The price of Bitcoin (BTC) has been continuing the previous week’s weakness as the support of $9,000 has been tested many times. However, the market itself is not acting bearish because altcoins such as DOGE, for example, are surging left and right.

Is the market ready for a momentum shift and a big volatile move by BTC, the top-ranked cryptocurrency by market capitalization?

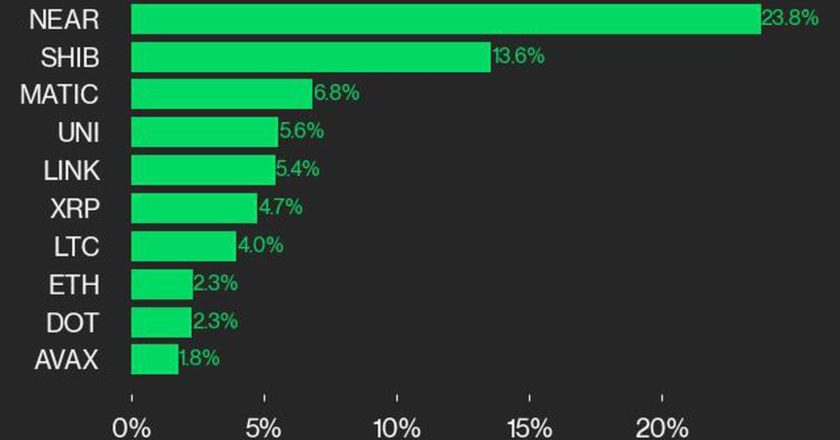

Crypto market daily performance. Source: Coin360

Bitcoin acting on final levels for support to justify bull scenarios

The price of Bitcoin is still resting at a significant level of support as there is a stalemate in place between the bulls and bears.

As Bitcoin’s price has been consolidating, there’s an argument to be made that the price is making constant higher lows since March 12. The most recent low is the area between $8,700-8,900. That’s the bullish case.

However, the price has been dropping since the peak high at $10,300 and has been making lower highs since. That leads to the overall conflict in the markets as both bullish and bearish arguments exist.

BTC/USDT 1-day chart. Source: TradingView

Bitcoin price is currently above the 100-day and 200-day moving averages (MAs), as the chart shows. At the same time, the crucial support level of $8,700-8,900 is still holding and also established a smaller support level at $9,050-9,100, which is where BTC/USD is currently at.

Meanwhile, a potential ascending triangle is ready to form if the price of Bitcoin breaks above $9,300 in the short term.

BTC/USD 4-hour chart. Source: TradingView

The 4-hour chart shows a clear breakdown of the $9,150-9,200 level, which is currently being tested for resistance and a confirmation of this support/resistance flip as it’s currently being supported by the $9,000-9,050 level.

This is remarkable for Bitcoin’s price action lately, since the levels have become very narrow resulting in very small price moves.

Additionally, as the price acts in such a small range, the volume decreases. Volume typically emerges via a breakout of any construction, which most likely is going to occur next week.

Total market capitalization showing more strength than Bitcoin

Total market capitalization cryptocurrency 1-day chart. Source: TradingView

The market capitalization shows more strength than the Bitcoin price. The market cap is showing a clear upward trend that flipped each previous resistance level into support, such as $255 billion (upper green box).

The next major step for market capitalization to break through is $270 billion. If that level breaks, a move toward $305 billion is likely.

Total altcoin market capitalization 1-day chart. Source: TradingView

The total market capitalization is showing more strength than Bitcoin because of the recent strength in altcoins as of late.

The total altcoin market cap shows a clear breakout and support/resistance flip of $91-92 billion. As long as the green box remains to support and the total altcoin market cap doesn’t drop below, the altcoins will likely continue the rally.

The next area of resistance to watch is $113 billion, which is approximately twenty percent from here.

The bullish scenario for Bitcoin

The bullish scenario is primarily built around breaking through the $9,200 resistance level, and another test of the support level could impact the bullish scenario.

BTC/USD 4-hour bullish scenario chart. Source: TradingView

The chart shows many untested levels on the upside, which are likely to get tested if $9,200 gets broken through.

The first potential level of resistance after $9,200 is the $9,400 resistance zone. As the chart shows, there’s not been a “test” of this previous level. A test means the price rallies towards this level to confirm a rejection by that level. Such a rejection can be classified as resistance, and then the price reverses.

However, the chart shows many untested levels above the current price level. Not only is $9,400 untested, but a similar case can be seen with $9,600 and $9,800, for instance. If the price of Bitcoin breaks through $9,200, a support/resistance flip of that level increases the likelihood of $9,600 shortly.

Breaking through $9,200 also forms the ascending triangle structure. Then it becomes massively more likely that the price will be testing and revisiting the $10,000-10,500 region and a possible giant breakout further upward.

The bearish scenario for Bitcoin

BTC/USD 6-hour bearish scenario chart. Source: TradingView

The bearish scenario consists of rejecting the $9,200 level and then losing the $9K support level. Every rejection of the previous support level by the resistance would indicate further downward momentum for BTC the price becoming more likely.

These signals are confirmations for traders that the price of Bitcoin is ready for a further fall to occur. However, a breakthrough of $9,200 towards $9,400, after which $9,200 is lost as support would also mean that no buyers are stepping in — another bearish signal.

As Bitcoin’s price is most likely going to accelerate once it breaks above the $10,500 barrier, the opposite is true for the bearish case if $8,600 support does not hold.

This is likely because there aren’t many support levels beneath $8,600, suggesting that the price can quickly drop $1,000 in a few hours as traders’ stop/losses may also add to downward pressure with the price dropping below a critical two-month-long support level.

The next major support level beneath $8,600 is the $7,500 range.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.