Bitcoin recently dropped below the critical support level between $67,000 and $68,000, having failed to break above the $70,000 price level successfully. Based on crypto analyst Josh’s analysis, the flagship crypto needs to climb above this critical support level soon enough or risk flipping into a bearish trend. Bitcoin Needs To Climb Above $68,000 Josh mentioned in a video on his YouTube channel that Bitcoin needs to achieve a confirmed breakout above $68,000 to flip bullish again and possibly experience more upside moves to the resistance levels between $72,000 and…

Day: June 18, 2024

Bitfinex Lists LayerZero’s Native Token ZRO, Enhancing Blockchain Interoperability

Bitfinex, a premier digital asset trading platform, has announced its latest listing addition, ZRO, the native token of LayerZero. This move positions Bitfinex among the first exchanges to support the token, according to a recent media release from the company. LayerZero’s Mission and ZRO Token LayerZero is a pioneering cross-chain protocol that aims to facilitate seamless interaction for decentralized applications across multiple blockchains. The introduction of the ZRO token is a significant step toward enhancing this ecosystem, offering users new avenues for engagement and innovation.…

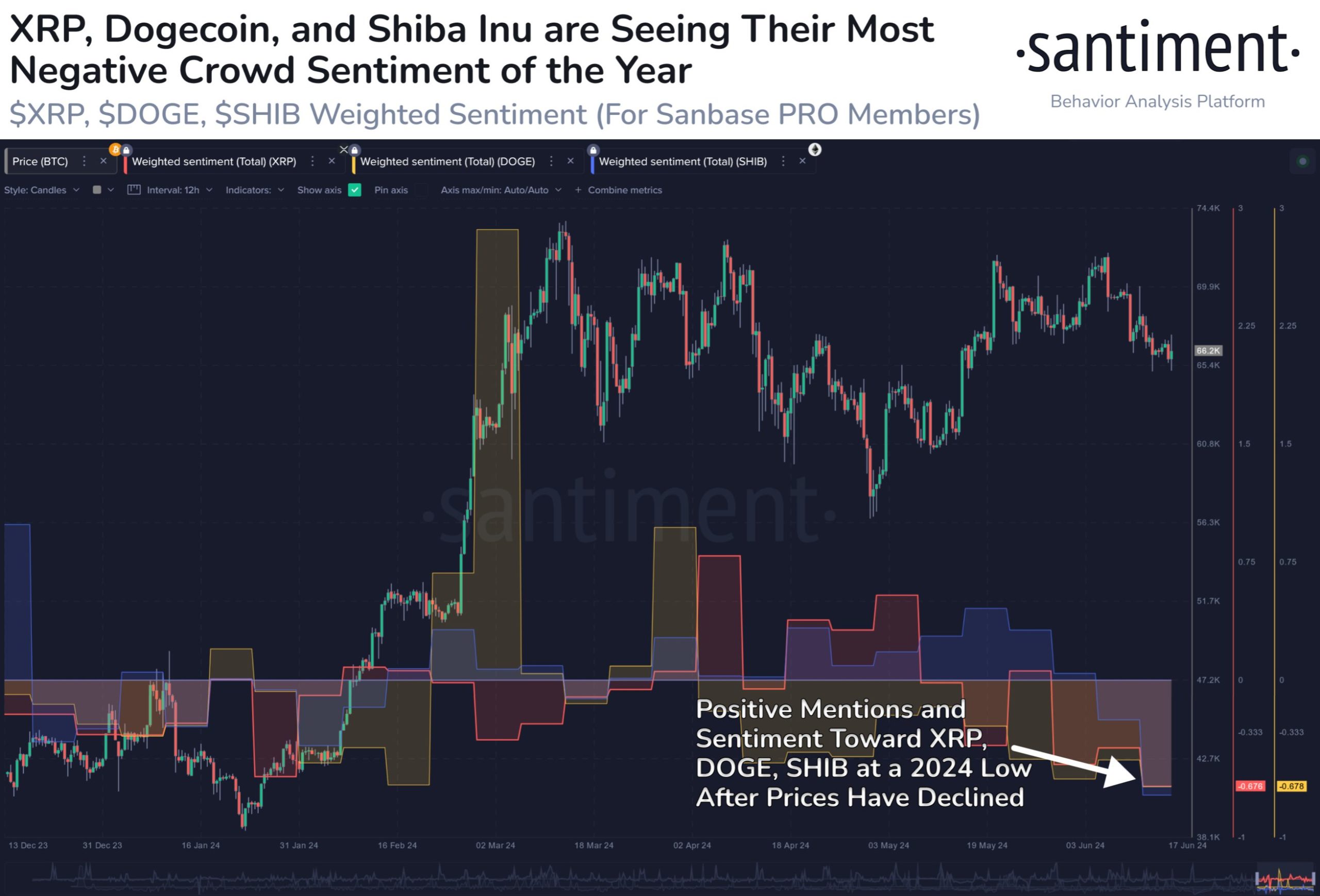

XRP, Dogecoin, & Shiba Inu All See Negative Sentiment: Signal To Buy?

Data shows social media users have been showing a negative sentiment towards XRP, Dogecoin, and Shiba Inu after their plunges in the past day. FUD Has Engulfed Traders Towards These Altcoins After The Latest Crash According to data from the analytics firm Santiment, the sentiment around XRP (XRP), Dogecoin (DOGE), and Shiba Inu (SHIB) has seen a significant drop recently. The indicator of interest here is the “Weighted Sentiment,” which derives its value from two other metrics: Sentiment Balance and Social Volume. The first of these, the Sentiment Balance, goes…

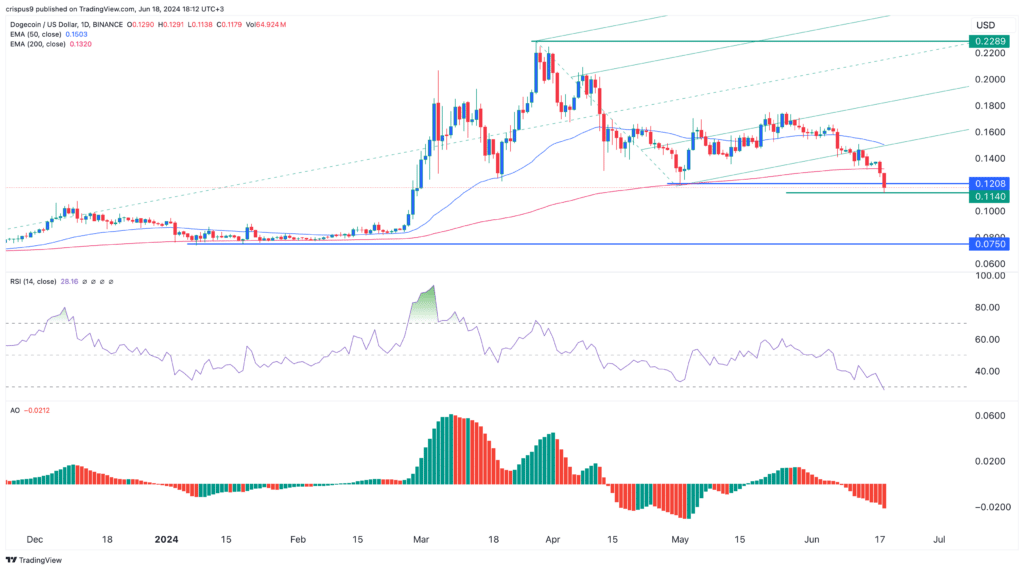

key support lost, death cross likely

Dogecoin price continued its downward trend on Tuesday as most cryptocurrencies plunged. DOGE moved to a low of $0.1140, its lowest swing since March 1st, 2024. It has slipped by almost 50% from its highest point this year. Crypto sell-off accelerates Dogecoin has come under pressure since March as focus among most meme traders turned to newer tokens like Pepe, Dogwifhat, and Brett. In this period, most traditional meme tokens like DOGE, Shiba Inu, and Baby Doge underperformed their newer peers. Dogecoin has also dropped because of Bitcoin’s performance. Bitcoin,…

Bitcoin (BTC) Hashrate May Finally Slow as Miners Face Scorching Summer Heatwave

In fact, the hashrate has already started to come down since reaching an all-time high in March. As of June 17, it is lower by 10% to 589 EH/s, according to Hashrate Index data. Since most miners are located in the U.S., particularly in steamy Texas, companies in North America shutting down their operations will likely make a dent in the hashrate growth. “According to data from the University of Cambridge, roughly 37% of all Bitcoin mining takes place in the United States,” said Blockware. “As summer continues heating up,…

Waka Flocka Flame’s Crypto Launch Crashes into Insider Trading Scandal

The red carpet of cryptocurrency rolled out for rapper Waka Flocka Flame’s FLOCKA token launch on June 17th, but quickly transformed into a red flag for investors. Suspicious pre-launch activity has cast a long shadow over the new coin, sparking accusations of insider trading and raising concerns about celebrity involvement in the volatile crypto market. Related Reading 40% FLOCKA Disappears Before Takeoff Blockchain detectives were the first to sound the alarm. Just before FLOCKA’s official debut, a single wallet swooped in and gobbled up a staggering 40% of the entire…

Institutional Investors Unlikely to Be Put Off by Ether (ETH) ETF’s Lack of Staking, 21Shares’ Ophelia Snyder Says

“For example, there could be months when the unstaking period is six or nine days, and that range can be so wide, it changes your liquidity requirements,” Snyder said. “And it doesn’t just jump from nine to 22 days. It actually slowly extends and if you monitor these things, there are data inputs that you can use to manage that portfolio such that you’re doing the right things in terms of maximizing returns while minimizing the probability of a liquidity issue.” Source

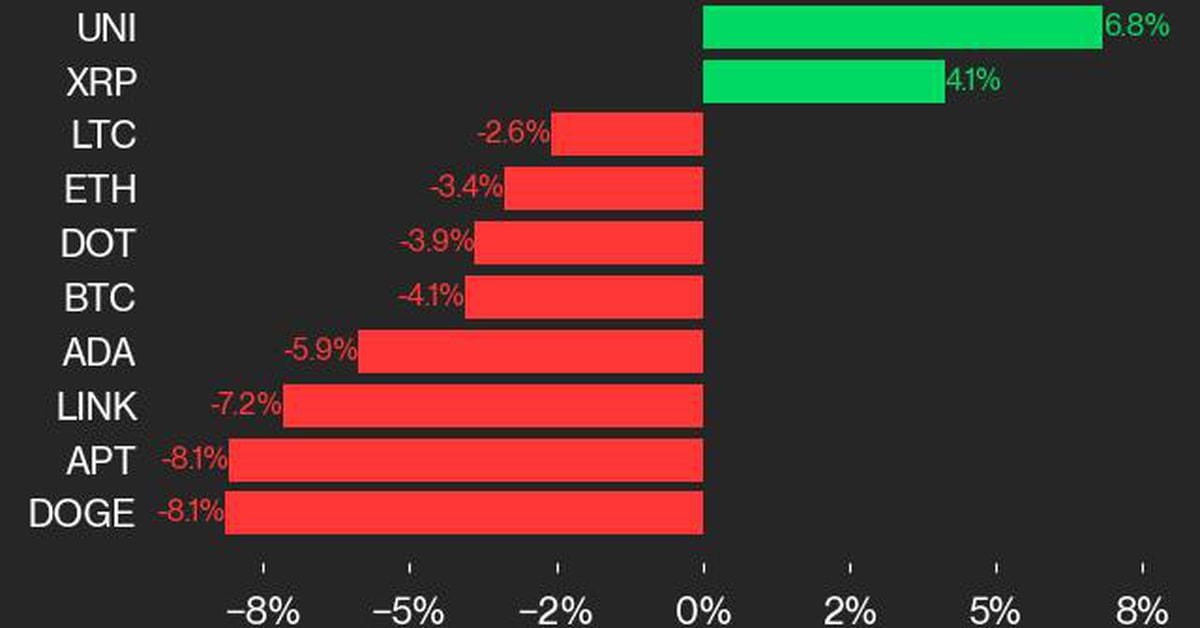

UNI Advance Led CoinDesk 20 Gainers Last Week: CoinDesk Indices Market Update

CoinDesk 20 tracks top digital assets and is investible on multiple platforms. The broader CMI comprises approximately 180 tokens and seven crypto sectors: currency, smart contract platforms, DeFi, culture & entertainment, computing, and digitization. Source

Circle Launches Credits Program to Support Blockchain Developers

Circle has announced the launch of its new Credits Program, aimed at supporting developers working on blockchain applications by minimizing associated costs, according to Circle. Introducing the Circle Credits Program The Credits Program provides financial assistance to developers by offering credits that can be used to pay for various Web3 Services. These include Programmable Wallets monthly fees, Smart Contract Platform API calls, and Gas Station fees. This initiative is intended to alleviate the financial burden of deploying blockchain applications, which typically incur transaction fees known…

Cleanspark Acquires 5 Bitcoin Mining Facilities in Georgia for $25.8 Million

Cleanspark Inc. has announced the acquisition of five new bitcoin mining facilities in Georgia for $25.8 million. The deal is expected to close immediately, increasing the company’s operating hashrate to over 20 EH/s by the end of the month. Publicly Listed Miner Cleanspark Obtains 5 New Mining Facilities The newly acquired sites, which range from […] Original