Deutsche Telekom has been very active in the digital assets sector for years. It has been running validators on networks such as Polygon, Q, Flow, Celo, Chainlink and Ethereum. The telecom giant also started Energy Web Chain last year, which the company said was “the world’s first public blockchain designed explicitly for the energy sector” and will help to create a “more decentralized, digitalized, and decarbonized energy system.” Source

Day: June 17, 2024

Bitcoin mining companies are hiding energy data, Wall Street is responsible

In a new report filed by Greenpeace, the climate group called for Wall Street accountability in crypto mining, and it correlated bitcoin mining to excessive global energy usage. Greenpeace claimed that Bitcoin (BTC) mining has evolved into a significant industry dominated by traditional financial companies that are buying up and operating large-scale facilities, using lots of energy. In 2023, global Bitcoin mining used approximately 121 TWh of electricity, comparable to the entire gold mining industry or a country like Poland. This resulted in significant carbon emissions, the report contended, as…

Crypto Trading Firm Cumberland Acquires New York’s BitLicense

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as…

Fairlead’s Katie Stockton says equities and Bitcoin still in bull market cycle

Katie Stockton, founder and managing partner at Fairlead Strategies, believes the broader equities market and Bitcoin (BTC) are still in a bull market cycle. Stockton shared her view of the market during an interview on CNBC’s ‘Squawk Box’ on Monday. Highlighting the current market outlook compared to three weeks ago, she said: “We were in a little bit of a pullback but that’s been sort of solved on the upside for the S&P. You know, hasn’t quite resolved yet, [but] almost, we’re very close to that. Where that happens is…

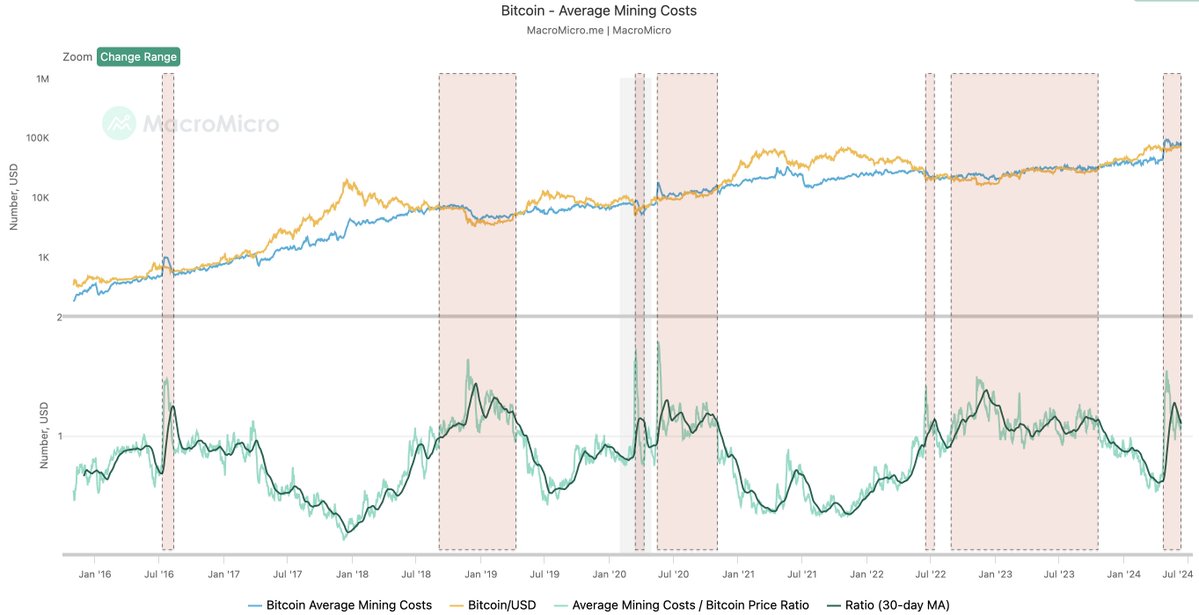

Price To Surpass This Soon?

Data suggests the average cost of mining Bitcoin is standing around $86,700 right now. Here’s what history suggests could happen next for BTC. Bitcoin Average Mining Cost Is Currently Notably Higher Than The Price In a new post on X, analyst Ali Martinez has talked about how the average mining cost of BTC is looking like right now. The Bitcoin network runs on a consensus mechanism based on the “proof-of-work” in which validators called the miners compete against each other using computing power to get to hash the next block…

ZKsync Airdrop of ‘ZK’ Token Puts Initial Market Cap Near $900M

The ZK token opened at $0.31 and is down about 21% since then, trading at $0.24 at the time of writing, according to CoinGecko. The market capitalization stands at about $908 million, based on the circulating supply, with about 3.7 billion tokens eligible to be distributed. On a fully diluted basis, the market cap would be $5.1 billion. Source

Bitcoin’s New Normal: Prices Over Five-Digits for 28% of Its Lifetime

Over the past week, bitcoin has declined by 4% against the U.S. dollar from June 9 to June 16, 2024, yet it has surged over 152% in the past year. This year, bitcoin has maintained a position above the $60,000 mark for a record-setting 107 days so far. Bitcoin’s Resilient Streak: Maintaining Highs Amid Market […] Original

PlayDoge Meme Coin Hits New Heights with $4.5M Presale Raise, Analyst Forecasts Big Gains

PlayDoge (PLAY) is cementing itself as one of the most anticipated new meme coin launches this year. The retro Play-to-Earn project has blown past the $4.5 million milestone in presale. And with that early backing, some analysts believe PLAY could be in line for sizable gains once listed on DEXs. ‘90s Nostalgia Fuels Early Demand […] Source CryptoX Portal

Ethereum Foundation Moves $64.4 Million Worth Of ETH, Is This A Dump?

The Ethereum Foundation is again in the news following its recent transaction involving millions of Ethereum (ETH) tokens. The non-profit organization’s Ethereum transactions are always significant, considering the impact they usually have on the second-largest crypto token. Ethereum Foundation Transfers $64.4 Million Worth Of ETH Crypto journalist Colin Wu revealed in an X (formerly Twitter) post that a wallet (0x8e…D052) linked to the Ethereum Foundation transferred 18,089 ETH ($64.4 million) to a new address (0x87…D812). On-chain data shows that the new address has yet to transfer these funds and that…

Australian Securities Exchange (ASX) Gives its First Approval of a Spot Bitcoin Listing to VanEck

Unlike in the U.S., in Australia, firms require the approval of the regulator, the Australian Securities & Investments Commission (ASIC), and then the exchange listing the product. In May, ASIC told CoinDesk via an email that DigitalX Ltd., VanEck and BetaShares either had “the relevant licence themselves or are working with another firm that has the requisite licence.” Source