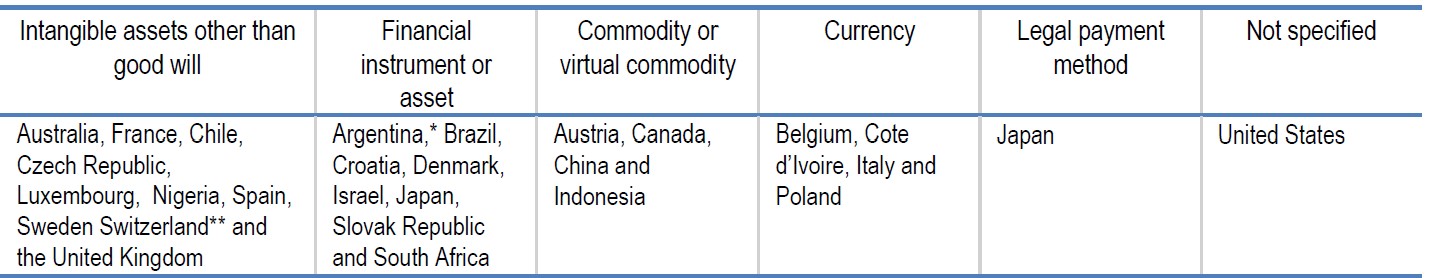

A study of cryptocurrency taxation regimes from around the world by the Organization for Economic Co-operation and Development, or OECD, found that global crypto taxation laws are highly inconsistent. Source: OECD Report. The way crypto assets are defined vary greatly by jurisdiction. Cryptocurrency is most commonly defined as a “financial instrument or asset”, followed by a “commodity or virtual commodity.” In the U.S., the asset class remains mostly undefined for tax purposes. Source: OECD Report. The same inconsistency is observed when it comes to determining the first taxable event for…

Day: October 14, 2020

Yearn.finance’s (YFI) Market Structure Points Towards a Q4 Move Below $10,000

Yearn.finance’s governance token (YFI) has been caught within a bout of extreme turbulence. A fragmented community, growing animosity towards the protocol’s founder, as well as a general downturn in the DeFi space have all struck serious blows to its outlook. The cryptocurrency has now erased the bulk of the parabolic gains seen throughout its recent multi-month uptrend. After rising from under $1,000 to highs of $45,000, the token has since plunged well below $20,000 and is showing signs of continued weakness. This has caused analysts to set relatively low price…

Market Wrap: Bitcoin Slips to $11.2K; Uniswap Flows Dominate Ether

Bitcoin is trending downward while ether transaction activity is showing Uniswap’s influence on the market. Bitcoin (BTC) trading around $11,359 as of 20:00 UTC (4 p.m. ET). Slipping 0.38% over the previous 24 hours. Bitcoin’s 24-hour range: $11,286-$11,555 BTC below its 10-day and 50-day moving averages, a bearish signal for market technicians. Bitcoin trading on Bitstamp since Oct. 12.Source: TradingView Bitcoin’s price dipped Wednesday after a move up to as high as $11,555 on spot exchanges like Bitstamp lost momentum. The world’s largest cryptocurrency by market capitalization then slipped to…

Price analysis 10/14: BTC, ETH, XRP, BCH, BNB, LINK, DOT, ADA, LTC, BSV

Bitcoin and most major altcoins are sustaining above their immediate support levels, increasing the possibility that the uptrend will resume. The bond yields across most developed economies have dropped sharply since the central banks unleashed a slew of measures to counter the economic crisis caused by the COVID-19 pandemic. This could pose a challenge to the institutional investors who rely on the traditional 60/40 portfolio allocation between equities and fixed income instruments. This week Fidelity Digital Assets also released its Bitcoin Investment Thesis report which details how a portfolio with…

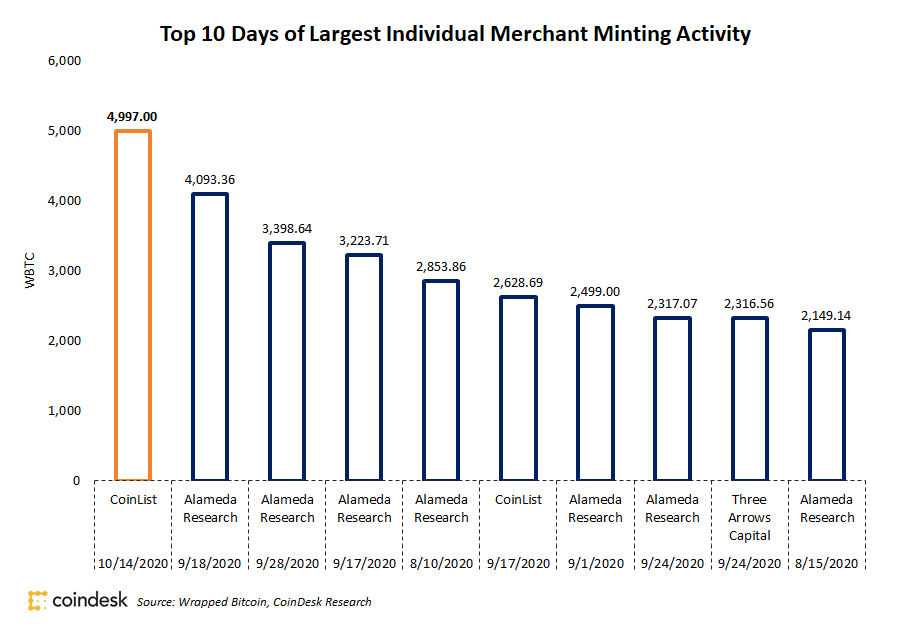

Wrapped Bitcoin Sees Record $57.1M in Tokens Minted by CoinList for Customers

CoinList set the record for most tokens minted in a day by a single merchant. Original

“Watch Out” For Bitcoin “Bulldozer” When Volume Expands

Volatility is finally increasing after a return to historical lows, but volume has yet to follow. When it does, however, one crypto trader says to “watch out” for the “bulldozer” that will be Bitcoin after a breakout supported by volume expansion. Here’s a look at the last time volume contracted this much, and what to potentially expect across the coming crypto market price action when volume finally arrives. Trader Joel Olszewicz Warns Bitcoin Bulldozer Is Coming The cryptocurrency market is known for its extreme price volatility that makes holding a…

Another ‘Sleeping Bitcoin’ Block Reward from 2010 Was Caught Waking Up After Ten Years

Another 2010 block reward was spent on Wednesday morning (ET) adding to the great number of ‘Satoshi era’ or so-called ‘sleeping bitcoins’ waking up in 2020. The block reward with 50 bitcoins was created on November 11, 2010, and transferred in block 652,669 after ten years. During the last few weeks, news.Bitcoin.com has been leveraging multiple tools to crawl the BTC blockchain, in order to research a great number of old coins that have moved this year. The term ‘Satoshi era’ refers to the period when Satoshi Nakamoto, Bitcoin’s inventor,…

CFTC Chairman Heath Tarbert Talks Ethereum, DeFi and the Next BitMEX

After the BitMEX enforcement action, are other noncompliant exchanges on the CFTC’s radar? “Maybe,” said Chairman Heath Tarbert. In an appearance Wednesday, the regulator largely deferred to his colleagues at the SEC on the question of whether ether in a proof-of-stake version of Ethereum would be a security or a commodity. He similarly punted on DeFi. “Let me just basically say how impressed I am by Ethereum, full stop, period.” No, that’s not a Silicon Valley investor. That was Heath Tarbert, chairman of the Commodity Futures Trading Commission (CFTC), who…

A $10B Firm Makes Bitcoin Its Primary Treasury Asset

Stone Ridge Holdings Group announces $50 million in new funding for its digital asset subsidiary as well as significant BTC treasury holdings. Our main discussion: Stone Ridge Holdings Group discloses $114 million in bitcoin treasury assets. NLW digs into what Stone Ridge is, why it spun off New York Digital Investments Group (NYDIG) and how the company has quietly built itself into a serious player in the institutional crypto asset space. Original

Cornell University shared a surprising revelation about this blockchain paper

A Ph.D. dissertation On Scalability of Blockchain Technologies has become the most downloaded dissertation at Cornell University in the past eight years. The paper was penned by Adem Efe Gencer in 2017, under the direction of computer scientists Emin Gün Sirer and Robbert van Renesse. When the university asked Sirer about the paper, he praised the work: “Dr. Gencer’s thesis represents a tour de force in the burgeoning area of blockchains and cryptocurrencies. It unveiled a brand new consensus protocol, improving upon Satoshi Nakamoto’s highly successful protocol that powers Bitcoin.” He…