Bitcoin price is leading from the front and is showing signs that a bottom has been reached.

On Dec. 2, open interest on Bakkt’s Bitcoin futures reached a new all-time high. This came just a few days after the daily Bitcoin futures trading volume had hit a lifetime high. These back to back trading volume records show an increasing interest from institutional investors but the majority of the crypto community is still wondering why Bitcon’s spot price is not steadily increasing.

Bakkt’s launch of Bitcoin options contracts on Dec. 9 is likely to attract more players to trade the digital asset. As the derivatives market size increases, it could have a greater effect on Bitcoin’s spot price. Hence, in the future, traders will have to keep a close eye on Bitcoin derivatives data.

In other news, WisdomTree launched a physically-backed Bitcoin exchange-traded product (ETP) designed to attract professional and institutional investors. The ETP will be listed on Switzerland’s principal stock exchange, SIX Swiss Exchange, under the WBTC ticker and will track the spot price of Bitcoin. Despite Bitcoin’s price action having a bearish bias, these products show that there is an underlying demand from the larger players.

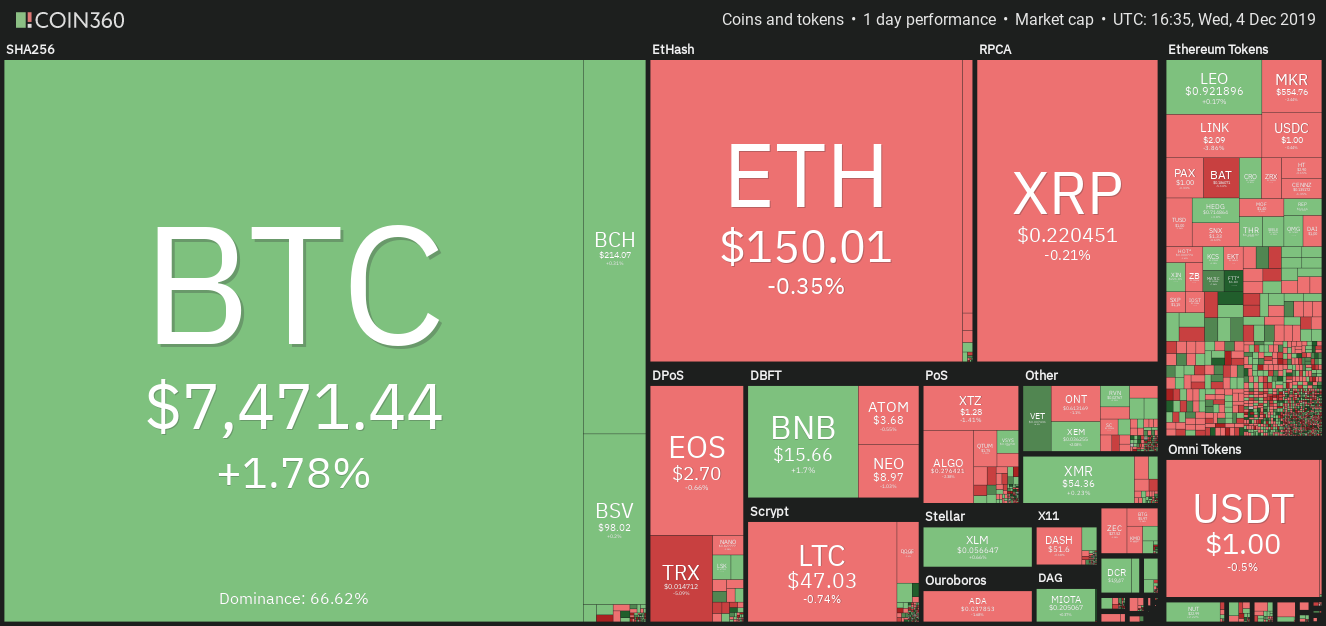

Daily cryptocurrency market performance. Source: Coin360

Saxo Bank, an Asian Infrastructure Investment Bank, recently published its “Outrageous Predictions” for 2020 and the bank also said that it will issue a new digital asset called the Asian Drawing Right (ADR) to reduce the impact of the US dollar in regional trade. The ADR will be backed by a basket of fiat currencies and gold but will be driven by blockchain technology.

If the digital asset successfully launches, it will be a negative for the US dollar but a positive for cryptocurrencies. With the current upheavals taking place with some fiat currencies, people might gradually gravitate towards borderless and decentralized digital assets.

Most cryptocurrencies are attempting to bounce off their recent lows, which is a positive sign. This shows that the bulls are attempting to defend the lows and put a bottom in place.

As this occurs, it is a good time to determine the critical levels to watch out for as they could signal a change in trend. Let’s analyze the charts.

BTC/USD

The bulls attempted to reverse direction from $7,085.80 today but stumbled just above the 20-day EMA at $7749.98. This shows that the bears continue to aggressively defend the resistance at the 20-day EMA. With buying at lower levels and selling at higher levels, Bitcoin (BTC) might remain range-bound for the next few days.

BTC USD daily chart. Source: Tradingview

A breakout of $7,856.76 will be the first sign that the bulls are back in action. Above this level, a move to the downtrend line is likely. If the price sustains above the downtrend line, we anticipate the start of a new uptrend.

Therefore, traders can buy on a breakout and close (UTC time) above the downtrend line with a stop below $6,500. The first target objective is $10,360.89 and above it $12,000.

Contrary to our assumption, if the bears sink the BTC/USD pair below $6,512.01, the downtrend will resume. The next support on the downside is $5,533.90.

ETH/USD

Ether (ETH) is attempting to turn around from the support at $140. This is a positive sign as it shows that the bulls are using the dips to accumulate or book quick profits. The recovery will face stiff resistance close to the 20-day EMA.

ETH USD daily chart. Source: Tradingview

However, if the bulls can push the price above the 20-day EMA and sustain it, a rally to $173.841 is possible. Above this level, the up move can extend to $197.70. Therefore, we would recommend a long position after the price sustains above the 20-day EMA.

Contrary to our assumption, if the ETH/USD pair fails to break out and sustain above the 20-day EMA, the bears will attempt to sink it to the recent low of $131.484. A break below this level will be a huge negative.

XRP/USD

XRP has been trading close to $0.22 for the past three days. Today, the dip below $0.22 was purchased by the bulls, which shows demand at lower levels. However, unless the price climbs and sustains above the 20-day EMA, the advantage will remain with the bears.

XRP USD daily chart. Source: Tradingview

If the bears sink and sustain the price below $0.22, a retest of the yearly low at $0.20041 is possible. A new 52-week low will be a huge negative and can drag the price to $0.18.

Conversely, if the XRP/USD pair rises above $0.23260 to $0.24508 resistance zone, a rally to $0.31503 is likely. We will wait for the price to sustain above the 20-day EMA before turning positive.

BCH/USD

Bitcoin Cash (BCH) has bounced off the first support at $203.36. This is a positive sign as it shows demand at lower levels. If the price can continue to climb higher and break out of $227.01, it will be the first sign that a new up move is likely.

BCH USD daily chart. Source: Tradingview

However, if the bears sink the price below $203.36, the BCH/USD pair can slide to the next support at $192.52. A break below this support will resume the downtrend. The target objective on the downside is $166.98. We will wait for the price to break out of $227.01 before turning positive.

LTC/USD

Litecoin (LTC) is attempting to bounce off the support at $42.0599. This is an important level, hence, we expect the bulls to aggressively defend it. The altcoin is likely to consolidate between $42.0599 and $50.

LTC USD daily chart. Source: Tradingview

A break out of this range will indicate a likely bottom and can offer a buying opportunity. Above $50, the LTC/USD pair can rally to $66.1486. There is a minor resistance at 50-day SMA but we expect it to be crossed.

On the other hand, if the LTC/USD pair breaks below the critical support at $42.0599, it will resume the downtrend. The next support on the downside is $36.

EOS/USD

EOS continues to face selling at the 20-day EMA. This shows that the bears are active at higher levels. The altcoin has formed an outside day and a doji candlestick pattern, which indicates a balance between both buyers and sellers. While the buyers are defending the support close to $2.4001, the bears are defending the 20-day EMA.

EOS USD daily chart. Source: Tradingview

If the bears can sink the price below $2.4001, a drop to the next support at $1.55 will be on the cards.

Alternatively, if the EOS/USD pair breaks out of the 20-day EMA, it can move up to the 50-day SMA and above it to the downtrend line. Short-term traders might stay on the long side after a break above $2.8695.

BNB/USD

Binance Coin (BNB) continues to consolidate between $16.50 and $14.2555. This shows that buyers step in at $14.2555 and the bears sell close to $16.50. The next trending move is likely to begin after the price escapes this range.

BNB USD daily chart. Source: Tradingview

It is difficult to predict the direction of the breakout from a range, hence, traders should wait for the price to start a trending move before entering a trade. If the range is large, dips to the support can be purchased and the positions can be closed near the resistance. However, this is not feasible if the range is small.

If the bears sink the BNB/USD pair below $14.2555, the downtrend will resume and the next stop is likely to be $11.30. On the other hand, if the bulls can propel the pair above $16.50, a move to $21.2378 is likely. We will wait for the price to make a decisive move above $16.50 before proposing a trade in it.

BSV/USD

The bulls are attempting to keep Bitcoin SV (BSV) above the support at $92.693. However, the rebound off the support is not sustaining, which shows that buying dries up at higher levels. This increases the possibility of a break below this support.

BSV USD daily chart. Source: Tradingview

If the bears sink the price below $92.693, the BSV/USD pair can drop to the next support at $78.506. This is an important level to watch out for because if it cracks, the decline can extend to $66.666.

The pair will turn bullish if the buyers can push the price above the downtrend line and the overhead resistance at $113.96. Above this level, a rally to $155.38 is possible.

XLM/USD

Stellar (XLM) has repeatedly broken below $0.056 in the past few days but the bears have not been able to sustain the price below it. This is a positive sign as it shows that lower levels are attracting buying by the bulls.

XLM USD daily chart. Source: Tradingview

However, unless the price moves up sharply and sustains above $0.06, the bears will continue to hold the advantage. If the XLM/USD pair plunges to a new yearly low, it will be a huge negative. The next support to watch on the downside is $0.041748.

Conversely, if the bulls can carry the price above $0.06, it will attract buyers. Such a move will offer a trade with a good risk-reward ratio. Until then, we suggest traders remain on the sidelines.

TRX/USD

Tron (TRX) has declined to the critical support at $0.0136655. This is the fourth time the price has dropped to this support level since October. Generally, repeated retests of a support level weaken it.

TRX USD daily chart. Source: Tradingview

If the bears sink the price below $0.0136655, it will result in a quick fall to the $0.0116262 to $0.011240 support zone. We anticipate a strong defense of this zone by the bulls.

Conversely, if the TRX/USD pair rebounds off $0.0136655, it can move up to $0.0163957, which is likely to act as a strong resistance. Above this level, we anticipate the buyers to jump in. Though the 50-day SMA might offer a minor resistance, we expect it to be crossed.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.