Australia’s securities regulator has issued a cautionary statement to investors ahead of the launch of Bitcoin ETFs on the Australian Stock Exchange (ASX). A spokesperson from the Australian Securities and Investments Commission (ASIC) has warned of the risks involved with cryptocurrencies as the Australian Stock Exchange gave the green light to the country’s first spot Bitcoin exchange-traded fund (ETF), according to a local report. “ASIC has repeatedly warned investors that crypto is risky, inherently volatile and complex.” ASIC spokesperson. According to the official, investors should only risk funds they are…

Day: June 17, 2024

Bitcoin Investment Products Saw Over $600M in Outflows Last Week: CoinShares

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as…

Binance lists Zksync (ZK) with token giveaway amid airdrop controversy

Crypto exchange Binance announced the listing of Zksync (ZK) trading pairs and a token distribution program aimed to alleviate community concerns about the token airdrop. Starting at 10:00 (UTC) on Jun. 17, the ZK token will be available for spot trading on Binance in pairs against Bitcoin (BTC), Tether (USDT), First Digital USD (FDUSD), and the Turkish Lira (TRY). The exchange encouraged users to deposit ZK for trading, with withdrawals becoming available the following day. Additionally, Binance revealed plans for a token giveaway program, intending to allocate 10.5 million tokens…

U.S.-Listed Bitcoin (BTC) Miners Reached Record Total Market Cap of $22.8B in June, JPMorgan (JPM) Says

The bank noted that almost all the companies outperformed bitcoin in the first two weeks of June, with Core Scientific (CORZ) the best performer, adding 117%, and Argo Blockchain (ARBK) the worst, dropping 7%. The world’s largest cryptocurrency fell 3% in the same period. Source

Australian Securities Exchange (ASX) Approved Listing Its First Bitcoin ETF

Vaneck, a global investment firm, has announced the launch of the Vaneck Bitcoin ETF (VBTC), the first Bitcoin exchange-traded-fund on the Australian Securities Exchange (ASX). Set to commence trading on June 20, 2024, the ETF is touted as the most cost-effective Bitcoin fund exposure in Australia. Arian Neiron, Vaneck’s CEO for the Asia-Pacific region, emphasized […] Source

Financial Stability Board (FSB) to Work More on Stablecoin Risks in Emerging, Developing Economies

“In emerging market and developing economies (EMDEs), crypto-assets pose particular challenges for monetary policy and capital flow management,” the FSB said. “Members discussed the challenges posed by the relatively higher levels of adoption and risks of global stablecoin arrangements in EMDEs. The FSB will undertake further work to consider how these challenges can be addressed.” Source

Japanese Regulator Issues Warning to Unregistered Crypto Platform Lbank Exchange

The Financial Services Agency (FSA) of Japan issued a warning to Lbank Exchange, an overseas cryptocurrency platform, for operating without registration. Lbank, which ranks 56th in trading volume according to Coingecko, has been offering services to Japanese residents despite reportedly having an unknown address and representative. This action follows similar warnings issued by the FSA […] Source

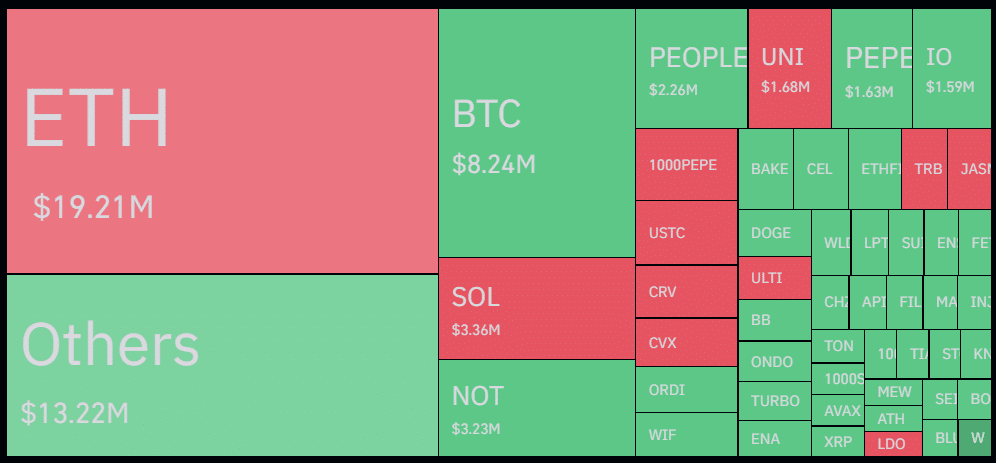

Crypto liquidations rally 78% with ETH leading the charts

Cryptocurrency liquidations have seen a sudden increase over the past day. Ethereum (ETH) is still leading the charts. According to data provided by Coinglass, the total crypto liquidations surged by 78.8% in the past 24 hours, surpassing the $75 million mark. The increase in liquidations came while the total cryptocurrency open interest recorded a 0.35% decline in the same timeframe — currently hovering at $66 million. Crypto liquidations map – June 17 | Source: Coinglass Per a crypto.news report on Jun. 16, the number of crypto liquidations plunged by 80%…

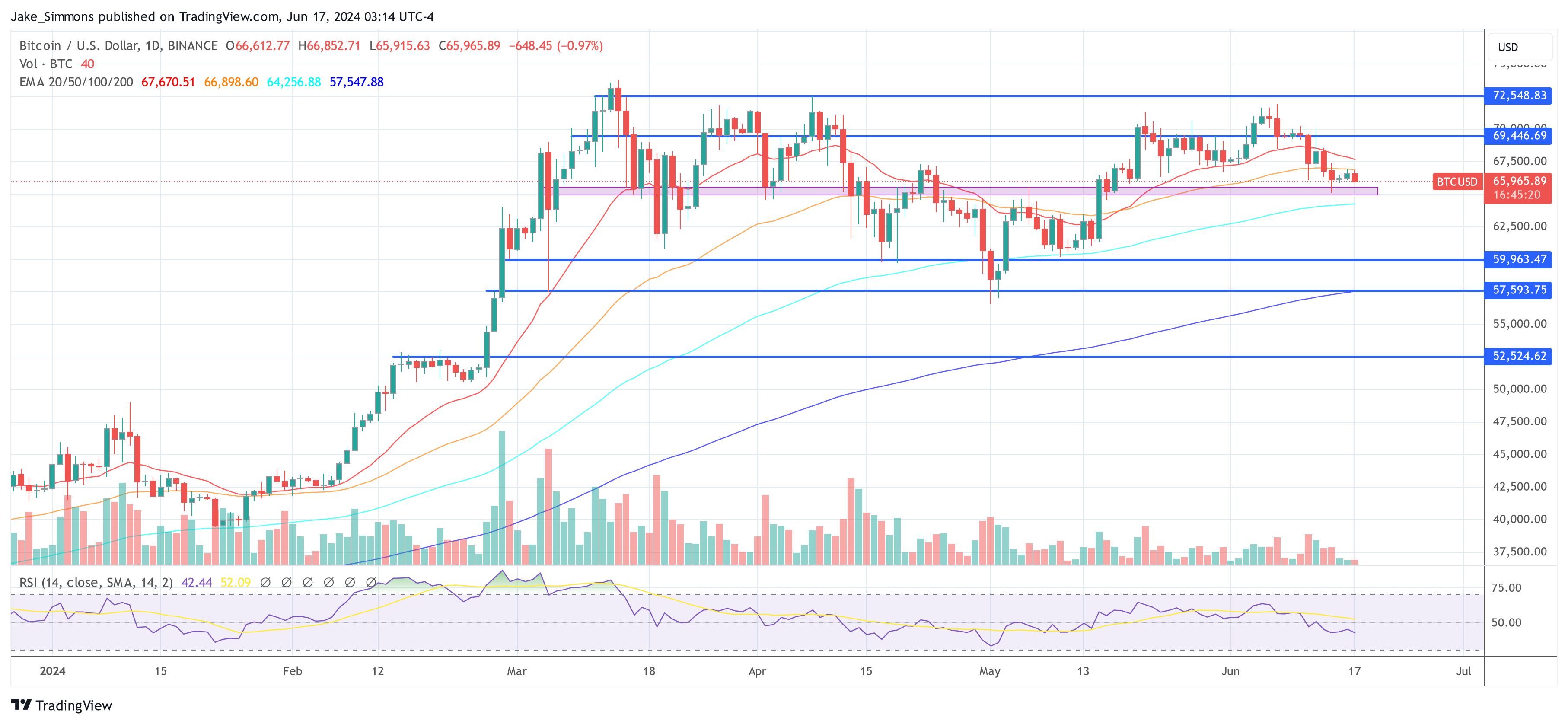

Here’s What At Stake This Week

As Bitcoin enters a pivotal week, market participants are closely monitoring several key indicators and events that could determine its near-term trajectory. Renowned crypto analyst Ted (@tedtalksmacro) has provided an in-depth analysis, highlighting the critical factors at play. Weekly Bitcoin Preview Ted’s analysis begins by contextualizing the broader macroeconomic environment. Last week’s US Consumer Price Index (CPI) and Producer Price Index (PPI) data were optimistic for risk assets, highlighting a continued disinflationary trend. “Both CPI and PPI data were optimistic for risk assets, with each showing that the disinflationary trend…

Polkadot Struggles At $6.20 – Is Now The Time To Accumulate?

Technical indicators are casting a shadow over Polkadot, the blockchain interoperability stalwart. The token has dipped below the Ichimoku Cloud, signaling a clear downtrend. Adding to the bearish outlook, both the conversion line and the baseline of the Ichimoku indicator loom above the current price, intensifying the negative sentiment. Related Reading Polkadot (DOT) is entangled in a fierce battle with a relentless bear. Once soaring high with its promise of connecting different blockchains, the token now grapples with breaching the stubborn $7 resistance level. Over the past two weeks, it…