Bitcoin, the undisputed king of cryptocurrencies, faces a challenge as it approaches a critical moment. After a stellar run in the first half of 2024, breaking past the crucial $71,000 barrier, the digital gold has retreated, currently hovering around the crucial $61,000 support zone. This recent dip has sparked a debate amongst analysts, with some clinging to bullish long-term outlooks and others cautioning of potential headwinds. Related Reading Rainbow Whispers: A Golden Buying Opportunity Or Fool’s Gold? One factor keeping some bulls optimistic is the Bitcoin Rainbow Chart, a popular…

Day: June 26, 2024

Hydrogen Technology Execs Jailed for Manipulating the HYDRO Token Price

“In this case, for the first time, a jury in a federal criminal trial found that a cryptocurrency was a security and that manipulating cryptocurrency prices was securities fraud,” Nicole M. Argentieri, head of the Justice Department’s Criminal Division, said in the press release Source

Strike Expands Bitcoin and Lightning Services to the UK

Strike has announced its expansion into the United Kingdom. This move allows individuals and businesses in the UK to access Strike’s suite of Bitcoin and Lightning Network services. The features include buying, selling, sending, and withdrawing bitcoin, global payments, and more. The company’s founder, Jack Mallers, believes that bitcoin can solve some of the world’s […] Original

ICO statement on its public sector approach trial

In June 2022 we revised our approach to working with public sector organisations and started a two-year trial, as set out in our open letter at the time. While we have continued to issue fines to public bodies where appropriate, we have also been using our other regulatory tools to ensure people’s information is handled appropriately and money isn’t diverted away from where it’s needed the most. We will now review the two-year trial before making a decision on the public sector approach in the autumn. In the meantime, we…

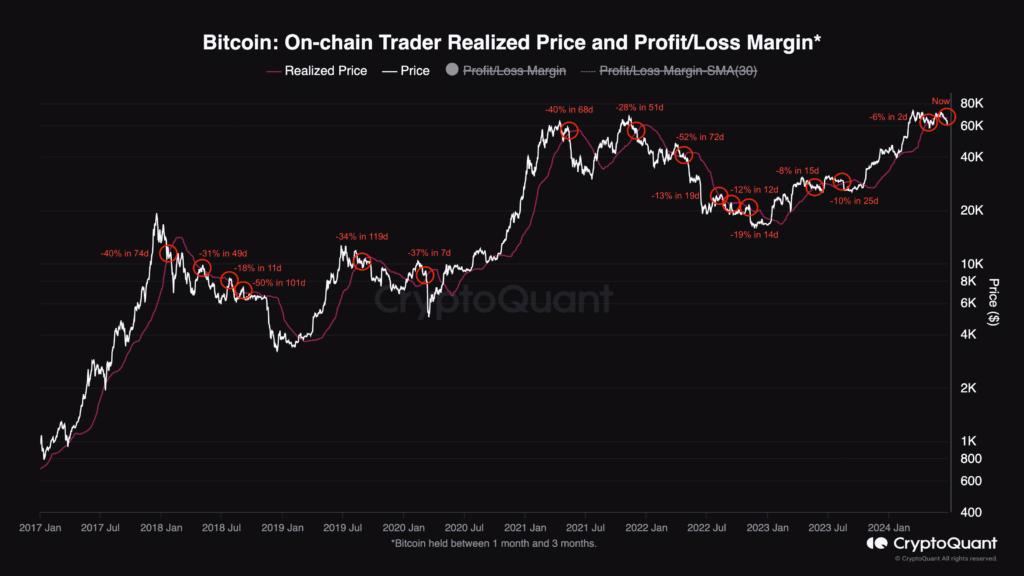

Learn how to spot the next crash

CryptoX – Cryptocurrency Analysis and News Portal How often have you seen Bitcoin plummet unexpectedly, just an hour or a day after buying a fresh stack? Everyone has faced this frustration, wondering, “If only I knew, I would have bought it later for cheaper.” The good news is that some indicators can help predict these downturns. While some indicators, like the MVRV Z-score and the Pi Cycle Top, help identify market tops, they do not provide insights into short-term downward movements. This is where the on-chain trader realized price comes…

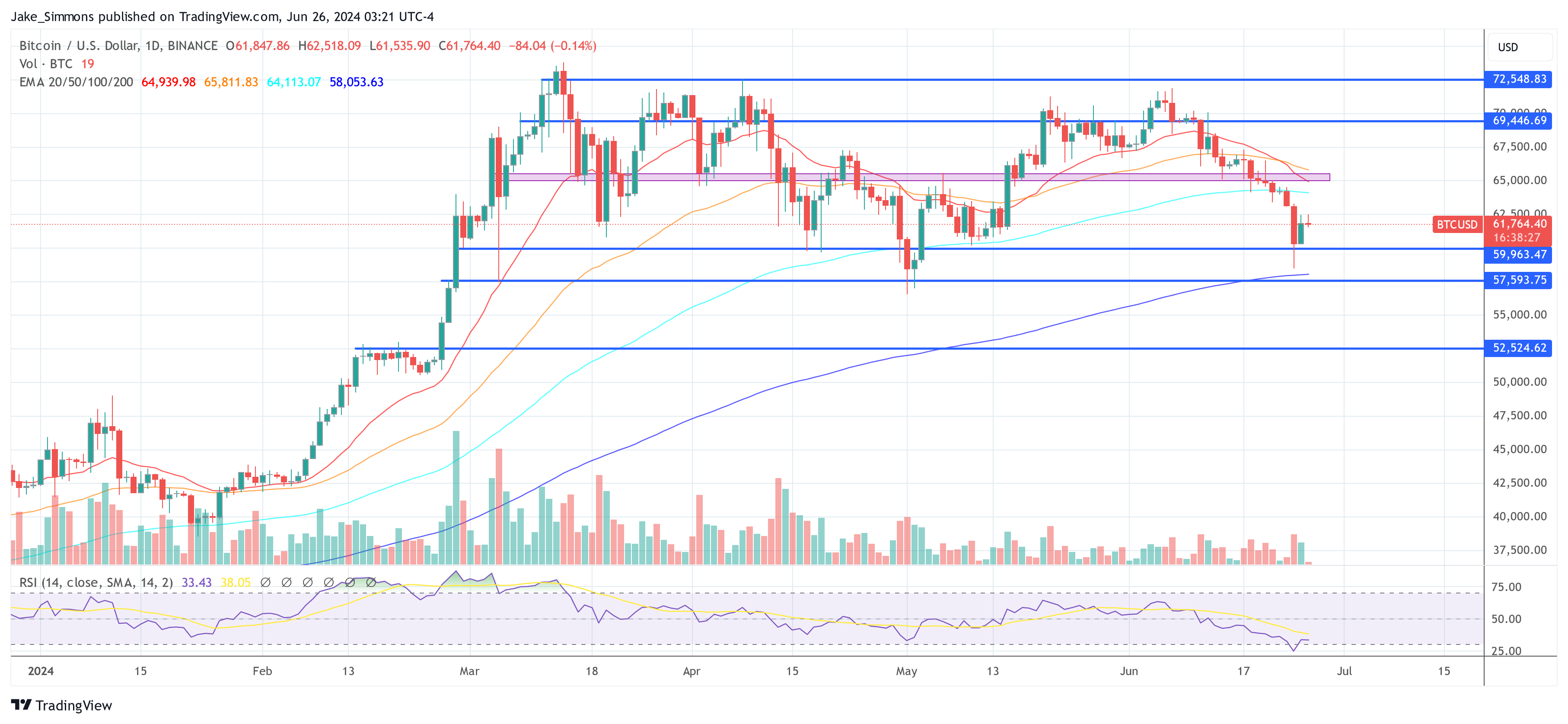

Here’s Why The Bitcoin Bottom Is In, New Highs Imminent: Expert

Crypto expert Duncan (@FloodCapital) recently expressed a strong conviction that Bitcoin has reached its market bottom and is poised for new all-time highs. His analysis, shared on X (formerly Twitter), provides a detailed examination of the current market dynamics and underlying fundamentals that signal a bullish turn for Bitcoin and potentially other cryptocurrencies. Is The Bitcoin Bottom In? In his in-depth analysis, Duncan pointed out that the crypto market has been underperforming relative to equities over the past few weeks. This trend was a concern until a pivotal development emerged…

CryptoQuant Integrates TRON Data to Empower Users with Enhanced Blockchain Analytics

PRESS RELEASE. Seoul, South Korea, June 26, 2024 – CryptoQuant, a leader in blockchain analytics, is excited to announce the integration of TRON data into its comprehensive analytical platform. This development is set to revolutionize how users interact with and derive insights from the TRON network. CryptoQuant’s enhanced platform now offers expanded capabilities for both […] Source CryptoX Portal

Analyst Foresees Huge Jump to $380

Injective (INJ), a project known for its cross-chain derivatives protocol, is grabbing headlines after crypto analyst Javon Marks released a bullish prediction. Marks, a popular figure in the crypto space, believes INJ is poised for a “monstrous rally” towards a staggering $380 target. Related Reading This optimistic outlook comes amidst a generally volatile cryptocurrency market, leaving investors to wonder: is Injective really hurtling towards the moon, or is this a case of overzealous enthusiasm? Technical Twinkle: Hidden Bullish Divergence Fuels Optimism Marks’ prediction hinges on a technical indicator known as…

Bitcoin, Ether Options Worth $10B Set to Expire on Friday

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as…

Crypto Execution-Only Platform Crossover Markets Raises $12M

Illuminate Financial founder Mark Beeston will join Crossover’s board of directors. Existing investors include Flow Traders, Laser Digital, Two Sigma, Wintermute, as well as retail brokers such as Exness, Gate.io, GMO, Pepperstone, Trademax, and Think Markets. Source