Deciding which tokens merit inclusion, and in what proportions, is a pivotal consideration. Despite the proliferation of thousands of cryptocurrencies, only a select few warrant inclusion in institutional portfolios. Bitcoin and Ethereum, as industry stalwarts, are indispensable. Additionally, tokens such as Solana (SOL) and Chainlink (LINK) should be considered, albeit with careful, active management to mitigate potential risks. This balanced approach ensures that investments in digital assets are both judicious and resilient. Original

Day: June 12, 2024

What ETF Approval Could Mean for Ethereum

The SEC’s recent decision sets Ethereum up for success in numerous new ways, says Ilan Solot, Senior Global Markets Strategist, Marex Solutions. Source

Bitcoin (BTC) Selling By Miners Rises to Two-Month High

The prior day, miners sent more than 3,000 BTC ($209 million) to exchanges with the majority of that coming from the btc.com mining pool into Binance. The spike in transfers coincided with a temporary correction in bitcoin as it fell from $70,000 to $66,000 before rebounding days later. Original

Major Analysts Say BTC Is Headed For 6-Digit ATH

Major crypto analysts have weighed in on the Bitcoin future trajectory, especially as the flagship crypto has maintained a tepid price action and has continued to consolidate since the halving took place. These analysts predict that Bitcoin will soon rise and climb to a six-digit all-time high (ATH). Bitcoin To Rise To $100,000 Crypto analyst CrediBULL Crypto predicted in an X (formerly Twitter) post that Bitcoin would rise to $100,000 on its next leg up. He claimed that this upward trend would begin in the next seven to ten days,…

Report: Major Entities Hold Over 4 Million Bitcoin, Accounting for 27% of Supply

The latest Glassnode onchain report reveals that major labeled entities collectively hold approximately 4.23 million bitcoin, representing over 27% of the adjusted circulating supply. This significant concentration of BTC holdings underscores the prominent role these entities play within the bitcoin ecosystem. Institutional Holdings: ETFs, Miners, Government, and Exchanges Control 4.23 Million Bitcoin According to Glassnode’s […] Original

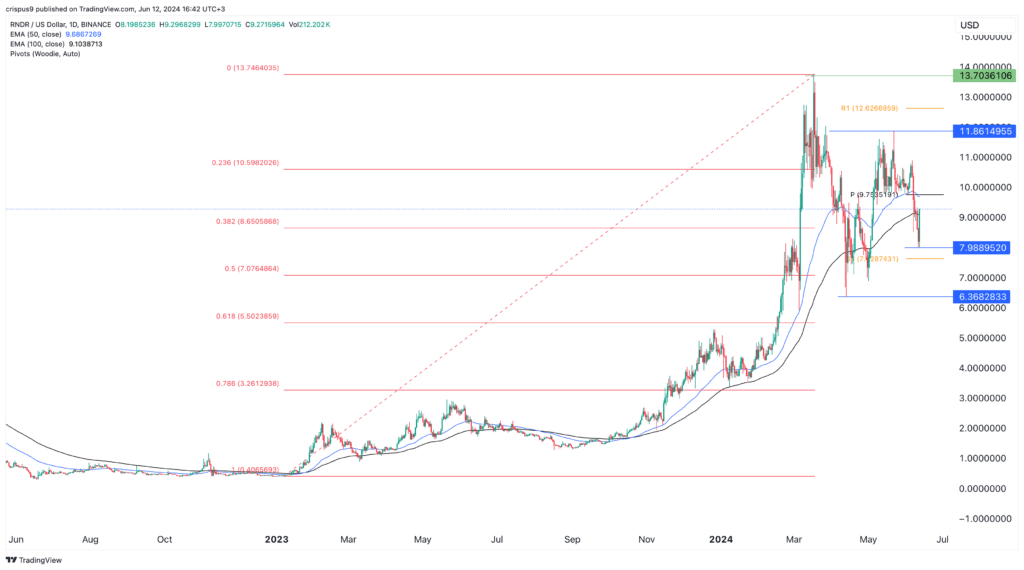

Crypto price forecasts: Render, Floki, Arweave

Cryptocurrencies and stocks rebounded on Wednesday after the weak US inflation data and as investors bought the recent dip. Bitcoin approached the key $70,000 level while futures tied to the Dow Jones and Nasdaq 100 indices rose by 365 and 150 points, respectively. Here is the outlook for some of the more followed cryptocurrencies on Wednesday: Render Token (RNDR), Floki, and Arweave (AR). Render Token price Render Token has been under pressure this week as the altcoin sell-off gained steam. It crashed from this month’s high of $11.86 to a…

Should Banks Be Crime Fighters? The Hidden (and Not So Hidden) Costs

Are these rules futile? Crime is impossible to effectively measure, intent even more so, which means we have no way of knowing just how much is prevented. But, to pick one example, a United Nations Office on Drugs and Crime (UNODC) report from 2022 showed that cocaine seizures in 2020 were more than double the 2010 level, and 5% higher than the previous year. Of course, this could mean that officials are better at tracing and seizure. But it’s more likely there’s just more drugs moving, and anyway, success at…

XRP Price Undergoes Brief Recovery

XRP has recently experienced a temporary recovery amidst ongoing market volatility. After a period of sustained downward pressure, XRP’s price has rebounded, offering a brief respite for traders and investors. This recovery comes amid a broader context of fluctuating market conditions, driven by various factors including regulatory developments, market sentiment, and overall cryptocurrency market trends. Despite this positive movement, the market remains highly unpredictable, and it is uncertain whether XRP’s recovery will be sustained in the long term. Investors are closely monitoring the situation, analyzing technical indicators and external factors…

Blast’s Rebasing Stablecoin USDB Now Ranks 9th Among Dollar-Pegged Crypto Tokens

A new stablecoin has emerged among the top ten U.S. dollar-pegged tokens. Known as USDB, this auto-rebasing stablecoin was developed by the Blast team. Despite the stablecoin economy being underwhelming over the past 30 days, USDB has quietly secured the ninth-largest market capitalization among all U.S. dollar stablecoins. USDB Climbs the Ranks The decentralized finance […] Source CryptoX Portal

Bitcoin Price (BTC) Rises After Consumer Price Index Rises Less Than Forecast

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as…