Even with less risk, Moreau said, Jet’s model faces some friction from big traders like market makers who have grown used to the flexibility of variable-rate products, where they can often pull their money at any time (assuming the utilization rate isn’t too high, of course). With a fixed-rate product their crypto is locked for the length of the contract. Source link

Day: June 22, 2023

Banning crypto ‘may not be effective in the long run’ — IMF

The International Monetary Fund (IMF) has reiterated its calls for crypto regulation across certain countries but said an outright ban may not be the best approach. In a June 22 report on Latin America and the Caribbean, the IMF pointed to various approaches taken by local governments in addressing the adoption of cryptocurrencies and central bank digital currencies, or CBDCs. Bitcoin (BTC) has been accepted as legal tender in El Salvador since September 2021, while the Bahamas was the first country to launch its own CBDC, the Sand Dollar, in…

Insights for Avoiding Business Failure

“For those operating in the blockchain space, it’s crucial to focus on growth and adoption, both at the retail and institutional levels,” noted Zatoshi. Let us introduce Zachari Saltmer, the influential co-founder of One Big Fund, affectionately known in his circles as Zatoshi. As a seasoned trader and venture capitalist, his insights have had a profound impact in the arena of crypto markets, particularly with innovations such as BRC-20 and ERC-6551. As we set foot into the next cycle of growth, let’s glean some significant business wisdom from Zatoshi on…

Tron Founder Justin Sun Withdraws $30M of Staked ETH from Lido Finance, Sends Tokens to Huobi Exchange

Crypto markets, led by bitcoin (BTC), rallied through the week as investors cheered the news that a slew of traditional financial institutions took steps to get more involved with digital assets. BlackRock, the world’s largest asset manager, filed to register a much-coveted spot BTC exchange-traded fund (ETF) last Thursday. This week, banking giant Deutsche Bank applied for a crypto custody license in Germany, while new crypto exchange EDX Markets, backed by Fidelity Digital Assets, Charles Schwab and Citadel Securities, launched its trading platform. CryptoX Portal

Tron Founder Justin Sun Unstakes $30M of Ether from Lido, Sends Tokens to Huobi

Crypto wallets linked to Sun still hold some $543 million in Lido’s stETH token, according to Arkham Intelligence data. Source

RBL Labs and the Future of Web3 Gaming

Amsterdam’s RBL Labs, an innovator in web3 gaming, has recently disclosed a comprehensive roadmap for its leading product, LegendsOfCrypto (LOCGame). LOCGame, an active participant in the flourishing Polygon blockchain ecosystem, benefits from the robust backing of industry stalwarts like Signum Capital, NGC, LD Capital, SL2, and Assensive Assets. Since its formation in 2021, RBL Labs has left an indelible mark on the web3 gaming landscape, offering innovative solutions and out-of-the-box approaches. The company’s beta launch of LOCGame for Web3 and Android users was a major achievement. This feature-packed platform, with…

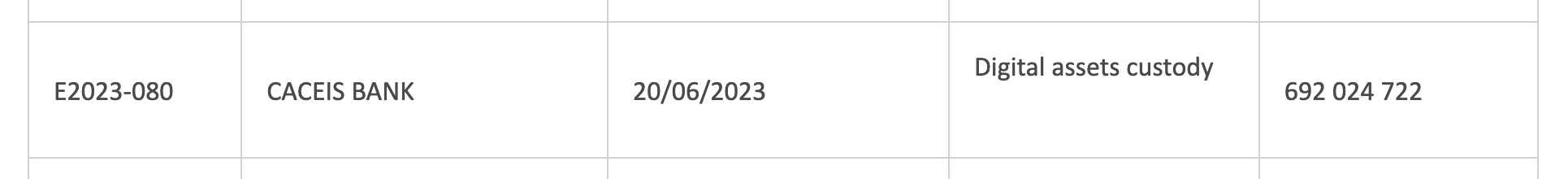

Santander, Crédit Agricole asset arm receives French crypto custody license

CACEIS Bank, the asset servicing arm of Crédit Agricole and Santander, has received a crypto custody license in France, according to the regulator’s website on June 20. CACEIS claims to be a European leader in asset servicing, offering services from clearing and fund administration to middle office outsourcing for asset managers, insurance companies, brokers, pensions and real estate funds, among other clients. As a crypto custodian, CACEIS will store users’ private keys, thereby increasing security for institutional clients. According to the bank’s website, CACEIS had 4.6 trillion euros ($5.06 trillion) in assets…

‘Bitcoin only’ buy-and-hold investment strategy outperforms altcoins over the long term — Analysis shows

Altcoins offer diverse, innovative features, promising technological advancements, and potentially lucrative investment opportunities. Many-a-time specific altcoins post handsome gains that surpass Bitcoin (BTC), popularly known as altcoin season. However, K33 Research analysis shows over the long-term, ‘Bitcoin only’ has been a better investment strategy than an altcoin portfolio. Altcoin portfolio underperformed Bitcoin over the long run Bitcoin has had three consecutive bull and bear market cycles, starting in 2013 with the latest one coming in 2021. In each cycle, Bitcoin’s price rose parabolically in a very short span, usually a…

Google launches ‘Anti Money Laundering AI’ after successful HSBC trial

Google Cloud recently announced the launch of its “Anti Money Laundering AI” (AMLAI) service after a successful trial with London-based financial services group HSBC. AMLAI uses machine learning to create risk profiles, monitor transactions and analyze data. Per a blog post from Google Cloud: “AI transaction monitoring replaces the manually defined, rules-based approach and harnesses the power of financial institutions’ own data to train advanced machine learning (ML) models to provide a comprehensive view of risk scores.” In practice, Google Cloud claims its trial partner, HSBC, saw an increase of…

Over Half of Fortune 100 Companies Embrace Crypto, Blockchain, and Web3, Reveals Coinbase Report

According to a recent report released by Coinbase, more than half of the Fortune 100 companies in the US have been actively pursuing crypto, blockchain, or web3 initiatives since the beginning of 2020. This surge in adoption is driven by the recognition that the outdated global financial system needs modernization and the need to stay competitive in the global economy. The report highlights that 83% of surveyed Fortune 500 executives familiar with cryptocurrency or blockchain have existing initiatives or plans for the future. However, the lack of clear regulations…