On-chain data shows Bitcoin whales have continued to shave off their holdings in recent weeks, suggesting that the current lows may not be attractive enough to them. Bitcoin Whales Continue To Sell Despite The Recent Deep Lows As pointed out by an analyst in a CryptoQuant post, the number of investors with balances in the 1k to 10k BTC range have continued to decline recently. The relevant indicator here is the “UTXO Count – Value Bands,” which tells us about the number of UTXOs (or wallets) that are currently in…

Day: December 9, 2022

A year after Taproot, Bitcoin community works to unlock its DeFi potential

Taproot support across the industry is still crawling one year after the Bitcoin soft fork, indicating a strong potential for innovation and broader adoption of Web3 solutions to be unlocked through the world’s largest cryptocurrency, sources told Cointelegraph. “Since early on, Satoshi predicted that layers being built on top of the Bitcoin blockchain would enable Bitcoin to move beyond being only sound money by adding programmability, which makes Bitcoin the optimal framework to build out Web3 capabilities,” noted Alex Miller, CEO of the Web3 developer platform Hiro. The Taproot upgrade took…

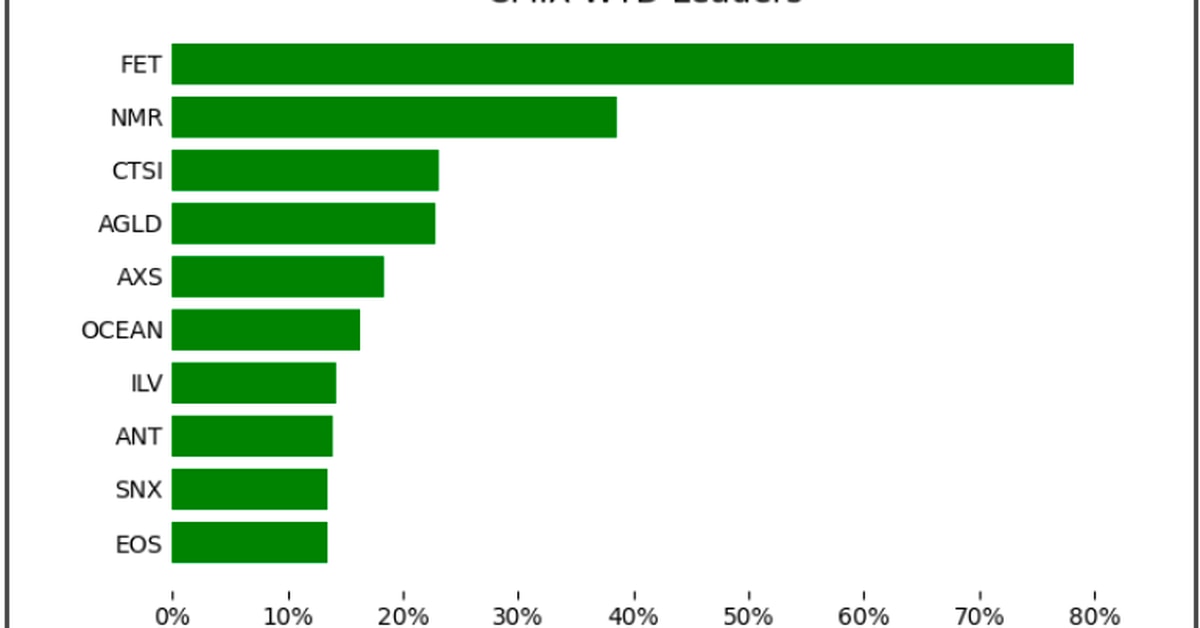

CoinDesk Market Index Week in Review

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity…

Symbiont.io, Which Tried to Bring Blockchain to Traditional Finance, Files for Chapter 11

Originally named Math Money FX, the company was formed in 2013 to help financial institutions leverage the Bitcoin blockchain to “reduce risk, save costs, and increase efficiencies,” according to a company timeline. Early on, it raised money from finance titans including the former CEO of the New York Stock Exchange, and allowed investors to track the cap table (finance jargon for who owns how much of a privately held startup) using the Bitcoin network. Source link

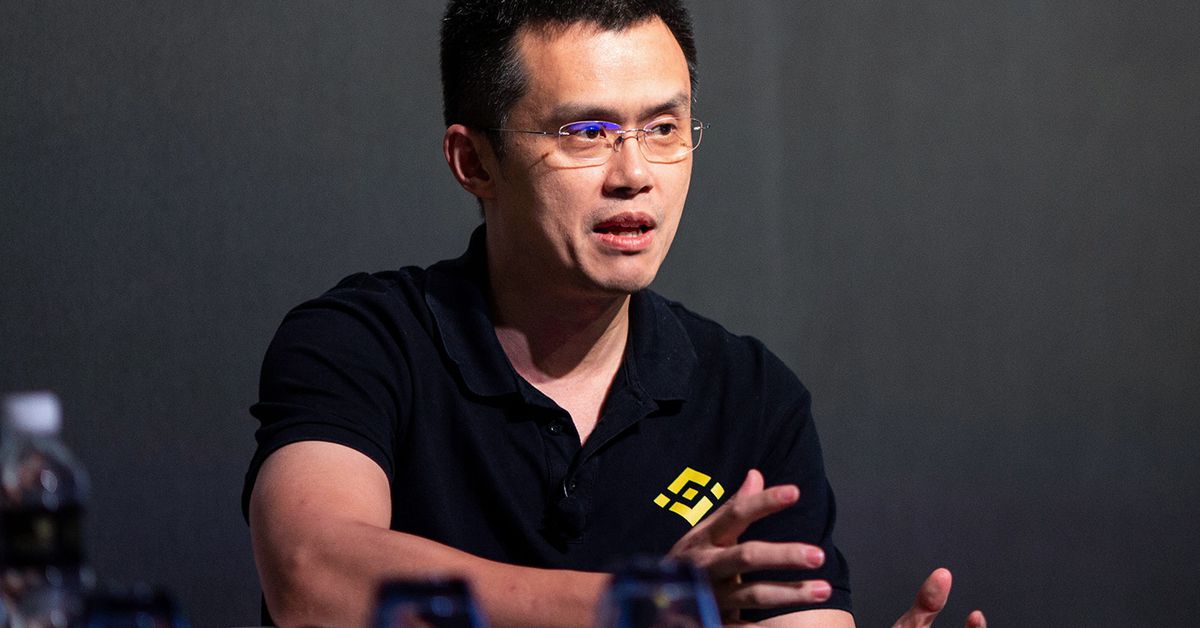

Binance Suspends Account of Customer for Being ‘Unreasonable’

The user, who goes by CoinMamba on Twitter, is, according to their profile, a futures trader and crypto investor. The user started tweeting about Binance after claiming to lose funds from their Binance account Tuesday due to a leaked API key that was tied to crypto trading platform 3Commas. The user said they didn’t receive much help from Binance in getting these funds back. Source

Ethereum’s Shanghai Hard Fork Could Happen in March 2023, ETH Dev Says Staking Withdrawals Is the ‘Highest Priority’ – Technology Bitcoin News

According to a recent Ethereum Core development meeting on Dec. 8, developers disclosed that the next Ethereum hard fork, called Shanghai, could be implemented by March 2023. It’s been suggested that the Shanghai hard fork will be able to manage the network’s staked ethereum withdrawals. Ethereum Devs Aim for Hard Fork Target ‘Around March-ish’ On Dec. 8, 2022, Ethereum Core developers convened for the 151st developers meeting, and a number of subjects were discussed including Ethereum’s next hard fork. Ethereum’s last major hard fork was The Merge, a significant change…

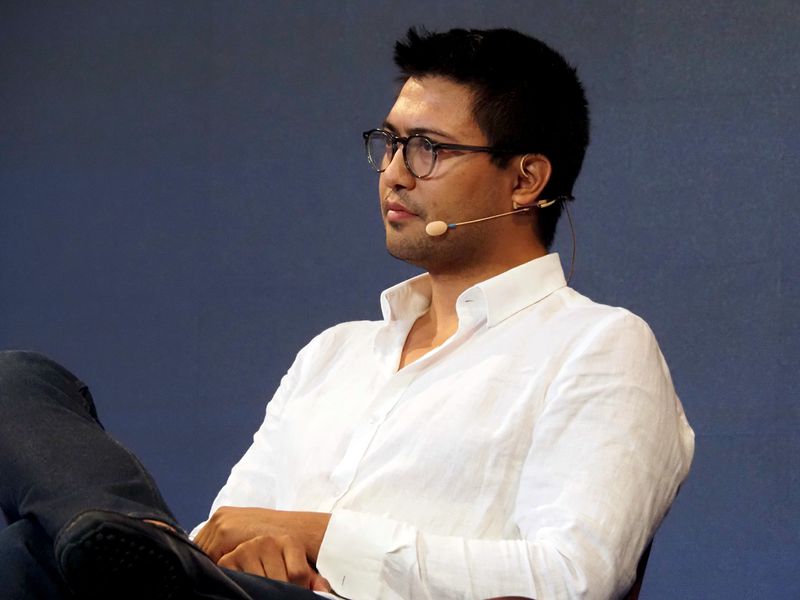

Sam Bankman-Fried’s Alameda Research Secretly Funded Crypto Media Site The Block and Its CEO

According to The Block, McCaffrey received three loans for a total of $43 million from 2021 through this year. The first loan was for $12 million in 2021 to buy out other investors in the media company, at which time McCaffrey took over as CEO. The second was for $15 million in January to fund day-to-day operations, and the third was for $16 million earlier this year for McCaffrey to purchase personal real estate in the Bahamas, according to The Block. Source AlamedaBankmanFriedsBlockCEOCryptoFundedmediaResearchSamsecretlySite CryptoX Portal

US regulator seeks feedback on DeFi’s impact on financial crime: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. The United States regulators want to take a closer look at money laundering and terror financing laws by the Financial Crimes Enforcement Network (FinCEN), as it asked banking sector players for feedback on DeFi’s crime risks. Ethereum developers are targeting the last week of March for Ethereum’s Shanghai hard fork and some additional improvement upgrades by June of next year. Ankr protocol has deployed…

CEO of crypto news site The Block resigns for failing to disclose $27M loans from Alameda Research

Bobby Moran of crypto news website the Block has announced he will be assuming the position of chief executive officer following the resignation of Mike McCaffrey, who reportedly financed the platform through loans from Sam Bankman-Fried’s Alameda Research. In a Dec. 9 announcement, Moran said McCaffrey had made an executive decision to restructure The Block in 2021 which involved a series of loans totaling $27 million from Alameda Research, a hedge fund part of former CEO Bankman-Fried’s FTX Group. According to Moran, the former CEO of The Block failed to…

FalconX says exposure to FTX represented 18% of its ‘unencumbered cash equivalents’

Cryptocurrency trading company FalconX has disclosed that it suffered losses in the collapse of FTX. According to the company, its assets locked on FTX represent only 18% of its “unencumbered cash equivalents.” However, the company added that this ratio fell well within their counterparty exposure limits. FalconX insisted that despite its exposure to the now insolvent FTX, its finances remain strong, as it continues to facilitate “billions of dollars” in daily trade volume for its clients. The company also claimed that its monthly volume has grown by “80%+ month-over-month.” It’s…