PRESS RELEASE. Beaxy Exchange is running a one-of-a-kind match bonus program that will double your deposit up to $500. For example, when you enroll in the program and deposit $1,000 worth of fiat or crypto, you will receive an additional 500 USDC to use for trading. How to Trade with More on Beaxy Doubling your deposit is easy on Beaxy. To receive your deposit bonus – log in or sign up, navigate to the deposit page and be sure to click Participate to opt-in to the program. Complete your deposit…

Day: October 24, 2020

Chainlink Rallies Higher as Analysts Expect Further Mid-Term Upside

Chainlink has seen one of the strongest rebounds from its recent lows across the aggregated altcoin market, with its price rocketing higher as investors begin rotating capital into “risk-on” assets as Bitcoin and Ethereum show signs of strength. Its rebound is showing few signs of slowing down, and a move back up to its all-time highs could be on the table if the wider crypto market continues showing signs of strength. One analyst is now pointing towards a diagonal resistance level that has been formed over the past few days,…

Filecoin (FIL) Shoots 25% Higher as Buyers Step Back In

Filecoin has undergone a strong drop since its all-time highs above $100 set on its launch date earlier this month. The coin currently trades for $25, 75% below those highs. Despite this drop, buyers seem to be stepping back in. The coin is up 25% in the past 24 hours, making it the best-performing digital asset in the top 100 by a long shot. For context, Bitcoin is only up by 1.5% in the past 24 hours while Ethereum has gained closer to 3%. Related Reading: Here’s Why Ethereum’s DeFi…

‘I Don’t See What’s Going to Stop Bitcoin From Appreciating,’ Says Commodity Analyst

A senior strategist with Bloomberg Intelligence says that he does not see what’s going to stop bitcoin from appreciating. He explains that as bitcoin matures, it will trade more like gold than stocks. The strategist also shares his view on how the November presidential election could affect the price of bitcoin. Bitcoin Will Keep on Appreciating Bloomberg Intelligence’s senior commodity strategist Mike McGlone told Kitco News on Thursday that he does not see what will stop bitcoin from appreciating in value. Discussing the stock market outlook, the gold market, and…

JPMorgan turns bullish on Bitcoin citing ‘potential long-term upside’

JPMorgan, the $316 billion investment banking giant, said the potential long-term upside for Bitcoin (BTC) is “considerable.” This new optimistic stance towards the dominant cryptocurrency comes after PayPal allowed its users to buy and sell crypto assets. JP Morgan, from “Bitcoin is a fraud and will blow up” in 2017 to “Bitcoin’s competition with gold” in 2020. We’ve come a long way. pic.twitter.com/xceabkHaVJ — Krüger (@krugermacro) October 24, 2020 The main factor put forward by JPMorgan’s Global Markets Strategy division is Bitcoin’s competition with gold. The note, obtained by Business…

XRP Moving Approximately $3,000,000,000 in Remittances From US to Mexico, According to Founder of Crypto Exchange Bitso

Ripple’s XRP-powered cross-border payment product, On-Demand Liquidity (ODL), is moving nearly 10% of the remittance volume from the US to Mexico, according to Daniel Vogel, chief executive of the Mexican crypto exchange Bitso. The US-Mexico remittance corridor is one of the busiest in the world, with Pew Research Center reporting that more than $30 billion was sent south across the border in 2017. Those figures indicate XRP is currently responsible for about $3 billion in annual remittances from the US to Mexico. Vogel says that Bitso, a Ripple partner, has…

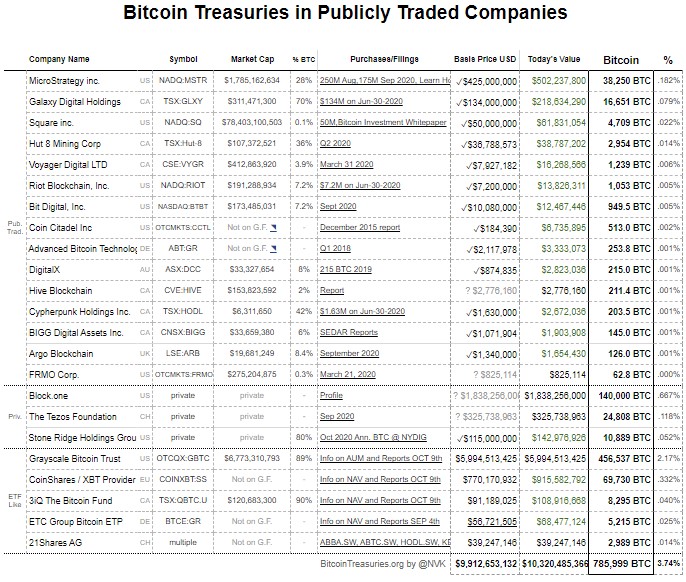

The CME Bitcoin (BTC) Futures Market is Now the Second Largest

Summary: Institutional demand for Bitcoin is rising as CME BTC Futures are now ranked second The open interest of the CME Bitcoin futures eclipses that of Binance, Bitmex and even Bybit This is a sign of continual institutional interest in Bitcoin Outside of futures platforms, 785,999 BTC is currently held by publicly traded companies The demand for Bitcoin (BTC) has continued to spread outside regular retail traders. According to data from Arcane Research, the CME Bitcoin futures market is now the second-largest with an open interest of nearly $800 Million.…

Billionaire Paul Tudor Jones Sees Massive Upside in Bitcoin, Like Investing in Apple or Google Early

American billionaire hedge fund manager Paul Tudor Jones has recently become more bullish on bitcoin. He declared the cryptocurrency the best hedge against inflation and compares investing in bitcoin now to investing in early tech stocks, like Apple and Google. “I think we are in the first inning of bitcoin and it’s got a long way to go,” he said. Paul Tudor Jones Increasingly Bullish on Bitcoin Paul Tudor Jones explained why he is more bullish on bitcoin now in an interview with CNBC Squawk Box on Thursday. Jones founded…

Bitcoin Could Rocket if It Closes Its Monthly Candle Above This Key Level

Bitcoin is currently consolidating within the lower-$13,000 region as bulls move to control its near-term price action. It has been struggling to break above $13,200 ever since it was rejected at this price level a few days ago. This currently marks the crypto’s 2020 high, and the selling pressure here is quite significant. If broken above, this level could spark a serious uptrend that sends it flying higher, with it potentially reaching up towards $14,000 before it faces any further selling pressure. It did face a slight rejection at these…

CME’s Bitcoin Futures Rise Suggests Institutional Investors Are Starting to Swarm Toward Crypto

The Chicago Mercantile Exchange (CME) has become the second-largest derivatives market for bitcoin futures in terms of open interest. The popular exchange has seen an influx of demand since the recent Paypal announcement and the Bitmex debacle as well. Data shows that the Bitcoin Mercantile Exchange (Bitmex) open interest for bitcoin futures has taken a dive since it was charged with illegally operating in the United States. CME Group’s rise in open interest began on Oct. 10, as Skew.com reported that the exchange added “nearly 1,500 contracts on the October…