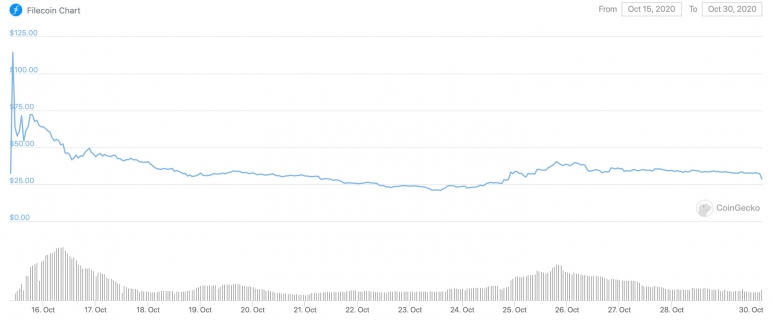

Filecoin miners are paying large investors an annual percentage rate as high as 40% to borrow FIL, the closely-held native token required to participate in the decentralized storage network. This dynamic has created a lending market and is leading to more questions about Filecoin’s economic model. The lack of liquidity in tokens required to mine on the proof-of-stake storage network is forcing desperate miners to borrow FIL rather than going into the open market to purchase tokens. The token’s price skyrocketed to $114 when the mainnet launched Oct. 15, settling…

July 17, 2025

Trending Now

- BITCOIN Se Mantiene Alcista... ¿Rumbo a ATH? l Trading en Vivo Bitcoin

- Altcoins Reclaim Key Technical Level – Can Momentum Sustain This Time?

- BSTR joins Bitcoin treasury arms race with 30,021 BTC and Wall Street backing

- Ethereum Climbs Over 50% Against BTC, Eyes Big Move Toward $6,000

- RWA Mass Adoption in TradFi And DeFi Boost LINK Price