Earlier in 2020, Bloomberg Intelligence claimed Bitcoin would soon reach $12,000 and would be a primary beneficiary in the post-pandemic world. The prediction coming true has the analyst who made the call sharing a new chart that appears to hint that the cryptocurrency is about to explode into another bull run, much like it did in 2017. Here’s what to expect if yet another forecast from the Bloomberg Senior Commodity Strategist is once again accurate. Bloomberg Senior Commodity Strategist: “Firmer” Crypto Market To Come In 2021 The year of 2020…

Tag: Bloomberg

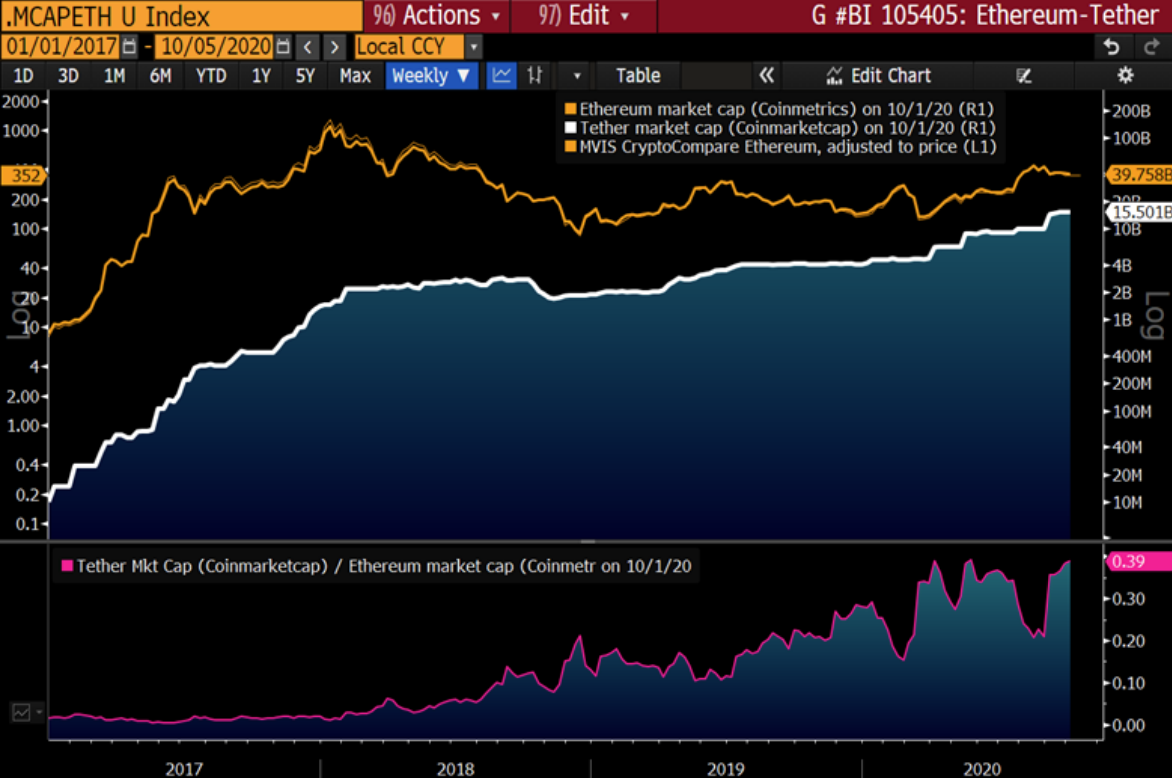

Tether’s market cap could overtake Ethereum’s next year — Bloomberg report

A new report predicts Tether could surpass Ether’s market cap by the end of next year, paving the way to mainstream adoption of stablecoins and central bank digital currencies (CBDCs). According to Bloomberg’s Crypto Outlook report for Q4 2020 written by Senior Commodity Strategist Mike McGlone, Tether (USDT) is likely to take the number two position by market capitalization from Ether (ETH) in 2021. The report cited the “stagnant market cap” of ETH, which currently stands at $43.2 billion but remained under $30 billion for most of 2019 and 2020,…

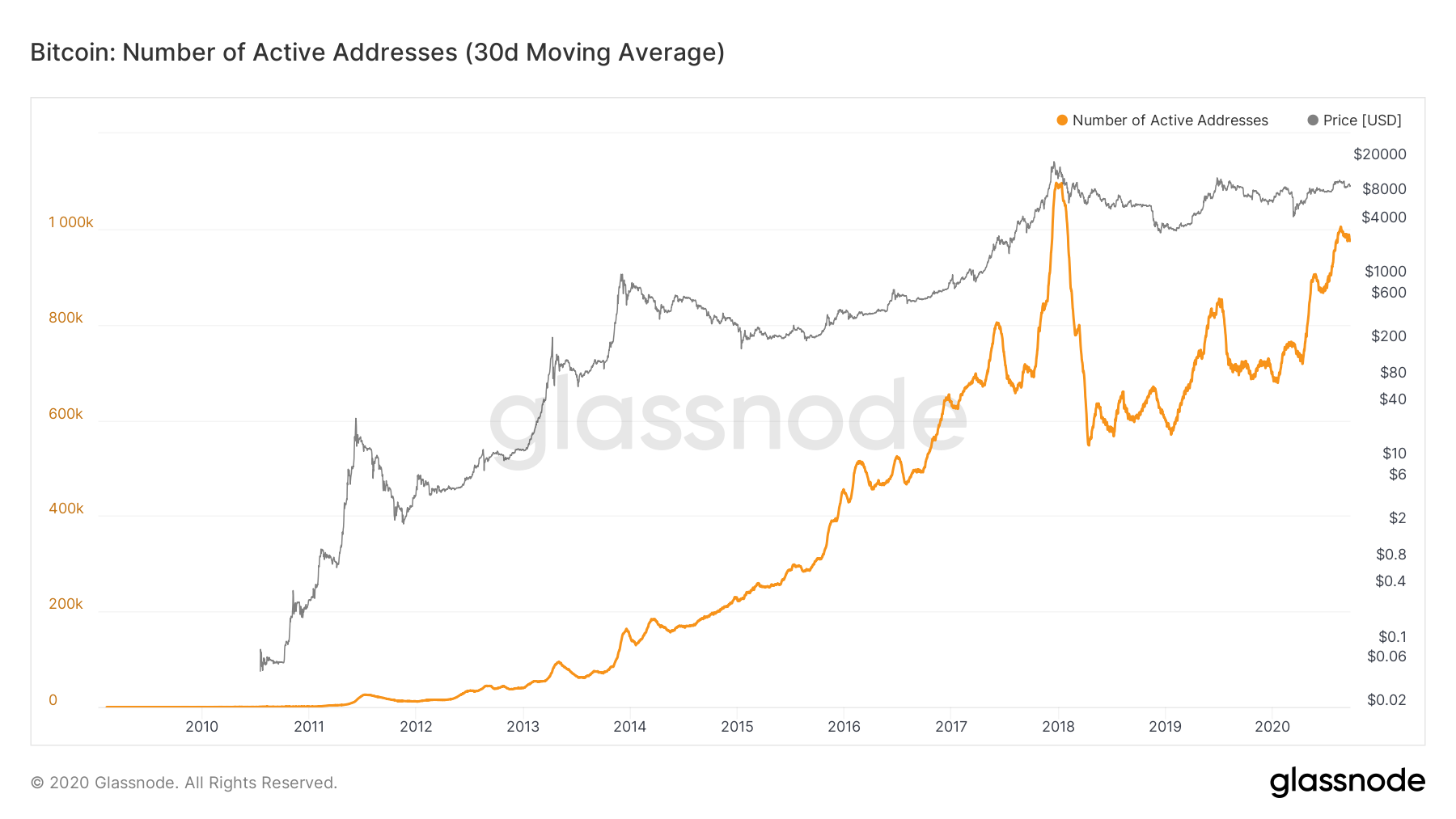

Bloomberg suggests that Bitcoin should be $15,000 according to this adoption metric

According to the Bloomberg crypto newsletter, a key on-chain indicator suggests that Bitcoin (BTC) is currently greatly undervalued. Bitcoin active addresses, the 30-day average. Source: Glassnode. Bloomberg’s crypto analyst Mike McGlone believes that the recent all-time highs in Bitcoin’s hashrate and more importantly, the 30-day average of active Bitcoin addresses, suggests a $15,000 price level for the asset: “The Bitcoin hash rate continues to increase and recently reached new highs. Also advancing are addresses used. A top metric for adoption, the 30-day average of Bitcoin addresses is equivalent to the…

First Mover: Bitcoins Hit Exchanges as Bloomberg Touts Crypto and DeFi Hedge Fund Seeks $50M

The upcoming U.S. presidential election has become one of the most contentious in history, fraught with searing divisions over everything from the economy to race to the continued health of democracy itself. So it’s not surprising that Wall Street options traders are now pricing in expectations of elevated market volatility around the November election. Analysts for the investment banking giant Goldman Sachs noted earlier this month that price swings of nearly 3% are implied around election day in the Standard & Poor’s 500 Index of U.S. stocks. What’s surprising is that options trading on…

Bitcoin will continue appreciating, although at a slower pace than in the past, Bloomberg analyst explains

Mike McGlone, Senior Commodity Strategist at Bloomberg, is convinced Bitcoin will continue to appreciate thanks to its fixed supply coupled with increasing demand. “I don’t see what [could] make it stop doing what [it’s] been doing for the last 10 years. And that’s going up”, he told Cointelegraph in a recent interview. McGlone sees Bitcoin’s capped supply as the main feature. He said that this potentially makes it a better store of value than gold, the total amount of which is unknown. Given the fixed supply, Bitcoin is going to…

An Article About DeFi And Ethereum’s SushiSwap Just Hit Bloomberg Terminals

It’s been quite the past few days for Ethereum, decentralized finance, and the entire crypto industry due to SushiSwap. SushiSwap marked a revolution in how protocols complete; the project, forked from Uniswap, has also marked a revolution in how and if anonymous developers can operate multi-million-dollar protocols. Unsurprisingly, with the unique journey that SushiSwap has been on, it has attracted the attention of mainstream investors and reporters. On Friday, Bloomberg released an extensive report on the SushiSwap saga entitled “Crypto Exchange Gets Millions After Copy-Paste of a Rival’s Code.” Many…

3 Reasons Why Bloomberg Calling Bitcoin a ‘Resting Bull’ Is Inaccurate

Bloomberg senior commodities strategist Mike McGlone recently released a midyear crypto outlook, which states that Bitcoin volatility should continue to decrease as the asset behaves more like gold. The report also says that primary demand and adoption indicators remain positive. The report concludes that Bitcoin is set for a breakout with a target at the $13,000 resistance. Although this perspective is defensible, the arguments presented in the article seem flawed. Correlation metrics for the past six months have drawn Bitcoin away from gold’s hedge status, as it has been trading…

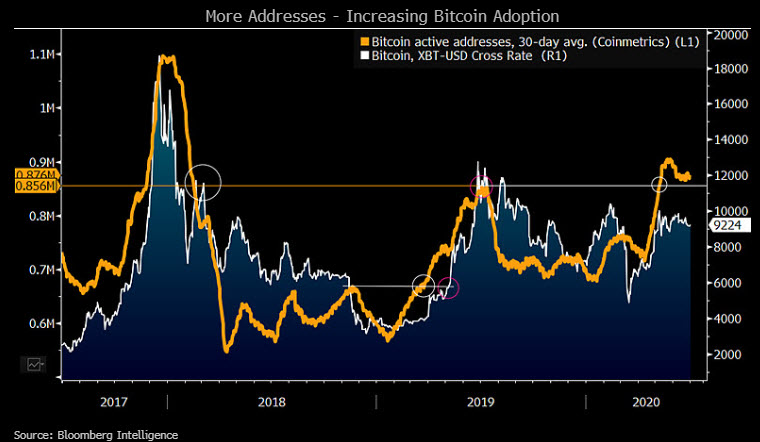

Bloomberg Report: Active Bitcoin (BTC) Addresses Point Towards $12,000

In brief: The research team at Bloomberg has released the July 2020 Crypto outlook report. The report explains that the number of active Bitcoin addresses points to demand that could push BTC to $12,000 in the near future. Furthermore, Bitcoin as an asset seems to be maturing based on the rising CME futures open interest. Every month, the research analysts at Bloomberg release their highly informative Crypto Outlook report. The July edition was released yesterday, July 2nd and it highlights the growing demand for Bitcoin by investors and traders. By…

Bloomberg BTC Bombshell, Coinbase Fury, Ether vs. Tether: Hodler’s Digest, June 1–7

Coming every Sunday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week Forget $10,000, Bitcoin’s $12,000 breakout will catch everyone off guard Once again this week, BTC suddenly soared into five figures — hitting $10,380 soon after Donald Trump mobilized police and the National Guard to disperse protests outside the White House. The surge helped break a…

Crypto Tidbits: $200M of Bitcoin Liquidated, Ethereum DeFi Adoption Limited, Bloomberg Is Bullish

Another week, another round of Crypto Tidbits. The past seven days have been volatile days for Bitcoin and other cryptocurrencies. The cryptocurrency on June 1st rallied past $10,000 for the first time in many weeks, reaching as high as $10,400. It was an explosive move that had many expecting more upside. One Wall Street analyst went as far as to say that the breakout past $10,000 was the biggest in BTC’s storied history. But just as fast as Bitcoin rallied, the asset tanked. Just 24 hours after the asset moved…