Ten days ago, the FTX estate overseeing the bankrupt company’s proceedings informed customers they would receive more than 100% repayment. Following this announcement, the exchange token FTT from the defunct trading platform rose above $2 per unit. Astonishingly, despite being tied to a failed crypto exchange, this token still holds a market valuation of $535 […] Source CryptoX Portal

Tag: Market

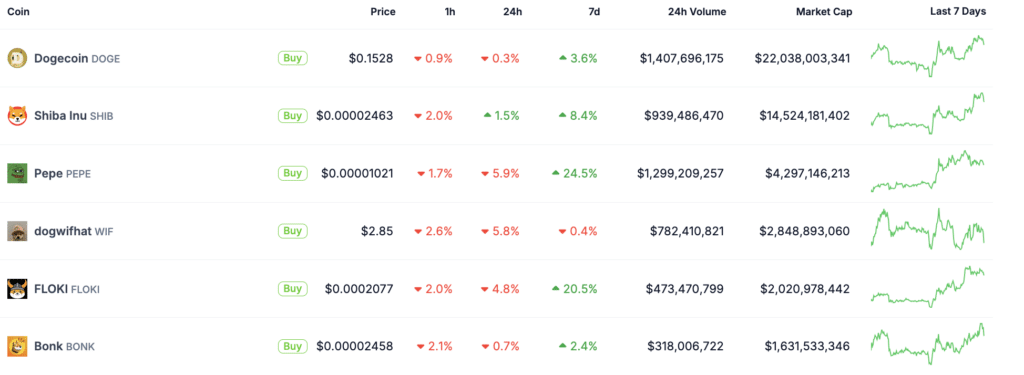

Meme coins market cap hits $58b

The market capitalization of meme coins increased by 8% and hit $58 billion. According to CoinGecko, meme coins are popular among investors and traders. The meme coin segment has outpaced the overall crypto asset market in growth over the past 24 hours. The crypto industry’s total market capitalization increased by 5.5%, while Bitcoin (BTC) showed an increase of 6%. The five largest meme coins by capital account for 77% of the total value of this asset class. At the same time, only three dozen coins by market capitalization exceed the…

Bitcoin Whales Quiet Down – Here’s Why And What It Means For The Market

Recent data from Santiment indicates a noticeable decrease in Bitcoin whale activity, reaching the lowest levels seen in 2024. This trend shows that holders of large amounts of Bitcoin, known as whales, are drifting away from active trading. While this could signal a negative trend, the situation presents a complex picture of the cryptocurrency’s market dynamics. Despite the fall in whale activity, the total number of Bitcoin wallets with at least 100 BTC remains high, at 11.79 million BTC across 15,907 wallets. Bitcoin Whale transactions trend. | Source: Santiment Historically,…

Liquid Staking Market in Flux: Withdrawals Hit Swell and Mantle, Reshuffling Landscape

Over the past 18 days, 27 distinct liquid staking derivatives (LSD) protocols have experienced withdrawals amounting to approximately 50,000 ether, valued at $146.72 million. The most significant reductions occurred in the LSDs Swell and Mantle, with Swell’s ether holdings decreasing by 23,078 ether since April 28, 2024. LSD Protocol Reductions Continue Despite Minor Gains for […] Source CryptoX Portal

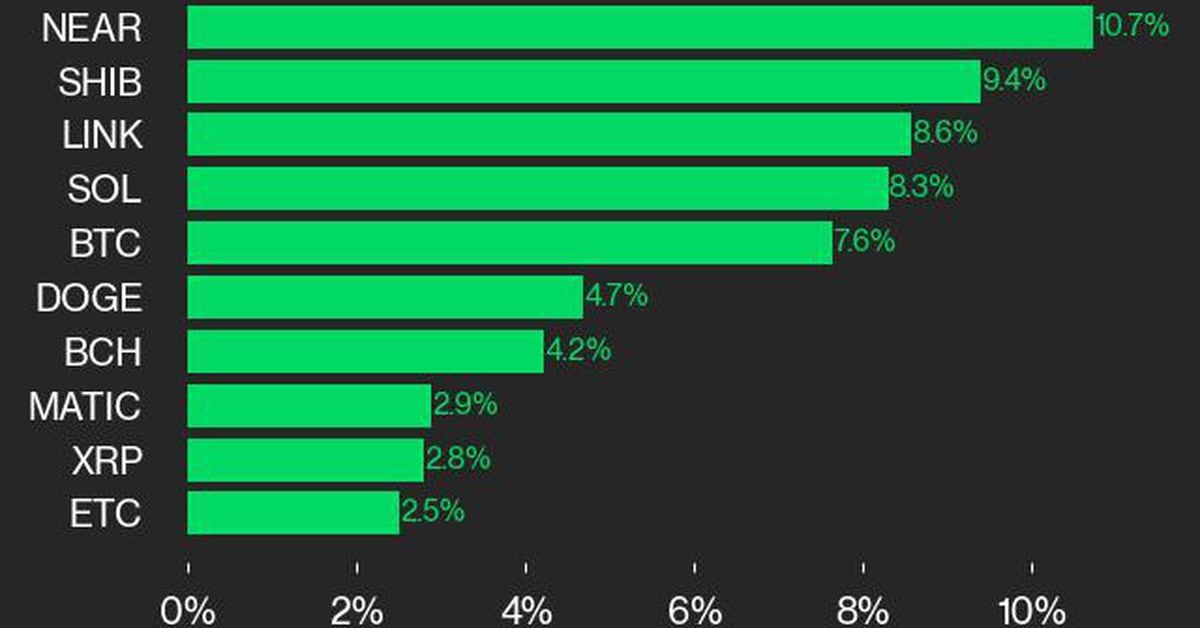

NEAR Token’s 10% Gain Tops CoinDesk 20 Last Week: CoinDesk Indices Market Update

CoinDesk 20 tracks top digital assets and is investible on multiple platforms. The broader CMI comprises approximately 180 tokens and seven crypto sectors: currency, smart contract platforms, DeFi, culture & entertainment, computing, and digitization. Source

Crypto Exchange Coinbase (COIN) Raised to Neutral at Bank of America on Positive Market Dynamics

Bank of America said it was upgrading the stock for a number of reasons, including the positive macro backdrop that has helped the cryptocurrency markets and trading volumes, analysts led by Mark McLaughlin wrote. The note also said the exchange’s expense discipline and increased diversification should also help its earnings. Source

The Pulse of the Market – How Fear and Greed Shape Cryptocurrency Trading

HodlX Guest Post Submit Your Post In the high-stakes world of cryptocurrency, market sentiment often swings wildly, driven by speculation and the whims of influential voices. Unlike traditional financial markets, crypto values can skyrocket or plummet based on the collective mood of traders, making it essential to stay attuned to these emotional undercurrents. Consider the sway of figures like Elon Musk and Michael Saylor – their tweets and public statements can send ripples through the market, causing dramatic shifts in value almost instantaneously. For instance, Musk’s tweet about Bitcoin’s environmental…

Market Adjusts After Recent Increase

Ethereum price tested the $3,040 zone and corrected gains. ETH is now testing the $2,925 support and might aim for a fresh increase. Ethereum started a downside correction after the bears defended $3,040. The price is trading below $2,960 and the 100-hourly Simple Moving Average. There is a connecting bearish trend line forming with resistance at $2,965 on the hourly chart of ETH/USD (data feed via Kraken). The pair could start a fresh increase unless there is a close below the $2,925 support. Ethereum Price Dips Again Ethereum price started…

Bitcoin Price Consolidates Gains: Stability in the Crypto Market Amid Recent Surge

Bitcoin price rallied and tested the $66,500 zone. BTC is now consolidating gains and might attempt another increase toward $67,500. Bitcoin started a consolidation phase from the $66,500 resistance zone. The price is trading above $65,000 and the 100 hourly Simple moving average. There is a key bullish trend line forming with support at $65,150 on the hourly chart of the BTC/USD pair (data feed from Kraken). The pair could start another increase unless the bears push it below $63,800. Bitcoin Price Remains Supported Bitcoin price formed a base and…

India’s Market Regulator SEBI Suggests Shared Crypto Oversight Even as Central Bank Seeks Stablecoin Ban: Reuters

The Securities and Exchange Board of India’s (SEBI) suggestion was made to a “government panel” tasked with formulating policy for the finance ministry to consider, Reuters said, citing documents. It added that the panel could submit its report by June. Source