Morris noted that during BTC’s latest corrective move, the crypto held above the key $25,000 level, which capped the price between May 2022 and March 2023.” If we can hold that $25,000 level, which we probably will, BTC is very much in a bull market, albeit a quiet one,” he said. Original

Day: October 5, 2023

Ledger lays off 12% of staff, citing ‘macroeconomic headwinds’

Pascal Gauthier, CEO and chair of hardware crypto wallet manufacturer Ledger, has announced the firm will be reducing its staff by 12%. In an Oct. 5 blog post, Gauthier said the staff cuts had been made “for the longevity of the business,” citing the 2022 bear market and the collapse of firms including FTX and Voyager Digital. Based on data from LinkedIn, Ledger may have had around 734 employees at the time of publication, suggesting that roughly 88 people may have lost their jobs. “Macroeconomic headwinds are limiting our ability…

Sui Foundation Retrieves 117 Million SUI Tokens From Market Makers

The Sui (SUI) Foundation has announced its latest initiative to strengthen its decentralized finance (DeFi) ecosystem, reclaiming 117 million SUI tokens worth $51.3 million from external market makers. The tokens will be redirected into various channels to support the growth of the Sui Network. This Layer 1 blockchain has gained recognition for its scalability since its mainnet launch in May. Per the announcement, the reallocation of these tokens will not impact the circulating supply of SUI, as they were previously released. In addition, the Sui Foundation has already earmarked 25 million SUI…

Bitcoin Financial Services Firm Swan Unveils 'Collaborative Custody' Service

Swan and Blockstream’s aim is to allow users to retain ultimate control of their bitcoin (BTC) while knowing that is stored in a highly secure way. Source

Bitcoin is a ‘critical hedge’ against currency debasement and return of inflation, Jefferies says

Bitcoin and gold are “critical hedges” against the potential for monetary policy that reduces the value of currency, as well as the return of inflation, Jefferies says. Although investors have “effectively given up” on the U.S. recession forecast, macro signals are still suggesting a coming downturn in the United States, and monetary tightening will work with a bigger-than-usual lag this cycle, thanks to an explosion of money supply growth dating back to 2020, the firm said in a note to investors Wednesday. “G7 central banks, including most importantly the Federal…

FTX Co-Founder’s Trial Commences: Defense Shifts Blame to Ex-Girlfriend and Binance CEO for Exchange’s Collapse

FTX co-founder Sam Bankman-Fried’s (SBF) defense team tried to place blame on his ex-girlfriend, Caroline Ellison, and Binance CEO Changpeng Zhao (CZ) for the collapse of the cryptocurrency exchange. Mark Cohen, SBF’s lawyer, argued during the opening statements that SBF did not defraud anyone and acted in good faith, shifting responsibility for the alleged misconduct onto CZ, media reports said. Cohen contested the portrayal of SBF as a “cartoon villain,” describing him as a math nerd who abstained from drinking and partying. The defense asserted that SBF believed loans from…

Friend.tech announces new features following SIM-swapping attack

Friend.tech, the decentralized social network that allows users to buy and sell keys linked to X, announced a new feature via social media. The feature will allow users to add and remove login methods and follows reports of SIM-swap attacks. Addressing user questions On social media platform X, Friend.tech announced an updated feature for login methods, stating the settings are now accessible through the app, with users needing to tap their wallet balance to make any changes. The thread goes on to answer a user question about Privy’s 2FA passcode…

Michael Lewis Was Charmed by Sam Bankman-Fried – But So Was Everyone Else

The book’s relatively sympathetic treatment of Sam becomes more striking in contrast to depictions of his adversaries, such as Binance CEO Changpeng Zhao. Before the book was published, a letter from Creative Artists Agency circulating in Hollywood said Lewis likened Sam and CZ “to the Luke Skywalker and Darth Vader of crypto.” Traces of this characterization still made it into the finished book. “Binance was the class bully, FTX the class nerd, and each took pleasure in using its special powers to torment the other,” Lewis wrote. He also said,…

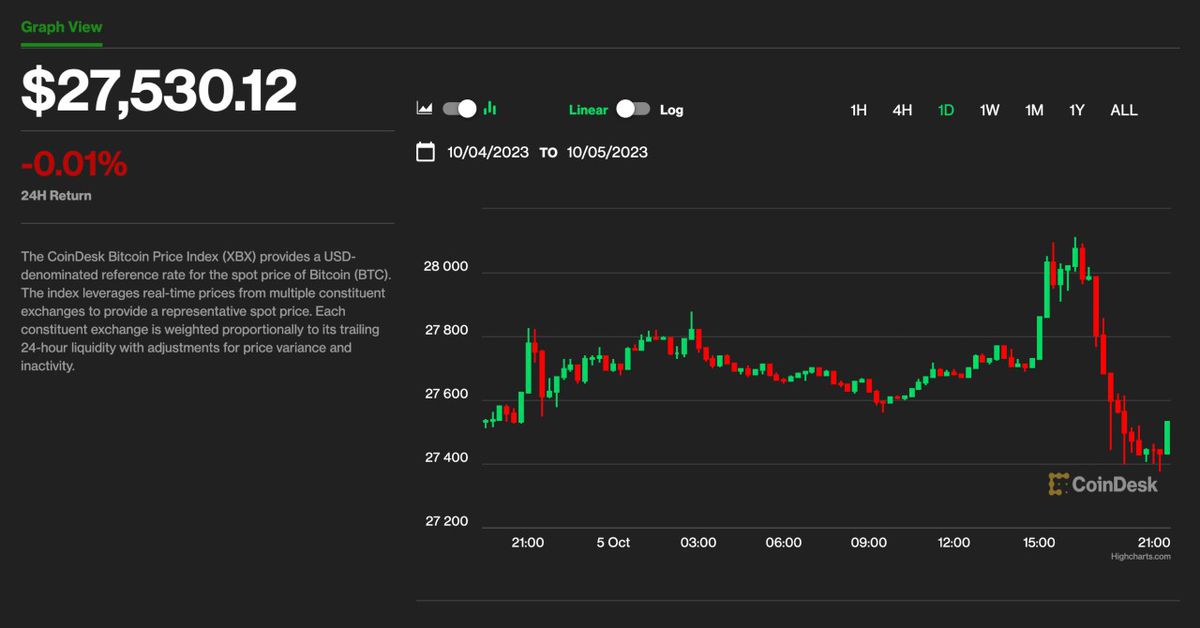

3 reasons why Bitcoin is struggling to rally above $28.5K

On Oct. 2, the price of Bitcoin (BTC) saw a 5.5% intraday increase to $28,600, but the largest cryptocurrency by market capitalization lost momentum as the highly anticipated launch of Ether (ETH) futures exchange-traded funds (ETFs) failed to generate significant trading volumes. While the recent rally into the upper end of the current price range was likely encouraging to investors, recent comments from United States Federal Reserve representatives reiterated concerns about an impending economic downturn. Bitcoin demonstrated short-term strength by maintaining support at $27,200 on Oct. 3 and subsequently surged…

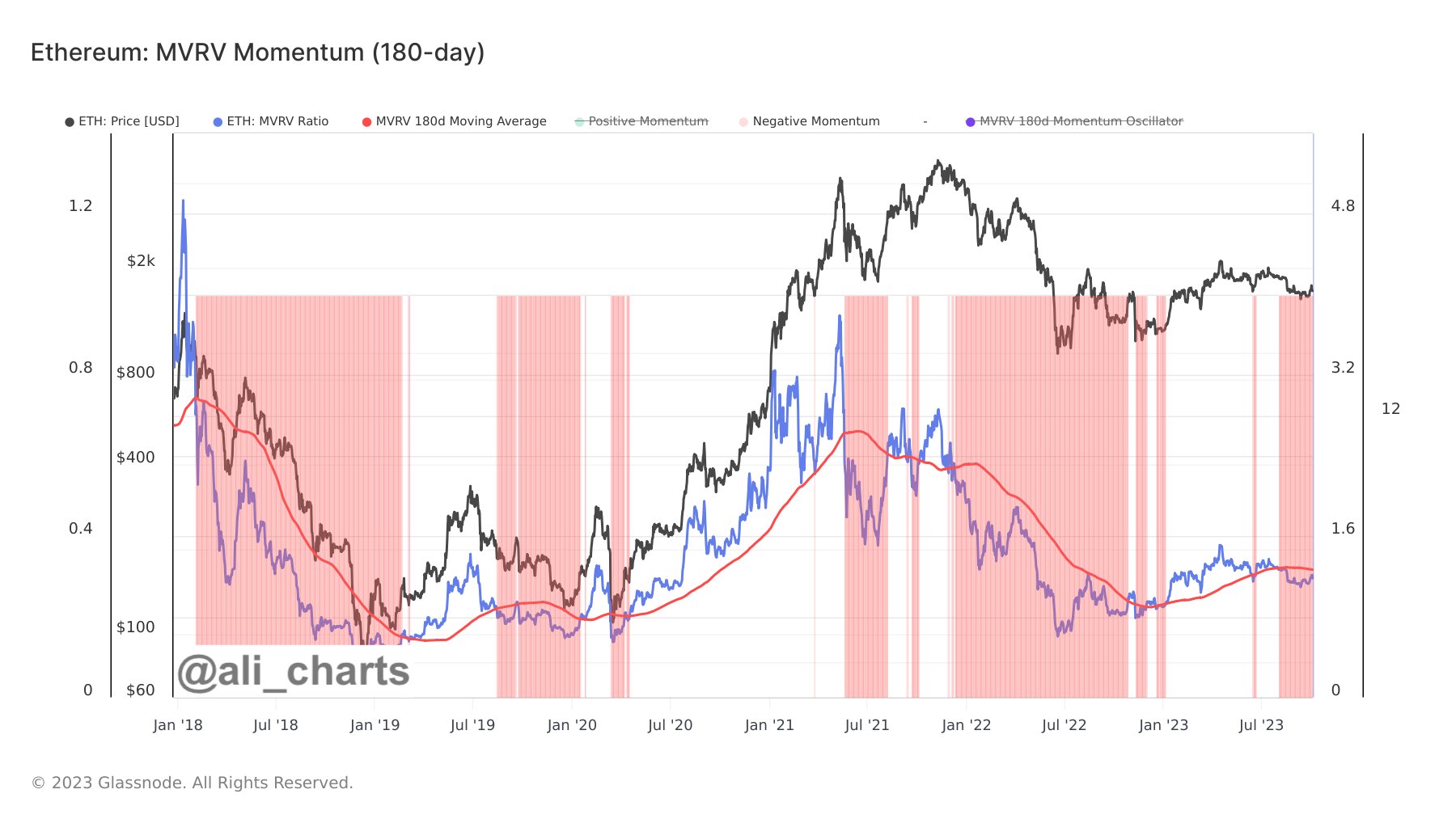

This Ethereum Metric Is Retesting The Bear-Bull Junction, Will Break Happen?

On-chain data shows the Ethereum MVRV ratio is currently testing a level that has historically served as the boundary between bear and bull markets. Ethereum MVRV Ratio Is Retesting Its 180-Day SMA Right Now The “Market Value to Realized Value (MVRV) ratio” is an indicator that measures the ratio between the Ethereum market cap and realized cap. The former is naturally just the total supply valuation at its spot price. At the same time, the latter is an on-chain capitalization model that calculates the value differently. The realized cap assumes…