By CCN: According to Wei Zhou, the chief financial officer at Binance, the most widely utilized crypto asset trading platform in the global market, the exchange is planning to issue a stablecoin in the upcoming months, possibly to compete against Tether.

Speaking to Bloomberg in an interview, Zhou reportedly said that the exchange plans to launch its stablecoin “in a matter of weeks to a month or two.”

Can binance compete against tether?

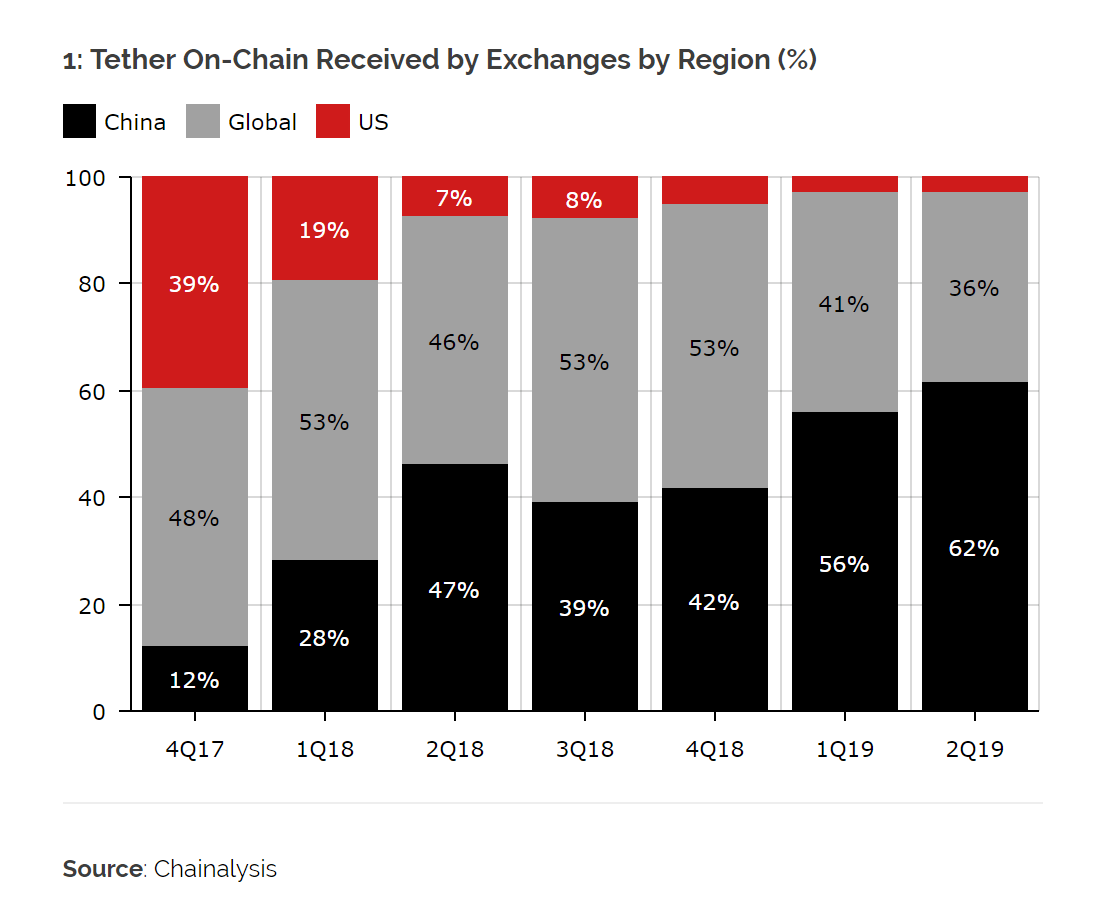

Although there were some periods wherein the dominance of Tether demonstrated signs of slight decline in December 2018 and in April 2019, ultimately, due to strong demand from users in Asia, Tether has been able to secure its dominance over the global stablecoin market.

According to a report released by Diar, Tether’s on-chain transaction volume, meaning the volume of the stablecoin on blockchain networks like TRON and soon EOS, achieved a new all-time high for 2019.

“On-chain data shows Tether movements hitting a new all-time-high for 2Q19 with one month left on the calendar for the period. What is most striking, however, is the volume coming in and out of Chinese exchanges dwarfs western and global trading venues and accounts for more than half of the total transaction value of known parties,” the research firm wrote.

The majority of Tether’s transaction volume in the second quarter of 2019 was driven by China, which currently has a major user base of the stablecoin.

Considering the network effect Binance has over the global crypto exchange market and its international user base, a native stablecoin issued by Binance could demonstrate a strong merit to users.

For stablecoins, liquidity is crucial. Despite the compelling features of other stablecoins like the Gemini Dollar and USDC, issued by strictly regulated exchanges Gemini and Circle in compliance with U.S. regulators, the volume of Tether on Binance dwarfs rival stablecoins.

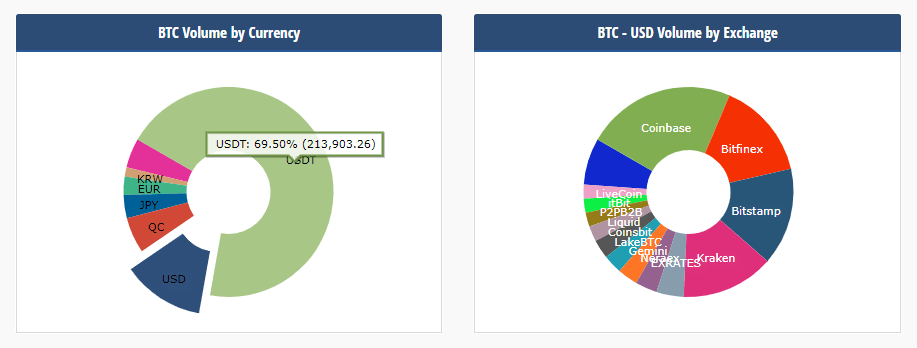

As of June 6, the BTC/USDT pair is trading with a volume of nearly $300 million. In comparison, the BTC/PAX pair, the second biggest BTC-to-stablecoin pair on Binance, is trading with a volume of $18 million.

Based on Bloomberg’s report, Binance does not intend to directly compete against Tether nor launch a USD-backed stablecoin. Instead, it is eyeing other reserve currencies like the euro and the yen.

“From the users’ perspective, only certain portions of the world use the dollar. Other users use other currencies, and we feel it should be reflected in stablecoins as well,” Zhou said.

For many users based in Asia, although the dollar remains a frequently quoted reserve currency, trading pairs with reserve currencies in Asia such as the yen or the Korean won could be compelling for local investors.

Not directly competing against tether may be the best way to establish dominance

Considering that Tether’s volume dwarfs the volume of competing stablecoins, competing head-on against Tether by issuing a USD-backed stablecoin may not be the most practical way of building a new user base for a new product.

With the general volume in the crypto market on the rise and major markets like Japan and South Korea seeing recovery in crypto volumes, offering an alternative stablecoin based on other reserve currencies could provide Binance with a market to penetrate in the near-term.

Japan accounts for 3.58 percent of the global bitcoin volume according to CryptoCompare, which is higher than Europe and South Korea. USDT accounts for nearly 70 percent of bitcoin volume, higher than the USD-to-BTC volume.