One of the great advantages of Bitcoin is its international nature. Wherever you are in the world, so long as you have an internet connection, you can use Bitcoin to send and receive money. That said; some parts of the world are much friendlier to Bitcoin users than others.

Anyone seeking to set up a Bitcoin business will naturally avoid those rare countries which actively discourage its use, either through burdensome regulations, harsh taxation, hostile banks, or even outright bans.

The good news is that such hostile nations are rare. Most governments are still deciding on how to approach Bitcoin and have yet to pass decisive legislation. The usual approach is to classify Bitcoin under some pre-existing category so that standing laws can be it applied to it, usually for taxation purposes.

Certain nations are however making a concerted effort to embrace Bitcoin, as they realize that Bitcoin could be of tremendous benefit to their economic future. By encouraging Bitcoin adoption and attracting Bitcoin companies, these nations seek to place themselves at the forefront of financial innovation.

This article examines the best possible countries to establish a new cryptocurrency business. We examine the tax rate on Bitcoin and the attitude of lawmakers and banks towards it. As such facts are subject to changes, sources are dated.

Countries are ordered them from best to worst, based on how low their taxes are, then by the clarity of regulations, then by friendliness of banks and finally how nice and business-friendly the country happens to be.

Tax Tip: If you’re interested in tax treaties between your nation and one of those covered below, this Worldwide Tax Summaries page by PwC should prove enlightening.

Banking Tip: To discover banks around the world which have been rated by users as either friendly or hostile to crypto, check out the Moon Banking site. Share your own experiences with banks to improve the site.

List of countries:

- Malta

- Bermuda

- Switzerland

- Gibraltar

- Slovenia

- Singapore

- Estonia

- Georgia

- Belaurs

- Hong Kong

- Japan

- Germany

#1 – Malta

Malta is a Southern European island nation of an estimated 450 000 people. With an area of just 316 km2, Malta is one of the world’s most densely-populated countries. Malta is part of the eurozone and uses Euros (EUR) as their currency.

The country’s economy is historically based in port trading. However, the Malta Financial Services Authority (MFSA) has successfully attracted aircraft and ship registration, credit-card issuing banking licences, fund administration, and gaming businesses.

There’s a bright outlook for cryptocurrencies in Malta. Binance, the largest crypto exchange by volume, has recently announced that it will relocate its headquarters to Malta. Additionally, obtaining residency in Malta is fairly easy due to its Global Residence Programme.

Maltese Taxes on Bitcoin

NoMoreTax.eu describes Malta as the EU’s crypto leader due to its favourable and detailed legislation.

Malta is one of the few EU countries which does not impose a property tax. Business taxes for “global residents” are 35%.

According to No More Tax, foreign residents aren’t subject to Maltese income tax on income generated outside Malta, provided it’s not remitted to a Maltese bank account. If brought into Malta, this income is taxed at 15% according to Chetcuti Cauchi Advocates (March 2017), a legal firm based in Malta.

Additionally, foreigners resident in Malta aren’t subject to income tax on any foreign sourced capital gains, even when they remit these gains to a Maltese bank account. This includes profit made in stock markets and so should extend to crypto gains too, at least until such time as specific laws are passed.

Finance Malta, a quasi-governmental info site, reports that Malta does not yet have laws in place for the taxation of cryptocurrency.

Government Stance on Bitcoin Businesses

In February of 2018, the Maltese government created the new Malta Digital Innovation Authority, which provides a comprehensive regulatory framework for crypto businesses. The MDIA seeks to certify blockchain platforms used by companies. It will also improve the verification processes for crypto platform users.

Malta’s Prime Minister has welcomed Bitcoin and blockchain tech, explicitly mentioning Malta’s aim to become “global trailblazers in the regulation of blockchain-based businesses and the jurisdiction of quality and choice for world class fintech companies.”

As of January 2018, the Maltese Financial Services Authority is making plans to enable regulated investment into cryptocurrencies and ICOs.

A Maltese economic minister recently announced (April 2018) that Malta wishes to become known as “The Blockchain Island.”

Finance Malta reports that Malta’s Prime Minister said in the European Parliament that EU governments should double down on blockchain technology. The PM also said that “the rise of cryptocurrencies can be slowed but cannot be stopped.”

How Malta’s Banking Sector views Bitcoin

As of November 2017, Malta’s oldest bank, the Bank of Valletta (BOV) has suspended cryptocurrency transactions. The government has stated that these delays with the banking sector will resolve themselves once official legislation is in place.

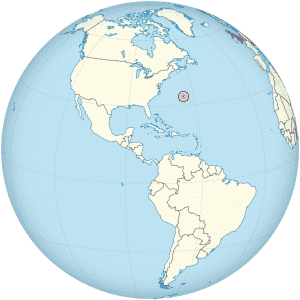

#2 – Bermuda

#2 – Bermuda

Bermuda is a small Caribbean island with a population of around 65,000. It’s a former British colony and remains a part of the Commonwealth. As currency, it uses the Bermudian Dollar, which is pegged to the US Dollar. Indeed, USD is frequently used in Bermuda.

A lot of financial companies operate from Bermuda, especially in the insurance sector, and there are 4 major banks situated there. Bermuda reportedly has the highest GDP per capita in the world, as its favourable tax rates and island lifestyle attract high net worth individuals and major corporations.

Bermuda is renowned as a tax haven. It has no VAT, nor any corporate, income, wealth or capital gains taxes. Bermuda has only a minimal payroll tax, which is around 10% on the high end, as well high consumption taxes on goods and services. There are also high duties levied on all imports. Bermuda’s capital tops the cost of living index.

Google is one of the more famous companies to take advantage of Bermudan tax law. Google sent over $10 billion to its Bermudan subsidiary. This allocation allowed the company to avoid $2 billion in taxes in 2011.

There are more than 15,000 companies registered in Bermuda which have no physical presence or employees there.

Bermudan Taxes on Bitcoin

Bermuda’s light taxation policies extend to Bitcoin and cryptocurrencies in general. Bitcoin is not recognised as legal tender in Bermuda, which explains its tax-free status.

Government Stance on Bitcoin Businesses

The government of Bermuda’s website carries a formal statement from the Minister of Finance on the Government’s Cryptocurrency Initiative, issued in November of 2017. The gist is that the country seeks to attract crypto business but is putting in place regulation to prevent criminality.

Following an investigation into cryptocurrency launched in November 2017, Bermuda’s financial regulator, the Bermuda Monetary Authority (BMA), published a paper in April of 2018 regarding its proposed “regulation of virtual currency business.” This paper is known as the Virtual Currency Business Act (VCBA).

Bermuda aims to implement anti-money laundering (AML) standards and provide a reasonable, friendly framework for cryptocurrency businesses and startups. The rules aren’t prohibitive but intended to foster a safe and predictable operating environment.

ICOs will receive special attention, requiring explicit approval from the Minister of Finance before being allowed to operate in Bermuda. Recording customer identity info (KYC measures) will be mandatory for ICOs.

The largest crypto business with ties to Bermuda is Binance, currently the leading crypto exchange by volume. The CEO and founder of Binance signed a memorandum of understanding with Bermuda’s Minister of Finance in April of 2018. Binance has so far invested $15 million into the island nation.

How Bermuda’s Banking Sector views Bitcoin

Banks in Bermuda may be reasonably expected to accommodate the government’s new regulations and welcoming attitude towards cryptocurrency.

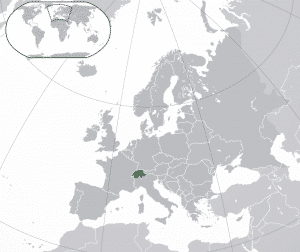

#3 – Switzerland

#3 – Switzerland

Switzerland is a prosperous country in central Europe, synonymous with political neutrality and banking privacy (although this has been degraded of late). Switzerland is not part of the eurozone, having kept the Swiss Franc (CHF) as its currency. The country is ranked first in the world for economic productivity and competitiveness and has an extremely high standard of living.

Several major crypto businesses, such as Shapeshift and Xapo, have set up in the Swiss town of Zug. This region, nicknamed “Crypto Valley,” has passed some very progressive laws regarding crypto and related businesses, even approving Bitcoin as payment for utility bills. Other Swiss regions are following suit, such as Chiasso. The Swiss state railway company even accepts Bitcoin for ticket payments nationwide.

Swiss Taxes on Bitcoin

The cantons of Zug and Lucerne have detailed their approaches to Bitcoin taxation in German-language papers dating from Q4 2017.

Swiss law firm, Vischer, wrote an excellent overview (December 2017) of the Bitcoin taxation situation in Switzerland, as did the GoldenVisa site.

Crypto holdings must be declared and are subject to wealth taxes. They are to be valued according to the Swiss Federal Tax Administration’s year-end average prices, if available. Otherwise, they are valued according to purchase price.

Capital gains taxes and offsets for losses only apply on those who trade crypto professionally.

Crypto earned as a salary is subject to income tax, even for self-employed persons. Mining profits are also subject to income tax.

Switzerland is an “unofficial” cryptocurrency tax haven, according to an expert’s view published (February 2018) on CoinTelegraph.

Government Stance on Bitcoin Businesses

The Swiss economic minister proclaimed (January 2018) Switzerland’s intention to become a major crypto-nation before journalists at a private conference on cryptocurrency. With Bitcoin businesses, Switzerland may be able to recapture its reputation for financial privacy.

An article (February 2018) published on RT.com characterized Switzerland as embracing Bitcoin, altcoins and ICOs while most of the rest of the world is cracking down on them.

ICOs will be regarded as securities within Switzerland, according to regulatory guidelines passed by the Swiss Financial Market Supervisory Authority in February 2018.

Although no license is required to send or receive Bitcoin, companies must comply with Swiss anti-money laundering (AML) legislation, according to an article published February 2018.

How Switzerland’s Banking Sector views Bitcoin

Switzerland’s Vontobel bank has offered Bitcoin “mini futures” on the Swiss stock exchange since November 2017.

Falcon Private Bank, a boutique investment firm, has been buying and storing Bitcoin on behalf of its high net worth clients since July 2017.

Both Vontobel and Falcon have stated (December 2017) that “cryptocurrency’s best days are ahead of it.”

Swiss online bank, Swissquote, launched a financial product in December of 2017 which allows users to allocate holdings between Bitcoin and USD.

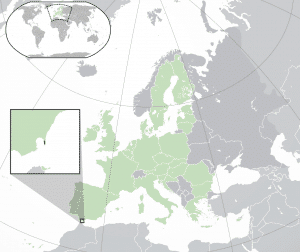

#4 – Gibraltar

Gibraltar is a tiny country located south of Spain. It is home to a mere ~33,000 people. While self-governing, Gibraltar is part of the territory of the United Kingdom. British and Gibraltar pounds are the legal tender there, although euros see frequent informal use.

Online gambling and financial services and are two of Gibraltar’s leading industries. Many banks, brokerages, investment and insurance firms are headquartered in Gibraltar. Blockchain-based companies, including many ICOs, have also been drawn to the territory as an attractive spot for doing business.

Gibraltar Taxes on Bitcoin

Gibraltar’s corporate tax rate has been fixed at 10% since 2011.

Gibraltar is in the process of formulating a legal framework for cryptocurrency businesses (Q1 2018), which should bring further clarity on taxation issues.

Government Stance on Bitcoin Businesses

Gibraltar formulated the Distributed Ledger Technology Regulatory Framework rules in January 2018, granting formal license to crypto companies in the region.

With the DLT Regulatory Framework, Gibraltar’s Financial Services Commission became the first financial ombudsman in Europe to draw up regulations governing ICOs. As ICOs exist in a legal grey area in most nations – except for those in which they’re banned – these rules are likely to attract many ICOs to the jurisdiction.

As part of Brexit, Gibraltar is set to leave the European Union in 2019. This may impact banking and legal relationships between Gibraltar and the rest of Europe.

How Gibraltar’s Banking Sector views Bitcoin

On the 25th of July 2016, the Gibraltar Stock Exchange announced an Exchange Traded Instrument (ETI) based on Bitcoin, called BitcoinETI. This is the first such instrument of its kind in Europe and signifies that the financial sector in Gibraltar is fully onboard with cryptocurrency.

While the Gibraltar International Bank is very accepting of crypto, its British partner bank is not. In January of 2018, the Royal Bank of Scotland (RBS) refused to process orders from crypto firms based in Gibraltar. This surprise move left many Gibraltar-based crypto businesses scrambling. What this incident highlights is the vulnerability of Gibraltar to British business decisions or even regulations.

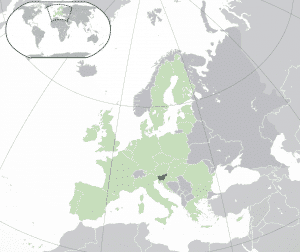

#5 – Slovenia

#5 – Slovenia

Slovenia is a central European nation with a population of around 2 million and a strong, advanced economy. It is the richest Slavic nation, as measured by per capita GDP. As a eurozone member, Slovenia uses the Euro. The economy is mostly service-based and quality of life there is rated 14th in the world.

Major international exchange, Bitstamp, was founded in Slovenia in 2011. Slovenia has considerable hydroelectric power and the well-known cloud mining service, NiceHash, operates from there. Similar to Estonia, Finland and Lithuania, Slovenia’s government is very welcoming towards cryptocurrency.

Slovenian Taxes on Bitcoin

The Ministry of Finance of Slovenia has published a document on cryptocurrency in late 2013, although unfortunately it’s not available in English.

Bitcoin and cryptocurrencies are classified as virtual currencies according an article (published 2017 or later). This means Slovenia does not tax Bitcoin as either money or a security.

Individuals who are taxed on crypto profits under income tax laws, based on the crypto’s value at the time of acquisition. However, Bitcoin trading is not taxed under these income tax laws.

Individuals who acquire Bitcoin as part of their business or mining activities will pay income tax on it.

Bitcoin and crypto are exempt from capital gains tax and mining is VAT-exempt.

The corporate tax rate on crypto business in Slovenia is not well-defined but taxation should certainly be expected. The Financial Administration of Slovenia has said that “the accounting treatment depends… on the circumstances.” Capital gains taxes of 19% may be levied on profits.

Government Stance on Bitcoin Businesses

The Slovenian town of Kranj inaugurated what is perhaps the world’s first public monument to Bitcoin in March of 2018. This symbolizes the Slovenian government’s acceptance of cryptocurrency.

Slovenia’s Prime Minister promoted the country as being friendly to blockchain in October of 2017. He praised crypto startups in the nation and revealed that the government is investigating the application of blockchain technology for its own purpose. The PM went on to say that government “want[s]to position Slovenia as the most recognised blockchain destination in the European Union.”

The PM and Economic and Technology Minister re-affirmed the nation’s commitment to blockchain technology during a meeting between government and industry players, held in February of 2018.

Slovenian crypto businesses are cooperating with each other and regulators under the Blockchain Alliance CEE.

How Slovenia’s Banking Sector views Bitcoin

In September 2017, Slovenia’s LON bank became the first regulated bank in the world to sell Bitcoin (indirectly, via the issuance of coupons) from its 15 nationwide ATMs. The bank reported sales of half a million euro achieved in less than four months.

Unfortunately, LON’s ground breaking approach to Bitcoin was halted in February of 2018 by the Slovenian Central Bank. The ban came one day after the central bank warned about the risks of cryptocurrency, saying that it could undermine financial stability if it continued to expand.

According to NoMoreTax.eu, businesses in the country must have a regulated bank account and may not operate solely in cryptocurrency.

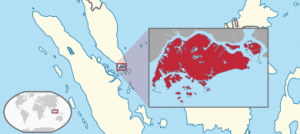

#6 – Singapore

#6 – Singapore

Singapore is a Southeast Asian island nation of 5.6 million people. The country’s has a highly developed market economy, with historic roots as a trading port. The country uses Singaporean dollars (SGD) as its currency. It is known as a tax haven and a global financial centre. Singapore was rated the world’s most “technology-ready” nation.

The Singaporean economy has been rated as the most innovative, freest, most dynamic, most competitive and most business-friendly in the world. It is rated as having the 3rd highest per capita income in the world. Singapore is also seen as one of the least corrupt countries in the world.

Singaporean Taxes on Bitcoin

The Inland Revenue Authority of Singapore has decided that Bitcoins are to be viewed as goods and not as currency.

Any company dealing with Bitcoin is required to pay GST (Goods and Services Tax) when trading Bitcoin or using it for purchases. This tax is currently set at 7%.

Tech in Asia reported in January of 2014 that Singapore will not apply taxation to online gaming worlds, which possibly includes online gambling.

Companies buying or selling Bitcoin to or from clients will be liable for GST on the amounts trades as well as their commission fees.

Capital gains tax apparently does not imply to long-term investments into Bitcoin. Indeed, Singapore currently has no capital gains tax system in place.

Government Stance on Bitcoin Businesses

In February of 2018, the Deputy Prime Minister of Singapore and Minister of the Monetary Authority of Singapore (MAS) answered parliamentary questions surrounding the banning of trading in Bitcoin and other cryptocurrencies.

The Deputy PM highlighted that cryptocurrencies are experimental, are host to many illicit transactions and present a great risk to consumers. He also said that the MAS is closely monitoring cryptocurrencies and seeks to warn consumers of their risks.

MAS is also looking to bring Bitcoin under singular regulation in combination with other monetary services.

However, the Deputy PM also stated that there is no foreseeable reason to ban Bitcoin at this stage, and that Singapore can tolerate the use of cryptocurrencies.

How Singapore’s Banking Sector views Bitcoin

In November of 2017 Singapore’s largest, state-owned bank, DBS accused Bitcoin of being a “Ponzi scheme.” This contrasts with the Monetary Authority of Singapore’s more neutral stance on Bitcoin.

Bitcoin businesses were in a tough spot in September of 2017, when Singaporean banks closed several cryptocurrency businesses’ bank accounts. For example, CoinHako, a cryptocurrency-related firm, had its bank accounts close by DBS.

While DBS was clearly hostile to Bitcoin, Moon Banking reports many banks in Singapore which are crypto-friendly. However, there are only a few votes in most cases. Recent votes suggest that DBS has become more open to Bitcoin.

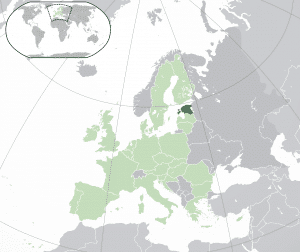

#7 – Estonia

Estonia is a Northern European country and a member of the eurozone. It has a small population of 1.3 million people. Estonia is technologically advanced, being the birthplace of the popular Skype service. The country is generally prosperous and rated highly for economic freedom (4th in Europe) and ease of doing business (12th in the world).

The country is also notable as a leader in e-government, having implemented internet voting in 2005. Estonia is even contemplating the launch of its own national cryptocurrency, Estcoin.

Estonian Taxes on Bitcoin

A possibly-outdated summary (Q2 2014) of Estonian laws on Bitcoin taxation reveals that Estonia classifies Bitcoin in much the same way as the ECB. Bitcoin is seen as an alternative currency, but not as a security. People or companies conducting Bitcoin transactions must be registered as providers of business services.

According to an article (Q4 2017) by the founder of Incorporate.ee, Bitcoin profits are subject to capital gains tax (of around 25%), but exempt from VAT (20%).

The ECJ, the European Union’s highest court, ruled in October of 2015 that Bitcoin transactions are exempt from VAT. The court sees Bitcoin as currency rather than property (the latter being subject to VAT).

A fairly recent (Q2 2017) article by a Bitcoin trader decries Estonia’s 25% capital gains tax and its 33% social tax. Such rates may not apply in all cases – a trader based in Estonia reports (Q1 2018) paying only 20% income tax.

Prospective businesses should conduct their own investigation into the rate their particular business would be charged, as it’s likely to be considerably lower than this stated maximum. A good place to start would be the Estonian Tax and Customs Board and this guide regarding the taxation of cryptocurrency transactions in Estonia.

Note that “e-residents” (described below) are only taxed on income derived in Estonia.

Government Stance on Bitcoin Businesses

Estonia’s pioneering e-residency scheme makes it easy for foreign nationals to establish a legal and banking presence in the country – and by extension, Europe. Combined with the nation’s positive attitude towards cryptocurrency, this makes it a great point of entry into the European market.

E-residency is not equivalent to tax residency, nor does it work for purposes of registering with crypto exchanges.

The government has a welcoming stance on Bitcoin and cryptocurrency in general. Estonia is considered the easiest Baltic nation in which to open a Bitcoin business. A recent (Q1 2018) forum thread, regarding the founding a crypto-related business in Estonia by e-resident “foreigners,” outlines the order in which to proceed. While the process appears easy and inexpensive, note that it’s necessary to secure specific licenses for the legal operation of any crypto-related business. This demonstrates that regulatory clarity on crypto certainly exists within Estonia.

The Estonian government is still considering launching Estcoin, despite criticism (Q3 2017) of the project by the European Central Bank. This shows that Estonia exercises at least some degree of independence in promoting cryptocurrency, even if the ECB opposes cryptocurrency in order to protect its fiat monopoly. The Estonian government is even contemplating a sovereign wealth fund (Q3 2017) based on Bitcoin.

The cost of opening a Bitcoin business in Estonia is low, reportedly (Q4 2017) around 8,000 euros.

How Estonia’s Banking Sector views Bitcoin

Estonia’s LHV Bank stated (Q1 2016) that it’s interested in blockchain tech and supports Bitcoin’s values. The bank has issued a blockchain-based wallet for Euro tokens and even trains its employees in cryptocurrency. LHV is also partnered with Coinbase and the UK’s Coinfloor exchange, so it’s probably the best choice for an Estonian bank.

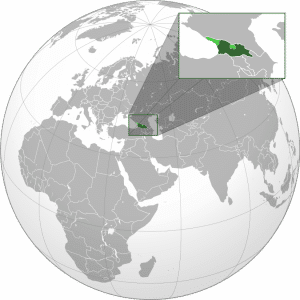

#8 – Georgia

#8 – Georgia

Georgia the country (not to be confused with the US state) is an Eastern European nation of close to 4 million people. It is not a eurozone member and uses the Georgian Iari (GEL) as currency. For purposes of attracting foreign investment into its IT industry, Georgia set up the Poti free industrial zone near its capital, Tblisi, in 2015.

The post-Soviet Georgian economy is one of the quickest-growing in Eastern Europe, thanks to economic reforms and modernisation. In 2017, Georgia was ranked 14th in the world for ease of doing business and 13th for economic freedom. However, in 2016 Georgia was rated poorly among European nations for the development of its IT sector (although this is steadily improving).

Goergia has the 2nd highest Bitcoin mining hashrate in the world after China, according to the Global Cryptocurrency Benchmarking Study, published in 2017. This is largely due to the presence of a Bitfury mining facility near Tblisi.

Georgian Taxes on Bitcoin

Taxes in Georgia are comparatively low, as described by the Company Formation Georgia website.

Only income generated from Georgia sources is taxed.

Companies situated in the Poti free industrial zone benefit from a preferential taxation scheme. Within this zone, there is no VAT, dividend, profit or property tax. Tax on leases and salaries will still apply.

Government Stance on Bitcoin Businesses

In February 2017, Georgia’s government approved a system whereby state property transactions will be recorded via the Bitcoin network. This will be developed in cooperation with Bitfury.

In April of 2016, Bitfury and the Georgian government launched a blockchain-based land registry project.

The government is welcoming of crypto-related investment and has close ties with large Bitcoin miner, Bitfury.

Cryptocurrency is not seen as legal tender in Georgia.

The co-founder of Georgia-based crypto business, Spotcoin, stated in May of 2018 that he believes it likely that the Georgian government will soon investigate cryptocurrency regulation.

How Georgia’s Banking Sector views Bitcoin

The National Bank of Georgia issued a warning regarding the volatility of cryptocurrency in December of 2017. However, no regulatory action was taken.

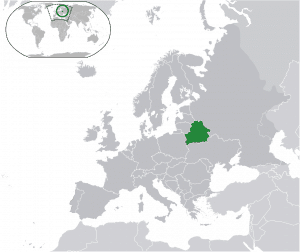

#9 – Belarus

#9 – Belarus

Belarus is an Eastern European nation of nearly 10 million people. The country’s economy is mostly manufacturing-based and uses Byelorussian rubles (BYR) as currency. The government has recently embraced cryptocurrency as part of its program to develop the IT sector and attract foreign businesses, investment and talent.

The Digital Economy Development Ordinance, signed by President Lukashenko in December 2017, lays out the country’s plans in detail. Note that these new rules governing crypto – perhaps the most progressive in the world – apply only to individuals or companies which are registered residents of the Hi-Tech Park. This is a special economic zone located in the capital city of Minsk.

While Western media is discernibly negative in its coverage of Belarus, perhaps due to the country’s close association with Russia, Belarus presents an interesting opportunity for the right type of Bitcoin business.

Belarusian Taxes on Bitcoin

Under the Ordinance, Belarus has waived all taxes on cryptocurrency transactions and income for five years (so until January of 2023). In other words, no taxation of mining, trading, or other business activities involving crypto. Bitcoin gifts and inheritances are also exempt from tax.

Tax-free status applies also to business conducted with foreign countries.

The Ministry of Finance in Minsk has created new accounting rules which specifically address cryptocurrency. This brings some much-needed clarity to tax reporting.

Government Stance on Bitcoin Businesses

The President of Belarus has put his name to a decree which fully legalizes blockchain technology within the country. All crypto-related business activities, including ICOs, exchanges, mining, smart contracts, etc. are now considered legal in the country.

Note that cryptocurrency is not regarded as legal tender in Belarus, meaning there is no compulsion for any person or business to accept it in lieu of Byelorussian rubles.

Foreign companies may take advantage of Belarus’s favourable policies by registering a company there, according to an article from January 2018).

Foreign IT specialists may stay in Belarus without a Visa for 180 days.

How Belarus’s Banking Sector views Bitcoin

Given the legislation passed at the highest levels, banks in the country have no real choice but to fall in line.

In July of 2017, the National Bank of the Republic of Belarus gave local banks the green light to use blockchain systems for “transmitting bank guarantees.” This appears to refer to a permissioned blockchain to record credit agreements between banks and the state.

The central bank has also revealed plans to apply blockchain technology in the management of Belarusian currency and stock exchanges.

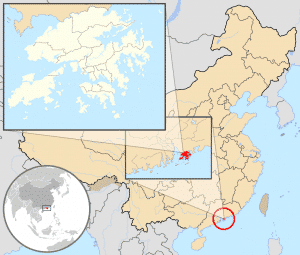

#10 – Hong Kong

#10 – Hong Kong

Hong Kong is a Special Administrative Region of China, located along its southern coast. Despite being a small territory, Hong Kong has a population over 7 million and a strong economy, largely based in finance and trade. Its economy, ranked the 44th biggest globally, has also been rated as the freest in the world since 1995 (although increasing Chinese influence may alter this in future).

Hong Kong has its own currency, the Hong Kong Dollar (HKD), which has a lot of trading volume. Hong Kong has lighter regulations than China and English is more commonly spoken there than in China, due to Hong Kong’s history as a British colony.

Hong Kong’s Taxes on Bitcoin

Bitcoin is exempt from both VAT and capital gains taxes in Hong Kong. However, income tax will still apply whether a business is receiving HKD or BTC. Reporting may be conducted in either currency.

Government Stance on Bitcoin Businesses

The Bitcoin Association of Hong Kong described (February 2018) the region as having reliable, predictable and hands-off regulations. Regulations are said to be simple and clear. The group gives a good overview of the evolution of Hong Kong’s Bitcoin regulations over the years.

Bitcoin is categorized as a virtual commodity rather than a currency. According to the Bitcoin Association of Hong Kong, this means it’s unregulated by existing financial watchdogs. The Association says that Bitcoin trading is not regulated by any of the organisations which oversee commodities trading either. Hong Kong’s legal status as a “free port” means that legislation of commerce is generally light.

In April of 2018, the Hong Kong Financial Services and Treasury agency published a report on money laundering and terrorist financing, which considered the role of Bitcoin and other cryptos in such activities. It was concluded that crypto had no “visible impact” in these areas.

As an example of Chinese influence leading to stricter regulation, the South China Morning Post reported in February 2018 that lawmakers and brokers have called on Hong Kong’s government to pass stricter regulations on Bitcoin. This comes in the wake of China’s bans on cryptocurrency exchanges and ICO activity, as well as tightening restrictions in Germany and the USA.

How Hong Kong’s Banking Sector views Bitcoin

Banks in Hong Kong do not seem as friendly to Bitcoin as the government there. Hang Seng Bank closed the account of large crypto exchange, Gatecoin, in September of 2017 without warning. Gatecoin claims to have made every effort at anti-money laundering (AML) compliance. Several other crypto startups also had their accounts frozen.

HSBC (Hong Kong and Shanghai Bank), one of the world’s largest banks which was founded in Hong Kong but is now headquartered in London, stated that it has “limited appetite” for crypto exchanges but welcomes start-ups.

The central bank of Hong Kong, known as the Monetary Authority, said that the rejection rate for new business accounts is only 5%.

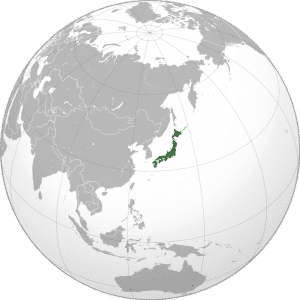

#11 – Japan

#11 – Japan

Japan is no laggard when it comes to Bitcoin. The world’s first major Bitcoin exchange, Mt. Gox, was based in Tokyo. The inventor of Bitcoin, Satoshi Nakomoto, even had a Japanese pseudonym.

Japan is certainly one of the nations at the forefront of Bitcoin adoption, legalization and integration. For example, Japan was the first country in the world to (arguably) approve Bitcoin as legal tender. The nation was also first to pass broad regulation of its 32+ cryptocurrency exchanges, aimed at improving their security.

While Japan is often reported (Q1 2018) as the world leader in crypto trading volumes, it must be borne in mind that many of their exchanges offer zero fee trading, which can greatly inflate volumes (as seen with Chinese Bitcoin volume), before and after their government’s imposition of mandatory trading fees).

Japanese Taxes on Bitcoin

In December of 2017, Japan’s National Tax Agency released guidance on the tax treatment of crypto profits. Essentially, anyone earning above 20m JPY (roughly $184k USD) annually or making profit in excess of 200k JPY ($1,840 USD) will be eligible for tax. Such profits are classed as miscellaneous income. Holders are not taxed, only those taking profits from selling coins or using them for purchase of goods and services.

Japan has a 7-tiered system of taxation. Tax rates range between 5 and 45 percent, based on annual earnings. There is also a residential tax on all income of 10 percent, for a maximum tax rate of 55 percent.

Business losses may not be used to offset crypto profits, nor may crypto losses be used to offset other gains.

Consumption tax was removed from Bitcoin in April of 2017, when it was declared legal tender.

Government Stance on Bitcoin Businesses

Japan’s Cabinet officially recognised Bitcoin as “real money” in Q1 2016.

Bitcoin is seen as legal in Japan and their regulation is not so strict as to stifle Bitcoin’s growth there.

Japan’s Virtual Currency Act went into effect on the 1st of April 2017. It mostly governs the capital requirements and security processes of exchanges.

The Nomura Research Institute issued a report on blockchain tech in May 2016. It suggests that further changes to the country’s banking laws are required to properly deal with cryptocurrencies, specifically the Banking Act and the Financial Instruments and Exchange Act.

The Accounting Standards Board of Japan is reportedly (Q1 2017) working on a framework for the treatment of cryptocurrency.

How Japan’s Banking Sector views Bitcoin

The largest bank in Japan, MUFG (Mitsubishi UFJ), is planning to launch its own cryptocurrency exchange, its own coin and segregated Bitcoin accounts for clients of other Japanese exchanges. This is according to news coverage from January 2018.

Japan’s largest crypto exchange, bitFlyer, received investment capital in early 2017 or late 2016 from all three of Japan’s largest banking corporations; Mitsubishi UFJ, Sumitomo Mitsui and Mizuho Banking Corporation.

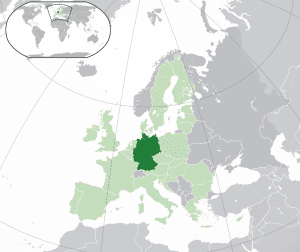

#12 – Germany

With a population of nearly 83 million, Germany is often considered the leading European country in terms of its technological, industrial and economic might. The country is the world’s third largest exporter of goods and has a vibrant economy, with a highly skilled labour force and a large capital stock.

The country seems to have a love-hate relationship with Bitcoin. While accepting it as a valid currency, the government still seeks to impose further regulations on cryptocurrency, advancing this as a topic for discussion at the G20 summit held in early 2018. It is yet to be seen if Berlin, labelled by The Guardian in 2013 as the “Bitcoin Capital of Europe,” can retain this glowing reputation in the face of serious competition from other European cities.

German Taxes on Bitcoin

As Bitcoin is seen as a legitimate currency in Germany, the country has announced that no tax will be charged for transactions.

No More Tax EU stated (in 2017 or later) that if you hold Bitcoin or other altcoins for one year or longer, you will pay no capital gains tax when selling them. This is a law seemingly designed to encourage hodling!

Government Stance on Bitcoin Businesses

In 2018, Germany’s finance ministry officially classified Bitcoin as a “unit of account.” Bitcoin had long been accepted in Germany as “private money.” This new classification means that Bitcoin may be considered as currency for purposes of taxation and trading.

Bitcoin was approved as an acceptable means of payment in March of 2018 by Germany’s National Tourist Board.

How Germany’s Banking Sector views Bitcoin

At the recent G20 summit in February of 2018, Germany’s economic chiefs and senior central bankers sided with France in calling for serious investigation and greater regulation of Bitcoin and other cryptocurrencies. However, during the course of the summit, it was decided that no further regulation was to be implemented.

In April of 2018, Deutsche Bank called for a serious regulatory crackdown on – and even a halt to – cryptocurrencies. They claim that currencies like Bitcoin only lead to greater financial fraud and cybercrime.

In April of 2018, German securities bank, Wertpapierhandels Bank, launched a cryptocurrency trading service, in partnership with Solaris Bank. At this stage, the service is only open to their professional customers.

A promising new German online banking service named Bitbond uses Bitcoin as the platform for international peer to peer lending.

Moon Banking reports that Bayrische Landesbank, Commerzbank, Fidor, GLS Bank, Landesbank Baden-Württemberg, N26, Norddeutsche Landesbank, and Sparkasse are all crypto-friendly banks. Deutsche Bank was seen as unfriendly towards crypto.

#2 – Bermuda

#2 – Bermuda

#5 – Slovenia

#5 – Slovenia #6 – Singapore

#6 – Singapore

#8 – Georgia

#8 – Georgia