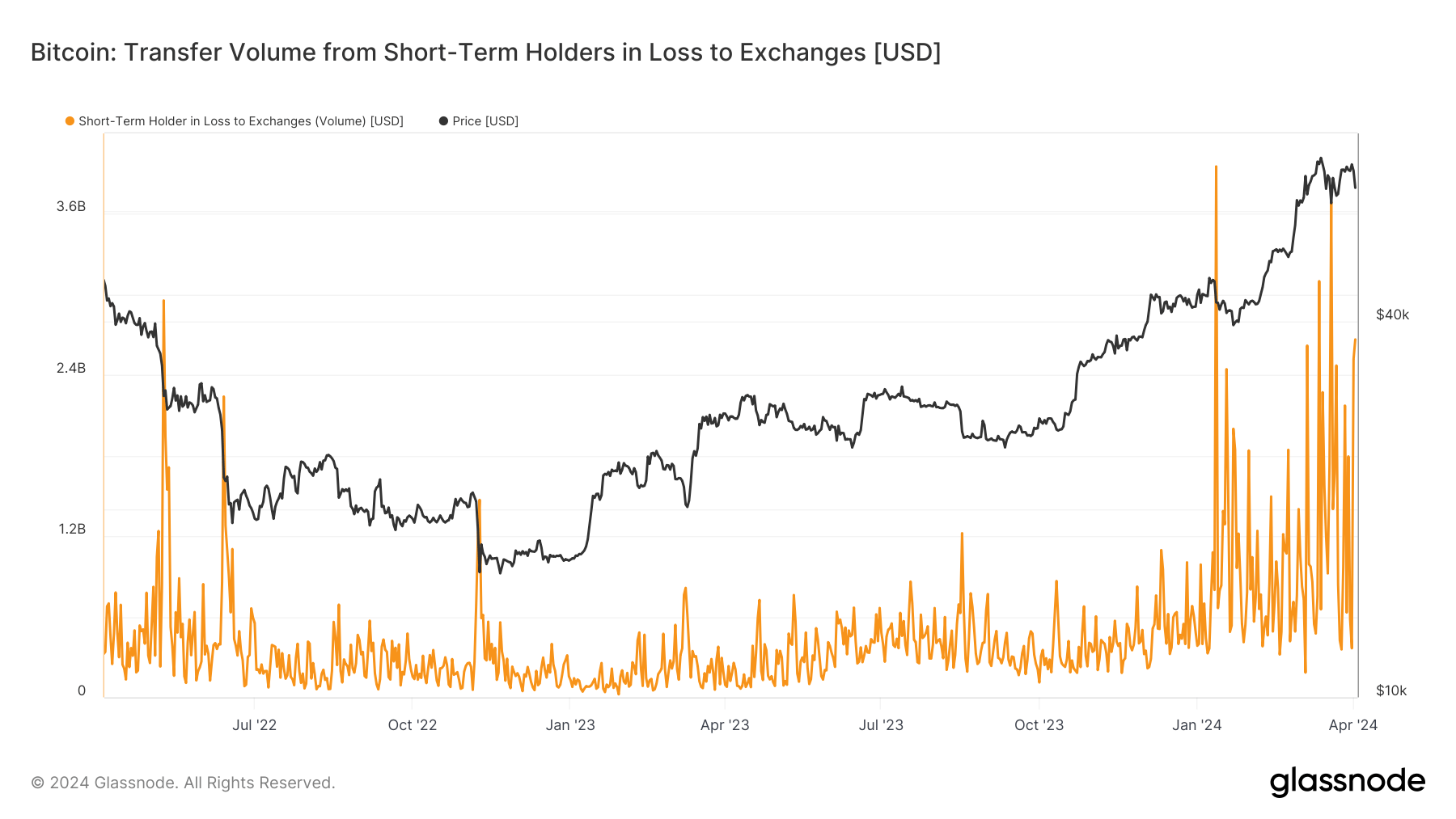

On-chain data shows the recent Bitcoin drawdown has shaken up the short-term holders, leading them to make large exchange deposits at a loss. Bitcoin Short-Term Holders Have Transferred Huge Volume In Loss To Exchanges As analyst James Van Straten pointed out in a post on X, the BTC short-term holders have recently participated in a large amount of loss-taking. The “short-term holders” (STHs) are the Bitcoin investors who bought their coins within the past 155 days. The STHs make up one of the two main divisions of the BTC market,…

Day: April 4, 2024

Bitcoin’s peak could be a harbinger of a stock market top next, Stifel says

A bitcoin top could signal trouble for stocks – and a shift in market leadership, according to Stifel. According to Barry Bannister, Stifel’s chief equity strategist, there’s evidence the cryptocurrency may be peaking, which could lead to a pullback in investor sentiment, weaker Big Tech stocks, and a rotation into value, he said in a note Wednesday. “Bitcoin & Nasdaq 100 reflect the speculative fever fostered by cheap money after dovish Fed pivots, such as occurred 4Q 2023,” Bannister said. “We show that if Bitcoin reflects euphoria after a dovish…

Ether (ETH) Could Avoid Security Designation With Centralization Risk Easing, JPMorgan Says

Staking platform Lido’s share of staked ether (ETH) has continued to fall, which should reduce concerns about concentration in the Ethereum network, raising the chance that ETH won’t be designated as a security in the future, JPMorgan (JPM) said in a research report on Wednesday. “The share of Lido in staked ETH has decreased further from around one third a year ago to around a quarter at the moment,” analysts led by Nikolaos Panigirtzoglou wrote. The Hinman documents, which were released last June, “revealed the role of network decentralization in…

Bitcoin Cash jumped 10% after second-ever halving

One of Bitcoin’s most popular forks completed its halving roughly two weeks ahead of BTC’s quadrennial change slated for later this month. Bitcoin Cash (BCH) gained a 10% price increase in 24 hours following its halving today and was one of the top gainers among cryptocurrencies as the markets lulled. Following the event, BCH climbed as high as $660 per CoinMarketCap. Despite the price hike, BCH traded 84% below its $4,355 all-time high, which it reached six years ago in 2017. Like the Bitcoin (BTC) halving, BCH’s mining reward was…

Bitcoin Price (BTC) Correction Could Continue

Bitcoin hit a record high above $73,500 about three weeks ago and then quickly retreated to the $61,000 area. It’s since retraced to the current $67,600, giving bulls some hope that new records are imminent. At least one sentiment indicator, though, indicates that the price correction has more room to run. Source

Bitcoin bull run heats cryptocurrency jobs market, hits 12-month record

The sector’s bullish trend during Bitcoin’s surge has seen the cryptocurrency jobs market heat up. According to CryptoJobsList, rising cryptocurrency prices and activity have increased the number of applicants and postings on industry job sites. Last month, published vacancies reached an annual record. Such an indicator has not been seen for several years amid the ongoing bearish stagnation. At the same time, the active search for employees occurred in March against the backdrop of Bitcoin (BTC) updating its historical maximum. The number of vacancies hovered around 291 in February, increasing…

Binance to delist Bitcoin NFT collections

Binance’s NFT marketplace will end all support for Bitcoin NFTs from this month amid declining market trends. Starting April 18, Binance NFT will not accept trades or deposits for Bitcoin-based NFT collections. The platform has issued guidance for its users, urging them to transfer their Bitcoin NFTs out of the marketplace using the Bitcoin network by May 18. Binance will also automatically cancel all orders for listings affected on the mentioned date. The marketplace also stated that after April 10, it will halt support for additional airdrops, perks, or features…

Injective Whales Go On $24.8 Million Buying Spree, Is This The Next Solana?

Injective (INJ) may be on the brink of a potential price surge following a recent wave of accumulation by crypto whales. This would undoubtedly be a much-needed relief for the INJ token, which has dipped significantly in the last seven days. Crypto Whales Buy $24.8 Million Worth Of INJ Data from the market intelligence platform Santiment shows that Whale Addresses recently bought $24.8 million worth of INJ, bringing their total holdings to 10.69 million INJ. This purchase is significant considering the impact that crypto whales have on the market. As…

How Blockchain Enhances Transparency, Accountability, and Efficiency for Advisors and Clients

In conclusion, corporate governance practices in a blockchain world offer significant benefits to financial advisors’ clients. From enhanced transparency and trust to improved accountability, streamlined operations, enhanced security, and regulatory compliance, blockchain technology is revolutionizing the way financial advisors and their clients interact and collaborate. By embracing blockchain-based governance solutions, financial advisors can better serve their clients’ interests, help them achieve their financial goals, and build stronger, more resilient investment portfolios for a prosperous and sustainable future. Source

Binance NFT to Halt Bitcoin NFT Activities, Focus Shifts Away From BTC-Based Collectibles

In a recent announcement by Binance on April 4, 2024, the firm disclosed its decision to halt support for Bitcoin-based Ordinal non-fungible token (NFT) collectibles within its NFT marketplace. The directive from Binance calls for users of its NFT marketplace to withdraw their Ordinal inscriptions by May 18, 2024. Binance NFT Marketplace to End Ordinal […] Original