PRESS RELEASE. As a part of Bitcoin Asia Week 2024, the “Scaling Bitcoin Together” event will take place on May 11, 2024, in Hong Kong. This event will bring together top blockchain experts to discuss how to grow the Bitcoin ecosystem. The “Scaling Bitcoin Together” aims to foster discussions that propel the development of the […] Source CryptoX Portal

Category: CryptoX News

JPMorgan: Retail Investors Drive Selloff in Both Crypto and Equity Markets

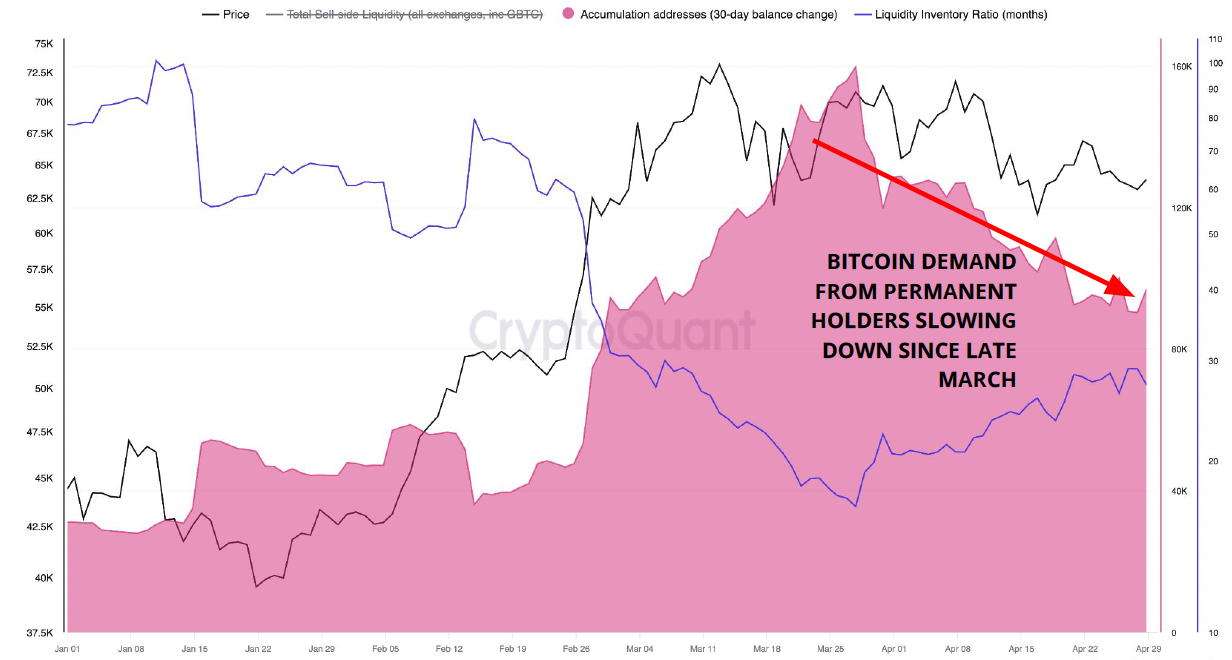

JPMorgan has highlighted a significant increase in selling and profit-taking across equity and crypto markets, driven largely by retail investors. The global investment bank also observed institutional momentum traders and quantitative funds reducing positions, particularly in stocks, bitcoin, and gold. Insights on Market Trends by JPMorgan JPMorgan, a global investment bank, has provided insights on […] Source CryptoX Portal

Zksnacks to Cease Coinjoin Transactions, Affecting Wasabi, Trezor and Btcpay

On Thursday, Zksnacks, the developer behind Wasabi Wallet, announced its decision to cease its coinjoin services following regulatory measures in the U.S. The company stated that the wallet will now operate as a standard non-custodial bitcoin wallet without the coinjoin feature. Zksnacks Withdraws Coinjoin Feature from Wasabi Wallet Following intensified regulatory scrutiny in the U.S., […] Source CryptoX Portal

Mark Cuban, Kevin Durant, Steve Aoki among top crypto-invested celebrities

Cryptorush Casino data reveals that celebrities Mark Cuban, Kevin Durant, Baron Davis, and Steve Aoki hold crypto in their investment portfolios. Mark Cuban Cuban, worth $5.4 billion, takes a subtle stance on crypto. His investments total a little over $6 million, and he has disclosed amounts into OpenSea and Yuga Labs. Although Cuban invests in cryptocurrency, he describes it as a hail mary. During a discussion in January on X, the Shark Tank co-host shared that his crypto holdings consist of Bitcoin (BTC), Ethereum (ETH), Polygon (MATIC), and Injective (INJ).…

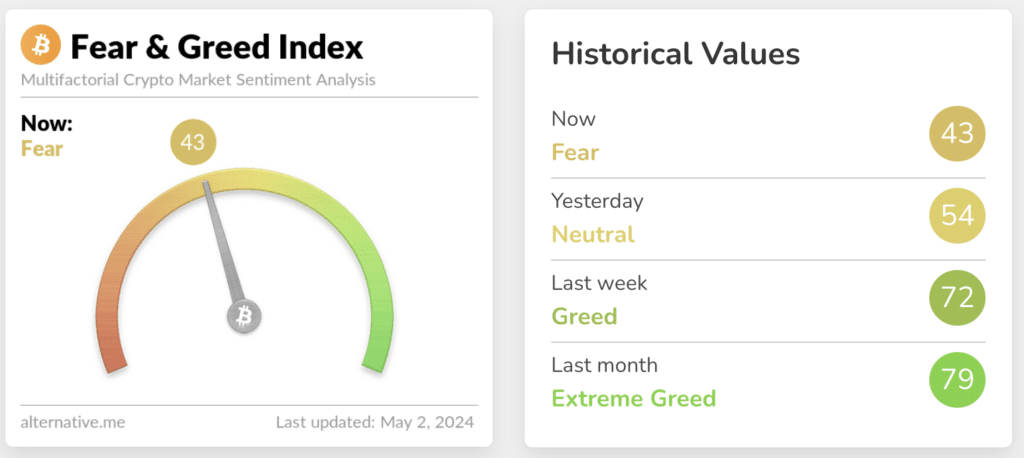

Fear and Greed Index falls back to fear for 1st time since October

The sharp drop in the price of Bitcoin has led to a significant deterioration in sentiment among cryptocurrency traders. The Crypto Fear and Greed Index, which reflects the overall emotional background of the crypto market, dropped to 43, the lowest level since last October. Source: Alternative.me The indicator has moved from the greed zone, where it was just a week ago, to the fear zone, signaling growing investor anxiety. Fear is indicated on the scale by a value from 26 to 46. At these levels, bearish sentiment is assumed to prevail. Continued capital outflows from U.S. spot ETFs are weighing…

Former Biden advisor predicts US crypto regulation imminent

The double-edged nature of cryptocurrencies has become increasingly apparent, particularly in their role in facilitating child sexual abuse material (CSAM). Speaking to crypto.news, former Whitehouse insider Moe Vela said he expects the government to intervene soon. U.S. Senators Elizabeth Warren and Bill Cassidy have attacked the cryptocurrency sector, raising concerns about the matter. Federal agencies have been urged to enhance their capacity to detect and prosecute cryptocurrency transactions linked to CSAM. Their call comes at a critical time when privacy-focused cryptocurrencies and mixing services have been identified as tools for laundering funds derived from CSAM, as detailed in recent studies by Chainalysis…

Record Withdrawal From US Bitcoin ETFs Marks Largest Single-Day Outflow

On May 1, 2024, U.S. spot bitcoin ETFs experienced their most significant single-day outflows since their inception on Jan. 11, 2024. ETF Institute Co-Founder: ‘Inflows Don’t Go up in a Straight Line’ Data sourced from coinglass.com reveals that these funds saw a withdrawal of $563.7 million on Wednesday, with Fidelity’s FBTC experiencing the highest outflow, […] Source CryptoX Portal

BlackRock (BLK) Sees Sovereign Wealth Funds (SWF), Pensions Coming to BTC ETFs

“Many of these interested firms – whether we’re talking about pensions, endowments, sovereign wealth funds, insurers, other asset managers, family offices – are having ongoing diligence and research conversations, and we’re playing a role from an education perspective,” Mitchnick said. And the interest is not new: BlackRock has been talking about bitcoin to these sorts of institutions for several years, he said. Source CryptoX Portal

Bitcoin Dominance Peaked, Says Analyst, Altcoins to Take Charge?

CoinspeakerBitcoin Dominance Peaked, Says Analyst, Altcoins to Take Charge? The world’s largest cryptocurrency Bitcoin has come under strong selling pressure extending its weekly losses to more than 10%. Soon after the FOMC meeting on Wednesday, May 1, Bitcoin (BTC) price tanked another 5% dropping to the lows of $56,500, before bouncing back partially. Popular crypto analyst Michaël van de Poppe recently stated that the “Bitcoin dominance has already peaked” while it’s time for altcoins to shine. “Altcoins start to wake up in their Bitcoin pairs, which means that the rotation…

Aave Labs Unveils Ambitious Plans for Protocol V4: Enhancing GHO Stability and Cross-Chain Liquidity

Aave Labs proposed a significant upgrade to its protocol, aimed at enhancing features like its stablecoin GHO, introducing a Unified Liquidity Layer for better integration, and improving the protocol’s architecture for cross-chain liquidity across both Ethereum and non-EVM layer-1 platforms. The update also focuses on automatizing interest rates based on market conditions with Chainlink data […] Source CryptoX Portal