After failing to gain above the $6,400 resistance on March 22, Bitcoin (BTC) bulls spent the remainder of the day struggling to bring the digital asset back above $6,000. At the time of writing Bitcoin trades slightly below $6,000 and many traders anticipate further downside as the Coronavirus pandemic continues to worsen in the United States and Europe.

Crypto market daily performance. Source: Coin360

As mentioned by previous analysis last week, crypto traders, along with those in the traditional markets are keeping a close on how markets and investors respond to the assorted stimulus packages being prepared by governments around the world.

If investors feel the financial aid packages are sufficient enough to meet the needs of citizens and corporations then they are likely to begin bargain shopping for stocks that are slated to recover quickly once the COVID-19 pandemic peters out.

Large-cap cryptocurrencies are likely to also benefit if markets begin to recover but if investors observe equities markets continuing to fall even in the face of multi-trillion-dollar bailouts, they are unlikely to embrace stocks or cryptocurrencies, thus prompting further downside price action from Bitcoin.

Let’s take a quick look at the charts to see what is happening with Bitcoin’s price.

Bulls fight to hold a key support zone

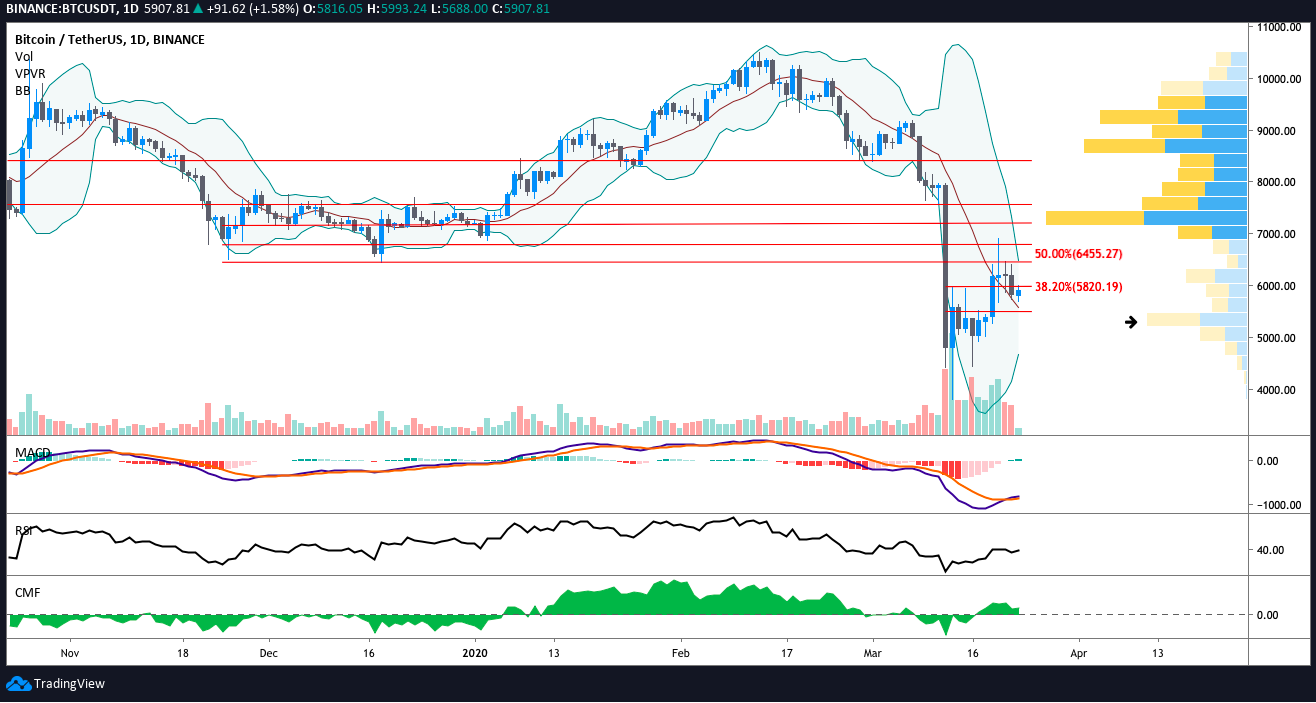

BTC USDT 4-hour chart. Source: TradingView

As shown by the 4-hour timeframe, Bitcoin’s price dropped below the ascending trendline and 38.2% Fibonacci Retracement level on Sunday. Currently, the support zone from $5,900 to $5,800 is holding but if the price falls below this point Bitcoin could revisit the $5,400 support.

Below $5,400 draws up memories of the March 12 drop to $3,775 so bullish investors are likely crossing their fingers with hope that the $5,400 support holds.

BTC USDT daily chart. Source: TradingView

On the daily timeframe, one can see that below $5,400 there is a high volume node on the VPVR at $4,061 and currently the lower Bollinger Band arm is at $4,660, somewhat close to where the price bounced on March 12 and March 16.

At the moment the price is riding along the 20-MA of the Bollinger Band indicator and the MACD histogram is positive with a newly formed bull cross between the MACD and the signal line. Above $6,000, there is resistance at $6,400 and if this level could be flipped from resistance to support, a gap in the VPVR shows that the price could move to $6,900 and $7,166 with sustained volume.

Short term strategy

For the time being, interim traders following the 4-hour chart can watch to see if Bitcoin price breaks above the ascending channel trendline to set a 4-hour close above $6,170. Risk-averse traders might consider waiting for a 4-hour to daily close above the $6,400 resistance.

Since the Coronavirus outbreak, Bitcoin price has closely followed the decline in traditional markets and at the time of writing the S&P 500 and Dow futures are down 3.85% and 4% respectively. This drop came shortly after US lawmakers failed to agree on the specific details of a proposed $2 trillion Coronavirus economic stimulus package.

This suggests that the markets will see similar losses when the opening bell rings in a few hours and one could infer that losses in traditional markets will not bode well for Bitcoin’s price action.

Bearish traders looking to short might consider a drop below $5,800 as a lucrative opportunity to go short as $5,400 is 6.77% away and a drop to $4,700 and $4,061 is even more rewarding.

Bitcoin daily price chart. Source: Coin360

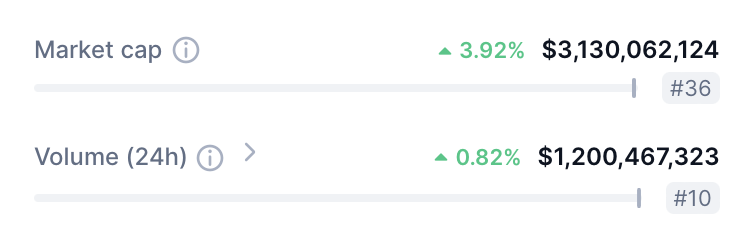

Altcoins also performed poorly over the weekend and at the time of writing Ether (ETH) is down 7.23%, Bitcoin Cash (BCH) has lost 8.88% and Tezos (XTZ) is down 10.58%.

The overall cryptocurrency market cap now stands at $166.6 billion and Bitcoin’s dominance rate is 65%.