United States-based cryptocurrency lending service Cred filed for Chapter 11 bankruptcy protection on Saturday, leaving many customers searching for solutions to get their funds. According to court documents, the legal team for Cred CEO Daniel Schatt filed bankruptcy papers for the company in the District of Delaware on Nov. 7. Cred listed its estimated assets at between $50-100 million and its estimated liabilities between $100-500 million. In an official statement, the company said it had filed for Chapter 11 in an attempt “to maximize the value of its platform for its…

Day: November 8, 2020

Every Major Bank Will Have Exposure to Bitcoin, Says Renowned Fund Manager Bill Miller

Veteran investor Bill Miller says that all major banks, investment banks, and high net worth firms will eventually have some exposure to bitcoin or something like it. He said that bitcoin’s staying power is getting better every day. Bill Miller’s Bullish Statements About Bitcoin A growing number of major corporations have been gaining exposure to bitcoin, prompting speculation of when the rest of them will follow. Following Microstrategy’s $425 million investment, Square invested in bitcoin and Paypal launched a cryptocurrency service. Now, famous investor Bill Miller reportedly told CNBC on…

Despite Drop From $16k High, Bitcoin’s Weekly Chart Is “Convincing”

Bitcoin has dropped since the highs of $15,975 set in the middle of last week. The price of the leading cryptocurrency currently trades for $15,200 but traded as low as $14,300 on Saturday. Despite the drop, analysts believe that the cryptocurrency remains on an upward path. They point to longer-term charts that show Bitcoin is still holding key support levels on a medium-term to long-term basis. Related Reading: Here’s Why Ethereum’s DeFi Market May Be Near A Bottom Bitcoin Remains “Convincing” For Bulls Bitcoin remains in a bullish position on…

Family Offices May Now See Bitcoin as Alternative to Gold: JPMorgan Report

In a research report by JPMorgan’s global markets team, analysts noted that Grayscale Bitcoin Trust’s flow trajectory outperformed gold exchange traded funds. Original

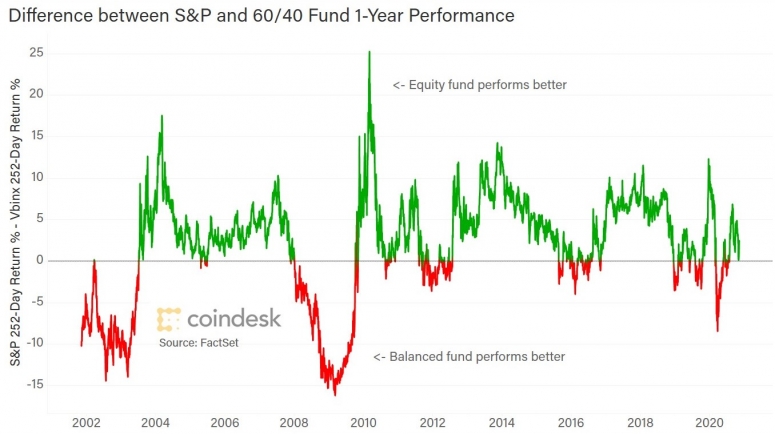

Bitcoin Gets Ready for a New Type of Hedge

Of all of the many clever things Mark Twain is alleged to have said, one of my favorites, especially these days, is: “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” In the turmoil that is 2020, many market “truths” have morphed into myths. And many trusted investment adages no longer make sense. One that continues to puzzle me is how many financial advisers still recommend the 60/40 portfolio balance between equities and bonds. Equities will give you…

Bitcoin reaches yearly highs, letting sights on ATH: Hodler’s Digest 11/8

Coming every Sunday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week Bulls keep running as Bitcoin notches a new 2020 high at $15,950 It’s been another extraordinary week in the crypto markets. Over the course of Thursday, BTC surged by more than 10%. As well as breaching $15,000 for the first time since January 2018,…

Top 5 cryptocurrencies to watch this week: BTC, ETH, LINK, LEO, XEM

Select altcoins are moving higher as Bitcoin prepares for a renewed push to $16,000 This week Bitcoin (BTC) price nearly hit a new multi-year high at $16,000 and legendary investor Bill Miller told CNBC that the law of supply and demand favors BTC. While the supply is increasing by about 2.5% a year, “the demand is growing faster than that.” Miller expects every major bank, high net worth firms, and investment banks to “eventually have some exposure in Bitcoin.” Although Bitcoin’s volatility remains high, Miller expects investors to focus on…

3 Factors That Suggest Yearn.finance’s YFI is About to Explode Higher

Yearn.finance’s YFI token has been subjected to immense volatility throughout the past few days, with its price plunging to lows of $7,500 before seeing one of the most intense short squeezes ever. Within hours of tapping these lows, a sudden influx of buy-side pressure sent it rocketing to highs of $18,000, marking a well-over 100% rally from its daily lows. This move revitalized the aggregated DeFi sector, causing DEX trading volumes to rocket while investors began rushing back into the embattled sector. Because the DeFi blue chips have seen sustainable…

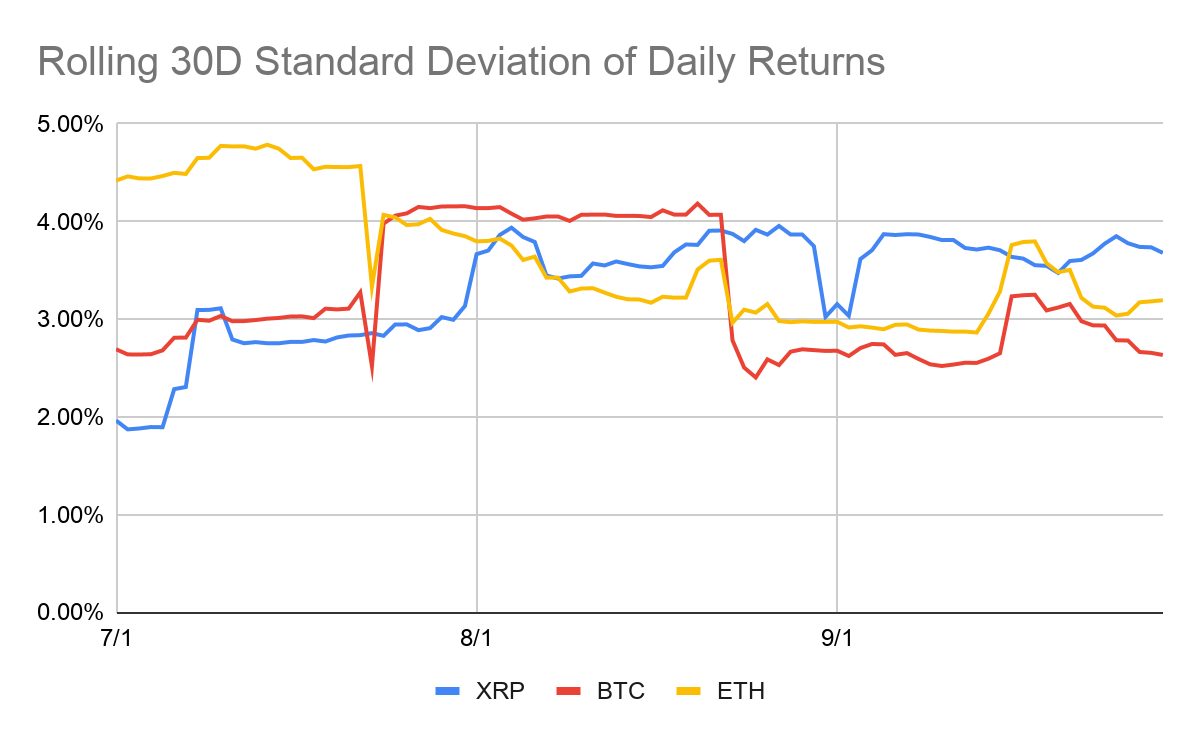

Ripple opens regional office in Dubai following volatile Q3 for XRP

According to a Nov. 7 announcement, Ripple has established a regional office in the Dubai International Financial Centre, or DIFC. The blockchain-based payments firm reportedly chose the location for its “innovative regulations.” The DIFC website states the special economic zone serves more than 2,500 companies across the Middle East, Africa, and South Asia as an “independent regulator” with a “proven judicial system.” “Ripple already has a significant client base in the MENA [Middle East and North Africa] region and the opportunity to co-locate with our customers made DIFC a natural…

Japanese firm Layer X Labs develops blockchain-based e-voting protocol

Japanese firm Layer X has announced the development of an electronic voting system based on a blockchain protocol as part of a wider “smart city” initiative being pursued by Tsukuba City. The Tokyo-based company said that the new system will meet the technical needs of electronic voting, including the prevention of double voting, accurate storage of voting content, voter confidentiality, and management of operation records. In addition, it will enable voters to check their own voting results, providing the cryptographic ability to verify that the recording and aggregation processes for…