“We are excited to see IBIT reach this milestone in its first week, reflecting strong investor demand,” Robert Mitchnick, Head of Digital Assets at BlackRock said via an email. “This is just the beginning. We have a long-term commitment focused on providing investors access to an iShares quality ETF.” Original

Tag: iShares

SEC meets with BlackRock for iShares Bitcoin ETF

In their latest meeting, SEC and BlackRock reportedly discussed the iShares Bitcoin ETF on Dec. 14, raising questions about in-kind transactions. Unlike previous meetings, James Seyffart, a Bloomberg Intelligence analyst, reports that there were no presentations. As part of a follow-up thread on X, Seyffart reminds the community that Hashdex, another firm in the spot Bitcoin ETF race, had also engaged with SEC’s Office of the Chair. After this, a community member asked Seyffart about the likelihood of SEC approval, given Chairman Gary Gensler’s comment on listening to the courts from yesterday. …

IShares XRP Trust Filing Referred to Delaware Department of Justice

The most important requirement seems to be that an entity must obtain a registered agent in the State of Delaware, which can either be a resident or a business entity that is legally allowed to do business in the state. However, it seems that if the name and address are all that’s required, it could easily be copied from another filing. In this case, the pretender appeared to do little more than copy/paste the registered agent – Daniel Schwieger, a managing director at BlackRock according to his LinkedIn profile –…

Fake News on BlackRock’s iShares XRP Trust Sends Price Briefly to $0.74 Leading to High Liquidation

For several hours, the iShares XRP Trust appeared on the ICIS Delaware website suggesting that BlackRock had filed to list an XRP ETF, which was confirmed to be fake. Amid the ongoing Bitcoin (BTC) and Ethereum (ETH), exchange-traded funds (ETFs) in the United States, the crypto community has questioned why the Ripple Labs-backed XRP has not been included and it has legal clarity. On Monday, reports circulated on the X platform that BlackRock Inc (NYSE: BLK) had filed to list an XRP exchange-traded fund (ETF). Notably, BlackRock’s iShares XRP Trust…

BlackRock iShares Ethereum Trust registered in Delaware

BlackRock has apparently registered an Ethereum trust in the state of Delaware, which is possibly a first step toward an Ether (ETH) spot exchange-traded fund (ETF). BlackRock registered an analogical Bitcoin (BTC) trust in June, shortly before filing with the United States Securities and Exchange Commission (SEC) for a Bitcoin ETF. The entity has been registered by the state’s Division of Corporations with a formation date of Nov. 9. The agent registered is Daniel Schweiger at the address of BlackRock in Wilmington, DE. According to LinkedIn, Schwieger is a BlackRock…

ETH Soars Above $2K as BlackRock iShares Ethereum Trust Registered as Corporate Entity in Delaware

BlackRock declined to comment on the filing. Source

BlackRock iShares Bitcoin ETF Appeared on DTCC Website since August

A DTCC spokesperson confirmed that the IBTC ticker for the BlackRock iShares Bitcoin ETF has appeared since August through a unique ID code called CUSIP. Bitcoin has made a strong move moving to $35,000 earlier this week and clocking more than 20% gains on the weekly chart. This typically happened as the BlackRock iShares Bitcoin ETF ticker IBTC surfaced on the Depository Trust and Clearing Corporation’s (DTCC) website. Interestingly, one spokesperson from DTCC recently confirmed with CoinDesk that the appearance of the ticker is nothing new. Rather, it’s present on…

BlackRock’s iShares Bitcoin ETF mysteriously disappears — then reappears — on DTCC site

The ticker for BlackRock’s spot Bitcoin (BTC) exchange-traded fund (ETF) IBTC has reappeared on the Depository Trust and Clearing Corporation’s (DTCC) website after disappearing for a few hours. The price of Bitcoin surged to new yearly highs following the Oct. 23 surprise appearance of IBTC on the website with markets frenzied over the sign of a potential soon-to-come spot ETF approval. When the ticker quietly disappeared from the site a few hours later, Bitcoin‘s price slumped nearly 3%, indicating that much of the trading activity seems to be hinged on…

iShares Bitcoin ETF absent from DTCC website after initial listing

BlackRock’s spot Bitcoin ETF is no longer listed on the Depository Trust and Clearing Corporation (DTCC) website, as Bitcoin rallied to $35,000 and traders speculated on an imminent regulatory nod for such products. The iShares Bitcoin Trust under the ticker IBTC was delisted from the DTCC’s official platform following its surprise listing on Oct. 24. DTCC is the clearing agency for the NASDAQ and appearing on its website is procedural when issuing an exchange-traded product or ETF. The reasons for IBTC’s early listing and swift removal from the DTCCs catalog…

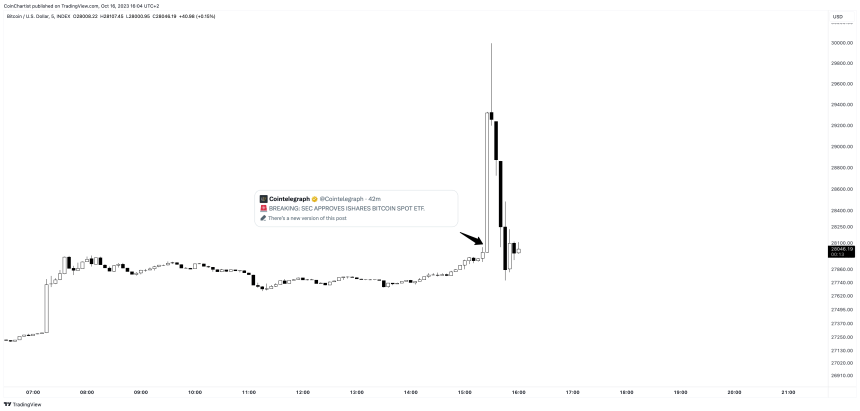

Bitcoin Price Surges 7% In 10 Minutes On Fake iShares ETF News

Bitcoin price just made one of its most volatile moves in some time on the back of what has amounted to be fake news regarding the approval of the BlackRock iShares spot BTC ETF. Within seconds of a fake X post, BTCUSD surged by over 7% in ten minutes – only to retrace the entire rally and then some. Bitcoin Price Rejected As iShares ETF News Revealed To Be False No, BlackRock’s iShares spot Bitcoin ETF has not been approved. But that’s what was just making waves around social media,…