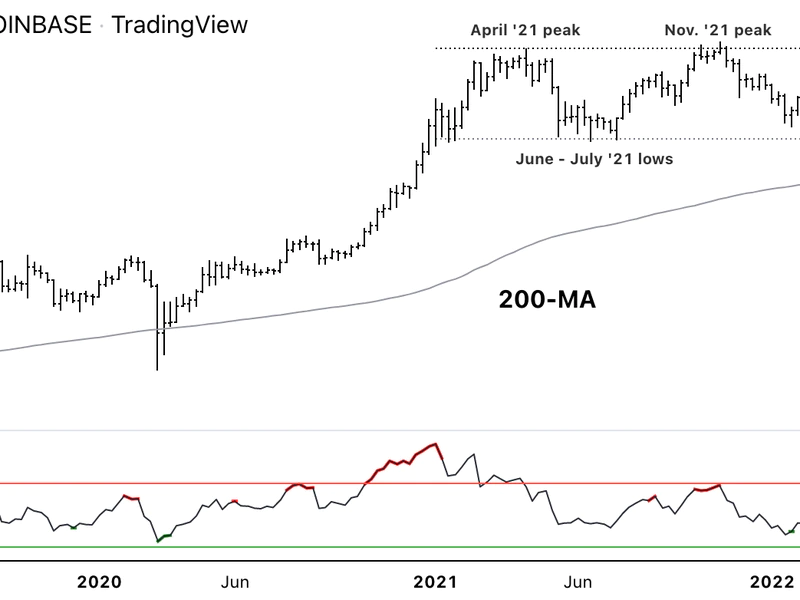

Bitcoin price just experienced one of its fastest and sharpest corrections in over a year, dropping 10% in a matter of minutes. The mass liquidations and panic from the selloff caused BTCUSD daily charts to reach the most oversold level since the COVID crash in early 2020. BTC Panic-Selling Reaches Extremes Not Seen Since COVID Crash As much as people try to fight it, investing and trading is an emotion-driven process. Few emotions cause humans to take action more urgently than those associated with fear and panic. This is precisely…

Tag: Oversold

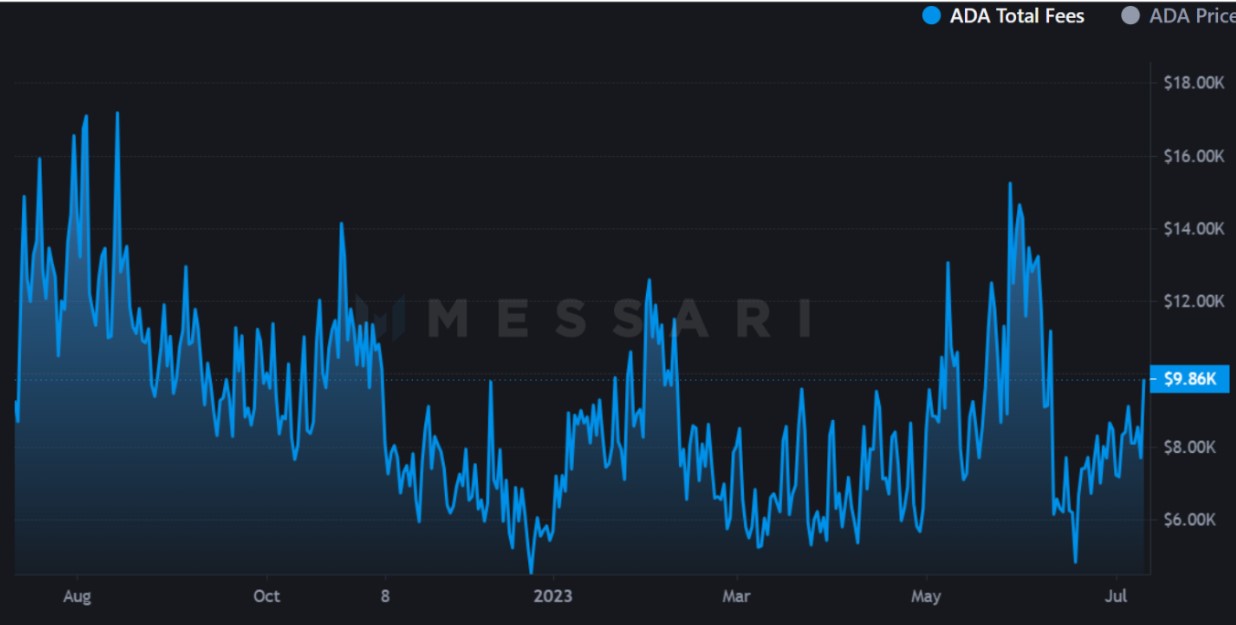

Cardano network activity and ADA’s oversold price action hint at a powerful breakout

Caradano’s native gas-paying token ADA received a big blow at the start of June when the SEC regarded it as a security in its lawsuit against Binance and Coinbase. The lawsuit triggered a 42.5% drop in ADA’s price from $0.37 to a two-year low at $0.21 within a few days after SEC’s lawsuit. Additionally, the token faced further downside selling pressure due to delisting on U.S.-based trading apps Robinhood and eToro. However, under the hood, the network has been making progress with an uptick in DeFi activity after a scalability…

Why Bitcoin Is Oversold As BTC Reclaims Territory North Of $20,000

Bitcoin was able to score some profits over today’s trading session as the market slightly rebounded after a spike in selling pressure. This saw the largest cryptocurrencies trading in the red negatively impacting market sentiment. At the time of writing, Bitcoin (BTC) trades at $20,300 with a 1% profit over the last 24 hours and a 6% loss over the past week. In the crypto top ten by market cap, BTC stands as one of the best performers only surpass by ETH’s price by 4% over the same period. BTC’s…

Bitcoin and Ethereum”Incredibly Oversold” States Bloomberg Analyst: Forbes

TLDR: Bloomberg Intelligence senior commodity strategist Mike McGlone stated that Bitcoin trades at a substantial discount. McGlone highlights several observations when making his case, such as technical analysis focusing on key indicators such as the 100-week moving average. McGlone stressed the Federal Reserve’s critical role in the price of equities and cryptocurrencies. Bitcoin is currently trading at $23,203.64, according to CoinGecko, a %66.4 drop from its all-time high. According to McGlone, a senior commodity strategist at Bloomberg Intelligence, Bitcoin and other cryptocurrencies are trading at a significant discount. Currently trading…

SkyBridge’s Scaramucci: Bitcoin is ‘Technically Oversold’

The investment fund founder Anthony Scaramucci spoke during a conference in Toronto Thursday afternoon. Source

Fidelity exec says BTC undervalued and oversold

Jurrien Timmer, Fidelity’s director of global macro, has argued that Bitcoin (BTC) may be “cheaper than it looks”, highlighting evidence on Tuesday that the cryptocurrency may be both undervalued and oversold. Addressing his 126,000 Twitter followers, Timmer explained that while Bitcoin has fallen back to 2020 levels, its price-to-network ratio has reeled all the way back to 2013 and 2017 levels, which he said may indicate it is undervalued. Is BTC cheaper than it looks? If we consider a simple “P/E” metric for BTC to be the price/network ratio, then…

Bitcoin Weekly RSI Sets Record For Most Oversold In History

Bitcoin price is in free fall and the cryptocurrency community is in panic. The high-risk, speculative asset class is living up to its notorious volatility and the selling appears unstoppable. At some point, all assets become oversold and recovery begins. After the most recent selloff, BTCUSD weekly RSI has reached the most oversold level in the entire history of price action, including two bear market bottoms. Bitcoin Selloff Sets Record For Most Oversold Weekly RSI Ever Bitcoin price today tapped below $22,000 per coin and is rapidly approaching prices closer…

Ethereum price enters ‘oversold’ zone for the first time since November 2018

Ethereum’s native token Ether (ETH) entered its “oversold” territory this June 12, for the first time since November 2018, according to its weekly relative strength index (RSI). This is the last time $ETH went oversold on the weekly (hasn’t confirmed here yet). I had no followers, but macro bottom ticked it. Note, you can push way lower on weekly rsi, not trying to catch a bottom. https://t.co/kLCynTKTcS — The Wolf Of All Streets (@scottmelker) June 12, 2022 ETH eyes oversold bounce Traditional analysts consider an asset to be excessively sold…

Crypto Market More Oversold Than Black Thursday

Panic struck the crypto market last week when Bitcoin broke below support, stablecoins unpegged from the dollar, and LUNA dropped to zero. The bloody aftermath has left cryptocurrencies as a whole more oversold than the Black Thursday COVID collapse. Here is a closer look at the historically oversold conditions in crypto. Total Crypto Market More Oversold Than Black Thursday It was a bloodbath in Bitcoin, apocalypse in altcoins. Even stablecoins pegged to the price of the almighty dollar were completely shaken. A nefarious actor or group of actors strategically attacked…

Bitcoin Oversold, Resistance at $33K-$35K

CryptoX is a multi-platform publisher of news and information. CryptoXtrade has earned a reputation as the leading provider of cryptocurrency news and cryptomarket analysis, bitcoin and other cryptocurrencies, blockchain technology, finance and investments. CryptoXtrade have become a known leader in the cryptocurrency information market. We work only with trusted information sources providing latest financial and technological innovations that improves the quality of life of CryptoX readers by focusing on Cryptocurrency and Blockchain. CryptoX Portal