In a pivotal announcement, the London Stock Exchange (LSE) has shared its plans to accept bitcoin and ethereum exchange-traded note (ETN) applications, signaling a significant shift toward incorporating digital currencies into mainstream financial markets. LSE Announces Acceptance of Crypto ETNs The launch of bitcoin (BTC) and ethereum (ETH) ETNs on the LSE platform marks a […] Source CryptoX Portal

Tag: Stock

London Stock Exchange to open applications for Bitcoin, Ethereum ETN admission

The main stock exchange in the United Kingdom is set to start accepting applications for crypto-tied exchange-traded notes. The London Stock Exchange (LSE) revealed in a press release on on Mar. 11 that it will start accepting applications for the admission of Bitcoin (BTC) and Ethereum (ETH) crypto exchange-traded notes (ETNs) in Q2, 2024. Although the exact launch date remains unclear as the LSE plans to disclose it “in due course,” the exchange noted that it plans to accept applications in accordance with the details contained in the crypto ETN…

Coinbase stock surpasses initial listing price amid Bitcoin rally

The stock price of Coinbase has surpassed its initial direct listing price for the first time in over two years, as Bitcoin reached a new all-time high. When the most prominent U.S. crypto exchange entered the public market through a direct listing in 2021, the starting price was $250 per share. Initially, the stock experienced a surge, reaching a peak of $350 per share in November 2021. However, it concluded its first year on the market with a 38% loss. The following years saw Coinbase’s shares struggle as the cryptocurrency…

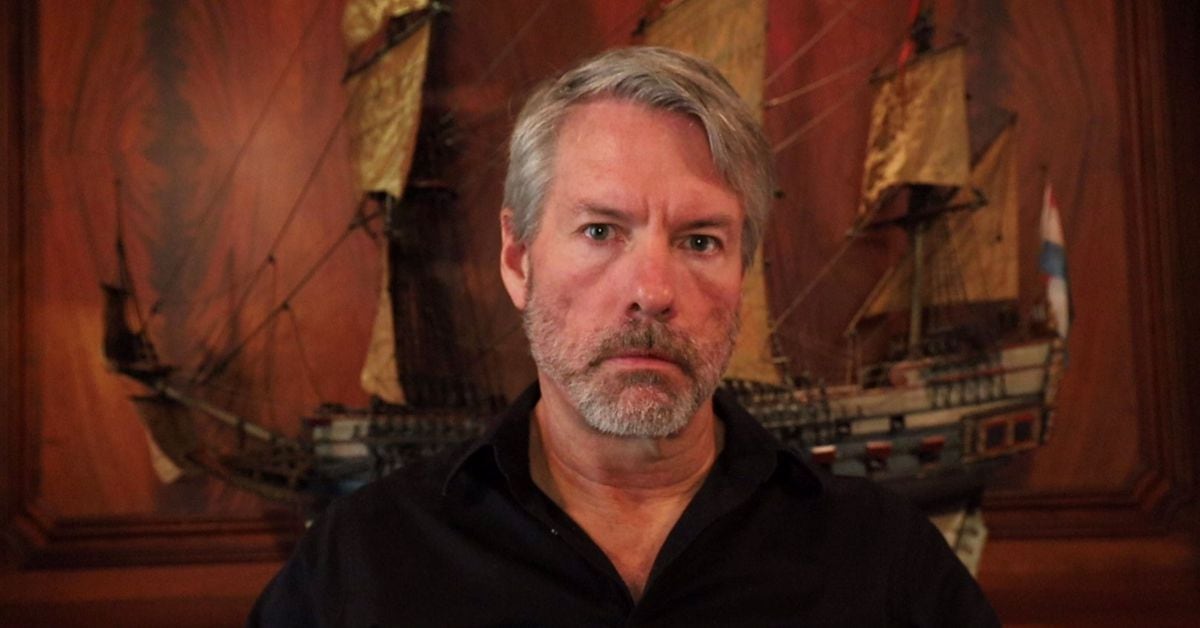

MicroStrategy (MSTR) to Offer $600M Debt to Buy More Bitcoin (BTC) Following Stock Rally

Helmed by its founder, former CEO and now Executive Chairman Michael Saylor, the company has been a relentless accumulator of bitcoin since mid-2020. At last check, MicroStrategy held 193,000 tokens worth more than $13 billion at the current price of $67,500. Source

Germany’s Biggest Stock Exchange Goes Crypto

Deutsche Börse Group has taken a significant step into the realm of digital assets by introducing the Deutsche Börse Digital Exchange (DBDX), a regulated spot trading platform for cryptocurrencies tailored to institutional clients. DBDX fills a gap in the market by offering a fully regulated and secure ecosystem for trading, settlement, and custody of cryptocurrencies. It leverages the existing connectivity to market participants, providing clients with a comprehensive suite of innovative and secure financial solutions for digital assets from a single point of access across the value chain. Initially, trading…

MicroStrategy’s MSTR stock jumps 23% as it unveils $600m offering to buy more Bitcoin

The largest corporate holder of Bitcoin, MicroStrategy, is about to become even larger with the latest $600 million offering in convertible notes to buy more crypto. MicroStrategy wants to sell $600 million in convertible senior notes to buy more Bitcoin (BTC) as the largest crypto by market capitalization nears its all-time high. According to a press release on MicroStrategy’s official website, the latest offering due 2030 will be to qualified institutional buyers only. The Virginia-headquartered business analytical software provider also plans to grant initial purchasers of the notes an option…

Bloomberg Strategist Sees Bitcoin as Global Alternative Currency — Warns Stock Market Drawdown Could Impact BTC

Bloomberg Intelligence’s senior commodity strategist, Mike McGlone, says bitcoin is “becoming an alternative currency on a global basis,” noting that “The world’s going towards intangible assets and bitcoin is the most significant in cryptos.” However, the strategist warned that as bitcoin’s price approaches $70,000, a key test for the cryptocurrency may come “when the U.S. […] Original

Peruvian Stock Exchange Announces Bitcoin Spot ETF Listings

The Lima Stock Exchange, the main Peruvian exchange, announced the inclusion of three different bitcoin spot ETF instruments in its trading platform. Ishares Bitcoin Trust (IBIT), Vaneck Bitcoin Trust (HODL), and Invesco Galaxy Bitcoin (BTCO) will be the instruments made available for Peruvians, which come to diversify the investment options for traditional investors in the […] Original

Bitcoin miner Marathon’s stock jumps 20% ahead of Q4 earnings report

Marathon’s shares surged by more than 20%, fueled by investor optimism ahead of the forthcoming earnings report. Anticipation surrounding Marathon‘s financial performance, particularly in the wake of Bitcoin’s recent price surge, has fueled significant investor interest. The bullish sentiment was evident as Marathon’s stock (MARA) on Nasdaq surged by 21% to $29 as of Feb. 27, according to data from Google Finance. MARA stock price in USD | Source: Google Finance Analysts from Zacks Investment Research are forecasting Q4 revenues to reach $138.2 million, reflecting a staggering increase of over…

Bitcoin ETFs Pose Risk for Coinbase Stock, Leverage Shares Says

COIN was one of the best-performing stocks in 2023, but has dropped by almost a third since the start of 2024. Original