A new report by Bitstamp and Bytetree says bitcoin responds better to the rising money supply, rising real interest rates and a strong economy. This is in contrast to gold which appears to perform better when real interest rates are falling while inflation is rising. To support these findings, the report points to the collapse of the gold price in Q2 of 2013, after the US Federal Reserve signalled it would raise rates in the future. During that period bitcoin value surged. In fact, the report asserts “that 2013 was…

Day: October 8, 2020

Will DeFi Migrate to New Blockchain Platforms with the Surge in Ethereum Gas Prices?

With the rise in decentralized finance (DeFi) being one of the biggest hits of the blockchain industry in 2020, experts have questioned whether Ethereum, the underlying infrastructure for most DeFi protocols, could sustain the sheer volume of transactions in the long run. DeFi hype escalates, gwei soars The decentralized finance (DeFi) sector has undoubtedly revolutionized the crypto and blockchain industry this year, with over $10 billion in total value locked in its smart contract applications. Currently, most decentralized finance apps (dApps) run on the Ethereum blockchain. However, as the amount…

Bitcoin Options Volume on CME Jumps 300% as Traders Take Bullish Bets

Trading volumes for CME bitcoin options surged as traders made bull call spreads anticipating a rally. Original

Travel Rule Protocol (TRP) Working Group Unveils Crypto AML Tools

The Travel Rule Protocol working group’s solution uses two simple RESTful APIs designed for querying address ownership and sending required originator and beneficiary information about digital asset transfers. The Travel Rule Protocol (TRP), a working group backed by Standard Chartered, Fidelity, ING, and about 22 other firms involved in cryptocurrency transactions has unveiled an Anti-Money Laundering tool dubbed TRP API version 1.0.0. According to Coindesk, the TRP API version 1.0.0 from the Travel Rule Protocol working group is aimed at helping every firm, ranging from banks to crypto exchanges and…

KPMG Airs Blockchain Solution to Help Corporates Offset Carbon Emissions

“Big Four” firm KPMG says its patent-pending blockchain solution will help organizations measure, report and offset their carbon emissions Source link

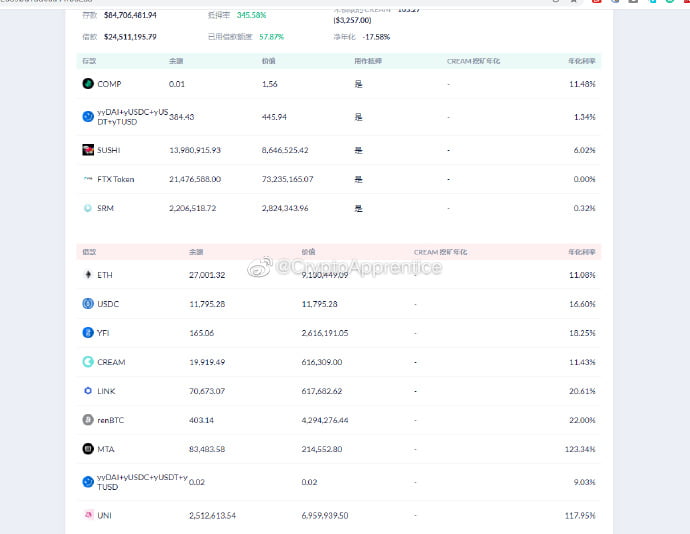

FTX CEO is Behind YFI Price’s Crash Towards $12K, Claims Weibo Profile

YFI crashed towards $12,000 on Thursday and unconfirmed evidence shows that Sam Bankman-Fried was behind the plunge. A Weibo-based profile, operating under the pseudonym of “Crypto Apprentice,” published a string of screenshots that connected the FTX crypto exchange CEO with the YFI’s massive price meltdown. Per the images, Mr. Bankman-Fried deposited FTX’s native token FTT and Serum decentralized exchange’s governance token SRM into Cream’s liquidity pool as collateral. In retrospect, Cream is an Ethereum-based lending platform that allows users to borrow or lend from a pool of assets. Mr. Bankman-Fried…

Bungled Theft of Bitcoin ATM Puts Canadian Business Out of Action

The inept thieves reversed their pickup truck into the store window next door after failing to nab the crypto ATM they wanted. Original

KPMG Unveils Blockchain-Based Climate Accounting Tool To Help Drive Environmental Sustainability

Multinational professional services firm and one of the Big four auditing firms, KPMG is set to offer a blockchain-based tool dubbed the Climate Accounting Infrastructure (CAI) to help organizations more accurately measure, mitigate, report, and offset their greenhouse gas emissions. Per the official KPMG announcement, the patent-pending Climate Accounting Infrastructure will be able to analyze climate risks associated with asset valuations and help organizations better assess and employ systems to offset their emissions. The CAI as noted by the company will come in handy in helping organizations to meet their sustainability…

Winklevoss-Founded Crypto Exchange Gemini Hires Former Morgan Stanley Exec

The U.S.-based cryptocurrency exchange has tapped a former Morgan Stanley executive to head its compliance operations in Asia. Source

Here’s Why Ethereum’s DeFi Market May Be Near A Bottom

It’s been an extremely poor month for the Ethereum decentralized finance (DeFi) space. Leading coins pertaining to this fledgling space have shed dozens of percent from their all-time highs, set either in August or in early September. Take the example of Yearn.finance (YFI), which has dropped from its all-time high of $44,000 to $14,000 as of this article’s writing. Surprisingly, it actually isn’t the worst-performing DeFi: Curve DAO Token has dropped over 95% from its all-time high. While it fears that the worst is yet to come for some holders,…