Sep 18 flash gains are quickly evaporating giving way for solid Sep 17 losses backed by high level of participation syncing with the dominant trend—that of sellers. That is why, it’s likely that EOS, Litecoin, Stellar Lumens, Monero and Cardano prices might drop in coming days with Cardano for example dipping below 6 cents and printing new lows. Litecoin is also poised to shed some more so if there are dips below $50 before the weekend.

Let’s have a look at these charts:

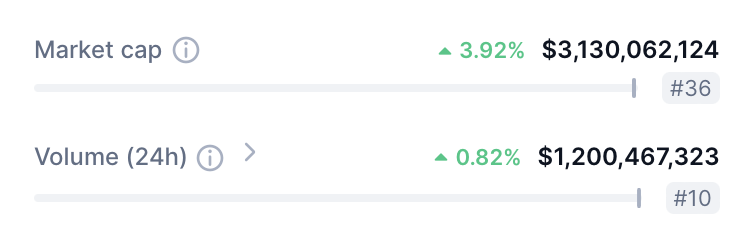

EOS Price Analysis

Latest EOS News

- Block One, the original publishers of the EOSIO blockchain have released EOS Version 1.3.0. All documentations are available at the EOSIO portal with complete release notes at GitHub. This new upgrade fixes among others, Replay and Resync under proposal 5130 addressing the issue of node set up and blockchain replay. On the other hand, performance enhancement in highlight 5631 creates space for Trusted Producer Light Validation.

EOSIO 1.3 Release https://t.co/niM2CjZxKa

— Block.one (@EOS_io) September 19, 2018

EOS Price Prediction

Blockchain improvement isn’t affecting price and technically, prices are consolidating on two levels. On the upper side—and this is important for long time holding, EOS is ranging within $4 on the lower side and $7 on the upside. Zooming out, on a micro level, prices are between $5.5 and $4.5–$4 zone. In both cases, the last three days periods of indecision dip print a whip saw nullifying our previous EOS price analysis. Unless we there are movements above $5.5 and $4, we remain neutral going forward.

Litecoin Price Analysis

Though there is a bit of optimism after Sep 18 rejection of higher highs, still Sep 17 declines and spike in market participation is influencing prices and clipping buy pressure. In any case, a top down approach of this pair means there is more space for further declines and the only trigger for that is once there is a confirmation of that bear candlestick.

To reiterate yesterday’s Litecoin price predictions, any move above $60 and $70 triggers a new-found wave that could thrust prices towards $90, $110 and even $190. On the flip-side, a wide range, high-volume bar closing below $50 would likely drive prices towards $30 or even lower.

Stellar Lumens Price Analysis

Price volatility is best exemplified by how Stellar Lumens have been moving in the last couple of days. Regardless of how prices turn out to be in coming days, Stellar Lumens buyers no doubt have an uphill task thanks to the relentless sell pressure evident in the better part of this year. Going forward, our previous Stellar Lumens trade position holds true since prices are still trending inside the confines of 25 cents on the upsides and 18 cents floors.

Cardano Price Analysis

Encouragingly, there were attempts to follow through Sep 18 bullish moves. Even if at the end of there was a sharp down turn resulting in an inverted hammer complete with long upper wicks signaling lower time frame sells, the fact that Cardano prices are still trending below 7 cents is a cause of concerns for bulls.

Regardless, what is important is that our sell recommendation holds true because stops at 8 cents are yet to be hit. Before that happens, sellers should have an upper hand and with every low that prints, our Cardano trade plan gradually moves in place.

Any conclusive close below 6 cents—the lower limit of the last five days range would trigger the next wave of selling and move of stops to break even.

Monero Price Analysis

Yesterday’s five percent loss and the failure of Sep 18 bulls to reverse Sep 17 bears means sellers are in charge. It’s clear to see why. From our previous Monero price prediction mentions, Sep 17 spike in market participation and decline did complement Sep 5 losses meaning odds are today we might see a comprehensive close below $100 and the support trend line of the past three months in line with our previous Monero price analysis. When that happens, we suggest selling on pull backs with first targets at $70.

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.