Ethereum, the second-largest cryptocurrency by market capitalization, has experienced a significant decline in value recently. Over the past month, its price has dropped by 15%, leading to concerns among investors about the future of this digital asset. The current situation raises questions about whether this downturn signals a prolonged decline or if it is merely a temporary setback before a potential recovery. Related Reading Despite the price decrease, some analysts remain optimistic about Ethereum’s prospects. Prominent cryptocurrency analyst Yodhha has identified technical patterns that may indicate a forthcoming reversal in…

Day: June 28, 2024

Kraken Co-Founder Jesse Powell Donates $1M, Mostly Ether, to Donald Trump

Powell said he is supporting the only major pro-crypto party candidate. Source

2024 Crypto Losses Attributable to Deepfakes Projected to Exceed $25 Billion

Losses attributed to crypto crimes involving the use of deepfakes are projected to surpass $25 billion in 2024. According to the latest Bitget research study, these losses are expected to continue rising if no regulatory intervention is introduced to curb this type of fraud. Educating users and implementing comprehensive legal and cybersecurity frameworks globally are […] Source CryptoX Portal

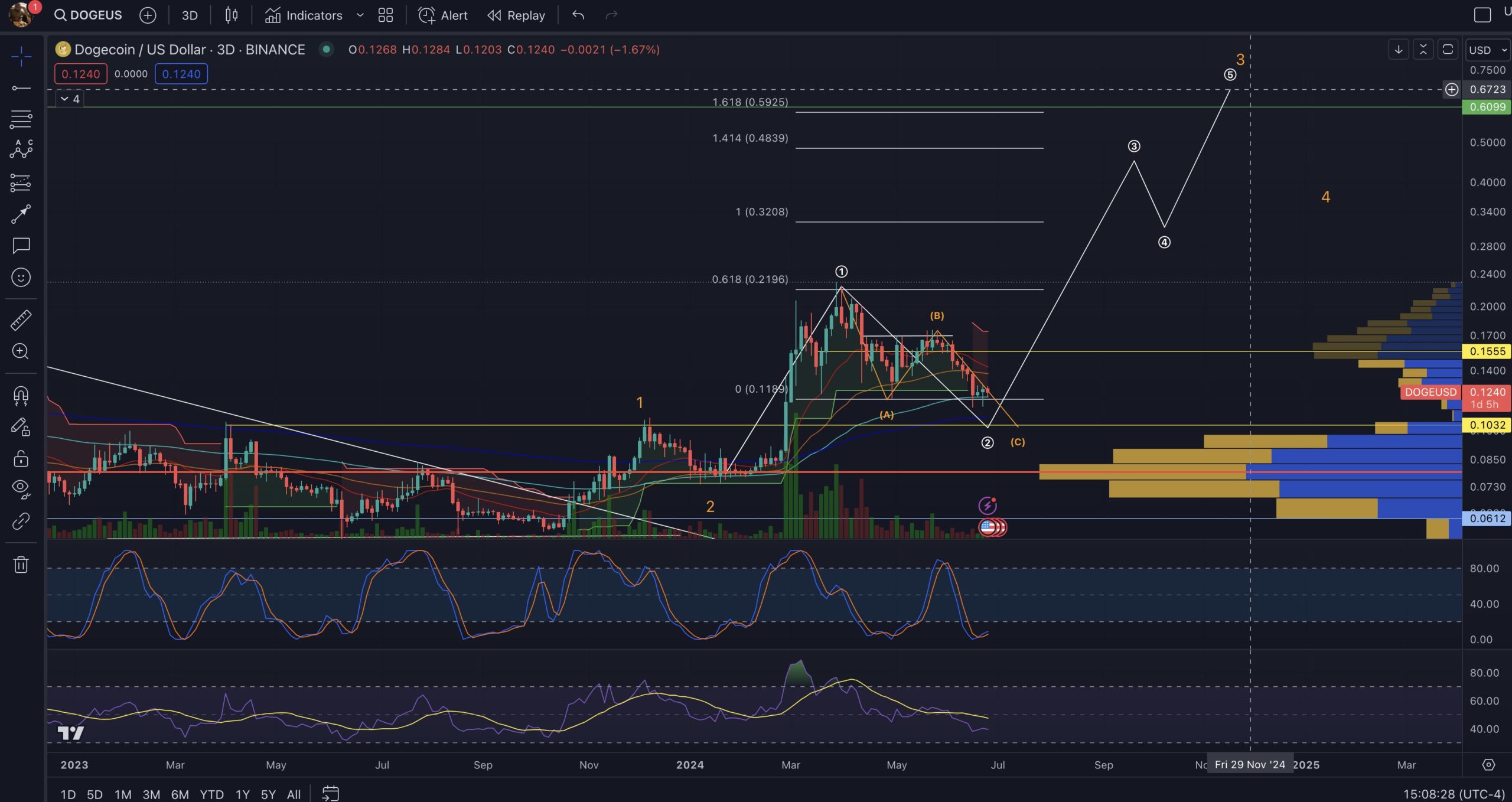

Dogecoin To The Moon? Crypto Analyst Predicts 440% Price Rally

In a recent technical analysis by popular crypto analyst Big Mike (@Michael_EWpro), the likelihood of a substantial rise in Dogecoin (DOGE) has been spotlighted. Employing a blend of Elliott Wave theory, Fibonacci retracement levels, and crucial indicators such as the RSI and MACD, the analysis presents a bullish scenario that could greatly influence Dogecoin’s market stance. Why Dogecoin Could Skyrocket By 440% The three-day chart for Dogecoin, as traded on Binance, exhibits a complex structure that suggests the application of Elliott Wave theory, which is essential in predicting price movements…

Ether (ETH) to Hit $6,500 Later This Year Driven by Inflows Into Spot ETFs: Analyst

“We continue to forecast a net inflow between $15 billion and $20 billion in the first 12 months, even considering the outflow from the Grayscale Ethereum Trust (ETHE),” senior analyst Mads Eberhardt wrote, adding that this should drive the value of ether higher, in dollar terms and also relative to bitcoin (BTC). Source

Long Dormant Whale Sends $61M BTC to Coinbase, OnChain Data Shows

The so-called old hands have been selling coins this quarter, adding to bearish pressures in the market. Source

Microstrategy (MSTR) Long and Inverse ETF Coming Soon as T-Rex Group Files for Two New Leveraged Funds

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. CryptoX is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CryptoX was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CryptoX operates as…

MiCA’s Looming Deadline: Crypto Exchanges Shake-Up Stablecoins

The European Union’s Markets in Crypto-Assets Regulation (MiCA) will come into effect on 30 June, which is only three days away. As such, many crypto exchanges offering services in the bloc are already taking measures, mostly by dropping stablecoin offerings. “This will be a first step entering the new regulatory framework, and it will have a significant impact on the stablecoin market in the European Economic Area (EEA),” Binance, the largest crypto exchange in terms of trading volume, stated. Crypto Exchanges Dropped Stablecoins At least four cryptocurrency exchanges have confirmed…

Solana (SOL) Rockets Over 10%: Analyzing The Bullish Trend

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis. From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked…

BlackRock Global Allocation Fund Reveals Major Bitcoin ETF Stake With 43,000 Shares

In a recent filing with the US Securities and Exchange Commission (SEC), the BlackRock Global Allocation Fund disclosed its ownership of 43,000 shares of the asset manager’s Bitcoin ETF, iShares Bitcoin Trust, as of April 30. This announcement follows two previous filings by BlackRock on May 28, which disclosed the fund’s exposure to Bitcoin in its Strategic Global Bond Fund and Strategic Income Opportunities Portfolio. BlackRock Bitcoin ETF Investment Plan The investment giant’s move towards Bitcoin integration became evident in March when it submitted a filing to the SEC, expressing…