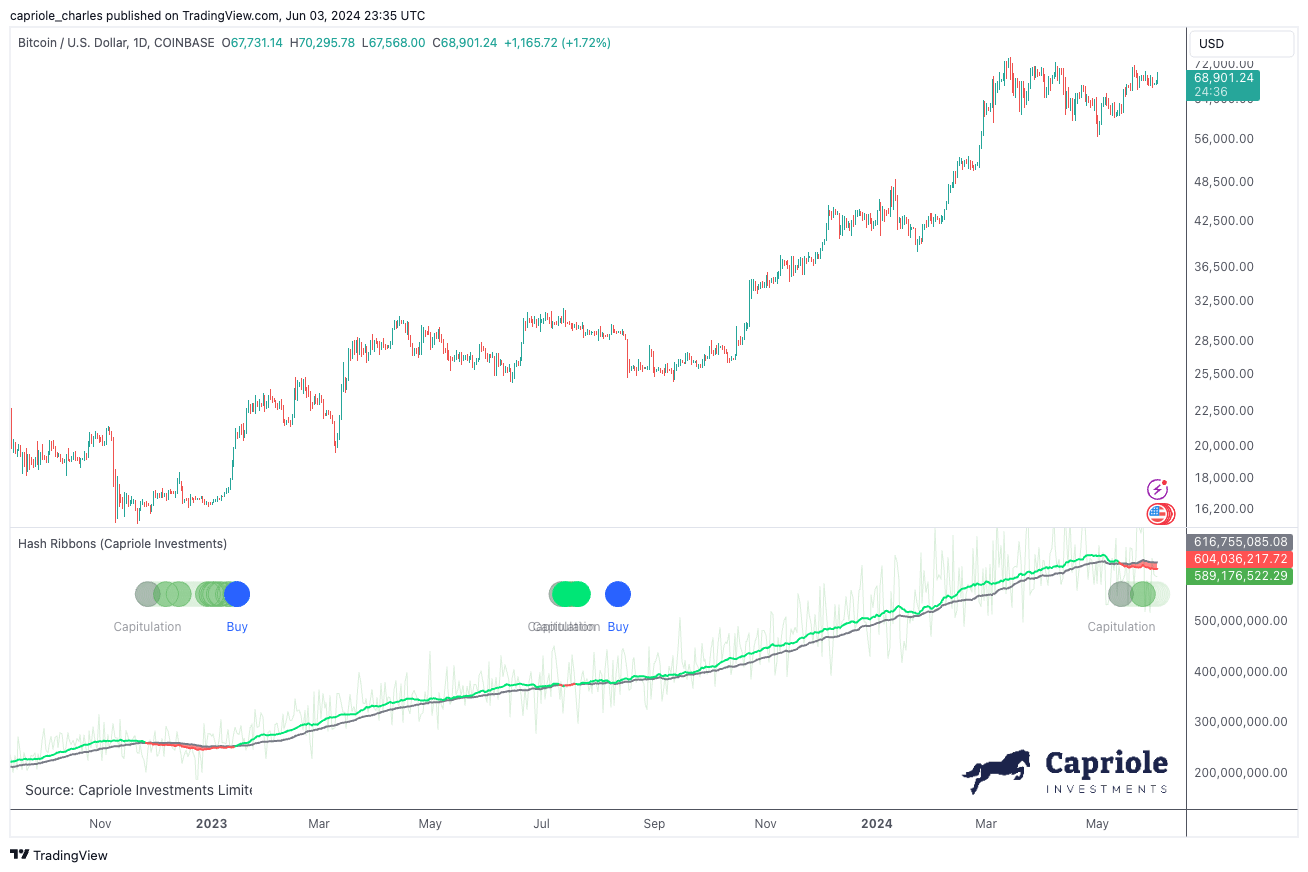

Best Long-Term Bitcoin Buy Signal Flashes: Hedge Fund CEO

In his latest dispatch, Charles Edwards, CEO of the Bitcoin and digital asset hedge fund Capriole, has flagged a significant market indicator in the latest edition of the firm’s newsletter, Update #51. Edwards points to the activation of the “Hash Ribbons” buy signal, a notable event that has historically indicated prime buying opportunities for Bitcoin. Bitcoin Hash Ribbons Flash Buy Signal The Hash Ribbons indicator, first introduced in 2019, utilizes mining data to predict long-term buying opportunities based on miners’ economic pressures. The signal arises from the convergence of short-term…