- The Nasdaq Composite has rallied 11.69% in the past 20 days, recovering towards an all-time high.

- In the near term, the U.S. stock market faces numerous threats, including rising COVID-19 cases heading into the winter season.

- The strong performance of Big Tech, a possible post-election stimulus, and vaccine breakthroughs could fuel equities in November.

The Nasdaq Composite faces several threats in the fourth quarter that could potentially hinder its strong technical momentum. But numerous vital catalysts could uplift its momentum, particularly after the presidential election.

The three critical factors for an extended Nasdaq recovery are Big Tech’s resurgence, a post-election stimulus, and the vaccine breakthroughs.

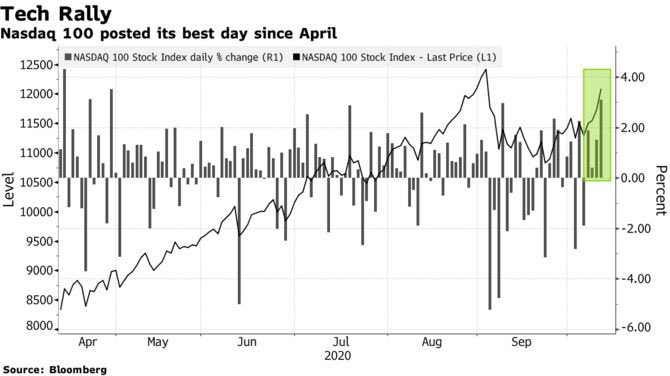

Since September 23, the index climbed 11.69%, nearing its all-time high it hit on September 2.

Dr. Fauci’s COVID-19 Warnings and Gloomy Earnings are Nasdaq Risks

Since September, Dr. Anthony Fauci has voiced concerns about the worrying trend of COVID-19 in the U.S.

Fauci pinpointed the high baseline of virus cases in the U.S. and the infection rate as concerning figures.

Heading into December, Fauci has begun to sound the alarm on growing COVID-19 cases once again.

Talking to CNBC, Fauci bluntly stated that the U.S. is “in a bad place,” as colder weather approaches.

Dr. Fauci stated:

We’re in a bad place now. We’ve got to turn this around…We’ve got to convince Americans that public health measures do not mean shutting the country down. It’s actually an avenue to keeping the country open.

If virus cases spike, the probability of additional restrictions rises, which might hurt overall business productivity.

As such, the prospect of a worsening pandemic in the upcoming months could hinder the Nasdaq Composite’s momentum.

The U.S. also reported its first confirmed COVID-19 “reinfection,” which has scientists worried about the upcoming winter season.

Atop the gloomy prospect of the pandemic, other major stock market indices, especially in Europe, fell due to weak earnings.

But there are hopes that the Big Tech’s strength, the possibility of vaccines, and a new stimulus package could offset the grim market sentiment.

Catalyst #1: Big Tech Performance

Throughout April to September, Big Tech fueled the Nasdaq Composite’s record rally.

According to Holger Zschaepitz, a market analyst at Welt, Apple, Amazon, and tech stocks recently caused the Nasdaq to outperform. He said:

“Nasdaq notches best day since April in kind of Crack-up boom ahead of Q3 2020 earnings season, Apple iPhone announcement, Amazon Prime Days and a general revaluation of Tech Stocks due to lower rates forever.”

For tech-heavy indices, including Nasdaq and the S&P 500, the resurgence of Big Tech remains a significant catalyst.

Catalyst #2: Post-Election Stimulus Could Uplift the Nasdaq

On October 7, U.S. President Donald Trump rejected the $2.4 trillion stimulus proposal from the Democrats.

President Trump stated that stimulus talks would only continue after the election, criticizing the newly proposed stimulus bill.

But shortly after that, President Trump tweeted that the House and Senate should “immediately” approve more stimulus. He said:

“The House & Senate should IMMEDIATELY Approve 25 Billion Dollars for Airline Payroll Support, & 135 Billion Dollars for Paycheck Protection Program for Small Business. Both of these will be fully paid for with unused funds from the Cares Act. Have this money. I will sign now!”

The timing of President Trump’s call for additional stimulus so quickly after rejecting the stimulus proposal makes a stimulus agreement after the election more likely.

Strategists believe a stimulus package is not coming before the November 3 presidential election. Watch the video below:

Catalyst #3: Vaccine Breakthroughs

By the year’s end, Goldman Sachs strategists are not dismissing the outlook of vaccine breakthroughs buoying high-risk assets.

A team of strategists led by Zach Pandl, co-head global FX, rates, and EM strategy at Goldman Sachs, wrote:

“But the wide margin in current polls reduces the risk of a delayed election result, and the prospect for near-term vaccine breakthroughs may provide a backstop for risky assets.”

The confluence of the recovery of tech stocks and favorable macro factors could further strengthen the trend of U.S. stocks in November.