Coinspeaker

Bitcoin Dominance Peaked, Says Analyst, Altcoins to Take Charge?

The world’s largest cryptocurrency Bitcoin has come under strong selling pressure extending its weekly losses to more than 10%. Soon after the FOMC meeting on Wednesday, May 1, Bitcoin (BTC) price tanked another 5% dropping to the lows of $56,500, before bouncing back partially. Popular crypto analyst Michaël van de Poppe recently stated that the “Bitcoin dominance has already peaked” while it’s time for altcoins to shine. “Altcoins start to wake up in their Bitcoin pairs, which means that the rotation is started,” he added.

Usually, a drop in the Bitcoin market dominance signals market participants that an altcoin market rally is around the corner since investors shift their capital from BTC to altcoins. Considering the huge size of the Bitcoin market cap, the BTC dominance currently in the market stands at around 53.9%. This is after the 1.75% drop in dominance registered over the last week. Despite this, the BTC dominance in the broader crypto market is up over 4.6% since the beginning of 2024.

Several market analysts have pointed out the drop in BTC dominance recently. Crypto trader Matthew Hyland noted a significant loss of support in Bitcoin dominance and expressed the intention to await the weekly close before confirming or negating ‘the breakdown’.

Meanwhile, trading team IncomeSharks observed on May 1 via a post on X that Bitcoin dominance is declining, suggesting potential for altcoins to capitalize if price fluctuations persist for several months. They also highlighted the unexpected resilience of many altcoins on that day.”

#Bitcoin – Dominance dropping. If price continues to chop for a few months alts could take advantage. A lot of alts holding up surprisingly well today. pic.twitter.com/VQiG2zxJlq

— IncomeSharks (@IncomeSharks) May 1, 2024

On-chain Data Hints at Weakness in Bitcoin, $50,000 Coming?

As said Bitcoin price has faced a severe correction under $60,000 as on-chain data shows weakness in Bitcoin demand growth along with the surge in short positions. This shows that one cannot rule out any further downside in the Bitcoin price from here.

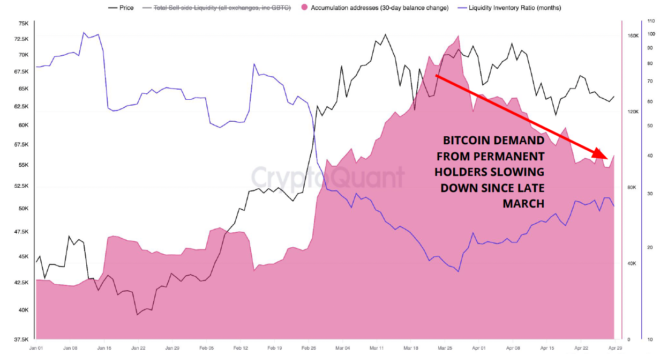

According to CryptoQuant’s report, BTC’s recent decline can be attributed to a reduction in demand, marked by a slowdown in the growth of Bitcoin balances among long-term holders, decreased interest in spot Bitcoin ETFs, and a rise in short positions in the futures market.

Data from CryptoQuant indicates that demand from long-term holders, defined as investors who consistently accumulate Bitcoin without selling, decreased by 50% in April. Balances went from over 200,000 BTC in late March to approximately 90,000 BTC.

On the other hand, the demand from Bitcoin whales has also been on a decline since March. CryptoQuant notes: “Bitcoin whale demand growth (purple area) peaked at a monthly growth rate of 12% in late March and has now slowed down to 6%.”

Photo: CryptoQuant

According to renowned analyst Scott Melker, the BTC price is unlikely to drop below $52,000 in the short term. Melker noted that despite the correction, which he considers relatively minor for a bull market, the daily Relative Strength Index (RSI) has not yet reached oversold levels.

“This is still only a 23% correction, very shallow for a bull market and consistent with other corrections on this run. We are yet to see a 30-40% pullback during this bull market, like those of the past,” he said.

Bitcoin Dominance Peaked, Says Analyst, Altcoins to Take Charge?