The wallet address, previously identified as belonging to the German Federal Criminal Police Office (BKA) by Arkham, moved 6,500 BTC to the address “bc1q0unygz3ddt8x0v33s6ztxkrnw0s0tl7zk4yxwd” and then back to itself. Transactional data shows that a tranche of $32 million worth of bitcoin was deposited on crypto exchange Kraken and a similar amount on Bitstamp. Source

Day: June 19, 2024

US Bitcoin ETFs See Fourth Day of Outflows, Totaling $152M

U.S. spot bitcoin exchange-traded funds (ETFs) experienced another day of outflows, marking the fourth consecutive day of losses. The 11 funds saw $152.42 million leave on Tuesday, bringing the cumulative total net inflows to $14.81 billion. Grayscale, Fidelity, and Bitwise Drive Tuesday’s Outflow in Bitcoin ETFs Another day of trading brought losses for spot bitcoin […] Original

Is Solana A Good Buy? Finance CEO Predicts ‘Magnificent’ Autumn Rally

Raoul Pal, the co-founder and Chief Executive Officer (CEO) of Real Vision, a financial media platform, has indicated that Solana is on the brink of reversing its bearish trends. The financial expert has predicted a “magnificent autumn rally” for the cryptocurrency in this market cycle. Solana To Witness Major Autumn Rally Solana’s recent downward trend could potentially signal a great buying opportunity for investors who remain optimistic about the cryptocurrency’s future outlook. Being a popular supporter and long-term investor of Solana, Pal has expressed confidence in the cryptocurrency’s ability to…

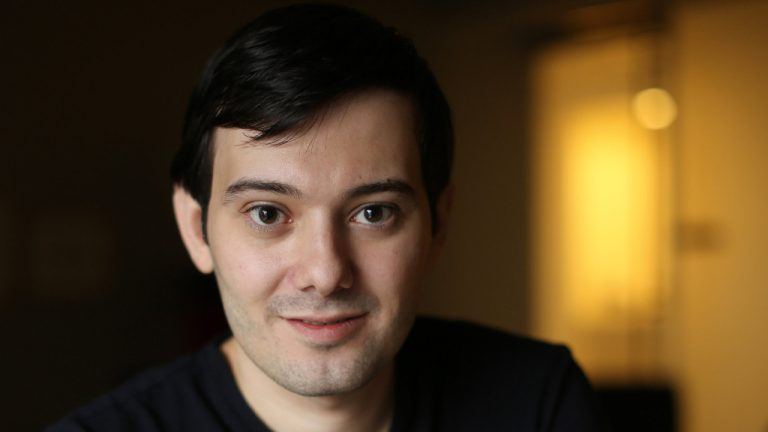

Controversial Figure Martin Shkreli Allegedly Behind New Trump-Themed Crypto Token DJT

Martin Shkreli, known for his previous securities fraud conviction, has reportedly claimed to co-create the DJT token, a new crypto asset themed after Donald Trump. The revelation comes as the token’s association with the Trump campaign remains unverified, stirring significant speculation and controversy. ‘Pharma Bro’ Martin Shkreli Allegedly Co-Creates Trump Crypto Token In a recent […] Source CryptoX Portal

Marathon’s Layer-2 Chain, Anduro, Plugs In ‘Portal to Bitcoin’ for Atomic Swaps

Anduro, a multi-chain layer-2 network incubated by bitcoin miner Marathon Digital Holdings (MARA), has incorporated the decentralized exchange (DEX) network Portal to Bitcoin – formerly known simply as Portal – with the goal of enhancing utility on the world’s oldest blockchain network. Original

Market Dominance Climbs To 9-Week Peak

The cryptocurrency market is currently experiencing significant turbulence, prompting a shift in investor behavior towards Bitcoin, which has traditionally been seen as the safest asset within the digital currency ecosystem. Related Reading This shift has resulted in Bitcoin’s dominance climbing to a nine-week high of 57%. Amidst the market chaos, Bitcoin has emerged as a beacon of relative stability, while altcoins are bearing the brunt of the sell-off. Flight To Safety: Bitcoin’s Rising Dominance In times of market uncertainty, investors often gravitate towards what they perceive as safer assets. This…

Ether, Meme Coins Lead Recovery While Bitcoin Remains Subdued

The digital asset market ticked upward during the European morning with ether reclaiming $3,500. ETH has climbed over 4% in the last 24 hours, trading at $3,540 at the time of writing. The CoinDesk 20 Index (CD20) added around 1.6%. DOGE is nearly 3.5% higher following its slump on Tuesday, while fellow meme coin SHIB is also up over 3%. Bitcoin remains subdued, trading around $65,400, a lift of 0.2% from 24 hours ago. Spot bitcoin ETFs in the U.S. experienced a further $152.4 million worth of outflows on Tuesday.…

Bitcoin Technical Analysis: Bearish Sentiment Tightens Grip as BTC’s Downtrend Continues

As of June 19, 2024, bitcoin’s price is $65,283, fluctuating within an intraday range of $64,149 to $65,633. On Wednesday, the leading cryptocurrency saw a trade volume of around $31.28 billion, with a market capitalization of $1.28 trillion. Bitcoin Bitcoin’s oscillators reflect mixed sentiment. The relative strength index (RSI) is at 41, suggesting neutrality. Similarly, […] Original

Bitcoin Whales Sold Over $1B BTC in Past Two Weeks: CryptoQuant

Since June 5, BTC prices have fallen from $71,000 to just over $65,000 as of Wednesday on a strong dollar, a flight away from riskier assets, and growth in traditional stock indices. Meanwhile, U.S.-listed exchange-traded funds (ETFs) tracking the asset recorded net outflows of over $600 million last week—their worst performance since late April. Original

Ether (ETH) Price Volatility Expectations May Be Overrated

The spread between the forward-looking, 30-day implied volatility indexes for ether (ETH DVOL) and bitcoin (BTC DVOL) flipped positive in April on dominant crypto options exchange Deribit. Since then, it has risen to 17%, according to data tracked by Amberdata. Implied volatility estimates the degree of future price swings based on options prices. Source