Crypto investors, like their traditional market counterparts, can transact on an exchange or through an over-the-counter desk. The exchange acts as an intermediary between trading parties, matching orders. On an OTC desk, trades happen directly between the two parties, with one of them typically being the desk itself. Source

Tag: OvertheCounter

B2C2 Adds Electronic Crypto Options to Over-the-Counter Trading Platform

The 7-year-old firm, a unit of the Japanese financial firm SBI Holdings, claims that the Options Chain offering is a first for digital-asset markets, where players say they’re moving to accommodate fast-growing interest in crypto from institutional investors. Source

Goldman Sachs Conducts First Over-the-Counter Crypto Trade With Galaxy

Michael Novogratz’s Galaxy says it’s building on the relationship with Goldman as more Wall Street clients seek to push into cryptocurrency trading. Source

Grayscale Brings Altcoins to Over-the-Counter Trading

Grayscale Investments, the asset manager behind the world’s largest Bitcoin trust, announced that its Bitcoin Cash Trust and Litecoin Trust are eligible for deposit at the Depository Trust Company, the largest securities depository in the world. The Depository Trust Company (often shortened to DTC) was founded in 1973 and is based in New York. It holds securities worth $54.2 trillion as of July 31, 2017. By clearing the bar to deposit here, Grayscale also happens to meet a requirement for being listed on major stock exchanges like the New York…

Coincheck Exchange Adds Ethereum And Ripple to Its New Over-the-Counter Trading Desk

Japanese cryptocurrency exchange Coincheck has added its first two altcoins to its recently launched over-the-counter (OTC) trading desk, Cointelegraph Japan reported on April 15. Coincheck, which began operating its OTC service with Bitcoin (BTC) at the start of the month, now also offers Ethereum (ETH) and Ripple (XRP), the second and third largest cryptocurrencies by market cap respectively. OTC desks offer specialized services for large-volume traders, allowing them to save on fees and skirt what would otherwise be considerable hurdles purchasing or selling major crypto investments via standard methods. The…

Fintech Firm trueDigital Expands Over-the-Counter BTC, ETH Reference Rate Distribution

New York-based fintech infrastructure provider trueDigital Holdings (TDH) is partnering with crypto data firm Kaiko and digital assets analytics company Inca Digital Securities to widen the distribution of its over-the-counter (OTC) reference rates for Bitcoin (BTC) and Ethereum (ETH). The development was shared with Cointelegraph in a press release on March 25. As reported last year, TrueEX created TDH as an affiliate in March 2018, immediately announcing a TDH partnership with prominent blockchain tech firm ConsenSys (created by Ethereum co-founder Joseph Lubin) to create a benchmark rate for the price…

South Korean Crypto Exchange Bithumb Lanches Over-The-Counter Trading Platform

South Korea’s major virtual currency exchange Bithumb has officially launched an over-the-counter (OTC) trading desk under the Ortus brand, according to a press release published on Feb. 7. Hong Kong-based entity Bithumb Global Limited owns the rights to the Ortus brand, which specializes in services for institutional investors. After completing Know-Your-Customer and Anti-Money Laundering inspections, institutional investors will be able to utilize Ortus services, including monitored funds transfers and access to an OTC trading desk. OTC trading is an option for institutional investors looking to perform large-volume trades, as it…

South Korean Crypto Exchange Bithumb Launches Over-The-Counter Trading Platform

South Korea’s major virtual currency exchange Bithumb has officially launched an over-the-counter (OTC) trading desk under the Ortus brand, according to a press release published on Feb. 7. Hong Kong-based entity Bithumb Global Limited owns the rights to the Ortus brand, which specializes in services for institutional investors. After completing Know-Your-Customer and Anti-Money Laundering inspections, institutional investors will be able to utilize Ortus services, including monitored funds transfers and access to an OTC trading desk. OTC trading is an option for institutional investors looking to perform large-volume trades, as it…

Bittrex Follows Major Crypto Exchanges in Launching Over-The-Counter Trading Platform

United States-based cryptocurrency exchange Bittrex will launch an over-the-counter (OTC) trading desk on Monday, according to a private statement released on Jan. 14. The latest major exchange to enter the OTC market, Bittrex will offer investors the same raft of around 200 crypto assets currently available on its standard platform. OTC trading has become an increasingly popular option for institutional investors looking to perform large-volume trades. Fellow U.S. exchange Bitfinex opened its own platform in 2016, while the country’s largest player Coinbase is currently in the process of rolling out…

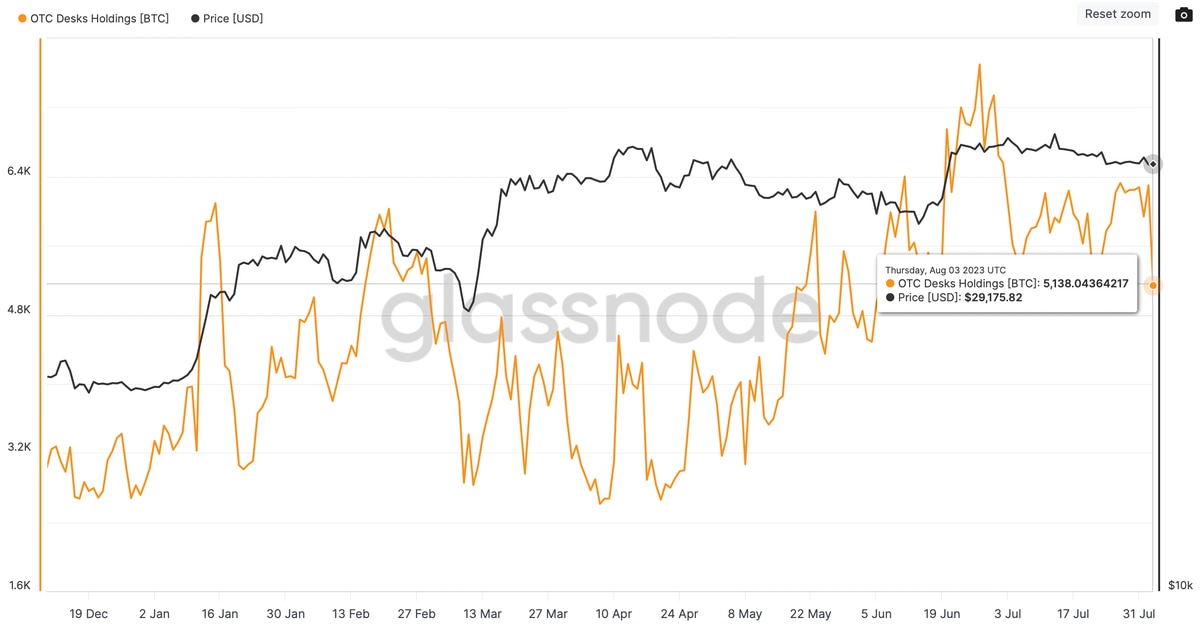

Traditional Investors Shift to Over-The-Counter Bitcoin Markets

In its recent analysis published Dec. 17, research firm Diar has found that institutional investors have shifted towards higher liquidity over-the-counter (OTC) physical Bitcoin (BTC) markets. Diar noted growing investment in OTC funds like that offered by major American cryptocurrency exchange Coinbase. According to the report, Coinbase outperformed Grayscale’s Bitcoin Investment Trust (GBTC) on OTC markets in terms of BTC trade volume. While OTC trade volumes are dwarfed by non-OTC investment, it is still significant as OTC markets are only open for 31 percent of annual tradable hours. Grayscale reportedly…