Japan’s Government Pension Investment Fund (GPIF), the largest pension fund in Japan and globally, is looking to explore investments in alternative assets such as Bitcoin (BTC) and gold. According to a Bloomberg report, GPIF revealed in a press release today that it plans to examine the possibility of accommodating Bitcoin and other commodities, including farmlands, forests and gold. The fund plans first to research the prospective investment choices. Interestingly, this decision comes on the back of the recent Bitcoin market uptrend and the success of the spot Bitcoin ETF market…

Tag: Pension

GPIF, Japan’s $1.4T-Asset State Pension Fund, Is Asking for Information About Investing in BTC

For the time being, GPIF invests in domestic bonds, domestic stocks, foreign bonds, foreign stocks, private equity, real estate and infrastructure. While the pension fund is seeking information about bitcoin, there’s no guarantee it will choose to invest in the world’s largest cryptocurrency once the evaluation is completed. Source

Japan’s $1.5 Trillion Pension Fund To Assess Bitcoin

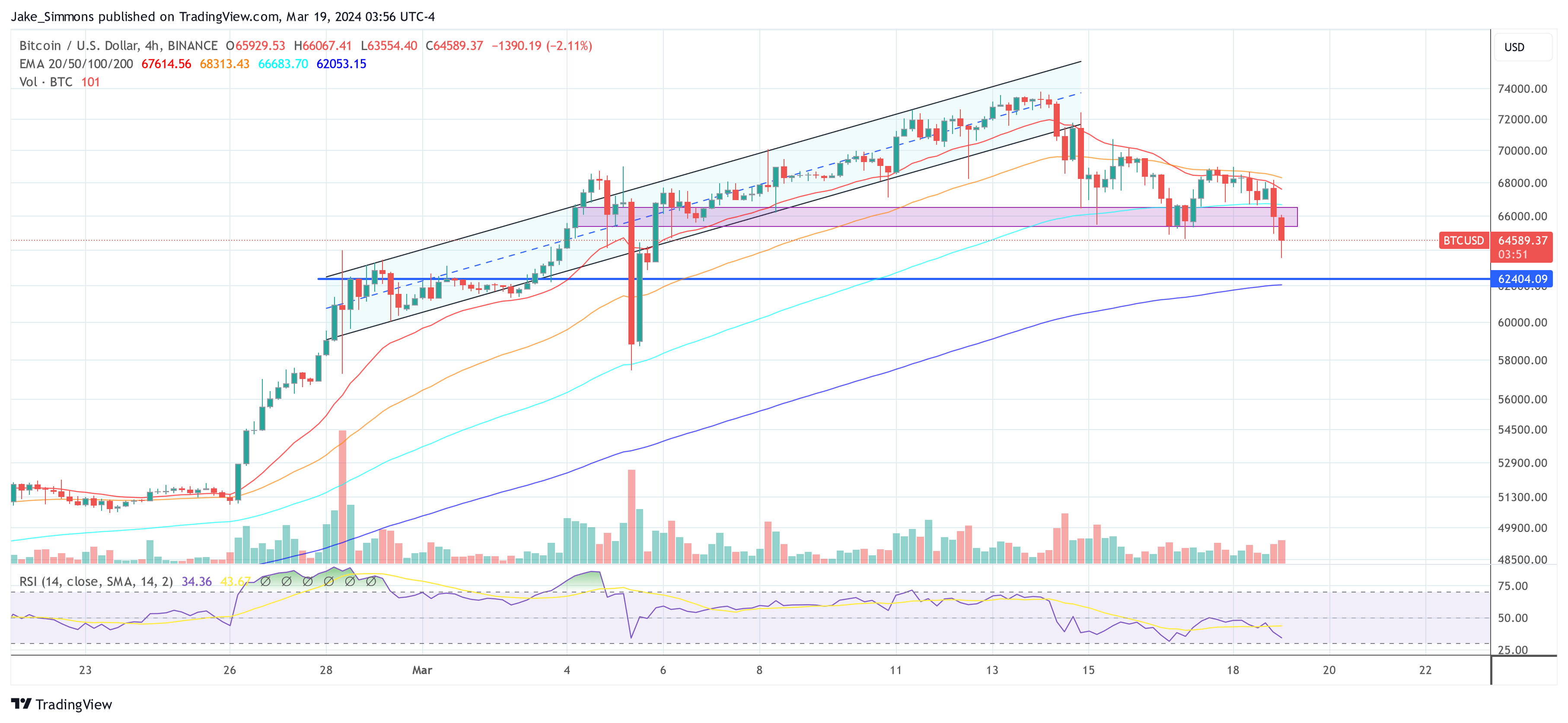

The Government Pension Investment Fund (GPIF) of Japan, the world’s largest pension fund with assets totaling $1.5 trillion, has officially announced its initiative to explore diversification opportunities that include Bitcoin, alongside traditional investments such as gold and more unconventional assets like forests and farmland. This exploration marks a monumental potential pivot in the investment strategy of a fund traditionally associated with more conservative asset classes. Japan GPIF Seeks Information On Bitcoin According to a Bloomberg report dated March 19, 2024, GPIF is in the initial phase of this exploration, focusing…

Bitcoin ETF will attract pension funds and RIAs, says CBOE digital chief

John Palmer, the president of crypto clearing house CBOE Digital, anticipates a significant influx of institutional investment into Bitcoin as soon as the SEC greenlights the first-ever spot ETF. In a Bloomberg TV interview, Palmer highlighted that such approval would open doors for pension funds and funds based on registered investment advisers (RIAs) to engage in Bitcoin assets through a spot ETF, a move currently restricted with standard Bitcoin tokens. This development comes as Bitcoin’s value surged past $45,000 for the first time in almost two years, just ahead of…

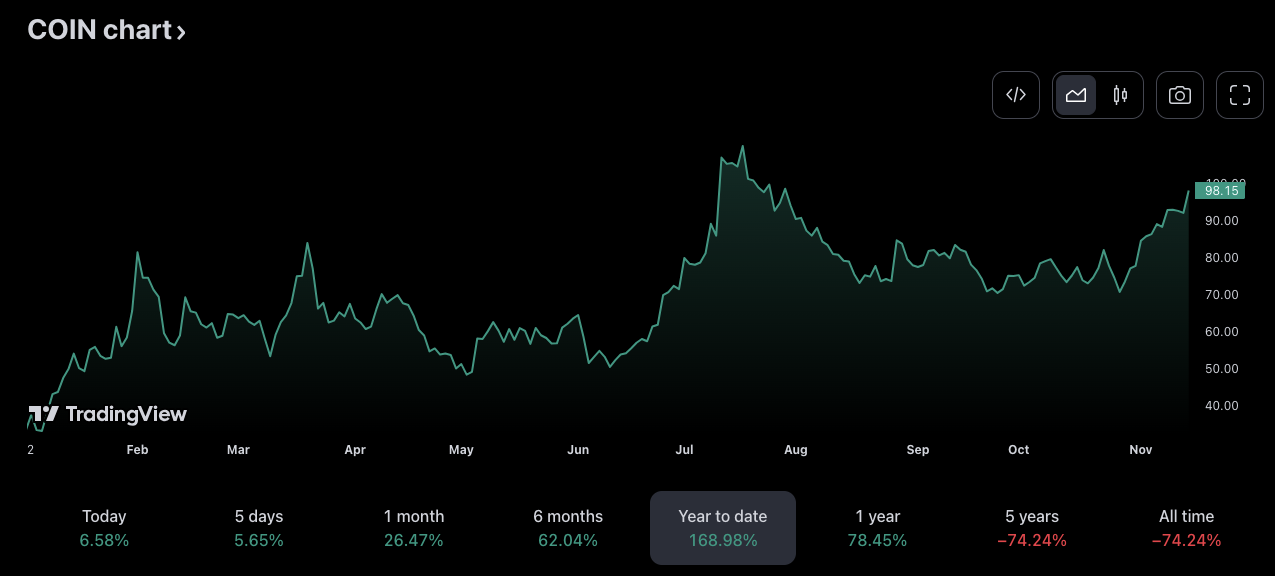

South Korea’s pension fund bags 280K Coinbase shares: SEC data

The National Pension Service (NPS), a public pension in South Korea and one of the world’s largest pension funds, bought just over 280,000 shares of the global cryptocurrency exchange Coinbase in the third quarter of this year, an investment that has gained 39% in value since the purchase. The NPS acquired 282,673 Coinbase (COIN) shares in the third quarter of 2023, according to a stock holdings report filed with the United States Securities and Exchange Commission (SEC) on Nov. 15. The investment is worth $27.7 million based on Coinbase’s last…

South Korea’s National Pension Service Snapped Up Nearly 290K Coinbase Shares in Q3: Report

South Korean pension fund, National Pension Service (NPS), bought nearly $20 million worth of Coinbase (COIN) shares in the third quarter, local outlet News1 reported, citing the NPS’ latest stock holding report to the U.S. Securities and Exchange Commission (SEC). Source

Pension funds could use AI to cut costs, increase returns, says report

Artificial intelligence (AI) could be used by pension funds to cut costs, increase investment returns, and highlight possible risks, but there are still “significant challenges to overcome” with its use, said the Mercer CFA Institute global pension report. On Oct. 17, the annual joint report from the consulting firm and investment professional association marked AI as useful for helping pension fund managers trawl through massive amounts of data that could highlight opportunities and build custom investment portfolios. “AI will affect the operations of pension systems around the world,” lead author…

Crypto Investments Still Appeal to Pension Funds, Hedge Funds, Family Offices: Survey

As many as 96% of the surveyed investors working for pension funds, wealth managers, family offices, hedge funds and investment funds see digital assets as representing an investment diversification opportunity alongside traditional asset classes such as fixed income, cash, equities and commodities, the survey found. They said they were prepared to stash as much as 5% of their investments in digital assets. Source

Ontario Teachers’ Pension Plan Will Stay Away From Crypto Investments After $95M FTX Write-Off: FT

CryptoX is a multi-platform publisher of news and information. CryptoXtrade has earned a reputation as the leading provider of cryptocurrency news and cryptomarket analysis, bitcoin and other cryptocurrencies, blockchain technology, finance and investments. CryptoXtrade have become a known leader in the cryptocurrency information market. We work only with trusted information sources providing latest financial and technological innovations that improves the quality of life of CryptoX readers by focusing on Cryptocurrency and Blockchain. CryptoX Portal

Ontario Teachers' Pension Plan Won't 'Rush' Into Crypto After FTX Write-Off: FT

The $190 billion Canadian pension fund is “still working through what exactly happened there,” according to its CEO. Source