After growing actively at the beginning of the week, the leading altcoin stabilized near 590.00 USD.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- Tech analysis of ETH/USD

- Ethereum launched phase zero of the 2.0 network

On W1, the ETH/USD pair has formed a correction of the uptrend. It is trading at 38.2% Fibo. In the case this level is broken away, the price will head for the next level of 50.0%. The MACD histogram has remained above zero for several weeks already, which promises the uptrend will soon resume. The signal lines of the indicator have crossed the zero level and keep growing, supporting the continuation of the trend. The Stochastic rests in the overbought area, perhaps on the verge of forming a Black Cross, which might signal for a correction before further growth.

Photo: RoboForex / TradingView

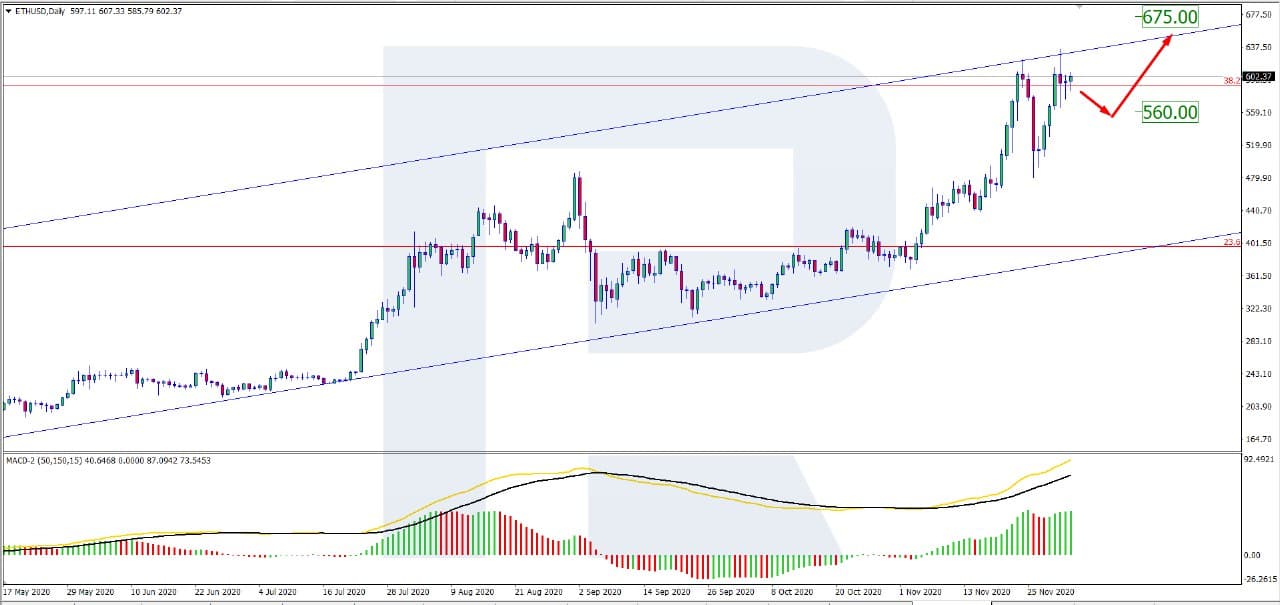

On D1, the situation is quite similar to that on W1. The pair is trading at the upper border of the ascending channel near 38.2% Fibo. The aim of the growth, in this case, is 675.00 USD at the resistance level. The MACD histogram keeps growing, supporting the other signal. However, its signal lines might soon form a Black Cross, increasing the chances for a correction. The aim of the pullback will be 560.00 USD.

Photo: RoboForex / TradingView

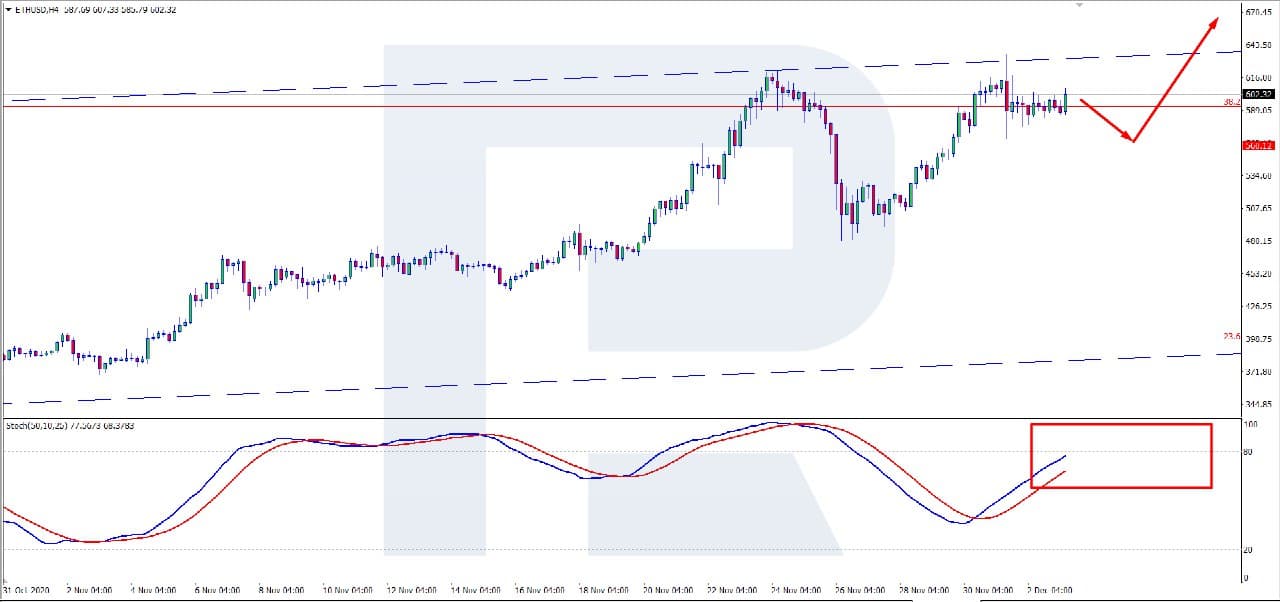

On H4, the picture is almost the same as on D1: the quotations are testing the upper border of the ascending channel. After a minor correction, the coin has all the chances for resuming the uptrend. The Stochastic rests in the overbought area, and a Black Cross there will increase the chances for a correction before the continuation of the ascending dynamics. The aim of the growth (as on the larger timeframe) is 675.00 USD.

Photo: RoboForex / TradingView

On December 1st, the 2.0 version of the Ethereum network was launched, after all. The first block was created at about 3 p.m. Moscow time. This means that Ethereum managed to gather enough money on the depository contract – a week before the start, there were many doubts if this would happen. Data shows that the limits were actually exceeded – the contract attracted 885 thousand ETH, while the threshold was 525 thousand.

The Coinbase exchange announced that at the beginning of the next year it will add the ETH2 token to the admission list. This does not allow trading, it is more about owning the coin. For this, you will need to exchange your tokens for new ones at the rate of 1:1. Then the stacking system will kick off – a novelty, long-anticipated in the market.

Binance, in its turn, is ready to add the ETH to the list of available coins this week, only there it will be called BETH. For now, they will be used for stacking only.

Stacking is a scheme of earning a passive income; investors are currently very keen on such schemes.

For this article, we’ve used ETHUSD charts by TradingView.

Disclaimer: Any predictions contained herein are based on the author’s particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.