Moreover, Gensler doesn’t sound particularly “merit neutral” (which is how the SEC describes its role in regulating markets) when drawing a comparison between bitcoin and gold, saying one is a commodity with industrial and consumer use and the other is primarily used for ransomware, money laundering, sanctions-evasion and terrorist financing, when not for pure speculation. Source CryptoX Portal

Tag: Long

Bitcoin “Outlook Remains Bullish,” As Long As This Stays True: Analyst

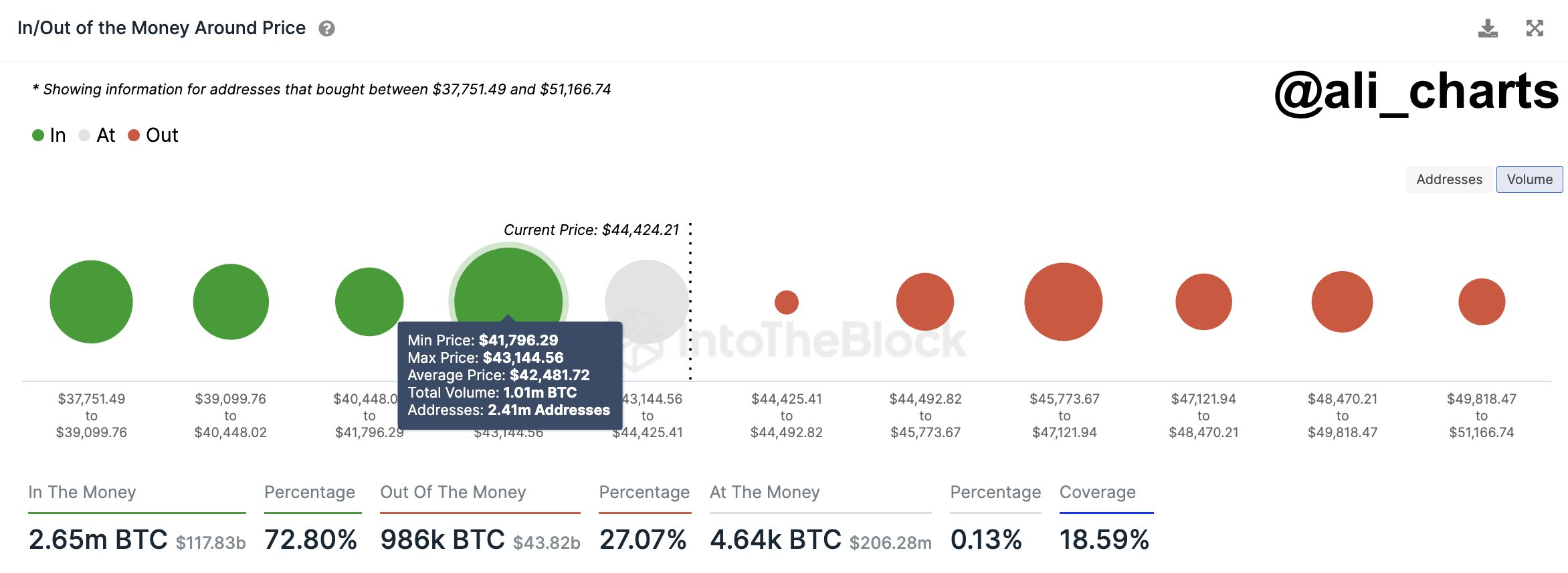

An analyst has explained that the outlook for Bitcoin should remain bullish as long as the cryptocurrency’s price remains above this level. Bitcoin Has Strong On-Chain Support Above $41,800 In a new post on X, analyst Ali talked about the various BTC support and resistance levels from an on-chain perspective. In on-chain analysis, the strength of any support or resistance level depends on the amount of Bitcoin that the investors bought at said level. The chart below shows what the distribution of the different BTC price ranges currently looks like…

Long Crypto Traders See $190M in Losses as Bitcoin Retreats After Apparent Mt.Gox Repayments

The drop came as the Mt. Gox crypto exchange appeared to be starting to repay customers who lost 850,000 bitcoin (BTC), now valued at around $36 billion, on Tuesday. Some participants in the mtgoxinsolvency subreddit group said they had received payouts in yen over Paypal. Others, who’d chosen to receive cash into bank accounts, said they had not seen any inflows. Source CryptoX Portal

The Smart Money is Record ‘Long’ on Bitcoin (BTC)

“For this reason, we expect topside resistance for BTC in the $45,000-$48,500 region and a possible retracement to $36,000 levels before the uptrend resumes,” QCP noted, adding that the bullish trend will likely resume ahead of April’s mining reward halving. Source

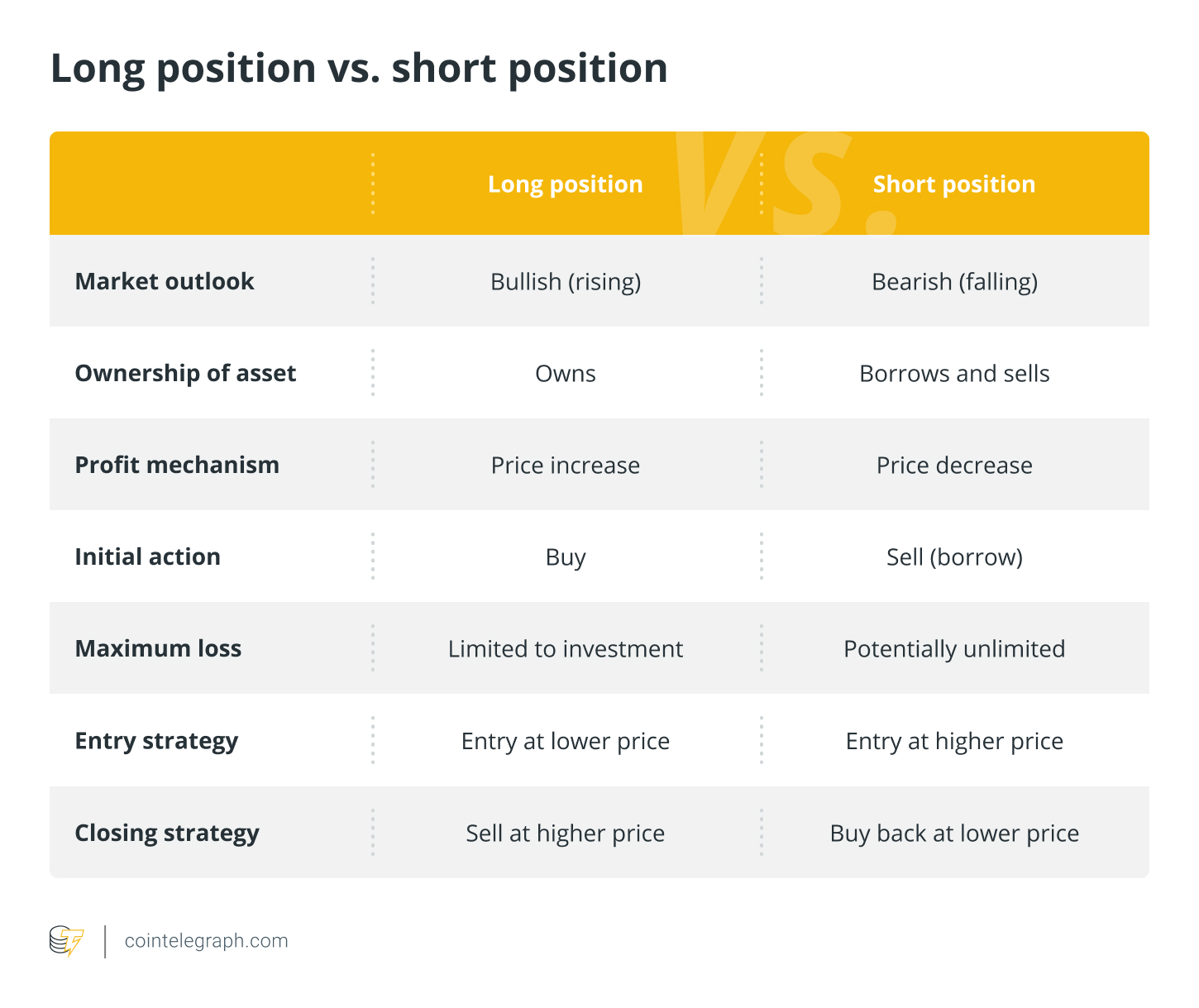

How To Take A Long And Short Position In Crypto

In crypto trading, mastering a long and short position is crucial for success. This guide dives into the essentials like “what is a short position” and “what is covering shorts” as well as strategies for both long & short crypto trading, tailored for traders at all levels. Uncover the strategies behind long positions, aimed at growth and value appreciation, and delve into the subtleties of “going short.” The Basics Of Long/Short Position Crypto Trading Before diving into the specific strategies of long and short crypto trading, it’s essential to grasp…

$300M crypto long liquidations — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a key week for macro markets with a bump as the weekly close gives way to a sharp 7% BTC price correction. In a fresh bout of volatility, the largest cryptocurrency broke down toward $40,000, reaching its lowest levels in a week. Arguably long overdue, Bitcoin’s return to test support nonetheless caught bullish latecomers by surprise, liquidating almost $100 million in longs. The snap move provides a rude awakening for BTC investors at the start of a week, which already holds a multitude of potential volatility triggers.…

NFTs witnessed turnaround in November, reversing year long downward trend

A new research report from Binance highlights that the NFT market experienced an upswing in November, marking a turnaround from its year-long downturn with a sales volume of $0.91 billion. These numbers highlight a 200% month-over-month increase, the most substantial growth seen in 2023 so far. Bitcoin NFTs dominate The research report shared with crypto.news on Dec. 4 points to indicators of this recovery, including Nansen’s NFT-500 Index and the Blue Chip 10 Index, showing reduced year-to-date declines at 49% and 43%, respectively, showcasing improvement from the previous month’s 58% and 50%.…

This Prediction Reveals How Long It Will Take XRP To Cross $10

XRP is one of the few cryptos with impressive price action this year. The cryptocurrency has been in the public eye for the past few months, as traders wait eagerly for XRP to embark on a major bull run ultimately. However, the crypto has been down for the past few days amidst ongoing market consolidation. Price action shows that XRP is down by 9% in a 7-day timeframe and is currently trading at $0.59. A recent price prediction made by the cryptocurrency exchange Changelly suggests that the value of XRP…

‘Long Big Tech’ Remains The Most Crowded Trade, BofA Fund Manager Survey Shows

“According to the latest Bank of America Fund Manager Survey, the most crowded trade at the moment is still ‘long big tech.’ This has repercussions for the crypto market, not necessarily good ones,” Noelle Acheson, author of the popular Crypto Is Macro Now newsletter, said in Thursday’s edition. Source

Long and short positions, explained

The concept of long and short positions The long and short positions represent opposite strategies that investors and traders use to speculate on the price movements of assets under consideration. The idea of long and short positions is still applicable to traditional financial markets in the realm of cryptocurrencies. In order to profit from a cryptocurrency’s price increase, a long position entails purchasing it with the expectation that its value will rise over time. In contrast, going short in the cryptocurrency market means selling a cryptocurrency one doesn’t own in…