Bitcoin price (BTC) traded above $10,000 July 15 after a weekend of heavy losses spelled disaster for cryptocurrencies across the board.

Market visualization courtesy of Coin360

Data from Coin360 showed BTC/USD holding onto support above the key barrier Monday, having temporarily dropped as low as $9,912.

The 9.7% daily losses compounded a worrying weekly trend which saw the pair fall rapidly from above $13,000.

Bitcoin 7-day price chart. Source: Coin360

Driving the bearish sentiment, analysts broadly claimed, was a mixture of criticism by United States president Donald Trump and overall market fatigue.

For many, BTC/USD had long been due a pullback after weeks of successive gains, which culminated in highs of $13,800.

“It’s healthy to see (Bitcoin) pullback here,” Tom Lee, head of research at Fundstrat Global Advisors, tweeted Sunday.

Lee, a serial Bitcoin bull, had claimed last week that new all-time price highs were “imminent,” something which Trump’s comments appeared to subject to delays.

A side-effect of Trump had been increased Google search activity around Bitcoin, something Lee says could in fact be counterproductive and not a helping hand for price growth.

“As for the search traffic for bitcoin being low, I also think that is a good sign. It means the rise in bitcoin has not been accompanied by massive hype,” he added.

In the short term, however, others were warning about impending moves lower. The trader known on social media as Filb Filb said that a close on Sunday below $10,580 would result in a continuation of the downtrend, a prophecy which meanwhile came true.

“The price action has obviously been very bearish having lost the key low I’ve been watching at 10900. Also we are right up against the megaphone trend line. A close below 10580 would mark a new daily low and therefore I’m expecting new lows if/when that occurs,” he told followers of his dedicated Telegram trading channel.

Nonetheless, it was altcoin traders who suffered the real pain this weekend. A glance at the top twenty cryptocurrencies by market cap painted another dismal picture at press time, with several coins shedding around 17% in 24 hours.

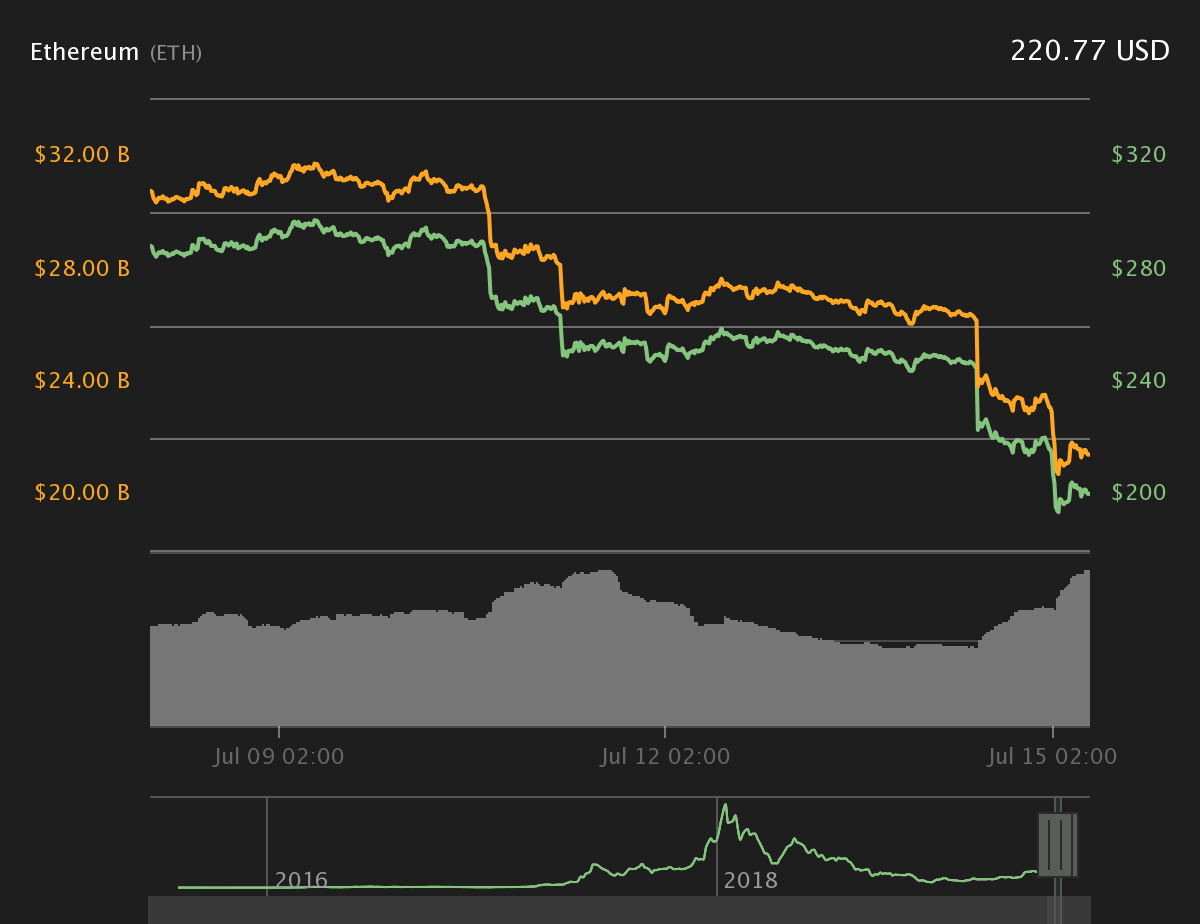

Ether (ETH) fell 17.3%, taking ETH/USD to just $220 compared to highs of $350 just weeks previously.

Ether 7-day price chart. Source: Coin360

Bitcoin Cash (BCH) lost an identical amount, while its hard fork, Bitcoin SV (BSV), fared even worse, losing 21.5% to hit $118.50.

Elsewhere, Tron (TRX), Neo (NEO) and Monero (XMR) all dropped by around 16%.