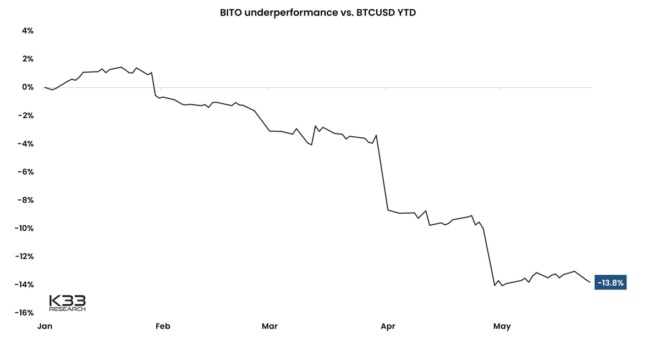

The underperformance stems from the costs associated with the fund’s structure. BITO does not purchase tokens, instead it holds BTC futures contracts on the Chicago Mercantile Exchange (CME). The fund must roll over the contracts every month as they expire, making it vulnerable to the price difference between terms. If next month’s contract trades at a premium to the nearest expiry – a phenomenon called contango and typical during a bull market – over a sustainable period, the fund will compound losses due to the “contango bleed.”

ProShares’ Bitcoin Strategy ETF BITO Underperforms BTC Price by 13.8% This Year: K33 Research