Bitcoin (BTC) bulls are still licking their wounds from the bloody Dec. 4 correction which saw the price collapse from $57,000 all the way to $42,000. This 26.5% downside move caused $850 million in long BTC futures contracts to be liquidated, but more importantly, it shifted the “Fear and Greed index” to its lowest level since July 21. Bitcoin/USD price at FTX. Source: TradingView It is somehow strange to compare both events, as the July 21 sub $30,000 low would have erased the entire gains in 2021. Meanwhile, the $42,000…

Day: December 8, 2021

Plan B – Bitcoin Will Continue To Go Up But Another Crash Is Coming

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Plan B – Bitcoin Will Continue To Go Up But Another Crash Is Coming Get FREE $100 In Bitcoin When You Open Tax-Free IRA Crypto Account With iTrust … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Meet Visa’s New Crypto Advisory Unit

This episode is sponsored by NYDIG. Download this episode Today’s episode covers a set of topics, including: Visa’s new crypto advisory unit An AWS official is leaving for Unstoppable Domains AWS downtime brings up questions of decentralized infrastructure Saule Omarova withdraws nomination for OCC chief Dan Tapiero’s 10T raises a fresh $500 million Eric Schmidt joins ChainLink Labs as an advisor Ubisoft announces NFTs coming to games See also: Bitcoin Drops 5%, Slipping Below $50K on Leverage Washouts “The Breakdown” is written, produced by and features Nathaniel Whittemore aka NLW, with…

Frax co-founder Sam Kazemian believes stablecoin regulations are currently too harsh

Stablecoins, or crypto assets which peg their value to less volatile fiat money, are useful tools for a variety of reasons. They can be used to cash out crypto investments, send or receive stable money abroad, and to pay for everyday consumer transactions without fear of fluctuation. A recent estimate from the Bank for International Settlements, or BIS, put the total stablecoin supply at roughly $150 billion. But central banks, the issuers of traditional fiat money around the globe, do not seem to be big fans of stablecoins. A sharp…

Australia to Regulate Crypto Sector as Part of Payments Reform – Regulation Bitcoin News

The government of Australia is preparing to comprehensively regulate the activities of cryptocurrency exchanges and custodians. The push is part of a major overhaul, aimed at preserving the country’s sovereignty over its payments system, which will also affect providers like Apple and Google. Payment Laws in Australia to Cover Crypto Business and Big Tech Authorities in Australia are gearing up to update the nation’s legislation governing payments in the largest reform of the industry in over two decades. The changes will expand the regulatory framework to encompass new payment processors…

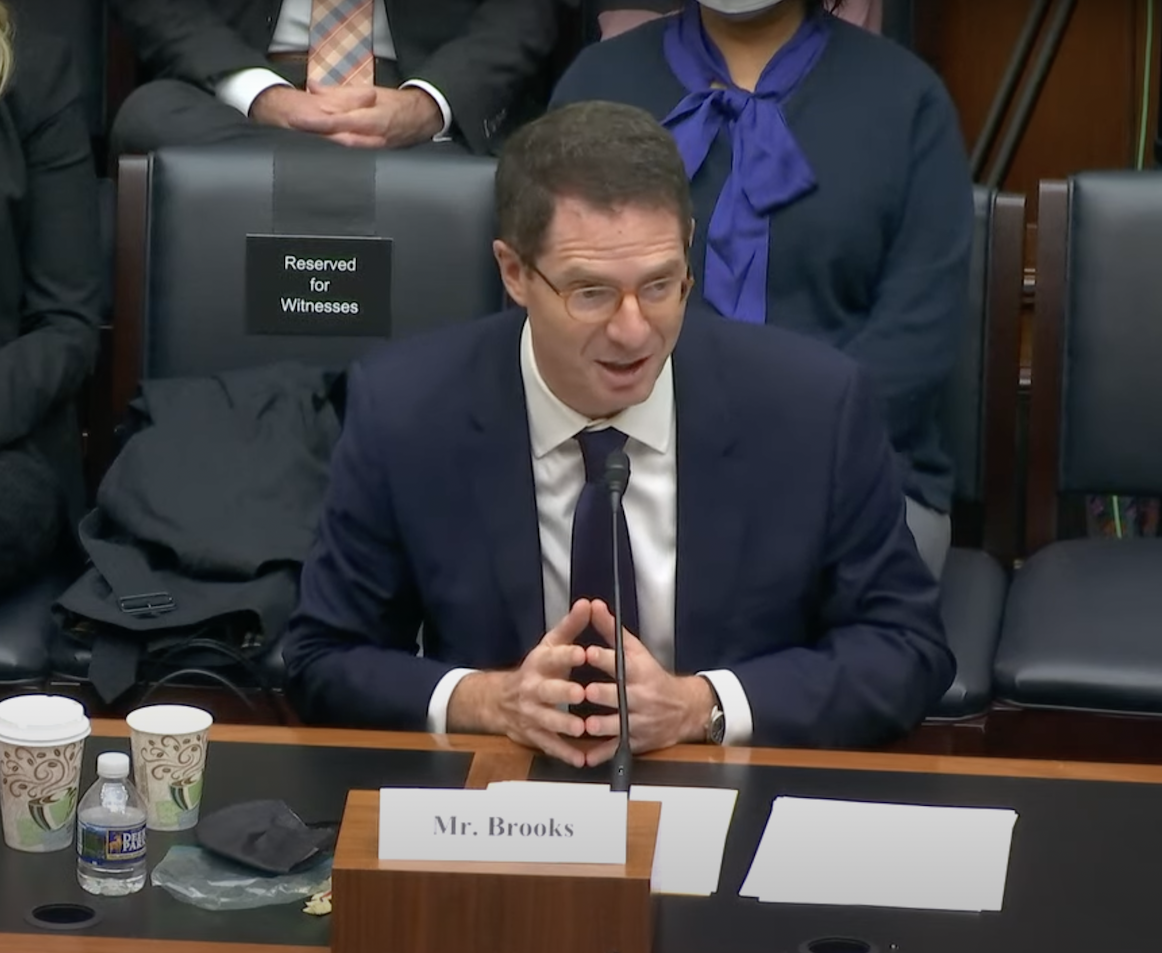

US is ‘unquestionably’ behind the curve on crypto ETFs, says Brian Brooks

Bitfury CEO and former Acting Comptroller of the Currency Brian Brooks has hinted the regulatory environment in the United States could drive many crypto firms outside the country, and has already stymied companies attempting to offer a variety of financial products. Speaking at a Wednesday hearing on Digital Assets and the Future of Finance with the House Committee on Financial Services, congressperson Ted Budd said he feared the current policy of regulation by enforcement in the U.S. could “force the next generation of financial tech to be created outside of…

Bitcoin Market Cycle Return On Investment

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io It is time for an update on the market cycle return on investment (ROI) of Bitcoin. We measure the market cycle ROI from the market cycle bottom and from the … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Discussion on crypto and major tech firms combine in hearing over decentralization of digital ecosystem

Blaine Luetkemeyer, a House representative from Missouri, revisited the issue of major companies exerting control over vast swaths of the internet, something he expressed concerns about encroaching in the crypto space. Speaking at a Wednesday hearing on digital assets with The House Committee on Financial Services, Luetkemeyer addressed Bitfury CEO and former acting Comptroller of the Currency Brian Brooks in saying that major tech firms including Instagram, Facebook — now Meta — and Twitter “control people on their platforms.” Luetkemeyer asked whether this level of control could extend to undue…

Kickstarter to Start Blockchain-Based Crowdfunding Project: Report

Kickstarter has not decided who will lead the initiative and has yet to choose a blockchain provider; however, citing a company spokesperson, Bloomberg said that the company is exploring various carbon-neutral or carbon-negative options for the platform. Source

‘Nation should not compensate investors for crypto losses’ says UK’s Financial Conduct Authority CEO

On Wednesday, Nikhil Rathi, CEO of the United Kingdom’s Financial Conduct Authority, or FCA, issued the following statement to the Treasury Committee when asked about the risks of the much-unregulated cryptocurrency sector in the country: When we talk about the compensation scheme, we have to draw some pretty clear lines. I would suggest anything is crypto-related should not be entitled to compensations, and consumers should be clear about that when investing. In the passage, Rathi refers to the FCA’s Financial Services Compensation Scheme, or FSCS, which pays out compensation to…