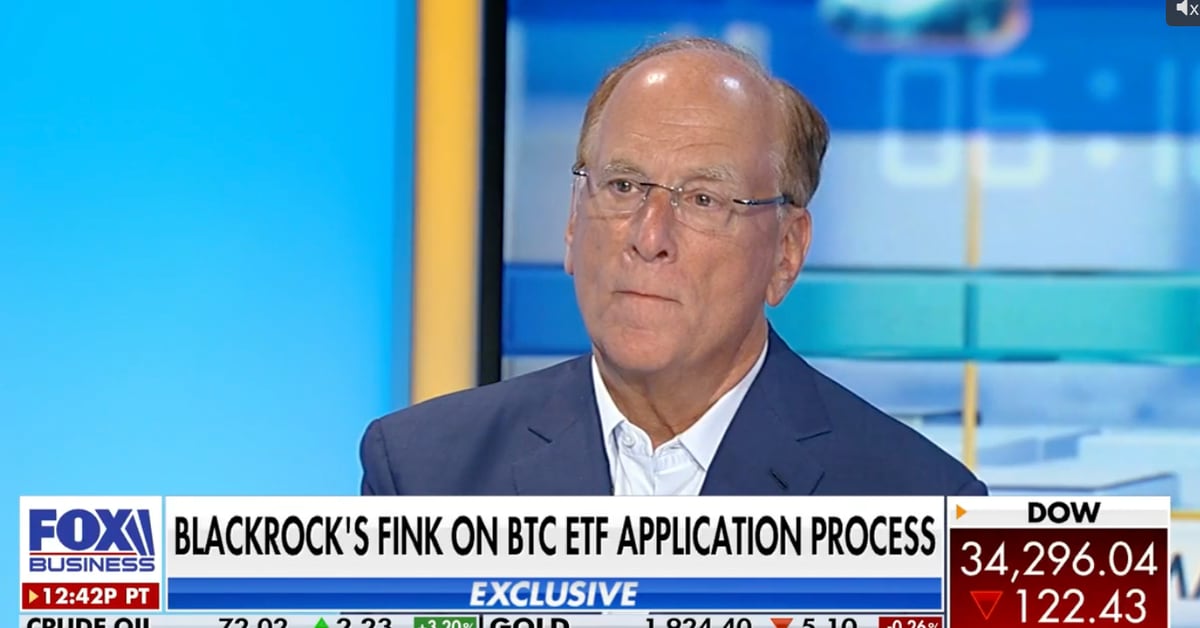

Many of the required revisions and adjustments are being carried out urgently by most companies, fueled by rumors that there may be a possible approval in January. BlackRock is making a strategic move in its plans for a bitcoin exchange-traded fund (ETF) by revising its approach to overcome regulatory obstacles. The asset management giant has updated its filing to feature cash redemptions instead of the previous in-kind model, where shares were converted directly to bitcoin. This change aligns with the preferences of the Securities and Exchange Commission (SEC), which has…

Tag: Proposal

BlackRock pivots to cash-based redemptions in spot Bitcoin ETF proposal

BlackRock, the world’s largest asset manager, is finalizing its spot Bitcoin exchange-traded fund (ETF) application, aligning with US financial regulators’ preferences for ‘cash creations’ for fund redemptions. Bloomberg’s senior ETF analyst Eric Balchunas shed light on this development on Dec. 19, following BlackRock’s filing a day earlier. BlackRock has gone cash only. That’s basically a wrap. Debate over. In-kind will have to wait. It’s all about getting ducks in row bf holidays. Good sign. https://t.co/vgocs1aIwS — Eric Balchunas (@EricBalchunas) December 19, 2023 Balchunas highlighted BlackRock’s transition to a cash-only approach,…

BlackRock Revises Spot Bitcoin ETF Proposal Ahead of Rumored SEC Approvals

Black Rock’s ETF proposal now includes cash redemptions, a concession to the SEC that may improve the fund’s approval odds. Source

FTX Files Proposal to Exit Bankruptcy and Repay Billions to Creditors

FTX highlighted its intention to repay billions of dollars in cash to affected customers. Beleaguered cryptocurrency exchange FTX has announced plans to exit bankruptcy and resolve its year-long financial troubles with victims of the troubled digital asset trading platform, Bloomberg reported Monday. According to the report, FTX is in final discussions with the official creditors committee regarding the resolution of the Chapter 11 bankruptcy proceeding and the potential return of customers’ funds. FTX Creditors to Vote on New Restructuring Plan Next Year The company submitted a fresh proposal for its…

Nirvana bassist Krist Novoselic led failed shareholder proposal asking Microsoft to study AI safety

Krist Novoselic, co-founder and bass guitarist for the seminal rock band Nirvana, recently led a shareholder proposal presentation urging Microsoft to reevaluate its approach to generative artificial intelligence. Called Shareholder Proposal 13: Report on AI Misinformation and Disinformation, per a press release, the proposal was submitted by Arjuna Capital “on behalf of Krist Novoselic” and several other shareholder groups. “Novoselic, co-founder and band member of Nirvana, will present the proposal citing concerns that Microsoft has not fully considered the business and societal risks of generative AI amid its rapid deployment…

New ETF Proposal Linked to MicroStrategy Stocks Aims for Monthly Payouts to Investors

The fund would use investor capital to buy call options on MSTR while simultaneously selling put options. The premiums collected from these transactions would then be distributed to shareholders as monthly yields. An investment firm YieldMax directed a request to the Securities and Exchange Commission (SEC) seeking regulatory approval for an exchange-traded fund (ETF) that offers monthly income tied to MicroStrategy derivatives. If granted the green light, the ETF is scheduled to launch in 2024 under the name Option Income Strategy ETF, with the ticker symbol MSTY. YieldMax, the company…

IRS proposal to track your wallets will put a damper on the crypto industry

The United States Internal Revenue Service (IRS) is considering a proposal that would have sweeping consequences for the cryptocurrency industry. Investors should be concerned, because it could significantly impact the way that individuals — both inside and outside America — are allowed to engage with digital assets. The IRS is proposing an initiative under Section 6045 of the tax code to establish new tax rules for the treatment of cryptocurrency providers. Specifically, the agency is seeking to amend the law to expand the definition of “brokers” to include nearly all…

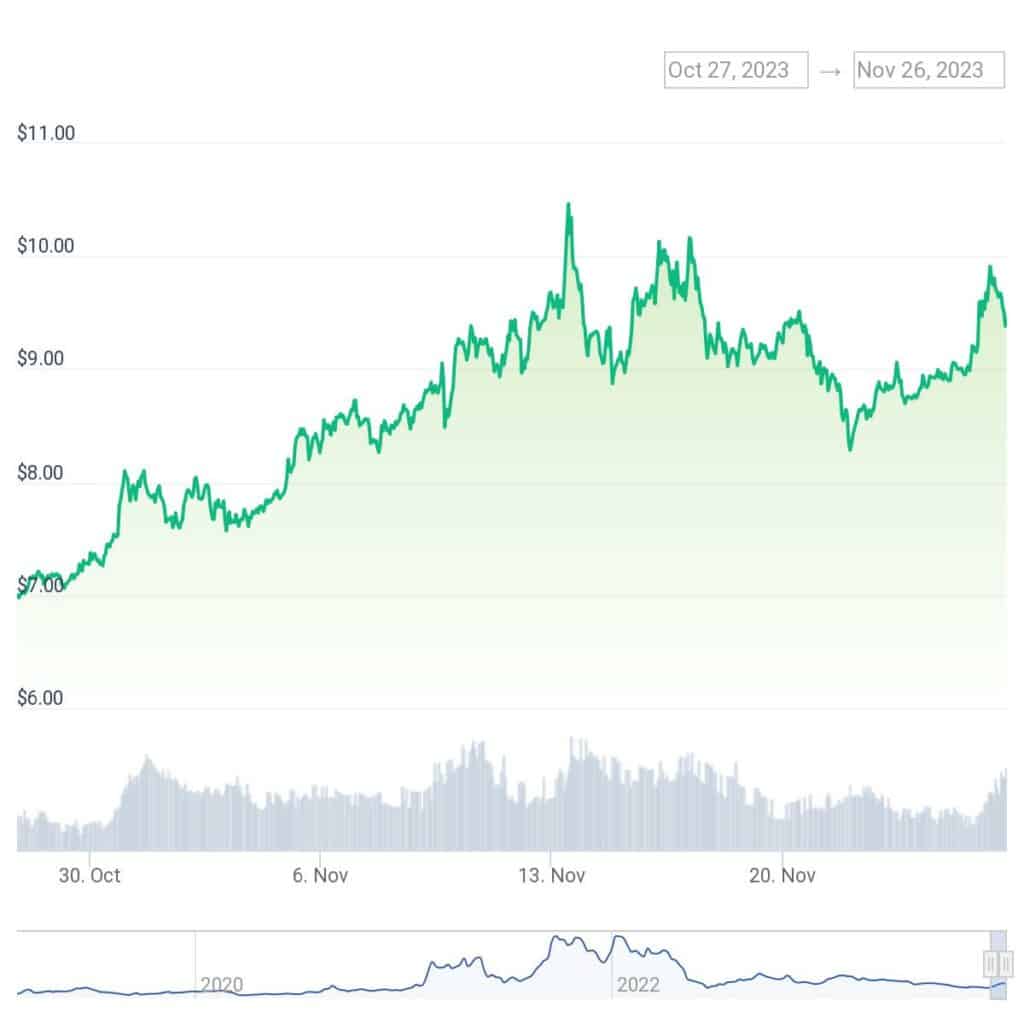

Cosmos Co-Founder’s Proposal Triggers 11% Plunge In ATOM

In a bold move, Cosmos co-founder Jae Kwon has called for a significant shift in the blockchain’s direction following the controversial passing of NWV #848. This proposal was approved by the community’s voting mechanism, earning around 40% of the votes, and it was aimed at changing the blockchain’s native token inflation rate. Kwon, expressing his dissent, is now advocating for a coordinated “split” in the Cosmos ecosystem, a proposal that could reshape the blockchain’s future. This development comes in response to what Kwon perceives as “deviating from the network’s core…

Cosmos Hub approves proposal to slash ATOM inflation

The Cosmos Hub community is giving the green light to a proposal aimed at reducing the maximum inflation rate of its native token, Cosmos (ATOM), from 14% to 10% as a security enhancement measure. The objective of this proposal is to decrease the annual interest rate for stakers, with the intention of fostering long-term profitability and facilitating price growth in ATOM. The proposal, which garnered 41.1% support, narrowly passed with 38.5% of votes against it, marking the highest-ever turnout vote in the Cosmos ecosystem. The approved change is set to…

ARK Investment Amends ARK 21Shares Spot Bitcoin ETF Proposal for Third Time

The third amendment is another attempt for ARK Invest to ensure that the proposal for the ARK 21Shares spot Bitcoin ETF will pass the SEC’s screening. ARK Investment Management has submitted another amendment to the US SEC for its ARK 21Shares spot Bitcoin ETF proposal. The application, created along with European crypto asset manager 21Shares, is one of several proposals gunning for SEC approval as soon as possible. ARK Investment Management was founded by Cathie Wood, a known Bitcoin bull. ARK 21Shares Adjustments The prospectus filed on Monday is ARK Invest…