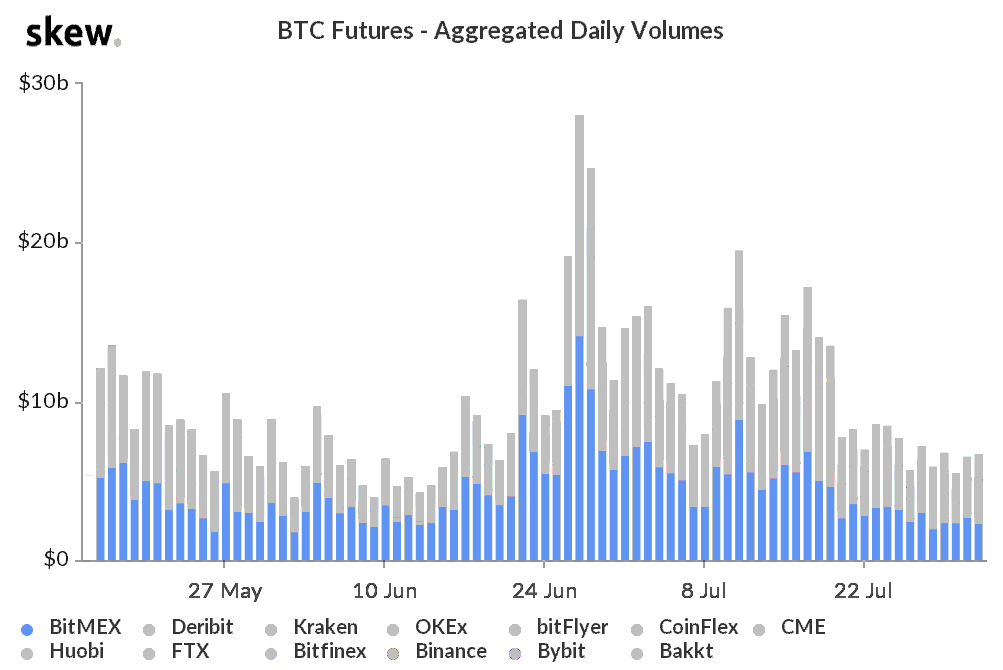

BitMEX used to be the indisputable leader of Bitcoin (BTC) futures trading and if something similar to yesterday’s civil enforcement action were to happen back in 2015-2018 the crypto markets would have completely collapsed. Regardless of partial recovery to $10,600, which was relatively quick, derivatives markets held steady during the $500 drop down to $10,400. Neither BTC futures or options displayed any signs of discomfort to the negative news. The futures market nearly ignored the entire event and this is a strong indicator that investors remain bullish. It also suggests…

Day: October 2, 2020

Chainlink Likely to Face Grim Downturn That Leads to $6.85

Chainlink’s price action has been overtly bearish as of late, with the cryptocurrency being unable to hold above $10.00 despite the technical strength resulting from its recent rebound from the $7.00 region. It seems that the “v-shaped recovery” it posted from these lows was not enough to alter its near-term outlook, as it now appears to be at risk of seeing further downside. This weakness has come about as a result of turbulence within the rest of the crypto market. Bitcoin’s price has faced heightened sell-side pressure due to revelations…

Market Wrap: Bitcoin Rebounds to $10.5K; Stablecoin Market Cap ‘Goes Parabolic’

Bitcoin has performed well in the face of a bleak news cycle while stablecoin assets in the crypto ecosystem continue to grow. Bitcoin (BTC) trading around $10,515 as of 20:00 UTC (4 p.m. ET). Slipping 0.44% over the previous 24 hours. Bitcoin’s 24-hour range: $10,362-$10,667 BTC above its 10-day moving average but below the 50-day, a sideways signal for market technicians. Bitcoin trading on Coinbase since September 30.Source: TradingView Bitcoin’s price stumbled in the early hours of Friday, falling to as low as $10,362 on spot exchanges such as Coinbase…

Stacking Satoshis: Leveraging Defi Applications to Earn More Bitcoin

As decentralized finance (defi) has become more popular, digital currency proponents are making money off of more than 140 yield-bearing cryptocurrencies. While most of the defi ecosystem revolves around the Ethereum network, a number of people leverage these defi applications in order to earn more bitcoin. The following list is a few defi platforms that allow individuals to stack satoshis by utilizing liquidity pools and lending apps. A great number of people hold bitcoin (BTC) for a long period of time whether in a noncustodial wallet or with a custodian…

DeFi Token Yearn.Finance (YFI) Breaks Massive Pattern Neckline, What’s Next?

Yearn.Finance (YFI) has stolen the attention away from most other DeFi tokens, Ethereum, and Bitcoin thanks to an amazing run where tens of thousands per coin in value were added. But the Ethereum-based ERC20 token has recently broken below and is now retesting the neckline of a massive head and shoulders pattern. If the altcoin falls deeper from here, confirming the pattern, it could soon find itself back being cheaper than Bitcoin once again. DeFi Token YFI Falls Below Neckline Of Massive Head And Shoulders The DeFi trend was already…

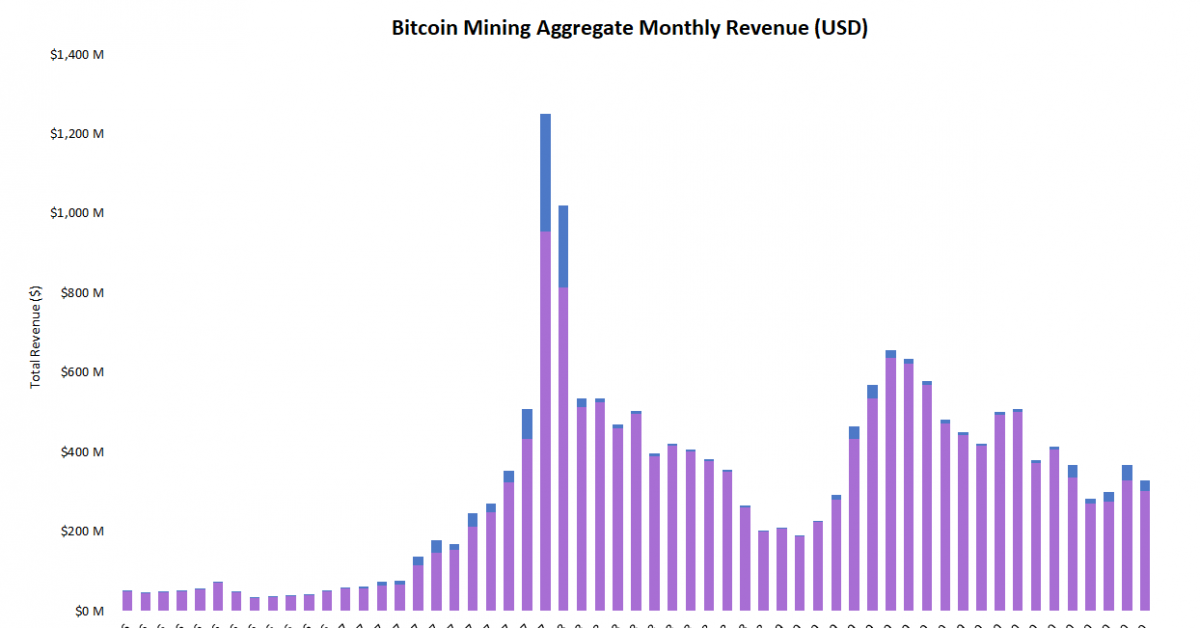

Bitcoin Miners Saw 11% Revenue Drop in September

Miners generated an estimated $328 million in September. Original

DeFi + NFTs – Blockchain News, Opinion, TV and Jobs

by Jamie Burke In this second article in a series posted on Outlier Venture‘s Blog, I propose we are a year into 5-year long DeFi hype cycle, likely made up of several mini-cycles, where the aggregate effect is a quadrupling of today’s combined market cap and a doubling of the 2017 $600bn highs based on a sustained ‘mainstreaming’ of the industry.In fact, it’s not impossible we hit that in the next 24 months alone should a few things fall into place. So now I’ve got your attention let me explain…

Price analysis 10/2: BTC, ETH, XRP, BCH, BNB, DOT, LINK, CRO, BSV, LTC

The bulls are buying the dips in Bitcoin and a few altcoins, suggesting that investor sentiment remains positive. The shallow pullback in Bitcoin (BTC) following the news of the CFTC’s regulatory crackdown on BitMEX and the late announcement that U.S. President Donald Trump tested positive for coronavirus shows that the underlying sentiment is still bullish. Generally, most damage during such periods of negative news flow is caused by the squaring up of leveraged positions. Data shows that Bitcoin futures volume and open interest has been dropping since hitting the peak…

The Broken DeFi Hypecycle – Blockchain News, Opinion, TV and Jobs

by Jamie Burke In this series first posted on Outlier Venture‘s Blog, I propose we are a year into a 5 year-long ‘DeFi Hype Cycle’, likely made up of several mini-cycles, where the aggregate effect is a quadrupling of today’s combined market cap and a doubling of the 2017 $600bn highs based on a sustained ‘mainstreaming’ of the industry. In fact, it’s not impossible we hit that in the next 24 months alone should a few things fall into place. So now I’ve got your attention let me explain. The power…

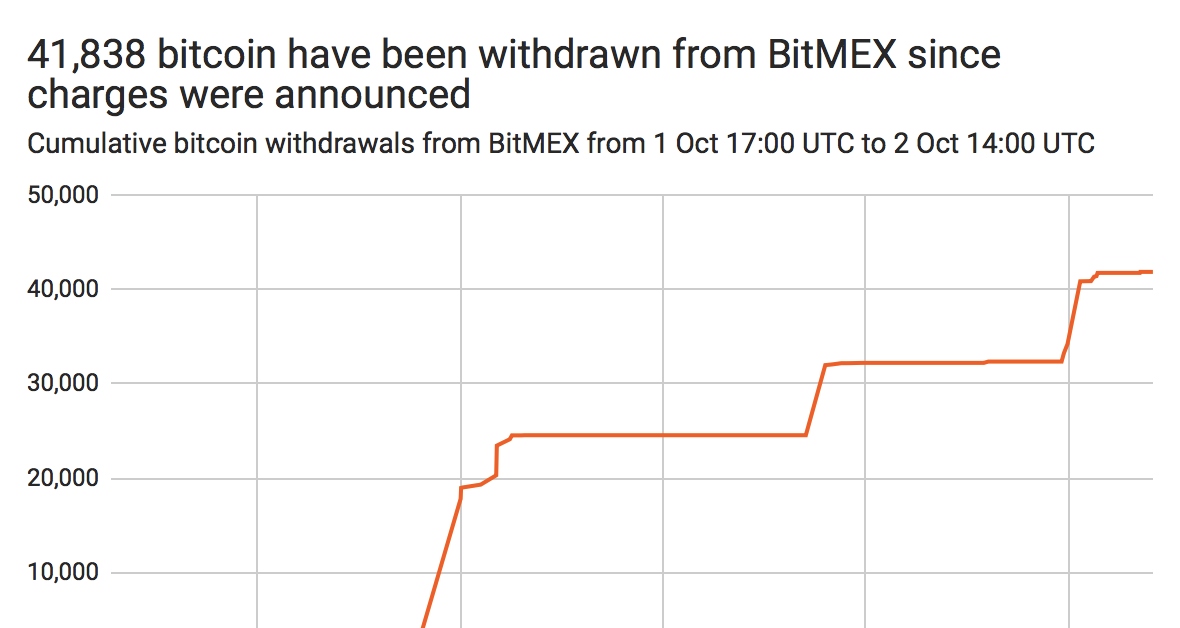

Bulls Exit BitMEX Bitcoin Futures Market

Since the announcement from U.S. regulators, BitMEX has witnessed an outflow of more than 40,000 bitcoins, currently worth more than $422 million. Original