Bitcoin (BTC), the leading cryptocurrency by market value, fell 2% to $16,950, extending a retreat from the one-month high of $18,300 reached Wednesday. Ether (ETH), the second-largest cryptocurrency, fell 4.3% to $1,210, hitting the lowest since Nov. 29, CoinDesk data show. Original

Tag: Audit

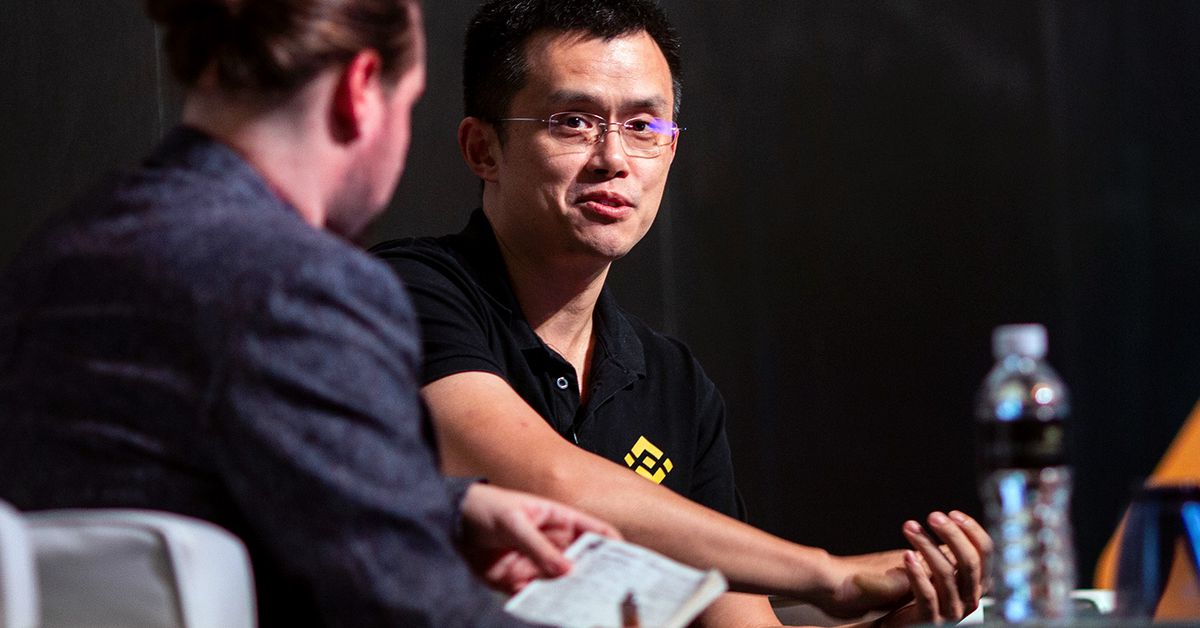

Binance’s Bitcoin Reserves Are Overcollateralized, Says Audit

The report was meant to assure customers that their bitcoin (BTC) assets are collateralized, exist on the blockchain and are in Binance’s control. Mazars took a snapshot of Binance’s total reserves and liabilities on Nov. 22 to perform a collateralization analysis. Assets included were customers’ spot, options, margin, futures, funding, loan and earn accounts for BTC and wrapped bitcoin (BBTC and BTCB) held on the Bitcoin, Ethereum, BNB Chain and Binance Smart Chain blockchains. Source

Crypto Audit Platform Sherlock Expects $4M Loss From Troubled Loans on Maple Finance As FTX Contagion Grows

Orthogonal Trading’s insolvency, triggered $31 million of loans in the credit pool to default this week. The bad debt represents 80% of the credit pool’s outstanding loans. When Sherlock invested in the pool, however, Orthogonal’s borrowings only accounted for 14% of the pool’s loans. Source

Audit firm Mazars to verify KuCoin’s proof of reserves

Crypto exchange KuCoin hired the international accounting firm Mazars for a third-party audit of its proof of reserves (PoR). According to an announcement on Dec. 5, the verification will provide the exchange customers additional transparency and reporting on whether their in-scope assets are collateralized, along with details on main, trade, margin, robot and contract accounts for Bitcoin (BTC) and Ether (ETH), as well as for the stablecoins Tether (USDT) and USD Coin (USDC). The report should be available on KuCoin’s official website within a few weeks. CEO of KuCoin Johnny Lyu…

Binance hires audit firm that served Donald Trump to verify crypto reserves

Cryptocurrency exchange Binance is working with accounting firm Mazars as part of its proof-of-reserve (PoR) audits triggered by the fall of FTX. Mazars, the accounting firm that worked for former United States President Donald Trump’s company, was appointed as an official auditor to conduct a “third party financial verification” as part of Binance’s PoR updates, the Wall Street Journal reported on Nov. 30. The accounting firm is reportedly already reviewing all of Binance’s publicly shared information on Bitcoin (BTC) PoR and will also be verifying future updates and tokens, a…

Kraken’s Jesse Powell Takes Aim at Newly Launched Proof-of-Reserve Lists, POR Audit ‘Requires Cryptographic Proof’ – Bitcoin News

On Tuesday, amid the many conversations concerning crypto exchange proof-of-reserves, Kraken executive Jesse Powell shared a screenshot of coinmarketcap.com’s newly launched proof-of-reserves (POR) dashboard. Powell said he planned to be “more assertive with calling out problems,” and he stressed that a POR audit “requires cryptographic proof of client balances and wallet control.” Jesse Powell Stresses a ‘Proof of Reserves Audit Requires Cryptographic Proof of Client Balances and Wallet Control’ Kraken’s Jesse Powell has had a lot to say about the recent FTX collapse, as the exchange executive recently said the…

The Smart Contract Audit Checklist

Blockchain is supposed to be secure for everyone. Is it the reality? According to reports, 5% of blockchain smart contracts were susceptible to funding lock, information loss, and user data leakage. Even Ethereum, the largest network, acknowledged that more than 32,000 smart agreements worth $4.4 million posed a security risk. Thus, we cannot emphasize enough that smart contract security will always be on the hitlist of swindlers, and they will exploit the vulnerabilities as per their wishes whenever they get an opportunity. Only the best smart contract security auditors can…

Terra’s $2.8B Defense System — Luna Foundation Guard Audit Says Group Spent More Than 80,000 Bitcoin Defending UST Peg – Bitcoin News

Months after the collapse of Terra’s U.S. dollar-pegged token UST, the organization created to protect the once-stable coin, the Luna Foundation Guard (LFG), published an audit report audited by the New York-based consultancy company JS Held. According to the report, LFG claims to have spent 80,081 bitcoin and 49.8 million stablecoins, which add up to roughly $2.8 billion to defend UST’s peg. LFG Audit by JS Held Claims Group Defended UST Peg With $2.8 Billion in Crypto Assets On Nov. 16, 2022, months after the mid-May Terra stablecoin depegging event,…

Terra Labs, Luna Guard commission audit to defend against allegations of misusing funds

The Luna Foundation Guard (LFG) and Terraform Labs (TFL) commissioned a technical audit of their efforts to defend the price of TerraUSD (UST) — since rebranded TerraUSD Classic (USTC) — between May 8 and 12. The audit was intended to answer “allegations posed in social media” about the fate of funds transferred during efforts to defend the UST dollar peg, according to the LFG blog. The audit found that LFG spent 80,081 Bitcoin (BTC) and $49.8 million in stablecoins (about $2.8 billion at the time) to defend the UST peg. That…

Luna Foundation Guard Spent $2.8B Defending UST Peg, Third-Party Audit Finds

“While there have been multiple recent failures in crypto, it is important to distinguish between Terra’s case, where a transparent, open-source decentralized stablecoin failed to maintain peg parity and its creators spent proprietary capital to try to defend it, and failure of centralized custodial platforms where its operators misused other people’s money (customer funds) for financial gain,” said Do Kwon, Terraform Labs founder. Source